Our PFE puts closed worthless last Friday. As a result, we were able to lock in a 1.30% return. Certainly not a home run, but definitely the beginning of piling up premium in the market stalwart.

So, in today’s trade alert, I want to sell more puts in PFE with the intent of eventually wheeling into the position.

The mechanics are simple.

- Sell Cash-Secured Puts on a stock until you are assigned shares (100 shares for every put sold)

- Sell Covered Calls on the assigned stock until the shares are called away

- Repeat the Process!

All this being said, you can simply just sell puts without the need to wheel into the position. Some of you don’t want to own stock and I get it … which is why we also have an Income Trades Portfolio that is just trades, with no intent of holding stock.

But before I get to the official trade, I want to briefly discuss our two trades that are due to expire Friday in BITO and GDX. Both ETFs are currently trading below their respective short puts. If that remains into the close of July 15 expiration, we will simply allow ourselves to be assigned shares and begin selling calls, thereby starting the “wheel” process.

Pfizer (PFE)

IV: 34.0%

IV Rank: 54.7

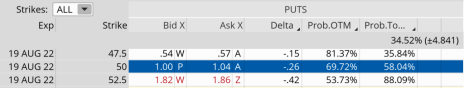

Expected Move (Range): The expected move (range) for the August 19, 2022, expiration cycle is from 50 to 57.

With PFE trading for 53.35 I want to sell puts going out 39 days.

The Trade

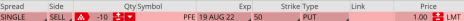

Sell to open PFE August 19, 2022, 50 put strike for a total of $1.00 or higher (As always, the price may vary, please adjust accordingly).

Delta: 0.27

Probability of Profit: 69.72%

Probability of Touch: 58.04%

Total net credit: $1.00

Breakeven: 49

Max return (cash-secured): 2.0%

Risk Management

I will be using PFE as part of the conservative side of our Income Wheel Portfolio, so if PFE closes below on expiration we will be issued shares at the 50 strike and begin the process of selling calls against it. Until that point, we will continue to sell puts on PFE. Of course, any necessary trade alerts/updates will follow.

If you have any questions, please do not hesitate to email me at andy@cabotwealth.com.