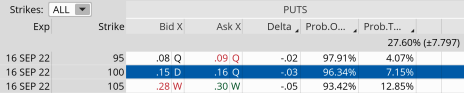

As I discussed in our issue last week, with 30 days left in the September 16, 2022, expiration cycle, it just doesn’t make sense to hold on to our JPM puts any longer. Our JPM 100 puts are only worth $0.16, and we can lock in well over $1 on the trade, so the risk of holding on to our puts to make an additional $0.16 over the next 30 days just isn’t worth the risk as we can free up some capital and use it elsewhere. Therefore, I’m taking off the trade, locking in some profits and moving on to the next opportunity.

J.P. Morgan (JPM)

JPM is currently trading for 122.86.

Here is the trade:

Buy to close JPM September 16, 2022, 100 put for $0.16

As always, if you have any questions feel free to email me at andy@cabotwealth.com.