Dogs of the Dow Portfolio Alert (WBA, IBM)

As I stated on our subscriber-only call yesterday, it’s time to roll the remainder of our short call positions for the July expiration cycle. We also have a few other short call positions that have little to no premium left, so I intend on buying the short calls back and immediately selling more premium against our LEAPS. I’ll be placing several trades over the next few days, so stay tuned!

Walgreens Boots Alliance (WBA)

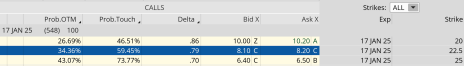

We currently own the WBA January 17, 2025, 25 call LEAPS contract at $11.10. You must own LEAPS in order to use this strategy.

If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 17, 2025, 22.5 calls. We typically initiate a LEAPS position, with a delta of roughly 0.80, that has about 18 to 24 months left until expiration.

WBA is currently trading for 29.66.

Here is the trade (you must own LEAPS prior to making the trade below):

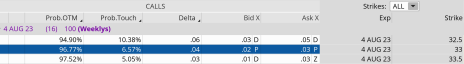

Buy to close WBA August 4, 2023, 33 call for roughly $0.03 (adjust accordingly, prices may vary from time of alert)

Once that occurs:

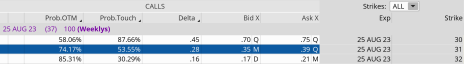

Sell to open WBA August 25, 2023, 31 call for roughly $0.36 (adjust accordingly, prices may vary from time of alert)

Premium received: 3.2%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $11.10 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in WBA.

International Business Machines (IBM)

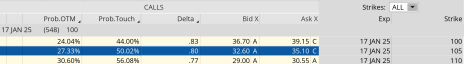

We currently own the IBM January 17, 2025, 105 call LEAPS contract at $43.15. You must own LEAPS in order to use this strategy.

If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 17, 2025, 105 calls. We typically initiate a LEAPS position, with a delta of roughly 0.80, that has about 18 to 24 months left until expiration.

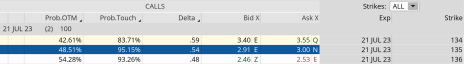

IBM is currently trading for 135.35.

Here is the trade:

Buy to close IBM July 21, 2023, 135 call for roughly $2.97 (adjust accordingly, prices may vary from time of alert)

Once that occurs (and you have LEAPS in your possession):

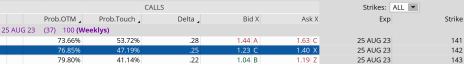

Sell to open IBM August 25, 2023, 142 call for roughly $1.30 (adjust accordingly, prices may vary from time of alert)

Premium received: 3.0%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $43.15 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in IBM.