Dogs of the Dow Portfolio Alert (CSCO)

We allowed our CSCO calls to expire worthless last week, thereby reaping the entire premium/return from the trade. As a result, I want to sell more out-of-the-money calls in CSCO today. Our position is up 30.9%, while the underlying benchmark stock is up only 5.9%, thereby showing the power of a poor man’s covered call approach.

Cisco Systems (CSCO)

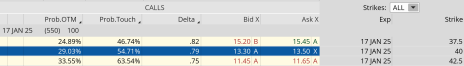

We currently own the CSCO January 17, 2025, 35 call LEAPS contract at $15.65. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 17, 2025, 40 calls. We typically initiate a LEAPS position, with a delta of roughly 0.80, that has about 18 to 24 months left until expiration.

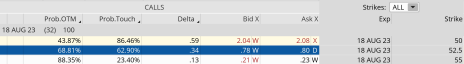

CSCO is currently trading for 50.71.

Here is the trade:

Sell to open CSCO August 18, 2023, 52.5 call for roughly $0.78 (adjust accordingly, prices may vary from time of alert)

Premium received: 5.0%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $15.65 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in CSCO.