All-Weather Portfolio Alert (VTI)

The rally continues and as a result, all of our portfolios are reaping the benefits. As I stated yesterday, I have begun the process of buying back our July calls that are due to expire this week and selling more premium in August and possibly September (if it makes sense), so expect to see several trade alerts, including a few new positions for our active portfolios, over the next few days.

As for the performance of our All-Weather portfolio, the benchmark S&P 500 is up roughly 8% since we started the All-Weather portfolio. Our All-Weather portfolio is up more than 12% ... with far less volatility (drawdowns) over the past year, once again proving the power of having some exposure to a passive approach to investing.

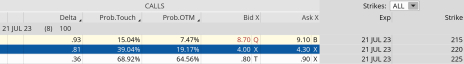

Vanguard Total Stock Market ETF (VTI)

VTI is currently trading for 223.59.

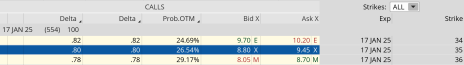

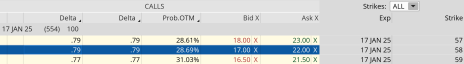

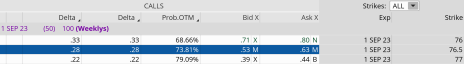

In the All-Weather portfolio, we currently own the VTI January 17, 2025, 165 call LEAPS contract at $55.05. You must own LEAPS in order to use this strategy.

If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 17, 2025, 191 calls. We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in VTI before placing the trade, otherwise you will be naked short calls):

Once you have LEAPS in your possession:

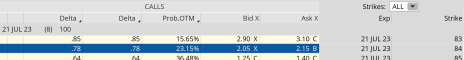

Buy to close VTI July 21, 2023, 220 call for roughly $4.10 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

Sell to open VTI August 18, 2023, 225 call for roughly $2.95 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 5.4%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $55.05 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in VTI.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

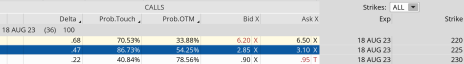

Invesco DB Commodity Index ETF (DBC)

We currently own the DBC January 17, 2025, 21 call LEAPS contract at $4.80. You must own LEAPS in order to use this strategy.

If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 17, 2025, 21 calls. We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Also, if you wish to enter the position and are uncertain about which LEAPS to purchase, please refer to the reports section of your subscriber page or our latest subscriber-exclusive webinar in which I go through the process, step by step, of entering a new position of an already established position.

Here is the trade (you must own LEAPS in DBC before placing the trade, otherwise you will be naked short calls):

Once you have LEAPS in your possession:

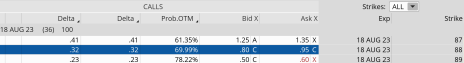

Buy to close DBC July 21, 2023, 23 call for roughly $0.70 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs (or if you are new to the position):

Sell to open DBC August 18, 2023, 24 call for roughly $0.30 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 6.3%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $4.80 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in DBC.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

Yale Endowment Portfolio Alert (EEM, VNQ, EFA)

The Yale Endowment portfolio continues to shine outperforming our benchmarks with portfolio gains currently reaching 18.7% since we initiated the portfolio back in mid-June of last year.

Just as a heads up, in my subscriber-only webinar on Tuesday of next week, I plan on spending some time on the ins and outs of getting started, if you are new to the service. How to use your subscriber-only page as an important resource, your first trade and what to expect going forward, among many other topics.

I’ll also take things a step further by going over a typical trade on the trading platform, step by step. We’ll discuss, in great detail, the mechanics of the trade, how to figure out your profit, assignment concerns, etc.

Again, I will be holding my next subscriber-only webinar next week, Tuesday, June 18 at 12 p.m. ET. Click here to join. No worries, if you can’t make it, we always archive our webinars on your subscriber page so you can access them at your leisure.

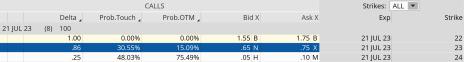

iShares MSCI Emerging Market ETF (EEM)

EEM is currently trading for 41.20.

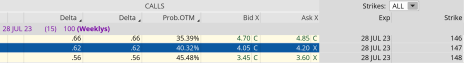

In the Yale Endowment portfolio, we currently own the EEM January 17, 2025, 29 call LEAPS contract at $12.15. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 17, 2025, 35 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in EEM before placing the trade, otherwise you will be naked short calls):

Once you have LEAPS in your possession:

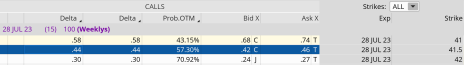

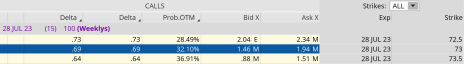

Buy to close EEM July 28, 2023, 41.5 call for roughly $0.45 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

Sell to open EEM September 1, 2023, 43 call for roughly $0.37 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 3.0%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $12.15 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in EEM.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

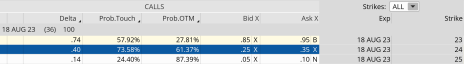

Vanguard Real Estate ETF (VNQ)

VNQ is currently trading for 85.78.

In the Yale Endowment portfolio, we currently own the VNQ January 17, 2025, 65 call LEAPS contract at $20.70. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 17, 2025, 70 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in VNQ before placing the trade, otherwise you will be naked short calls):

Once you have LEAPS in your possession:

Buy to close VNQ July 21, 2023, 84 call for roughly $2.10 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

Sell to open VNQ August 18, 2023, 88 call for roughly $0.85 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 4.1%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $20.70 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in VNQ.

iShares MSCI EAFE ETF (EFA)

EFA is currently trading for 74.13.

In the Yale Endowment portfolio, we currently own the EFA January 17, 2025, 63 call LEAPS contract at $14.90. You must own LEAPS in order to use this strategy.

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 17, 2025, 58 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in EFA before placing the trade, otherwise you will be naked short calls):

Once you have LEAPS in your possession:

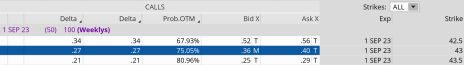

Buy to close EFA July 28, 2023, 73 call for roughly $1.70 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

Sell to open EFA September 1, 2023, 76.5 call for roughly $0.57 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 3.8%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $14.90 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in EFA.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

Dogs of the Dow Alert (JPM)

JPMorgan (JPM)

Our JPM poor man’s covered call position is up 32.2% YTD while the underlying stock is only up 8.3%. So far, so good in 2023 for JPM, and if the overall market keeps rallying we should see substantial returns in the overall portfolio.

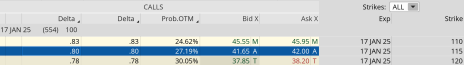

We currently own the JPM January 17, 2025, 100 call LEAPS contract at $46.20. You must own LEAPS in order to use this strategy.

If you wish to enter the position and are uncertain about which LEAPS to purchase, please refer to the reports section of your subscriber page or our latest subscriber-exclusive webinar in which I go through the process, step by step, of entering a new position of an already established position.

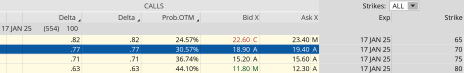

If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 17, 2025, 115 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has about 18 to 24 months left until expiration.

JPM is currently trading for 148.85.

Here is the trade:

Buy to close JPM July 28, 2023, 147 call for roughly $4.15 (adjust accordingly, prices may vary from time of alert)

Once that occurs (or if you are new to the position and already own LEAPS):

Sell to open JPM August 18, 2023, 155 call for roughly $1.62 (adjust accordingly, prices may vary from time of alert)

Premium received: 3.5%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $46.20 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in JPM.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

If you have any questions please feel free to email me at andy@cabotwealth.com.