Cabot Options Institute Fundamentals – Dogs of the Dow Alert (IBM)

International Business Machines (IBM)

After selling premium today, our IBM position is already up 31.6% since we initiated it just three weeks ago.

Yes, we are having to buy back our short calls at a far more rapid pace than usual, but by keeping our deltas positive we continue to reap the benefits to the upside, regardless of whether we are taking a loss on our short calls. Remember, our LEAPS more than make up for any loss on our short calls … as long as we continue to keep the overall delta of the position in a positive state. So, we plan on doing that today through buying back our February 16, 2024, calls and immediately selling more call premium during the same expiration cycle, but going out to the 205 call. This move will bring our deltas back to a normal state and ready for any additional upside the stock has left.

IBM is currently trading for 196.11.

Here is the trade:

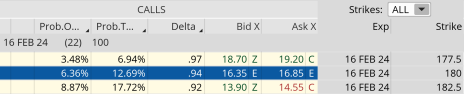

Buy to close the IBM February 16, 2024, 180 call for roughly $16.65. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

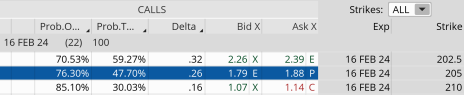

Sell to open IBM February 16, 2024, 205 call for roughly $1.83. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 4.5%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $40.30 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in IBM.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.