Cabot Options Institute Fundamentals – Dogs of the Dow Alert (IBM)

International Business Machines (IBM)

Our IBM position is already up over 12% since we initiated it just over two weeks ago.

The rally in the stock has caused the price of the stock to push through our short call strike of 165. No big deal. As a result, we are going to stay mechanical, buy back our short calls, immediately sell more calls and bring the delta of our position back to a more positive territory. By doing so, we have the ability to continue to take advantage of any further upside movement in the stock, while also bringing in some additional premium which we can use for income or to simply lower the cost basis of our position.

IBM is currently trading for 173.48.

Here is the trade:

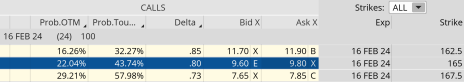

Buy to close the IBM February 16, 2024, 165 call for roughly $9.80. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

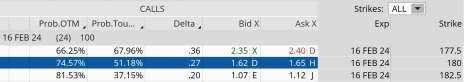

Sell to open IBM February 16, 2024, 180 call for roughly $1.64. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 4.1%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $40.30 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in IBM.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.