Buffett’s Patient Investor Portfolio Alert (TXN, AAPL, GOOGL)

I’ll be sending out alerts for several of our Fundamentals portfolios over the next two days as we stay mechanical and roll our January 19, 2024, calls into the February/March expiration cycles. For those who are new to the service and wish to add a position, please read through the alert carefully and if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Texas Instruments (TXN)

TXN is currently trading for 165.45.

In the Buffett’s Patient Investor portfolio, we currently own the TXN January 17, 2025, 135 call LEAPS contract at $53.05. You must own LEAPS in order to use this strategy.

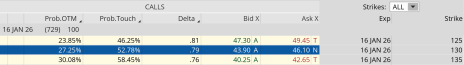

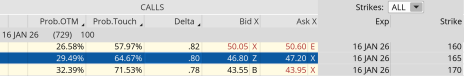

If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 16, 2026, 130 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in TXN before placing the trade, otherwise you will be naked short calls):

Buy to close TXN January 19, 2024, 165 call for roughly $1.35. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

Sell to open TXN February 16, 2024, 175 call for roughly $1.63. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 3.1%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $53.05 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in TXN. That being said, since TXN resides in one of our active portfolios, there is the potential we take the trade off during our periodic monthly rebalancing which falls around each options expiration cycle.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

I’ll be sending out a trade alert early tomorrow morning for our passive portfolios (All-Weather, Yale Endowment). Stay tuned!

Apple (AAPL)

We currently own the AAPL January 17, 2025, 135 call LEAPS contract at $48.00. You must own LEAPS in order to use this strategy.

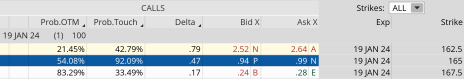

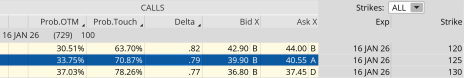

If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 16, 2026, 165 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has about 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in AAPL before placing the trade, otherwise you will be naked short calls):

AAPL is currently trading at 189.00.

Here is the trade:

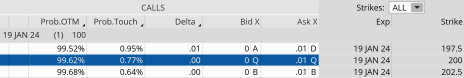

Buy to close AAPL January 19, 2024, 200 call for roughly $0.01 or more. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

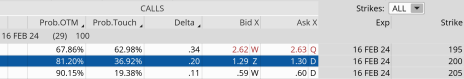

Sell to open AAPL February 16, 2024, 200 call for roughly $1.29. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 2.7%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $48.00 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in AAPL.

Alphabet (GOOGL)

GOOGL is currently trading for 143.97.

In the Buffett’s Patient Investor portfolio, we currently own the GOOGL January 17, 2025, 100 call LEAPS contract at $34.45. You must own LEAPS in order to use this strategy.

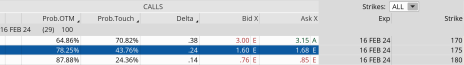

*If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of roughly 0.80: the January 16, 2026, 125 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in GOOGL before placing the trade, otherwise you will be naked short calls):

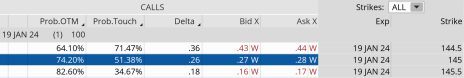

Buy to close GOOGL January 19, 2024, 145 call for roughly $0.28. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs (or if you are new to the position and already own LEAPS):

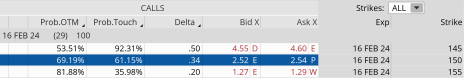

Sell to open GOOGL February 16, 2024, 150 call for roughly $2.52. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 7.3%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $34.45 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in GOOGL.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.