Yale Endowment Portfolio (SPY)

For those who are new and wish to enter a trade, all of the details are listed in the alert (as always) for those wanting to initiate a position. As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

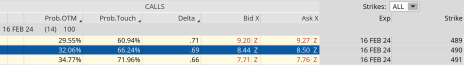

Our SPY position continues to perform well, up 32.1%. The ongoing rally in SPY has pushed the price of the underlying ETF above our short strike and as a result, the delta of our short February 16, 2024, 490 call is nearing parity with our LEAPS position. With 14 days left until the February 16 expiration cycle, I’m going to buy back our short calls in SPY and sell March calls. This will extend our deltas and allow us to take advantage of any continued upside in the ETF.

SPDR S&P 500 ETF (SPY)

SPY is currently trading for 495.20.

In the Yale Endowment portfolio, we currently own the SPY January 17, 2025, 345 call LEAPS contract at $98.00. You must own LEAPS in order to use this strategy.

If you are new to the position, based on our approach, the LEAPS contract that works best is the one with a current delta of 0.80: the January 16, 2026, 435 calls.

We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade (you must own LEAPS in SPY before placing the trade, otherwise you will be naked short calls):

Buy to close SPY February 16, 2024, 490 call for roughly $8.48. (Adjust accordingly, prices may vary from time of alert.)

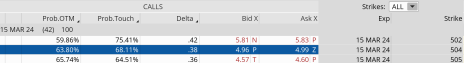

Sell to open SPY March 15, 2024, 504 call for roughly $4.97. (Adjust accordingly, prices may vary from time of alert.)

Premium received: 5.1%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $98.00 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in SPY.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.