I’ve never understood why professional “talking heads” rarely, if ever, mention the topic of probabilities.

As an investor or trader, wouldn’t you prefer to know the probability of a stock hitting a certain price? It certainly seems logical. Yet, I rarely hear investors, professional or otherwise, talk about statistics of any kind. It’s unfortunate.

We always hear the brief analysis about a stock, the analyst’s target price, but never the probability or a timeframe of the stock they are advising people to buy actually hitting the proposed price.

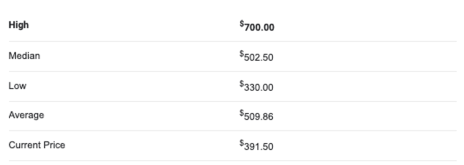

Just look at Netflix (NFLX). According to The Wall Street Journal there are currently 40 institutional analysts following the stock. At the time of this writing, the tech stock was trading at 391.50. The average price target is 509.86 with a high of 700. The high price target, which is roughly 78.8% above where NFLX is currently trading. Of course, no timeframe was given as to when the analyst predicts NFLX will hit the predicted price.

While it’s great to have an understanding of the company you are potentially investing your hard-earned money in coupled with an arbitrary price target, does it really equate to making money? And isn’t that why we invest, to make money?

This is why I take a quantitative approach to the market.

I want to know what the probabilities are of a stock going to a specific price before I put my money to work. More importantly, I want to know exactly how much I stand to make and stand to lose so I can manage my risk accordingly. I’ll discuss managing risk through the use of various options strategies at another time.

Let’s focus on the probabilities of NFLX hitting the average price target of roughly 510 and the high price target of 700.

Probability of Touch

The probability of touch may be a new concept to some investors/traders, but it certainly isn’t to those that trade options. The probability of touch tells us the probability of an underlying stock touching a specific price over a specific timeframe. For example, look at the probability of NFLX touching 510 over the next 74 days, 256 days and 655 days.

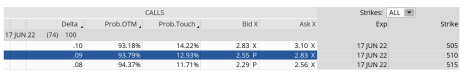

Probability of Touching 510 Over the Next 74 Days

As you can see above the probability of NFLX hitting the 510 strike prior to the June 17 expiration in 74 days is only 12.93%.

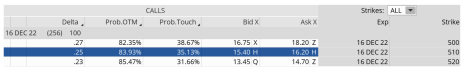

Probability of Touching 510 Over the Next 256 Days

The Probability of Touch increases as a stock’s option expiration increases. It makes perfect sense, right? An options expiration date that is further out in time gives the stock more of an opportunity to hit the stated strike price.

And as you can see, the Probability of Touch increased from 12.93% in our June 17 expiration date example above to 35.13% for the December 16 expiration cycle.

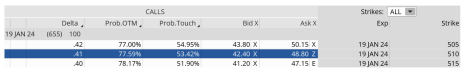

Probability of Touching 510 Over the Next 655 Days

It is only when we go out to the January 19, 2024 expiration that the Probability of Touch pushes to just above a coin flip at 53.42%

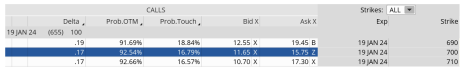

But what about the analyst who gave a price target of 700? What is the Probability of Touch for NFLX hitting that price target?

If we go out to the January 19, 2024 with an 655 days left until expiration the probability that NFLX will hit the 700 strike prior to the expiration date is a paltry 16.79%.

Overall, with price targets of 510 and 700 we, as investors, are left with essentially coin flips and lottery tickets. Maybe that’s why we never hear about the probabilities of price targets?

This is exactly why I take a quantitative approach to the market.

I want to know the probability of a stock or ETF hitting a specific price target over a specified period of time. By knowing this information, I have the ability to not only choose a variety of strategies, but I also have the ability to choose the probability of success for each and every trade I place.

That’s right, we all have the ability to use strategies that allow us to choose our own probability of success…in real time. That’s powerful! And as investors we need to harness this ability by expanding our arsenal of investment/trading strategies we use on a regular basis.