Dogs of the Dow Portfolio Alert (VZ, DOW, MMM, CSCO, IBM, WBA, CVX)

We started the process of closing out a few of our Dogs and Small Dogs of the Dow positions last week and will close the remaining over the next day or so. Once that is complete, we simply wait until the first week of 2024 to initiate our new Dogs and Small Dogs positions (and several others across various portfolios).

But before I enter our new 2024 Dogs of the Dow trades, I intend on having a subscriber-only event that will go into great detail on the strategy used within the Fundamentals service and how we approach each individual portfolio.

Click here to sign up for the event. And if you can’t make it, no worries, we archive absolutely everything here at Cabot so you can watch at your leisure.

Verizon (VZ)

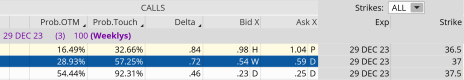

Verizon is currently trading for 37.44.

The stock was down 5.88% on the year, while our position managed to close out the year with a positive 1.54% return.

Here is the trade:

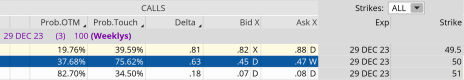

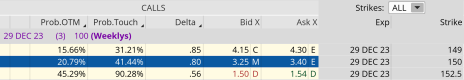

Buy to close VZ December 29, 2023, 37 call for roughly $0.57. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

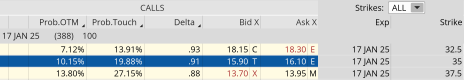

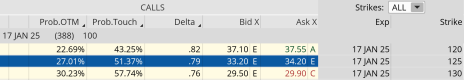

Sell to close VZ January 17, 2025, 30 call for roughly $7.75. (Adjust accordingly, prices may vary from time of alert.)

Dow Inc. (DOW)

Dow is currently trading for 55.58.

The stock was up 6.58% on the year. Our position was up 26.65%.

Here is the trade:

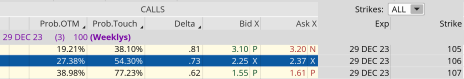

Buy to close DOW December 29, 2023, 53 call for roughly $2.67. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

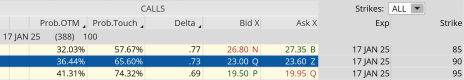

Sell to close DOW January 17, 2025, 37.5 call for roughly $18.75. (Adjust accordingly, prices may vary from time of alert.)

3M (MMM)

MMM is currently trading for 107.78.

Here is the trade:

Buy to close MMM December 29, 2023, 106 call for roughly $2.32. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

Sell to close MMM January 17, 2025, 90 call for roughly $23.30. (Adjust accordingly, prices may vary from time of alert.)

Okay, our Dogs of the Dow positions are officially closed for 2023. I’ll give the overall stats in our upcoming monthly issue that is due out in a few weeks. I can safely say that the Small Dogs outperformed the Dogs by a wide margin this year. And by the looks of it, our Small Dogs portfolio is close to pushing above 25% for the year. Not bad.

Cisco Systems (CSCO)

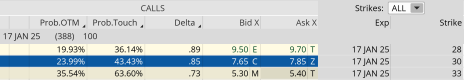

CSCO is currently trading for 50.24.

Here is the trade:

Buy to close CSCO December 29, 2023, 50 call for roughly $0.47. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

Sell to close CSCO January 17, 2025, 35 call for roughly $16.00. (Adjust accordingly, prices may vary from time of alert.)

International Business Machines (IBM)

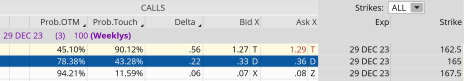

IBM is currently trading for 162.84.

Here is the trade:

Buy to close IBM December 29, 2023, 165 call for roughly $0.35. (Adjust accordingly, prices may vary from time of alert.)

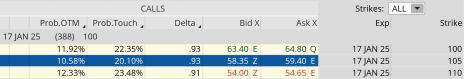

Once that occurs:

Sell to close IBM January 17, 2025, 105 call for roughly $58.85. (Adjust accordingly, prices may vary from time of alert.)

Walgreens Boots Alliance (WBA)

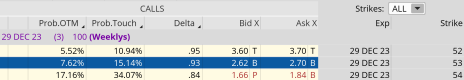

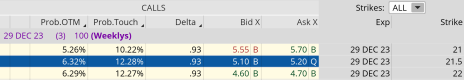

WBA is currently trading for 26.60.

Here is the trade:

Buy to close WBA December 29, 2023, 21.5 call for roughly $5.20. (Adjust accordingly, prices may vary from time of alert.)

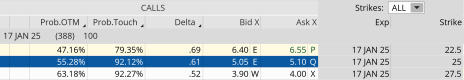

Once that occurs:

Sell to close WBA January 17, 2025, 25 call for roughly $5.05. (Adjust accordingly, prices may vary from time of alert.)

Chevron (CVX)

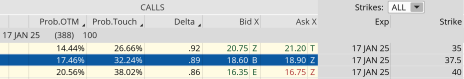

CVX is currently trading for 152.89.

Here is the trade:

Buy to close CVX December 29, 2023, 150 call for roughly $3.35. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

Sell to close CVX January 17, 2025, 125 call for roughly $33.70. (Adjust accordingly, prices may vary from time of alert.)

If you have any questions, please feel free to email me at andy@cabotwealth.com. I’m more than happy to help in any way I can.