Dogs of the Dow Portfolio Alert (INTC, JPM, AMGN)

Okay, it’s that time of year. We are going to close out a few of our Dogs and Small Dogs of the Dow positions today and early next week. Once that is complete, we simply wait until the first week of 2024 to initiate our new Dogs and Small Dogs positions (and several others across various portfolios).

But before I enter our new Dogs of the Dow trades, I intend on having a subscriber-only event that will go into great detail on the strategy used within the Fundamentals service and how we approach each individual portfolio.

Click here to sign up for the event. And if you can’t make it, no worries, we archive absolutely everything here at Cabot so you can watch at your leisure.

Intel (INTC)

INTC is currently trading for 48.14.

Here is the trade:

We are closing out the trade for a return of 134.4%.

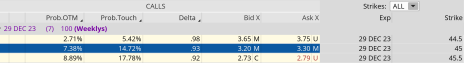

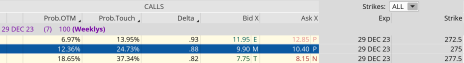

Buy to close the INTC December 29, 2023, 45 call for roughly $3.25. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

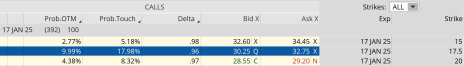

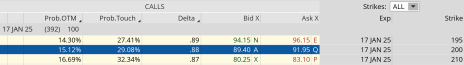

Sell to close the INTC January 17, 2025, 17.5 call for roughly $31.55. (Adjust accordingly, prices may vary from time of alert.)

JPMorgan Chase (JPM)

JPM is currently trading for 167.82.

We are closing out the trade for a return of 42.2%.

Here is the trade:

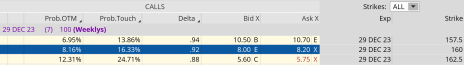

Buy to close JPM December 29, 2023, 160 call for roughly $8.10. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

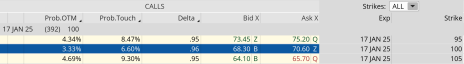

Sell to close JPM January 17, 2025, 100 call for roughly $70.00. (Adjust accordingly, prices may vary from time of alert.)

Amgen (AMGN)

AMGN is currently trading for 284.50.

After being down over 30% just a few months ago, we are happy to close the position, per our guidelines, for a -6% loss.

Here is the trade:

Buy to Close AMGN December 29, 2023, 275 call for roughly $10.20. (Adjust accordingly, prices may vary from time of alert.)

Once that occurs:

Sell to close the AMGN January 17, 2025, 200 call for roughly $90.70. (Adjust accordingly, prices may vary from time of alert.)

As always, if you have any questions, please fee