Cabot Options Institute Fundamentals – Alert (TIP)

Yale Endowment Portfolio

The Fed-induced rally yesterday has left a few of our positions with deltas that are shorter than we prefer. As a result, I want to buy back our short calls in those positions and sell more premium going out to a higher strike and further out in duration.

I intend on starting out with TIP and then continue to keep an eye on EEM and EFA to see how they perform, as both underlying ETFs’ short calls are hovering around their respective at-the-money strikes while in a short-term overbought state.

iShares TIPS Bond ETF (TIP)

We currently own the TIP January 19, 2024, 100 call LEAPS contract at $17.10. You must own LEAPS in order to use this strategy.

If you are new to the position, based on our approach, the LEAPS contracts with a delta of 0.81 are currently the January 17, 2025, 100 calls. We typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration.

Here is the trade:

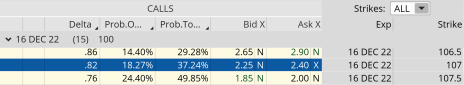

Buy to close TIP December 16, 2022, 107 call for roughly $2.35 (adjust accordingly, prices may vary from time of alert).

Once that occurs (or if you are new to the position and already own LEAPS):

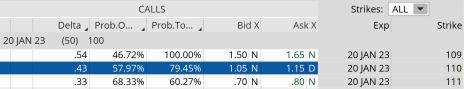

Sell to open TIP January 20, 2023, 110 call for roughly $1.10 (adjust accordingly, prices may vary from time of alert).

Premium received: 6.4%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $17.10 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in TIP.