Many of you have asked that I give a bearish call spread example in the iShares Russell 2000 ETF (IWM).

Before we begin to look at any potential trade, we must ensure that the underlying stock security has highly liquid options. We ALWAYS want to use the most efficient products the market offers.

[text_ad use_post='261460']

Russell 2000 (IWM) - Bearish Call Spread Example

IWM is a highly liquid ETF and one that I trade often. As a result, we can move forward with a potential bear call spread.

With IWM trading for 219.95 and showing weakness I want to place a bear call spread with a high probability of success. My preference is to go with a trade that has around an 80% probability of success.

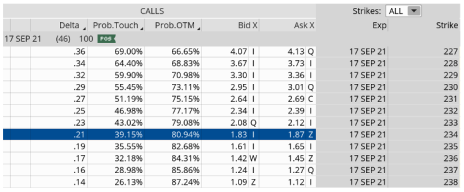

Let’s take a look at the September options chain for IWM with 46 days until expiration. My preference is to use options that have roughly 7 to 60 days until expiration. Once we have an expiration cycle in mind, we can then proceed to locate a call strike that has roughly an 80% probability of success.

It looks like the 234 calls with an 80.94% probability of success is where I want to start. The short call defines my probability of success on the trade. It also helps to define my overall premium or return on the trade. Basically, as long as IWM stays below the 234 call strike at expiration we will make a max profit on the trade. Time decay also works in our favor, so as we get closer and closer to expiration our premium will erode. As a result, we should have the opportunity to take the bear call spread off for a nice profit prior to expiration. Basically, we can be completely wrong in our directional assumption and still make a max profit on the trade. Just another reason why I prefer to sell options over buying them.

Once I’ve chosen my short call strike, in this case the 234 call, I then proceed to look at the other half of a 3- strike wide, 4-strike wide and 5-strike wide spread to buy.

The spread width of our bear call helps to define our risk on the trade.

The smaller the width of our bear call spread the less capital required and vice versa for a wider bear call spread. When defining your position size knowing the overall defined risk per trade is essential. Basically, my spread-width and my premium increase as my chosen spread-width increases.

For example, let’s take a look at the 5-strike, 234/239 bear call spread.

The Trade: 234/229 Bear Call Spread

Simultaneously:

Sell to open IWM September 17, 2021 234 strike

Buy to open IWM September 17, 2021 239 strike for a total net credit of roughly $0.85 or $85 per bear call spread

- Probability of Success: 80.89%

- Total net credit: $0.85, or $85 per bear call spread

- Total risk per spread: $4.15, or $415 per bear call spread

- Max Potential Return: 20.48%

As long as IWM stays below our 234 strike at expiration in 46 days, I have the potential to make 20.5% on the trade. In most cases, I will make slightly less, as the prudent move is to buy back the bear call spread prior to expiration. Typically, I look to buy back the spread when I can lock in 50% to 75% of the original credit. Since we sold the spread for $0.85, I want to buy it back when the price of my spread hits roughly $0.42 to $0.20.

Of course, there are a variety of factors to consider with each trade. And we allow the probabilities and time to expiration to lead the way for our decisions. But, taking off risk by locking in profits is never a bad decision and by doing so, we can take advantage of other opportunities the market has to offer.

Risk Management

Since we know how much we stand to make and lose prior to order entry we can precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so by keeping each trade at a reasonable level (I use 1% to 5% per trade) allows not only the Law of Large Numbers to work in your favor … it also allows you to sleep well at night.

I also tend to set a stop-loss that sits 1 to 2 times my original credit. In my example, I sold the 234/239 bear call spread for $0.85. As a result, if my spread reaches $1.70 to $2.55 I will exit the trade.

As always, if you have any questions, please do not hesitate to email me or post a question in the comments section below.