Cabot Options Institute Fundamentals – All Weather Portfolio Alert (GLD, IEF, VTI, TLT)

SPDR Gold Shares ETF (GLD)

We currently own the GLD January 19, 2024, 145 call LEAPS contract at $37. You must own LEAPS in order to use this strategy.

There are 273 days left until our GLD LEAPS are due to expire. Per our guidelines, we roll out our LEAPS further in duration once there are 10-12 months left in our LEAPS contract.

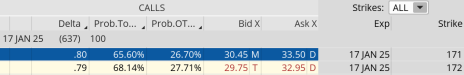

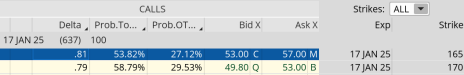

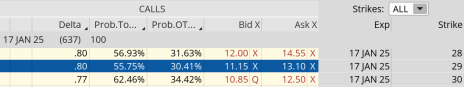

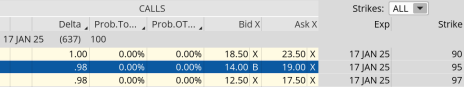

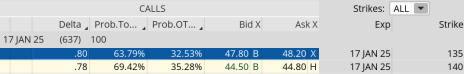

As a result, I want to sell to close our GLD January 19, 2024, 145 call LEAPS contract and immediately buy to open a January 2025 LEAPS contract with 637 days left until expiration.

Here is the trade:

Sell to close GLD January 19, 2024, 145 call for roughly $44.70 (adjust accordingly, prices may vary from the time of alert)

Once that occurs:

Buy to open GLD January 17, 2025, 171 call for roughly $32.00 or more (adjust accordingly, prices may vary from time of alert)

And once you have LEAPS in your possession:

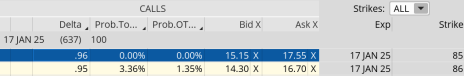

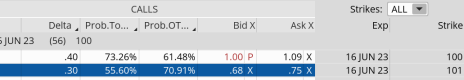

Buy to close GLD April 21, 2023, 193 call for roughly $0.01 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

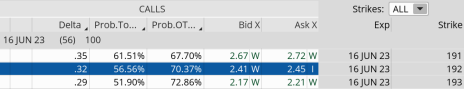

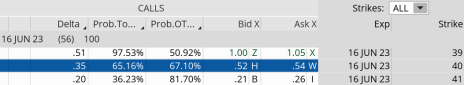

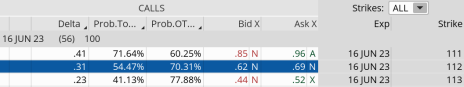

Sell to open GLD June 16, 2023, 192 call for roughly $2.42 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 7.6%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $32.00 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in GLD.

iShares Trust 7-10 Year Treasury Bond ETF (IEF)

We currently own the IEF January 19, 2024, 85 call LEAPS contract at $19. You must own LEAPS in order to use this strategy.

There are 273 days left until our IEF LEAPS are due to expire. Per our guidelines, we roll out our LEAPS further in duration once there are 10-12 months left in our LEAPS contract.

As a result, I want to sell to close our IEF January 19, 2024, 85 call LEAPS contract and immediately buy to open a January 2025 LEAPS contract with 637 days left until expiration.

Here is the trade:

Sell to close IEF January 19, 2024, 85 call for roughly $15.05 (adjust accordingly, prices may vary from the time of alert)

Once that occurs:

Buy to open IEF January 17, 2025, 85 call for roughly $16.35 or more (adjust accordingly, prices may vary from time of alert)

And once you have LEAPS in your possession:

Buy to close IEF April 21, 2023, 102 call for roughly $0.03 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

Sell to open IEF June 16, 2023, 101 call for roughly $0.72 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 4.4%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $16.35 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in IEF.

Vanguard Total Stock Market ETF (VTI)

We currently own the VTI January 19, 2024, 145 call LEAPS contract at $54.50. You must own LEAPS in order to use this strategy.

There are 273 days left until our VTI LEAPS are due to expire. Per our guidelines, we roll out our LEAPS further in duration once there are 10-12 months left in our LEAPS contract.

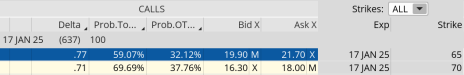

As a result, I want to sell to close our VTI January 19, 2024, 145 call LEAPS contract and immediately buy to open a January 2025 LEAPS contract with 637 days left until expiration.

Here is the trade:

Sell to close VTI January 19, 2024, 145 call for roughly $64.90 (adjust accordingly, prices may vary from the time of alert)

Once that occurs:

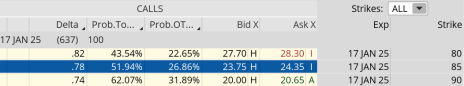

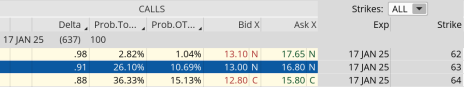

Buy to open VTI January 17, 2025, 165 call for roughly $55.05 or more (adjust accordingly, prices may vary from time of alert)

And once you have LEAPS in your possession:

Buy to close VTI April 21, 2023, 210 call for roughly $0.05 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

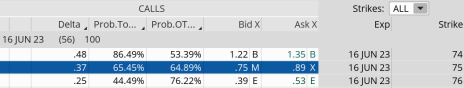

Sell to open VTI June 16, 2023, 215 call for roughly $1.10 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 2.0%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $55.05 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in VTI.

iShares 20+ Year Treasury Bond ETF (TLT)

We currently own the TLT January 19, 2024, 85 call LEAPS contract at $29.10. You must own LEAPS in order to use this strategy.

There are 273 days left until our TLT LEAPS are due to expire. Per our guidelines, we roll out our LEAPS further in duration once there are 10-12 months left in our LEAPS contract.

As a result, I want to sell to close our TLT January 19, 2024, 85 call LEAPS contract and immediately buy to open a January 2025 LEAPS contract with 637 days left until expiration.

Here is the trade:

Sell to close TLT January 19, 2024, 85 call for roughly $21.45 (adjust accordingly, prices may vary from the time of alert)

Once that occurs:

Buy to open TLT January 17, 2025, 85 call for roughly $24.05 or more (adjust accordingly, prices may vary from time of alert)

And once you have LEAPS in your possession:

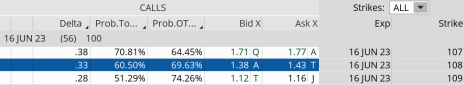

Buy to close TLT April 21, 2023, 110 call for roughly $0.01 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

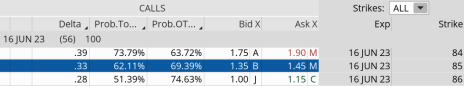

Sell to open TLT June 16, 2023, 108 call for roughly $1.41 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 5.9%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $24.05 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in TLT.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

Cabot Options Institute Fundamentals – Yale Endowment Portfolio Alert (EEM, VNQ, TIP, EFA)

iShares MSCI Emerging Market ETF (EEM)

We currently own the EEM January 19, 2024, 30 call LEAPS contract at $11.50. You must own LEAPS in order to use this strategy.

There are 273 days left until our EEM LEAPS are due to expire. Per our guidelines, we roll out our LEAPS further in duration once there are 10-12 months left in our LEAPS contract.

As a result, I want to sell to close our EEM January 19, 2024, 30 call LEAPS contract and immediately buy to open a January 2025 LEAPS contract with 637 days left until expiration.

Here is the trade:

Sell to close EEM January 19, 2024, 30 call for roughly $10.15 (adjust accordingly, prices may vary from the time of alert)

Once that occurs:

Buy to open EEM January 17, 2025, 29 call for roughly $12.15 or more (adjust accordingly, prices may vary from time of alert)

And once you have LEAPS in your possession:

Buy to close EEM April 21, 2023, 41 call for roughly $0.01 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

Sell to open EEM June 16, 2023, 40 call for roughly $0.53 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 4.4%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $12.15 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in EEM.

Vanguard Real Estate (VNQ)

We currently own the VNQ January 19, 2024, 70 call LEAPS contract at $23.25. You must own LEAPS in order to use this strategy.

There are 273 days left until our VNQ LEAPS are due to expire. Per our guidelines, we roll out our LEAPS further in duration once there are 10-12 months left in our LEAPS contract.

As a result, I want to sell to close our VNQ January 19, 2024, 70 call LEAPS contract and immediately buy to open a January 2025 LEAPS contract with 637 days left until expiration.

Here is the trade:

Sell to close VNQ January 19, 2024, 70 call for roughly $14.90 (adjust accordingly, prices may vary from the time of alert)

Once that occurs:

Buy to open VNQ January 17, 2025, 65 call for roughly $20.70 or more (adjust accordingly, prices may vary from time of alert)

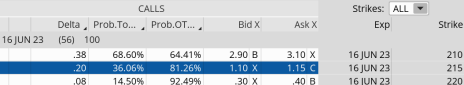

And once you have LEAPS in your possession:

Buy to close VNQ April 21, 2023, 88 call for roughly $0.03 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

Sell to open VNQ June 16, 2023, 85 call for roughly $1.40 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 6.8%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $20.70 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in VNQ.

iShares Trust TIPS ETF (TIP)

We currently own the TIP January 19, 2024, 100 call LEAPS contract at $17.10. You must own LEAPS in order to use this strategy.

There are 273 days left until our TIP LEAPS are due to expire. Per our guidelines, we roll out our LEAPS further in duration once there are 10-12 months left in our LEAPS contract.

As a result, I want to sell to close our TIP January 19, 2024, 100 call LEAPS contract and immediately buy to open a January 2025 LEAPS contract with 637 days left until expiration.

Here is the trade:

Sell to close TIP January 19, 2024, 100 call for roughly $10.75 (adjust accordingly, prices may vary from the time of alert)

Once that occurs:

Buy to open TIP January 17, 2025, 95 call for roughly $16.50 or more (adjust accordingly, prices may vary from time of alert)

And once you have LEAPS in your possession:

Buy to close TIP April 21, 2023, 111 call for roughly $0.01 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

Sell to open TIP June 16, 2023, 112 call for roughly $0.65 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 3.9%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $16.50 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in TIP.

iShares Trust MSCI EAFE (EFA)

We currently own the EFA January 19, 2024, 45 call LEAPS contract at $19.50. You must own LEAPS in order to use this strategy.

There are 273 days left until our EFA LEAPS are due to expire. Per our guidelines, we roll out our LEAPS further in duration once there are 10-12 months left in our LEAPS contract.

As a result, I want to sell to close our EFA January 19, 2024, 45 call LEAPS contract and immediately buy to open a January 2025 LEAPS contract with 637 days left until expiration.

Here is the trade:

Sell to close EFA January 19, 2024, 45 call for roughly $28.90 (adjust accordingly, prices may vary from the time of alert)

Once that occurs:

Buy to open EFA January 17, 2025, 63 call for roughly $14.90 or more (adjust accordingly, prices may vary from time of alert)

And once you have LEAPS in your possession:

Buy to close EFA April 21, 2023, 72 call for roughly $1.33 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

Sell to open EFA June 16, 2023, 75 call for roughly $0.80 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 5.4%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $14.90 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in EFA.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

Cabot Options Institute Fundamentals – Buffett Patient Portfolio Alert (AAPL)

Apple (AAPL)

We currently own the AAPL January 19, 2024, 130 call LEAPS contract at $54.20. You must own LEAPS in order to use this strategy.

There are 273 days left until our AAPL LEAPS are due to expire. Per our guidelines we roll out our LEAPS further in duration once there are 10-12 months left in our LEAPS contract.

As a result, I want to sell to close our AAPL January 19, 2024, 130 call LEAPS contract and immediately buy to open a January 2025 LEAPS contract with 637 days left until expiration.

Here is the trade:

Sell to close AAPL January 19, 2024, 130 call for roughly $42.95 (adjust accordingly, prices may vary from the time of alert)

Once that occurs:

Buy to open AAPL January 17, 2025, 135 call for roughly $48.00 or more (adjust accordingly, prices may vary from time of alert)

And once you have LEAPS in your possession:

Buy to close AAPL April 21, 2023, 165 call for roughly $0.34 or more (adjust accordingly, prices may vary from time of alert)

Once that occurs:

Sell to open AAPL June 16, 2023, 175 call for roughly $2.57 or more (adjust accordingly, prices may vary from time of alert)

Premium received: 5.4%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $48.00 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in AAPL.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.