Last Friday I sent out our first official trade alert in SPDR Gold Trust ETF (GLD).

We went through the trade step by step in hopes that you have a better understanding of the strategy. I plan on doing the same for our trades today, but the remainder of the trades going forward will be significantly shorter, focusing on the trade and the associated statistics.

If you wish to learn more about the strategy please reference the strategy guide on your subscriber page.

Today I want to build out the rest of our passive All-Weather Portfolio. I plan on making trades in iShares Trust 7-10 Year Treasury Bond ETF (IEF) and Invesco DB Commodity Index Tracking Fund (DBC) to start and I will send out a second alert for trades in Vanguard Total Stock Market ETF (VTI) and iShares 20+ Year Treasury Bond ETF (TLT) tomorrow or Friday as I want people to have time to digest the initial trade alert today. I hope this measured approach helps. We will discuss further in our upcoming webinar next week.

For those that aren’t interested in any of the above, no worries, I’ll be building two more passive portfolios over the next two weeks, including David Swensen’s Yale Endowment Portfolio and the Dogs of the Dow Portfolio. And if that wasn’t enough, the rebalancing period for our active portfolios occurs towards the latter part of each month, so I’ll be adding a few new positions for our O’Shaughnessy’s Growth-Value Portfolio and Buffett’s Patient Investor Portfolio.

The next few weeks will see quite a few trades as we build out the portfolios within the service. So, be patient. Read through the User Guide on your subscriber page to get a feel for what each portfolio is trying to accomplish.

Some of you may choose to strictly follow one portfolio or several, while others just want to diversify a few positions from each portfolio and everything in between. Just understand that we will be releasing numerous alerts over the next few weeks, so don’t feel obligated to take a position because you just want trade action.

As I stated before, I plan on adding the ETFs that reside in the David Swensen’s Yale Endowment Portfolio next.

Here are the following holdings I’ll be adding:

- SPDR S&P 500 ETF (SPY)

- iShares MSCI Emerging Market ETF (EEM)

- Vanguard Real Estate (VNQ)

- iShares Trust TIPS ETF (TIP)

- iShares trust MSCI EAFE ETF (EFA)

Once we have our two passive ETF portfolios built out, we will be focusing on the three additional stock-based portfolios (Dogs of the Dow, Buffett’s Patient Investor, O’Shaughnessy’s Growth/Value).

I’ll be going over all of this in greater detail and much more in our upcoming subscriber-only webinar on Tuesday, June 14 at 1:00pm EST.

As always, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.

Invesco DB Commodity Index Tracking Fund (DBC)

The Invesco DB Commodity Index Tracking Fund (DBC) is currently trading for 30.45.

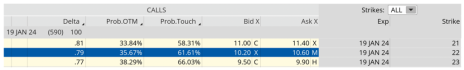

I always choose my LEAPS call contract by the delta of the option. I prefer to initiate a LEAPS position by looking for a delta of 0.80. With a delta of 0.79, the January 19, 2024, 22 call strike with 590 days until expiration works.

I can buy one options contract, which is equivalent to 100 shares of DBC, for roughly $10.50 (price may vary), if not slightly cheaper. Remember, always use a limit order, never buy at the ask price, which in this case is $10.60. Moreover, prices can and will most likely vary slightly from the alert, please adjust accordingly if you wish to take a position.

If we buy the 22 strike call for roughly $10.50, we are out $1,050, rather than the $3,045 I would spend for 100 shares of DBC. That’s a savings on capital required of 65.5%. Now we can use the capital saved ($1,995) to work in other ways, preferably to diversify our poor man’s covered call strategy among other stocks and ETFs.

Once we make the initial LEAPS purchase, we can maintain that position and focus on selling near-term call premium against our LEAPS each month – thereby generating income and lowering the original cost basis with each transaction.

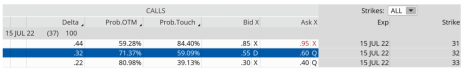

I begin the process of selling shorter-term calls against my LEAPS by looking for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 85%.

As you can see in the options chain below, the 32 strike call with a delta of 0.32 falls within my preferred range.

I can sell the 32 call for roughly $0.55 (price may vary).

My total outlay for the entire position now stands at $9.95 or $995 ($10.50 – $0.55). The premium collected is 5.2% over 37 days. Not a ton of premium, but remember, we are going out roughly 30 days and using an ETF that has, by most comparisons a modest level of implied volatility (IV).

Also, the 5.2%, or 46.8% annually, is just the premium return, it does not include any increases in the LEAPS contract if the stock pushes higher. Since our initial delta is 0.47 (0.79 – 0.32), the position will increase by $0.47 for every dollar DBC moves higher.

The overall delta of the position will eventually hit a neutral state if DBC continues to move higher over the next 37 days. If it does, we simply buy back our short call and sell more premium.

Delta is a major factor in managing poor man’s covered calls. I’m going to start going over the Greeks, including delta, theta and gamma next week. Stay tuned!

So, as you can see above, we have the potential to create 5.2% every 37 days, or approximately 46.8% a year using a fairly conservative ETF like DBC. This is our baseline and should be our expected return in premium, but again this does not include any capital gains from our LEAPS position if DBC trends higher.

The Trade

Buy to open January 19, 2024, DBC 22 calls for $10.50 (prices may vary, adjust accordingly)

Once that occurs:

Sell to open July 15, 2022, DBC 32 calls for $0.55 (prices may vary, adjust accordingly)

You could also place the order as a long diagonal debit spread, but I will go over that and much, much more in our upcoming webinar next week.

iShares Trust 7-10 Year Treasury Bond ETF (IEF)

The iShares Trust 7-10 Year Treasury Bond ETF (IEF) is currently trading for 101.93.

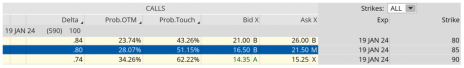

I choose my LEAPS call contract by the delta of the option. I prefer to initiate a LEAPS position by looking for a delta of 0.80. With a delta of 0.80, the January 19, 2024, 85 call strike with 590 days until expiration works.

I can buy one options contract, which is equivalent to 100 shares of IEF, for roughly $19.00 (price may vary, adjust accordingly). Remember, always use a limit order, never buy at the ask price, which in this case is $21.50.

If we buy the 85 strike call for roughly $19.00, we are out $1,900, rather than the $10,193 I would spend for 100 shares of IEF. That’s a savings on capital required of 81.4%. Now we can use the capital saved ($8,293) to work in other ways, preferably to diversify our poor man’s covered call strategy among other stocks and ETFs.

Once we make the initial LEAPS purchase, we can maintain that position and focus on selling near-term call premium against our LEAPS each month – thereby generating income and lowering the original cost basis with each transaction.

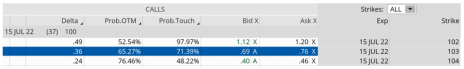

I begin the process of selling shorter-term calls against my LEAPS by looking for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 85%.

As you can see in the options chain below, the 103 strike call with a delta of 0.36 falls within my preferred range.

I can sell the 103 call for roughly $0.70, if not higher (price may vary, adjust accordingly).

My total outlay for the entire position now stands at $18.30. or $1,830 ($19.00 – $0.70). The premium collected is 3.7% over 37 days. Not a ton of premium, but remember, we are going out 30 days and using an ETF that has, by most comparisons a low level of implied volatility (IV).

Also, the 3.7%, or 33.3% annually, is just the premium return, it does not include any increases in the LEAPS contract if the stock pushes higher. Since our initial delta is 0.44 (0.80 – 0.36), the LEAPS contract will increase by $0.44 for every dollar IEF moves higher.

The overall delta of the position will eventually hit a neutral state if IEF continues to move higher over the next 37 days. If it does, we simply buy back our short call and sell more premium.

Delta is a major factor in managing poor man’s covered calls. I’m going to start going over the Greeks, including delta, theta and gamma next week. Stay tuned!

So, as you can see above, we have the potential to create 3.7% every 37 days, or approximately 33.3% a year using a fairly conservative ETF like IEF. This is our baseline and should be our expected return in premium, but again this does not include any capital gains from our LEAPS position if IEF trends higher.

The Trade

Buy to open January 19, 2024, IEF 85 calls for $19.00 (prices may vary, adjust accordingly)

Once that occurs:

Sell to open July 15, 2022, IEF 103 calls for $0.70 (prices may vary, adjust accordingly)

Like our DBC trade above, you could also place the order as a long diagonal debit spread, but I will go over that and much, much more in our upcoming webinar next week.