Last week we finished opening our final position in the Yale Endowment Portfolio. As it stands, we now have two portfolios up and running.

As I stated early on, I wanted to ramp up the passive portfolios (All-Weather, Yale Endowment) first and then move on to our actively managed portfolios which include Buffet’s Patient Investor Portfolio and James O’Shaughnessy’s Growth-Value Portfolio. That being said, I’m going to hold off a bit longer on initiating our first active portfolio trades in the Growth-Value Portfolio and Buffett’s Patient Investor Portfolio.

Today, we are going to roll a short call position in both our All-Weather portfolios and will most likely be doing the same tomorrow in the Yale Endowment Portfolio tomorrow.

But before I get to today’s trade, I want to briefly discuss how to enter a position if you are new to the service. I often get questions from those new to the service about how to enter an open position. While I plan to address this in full during our next Live Analyst Briefing with Q&A on July 12, 2022 at 12:00pm EST, I do want to go over a few basics today.

Stick to the Mechanics

I would advise everyone to read through the strategy report on your subscriber page. I follow a fairly strict mechanical setup where I buy a LEAPS contract with roughly 18-24 months left until expiration. Once I’ve chosen my expiration cycle, I then look to buy a LEAPS contract with a delta of roughly 0.80.

Once I’ve purchased my LEAPS contract, I then look to sell a call with a delta of .20 to .40 and 30 to 60 days until expiration.

So, when looking to open a new position, understand that due to fluctuations in the underlying security price, that options prices, deltas and the like can, and most likely will, be different than our original position.

That’s not a problem if you stick to the mechanics, particularly when buying your LEAPS contract. Because once you’ve opened your LEAPS contract, we are simply buying back our calls and selling new calls every 45 to 60 days. During this period, you have the ability to “get on track” if you wish to follow the alerts to a tee.

Which leads to the question, what if I want to open a position, but for instance:

- There is little to no premium left

- There are only a few days left until expiration

- Calls are in-the-money

This is when you have the choice of waiting until we issue a new alert to sell more calls, or simply set up that initial round of selling calls by sticking to the mechanics and selling a call against your LEAPS contract with 30 to 60 days left until expiration and a delta somewhere between .20 and 0.40.

I understand there are probably some other lingering questions that some new to the service might have about new positions, but I’m hoping this covers most of the major questions.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com. And if you were not able to catch the latest webinars with my thoughts on the market and a little education on our approach, click here or go to your subscriber page to access.

All-Weather Portfolio

We currently own the TLT January 2024 85 call LEAPS contract at $29.10. You must own LEAPS in order to use this strategy. If you wish to enter the position and are uncertain about which LEAPS to purchase, please refer to the reports section of your subscriber page.

As stated above, we typically initiate a LEAPS position, with a delta of roughly 0.80, that has roughly 18 to 24 months left until expiration. By going out this far we eliminate theta decay. We roll the LEAPS contract further out in time once there is roughly one year left until expiration to avoid any theta decay.

Here is the trade:

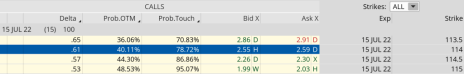

Buy to close TLT July 15, 2022, 114 call for roughly $2.58

Once that occurs (or if you are new to the position and already own LEAPS):

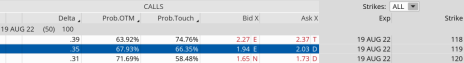

Sell to open TLT August 19, 2022, 119 call for roughly $1.95

Premium received: 6.7%

Once the initial LEAPS purchase occurs, we maintain the position and focus on selling near-term call premium against our LEAPS, lowering the original cost basis of $29.10 (or the price at which you purchased your LEAPS) with each and every transaction.

We can continue to sell calls against our LEAPS contract every month or so to lower the total capital outlay. But remember, options have a limited life, so when we get closer to the LEAPS contract’s expiration, we will simply sell the contract and use the proceeds to continue our poor man’s covered call strategy in TLT.