Today we are adding the last of the Yale Endowment Portfolio positions. So far, we’ve ramped up both passive portfolios, All-Weather and Yale Endowment, and will be focusing on adding a few positions in the active portfolios (Growth-Value and Patient) next week.

For those, that are new to the service please take the chance to read through the user guide, strategy reports, trade alerts and latest webinar. It will be incredibly helpful and certainly flatten your learning curve. And as always, if anyone has any questions, please do not hesitate to email me at andy@cabotwealth.com.

SPDR S&P 500 ETF (SPY)

The SPDR S&P 500 ETF (SPY) is currently trading for 387.00

The Trade

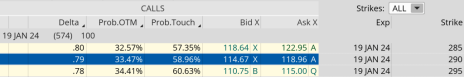

Buy to open January 19, 2024, SPY 290 calls for approximately $117.00 (prices may vary, adjust accordingly)

Once that occurs:

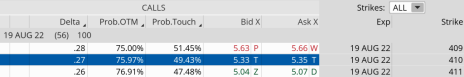

Sell to open August 19, 2022, SPY 410 calls for approximately $5.33 (prices may vary, adjust accordingly)

Potential Return (premium) – 4.56% over the next 56 days

Breakeven: 111.67

Cost Basis Since Initiated: 111.67