Before we get to the trades today, I want to discuss an important topic, risk management.

Since we started the All-Weather portfolio, roughly three weeks ago, the S&P 500 is down roughly 9%. And last week was one of the worst in market history. Yet, our All-Weather portfolio is up roughly 2%, proving not only the power of the All-Weather approach, but also the poor man’s covered call strategy. But don’t get confused, losses will happen from time to time, that’s a guarantee. It’s part of investing and trading. Which is why we should always look at ourselves as risk managers first.

We must have a sound risk-management plan in place and understand, at all times, how much we stand to lose. No strategy is foolproof. All we can do is invest/trade in what we feel are the best strategies for our financial goals, fully understanding that risk is perpetually at play.

We’ve discussed the pros and cons of a poor man’s covered calls in the strategy reports, subscriber-exclusive webinars and user guide. But I feel it is important to constantly remind investors about the importance of risk management throughout their overall investment approach.

When discussing the real risks of a poor man’s covered call, otherwise known as a long diagonal debit spread, there are two leading risks that we need to think about prior to taking a position.

- Losing money if the stock price declines below the breakeven point of our Initial LEAPS purchase.

The breakeven point is the purchase price of the LEAPS contract minus the option premium received. As with any investment strategy, there is substantial risk. Although stock prices can fall to zero, this is still 100% of the amount invested or position size, so it is important that when using poor man’s covered calls and any other strategy, a disciplined approach to position size is taken.

- The opportunity risk of not participating in a large stock price rise.

As long as a poor man’s covered call position is open, the writer (seller) of the poor man’s covered call is obligated to sell the stock at the chosen strike price. Although the options premium provides some profit potential above the strike price, that profit potential is limited when the delta of the LEAPS contract is equal to the delta of the short call. Therefore, the covered call writer does not fully participate in a push above the strike.

Position size is truly the best way to control your risk, and risk varies with each individual. Yes, we can naturally and continually hedge our positions each time we sell a call as the transaction lowers the cost basis of the initial purchase price of our LEAPS contract. And yes, the initial cost is 65% to 85% cheaper than a traditional covered call strategy.

But there is still risk at hand. Size positions accordingly.

We will continually discuss risk management as it is THE MOST IMPORTANT part of investing. Next week I intend to introduce another form of portfolio protection … collars.

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com.

Vanguard Real Estate ETF (VNQ)

The Vanguard Real Estate ETF (VNQ) is currently trading for 90.28.

The Trade

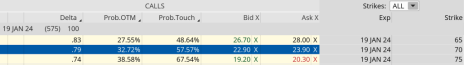

Buy to open January 19, 2024, VNQ 70 calls for approximately $23.25 (prices may vary, adjust accordingly)

Once that occurs:

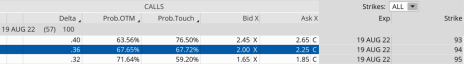

Sell to open August 19, 2022, VNQ 94 calls for approximately $2.10 (prices may vary, adjust accordingly)

You could also place the order as a long diagonal debit spread.

Potential Return (premium) – 9.03% over the next 57 days

Breakeven: 21.15

Cost Basis Since Initiated: 21.15

iShares TIPS Bond ETF (TIP)

The iShares TIPS Bond ETF (TIP) is currently trading for 115.40.

The Trade

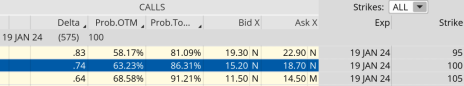

Buy to open January 19, 2024, TIP 100 calls for approximately $17.10 (prices may vary, adjust accordingly)

Once that occurs:

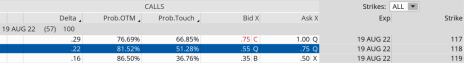

Sell to open August 19, 2022, TIP 118 calls for approximately $0.65 (prices may vary, adjust accordingly)

You could also place the order as a long diagonal debit spread.

Potential Return (premium) – 3.80% over the next 57 days

Breakeven: 16.45

Cost Basis Since Initiated: 16.45