We continue to take a patient approach to ramping up our portfolios, given the current market conditions.

Last week was one of the worst weeks we’ve seen in quite some time, so we decided to sit on the sidelines and allow the carnage to unfold without adding any new positions.

That being said, our All-Weather portfolio performed mightily, actually closing out the week slightly positive, and is up since we initiated our positions, which tells us just how the strategy fares in difficult markets.

Today, we move on to the Yale Endowment Portfolio. I plan to add two positions today and the remaining three, if the market cooperates, by the end of the week.

Once we get the Yale Endowment Portfolio positions in place I want to move on to adding some Dogs of the Dow stocks, but also some positions for our active portfolios as well (Growth-Value and Patient).

As always, if you have any questions, please feel free to email me at andy@cabotwealth.com. And if you were not able to catch the latest Live Analyst Briefing with Q&A with my thoughts on the market and a little education on our approach click here or go to your subscriber page to access.

iShares MSCI Emerging Market ETF (EEM)

The iShares MSCI Emerging Market ETF (EEM) is currently trading for 39.81.

The Trade

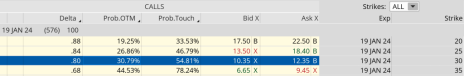

Buy to open January 19, 2024, EEM 30 calls for approximately $11.50 (prices may vary, adjust accordingly)

Once that occurs:

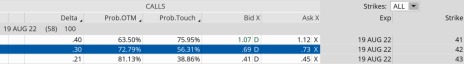

Sell to open August 19, 2022, EEM 42 calls for approximately $0.70 (prices may vary, adjust accordingly)

You could also place the order as a long diagonal debit spread.

Potential Return (premium) – 6.09% over the next 58 days

Breakeven: 10.80

Cost Basis Since Initiated: 10.80

iShares MSCI EAFE ETF (EFA)

The iShares MSCI EAFE ETF (EFA) is currently trading for 62.45.

The Trade

Buy to open January 19, 2024, EFA 45 calls for approximately $19.50 (prices may vary, adjust accordingly)

Once that occurs:

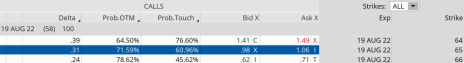

Sell to open August 19, 2022, EFA 65 calls for approximately $1.00 (prices may vary, adjust accordingly)

You could also place the order as a long diagonal debit spread.

Potential Return (premium) – 5.13% over the next 58 days

Breakeven: 18.50

Cost Basis Since Initiated: 18.50