Okay, it’s finally time to dip our toes into a few new positions for our active portfolios. I want to start by initiating one trade in each of our active portfolios today and plan to ramp both Patient Investor and Growth/Value portfolios up over the next few expiration cycles. Unlike our passive portfolio, we will be rebalancing our positions each month in our active portfolios, so there will be times when we are only in a position for one expiration cycle or possibly as many as twelve.

Growth-Value Portfolio

Chevron (CVX)

Chevron (CVX) is currently trading for 158.05.

The Trade

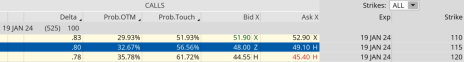

Buy to open January 19, 2024, CVX 115 calls for $48.60 (prices may vary, adjust accordingly)

Once that occurs:

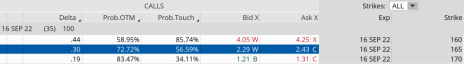

Sell to open September 16, 2022, 165 calls for $2.35, if not higher (prices may vary, adjust accordingly)

You could also place the order as a long diagonal debit spread, but I will go over that and much, much more in our upcoming Live Analyst Briefing with Q&A next week. Register Here.

Potential Return (premium) – 4.84% over the next 35 days

Breakeven: 46.25

Cost Basis Since Initiated: 46.25

Patient Investor Portfolio

Apple (AAPL)

Apple (AAPL) is currently trading for 170.85.

The Trade

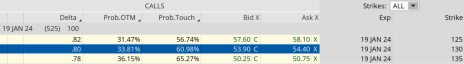

Buy to open January 19, 2024, AAPL 130 calls for $54.20 (prices may vary, adjust accordingly)

Once that occurs:

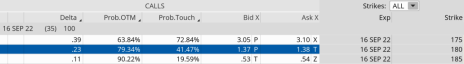

Sell to open September 16, 2022, AAPL 180 calls for $1.37, if not higher (prices may vary, adjust accordingly)

You could also place the order as a long diagonal debit spread, but I will go over that and much, much more in our upcoming Live Analyst Briefing with Q&A next week. Register Here.

Potential Return (premium) – 2.53% over the next 35 days

Breakeven: 52.83

Cost Basis Since Initiated: 52.83

Again, if you have any questions, please do not hesitate to email me at andy@cabotwealth.com.