After pulling back in September, the S&P 500 is back to flirting with all-time highs.

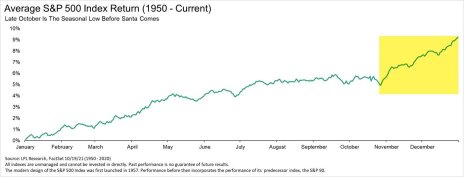

My favorite strategist, Ryan Detrick, recently shared that the market is typically weak now before starting to run into the “Santa rally.”

As you know, my approach is to focus on bottom-up fundamentals and try to pick the most attractive micro-caps no matter the market environment.

However, I do think it’s helpful to be aware of the typical seasonality in the market. For example, if the market does weaken for the rest of the month, we know that price action is consistent with history.

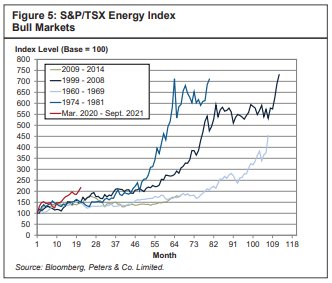

Before I get into this week’s update, I wanted to share one more chart that suggests you haven’t missed the “energy bull market.”

My top two energy picks are Dorchester Minerals (DMLP) and Epsilon Energy (EPSN). I think both are well positioned for continued strong performance.

This week, I have a few updates that I want to highlight:

- Increasing my buy limit for BBX Capital (BBXIA) given its reasonable valuation and strong fundamentals.

- Increasing my target price / buy limit for P10 Holdings (PIOE) given it’s imminent uplisting.

- Increasing my target price for Dorchester Minerals (DMLP) given higher oil prices.

- I listened to a recent interview with Medexus (MEDXF) and came away more bullish.

See below for more details on all four stocks.

Other than that, there wasn’t too much news this week. However, earnings are rapidly approaching. As such, expect some updates in the coming weeks.

The next issue of Cabot Micro-Cap Insider will be published on November 10, 2021. As always, if you have any questions, please email me at rich@cabotwealth.com.

Changes This Week

Increasing buy limit for BBXIA to Buy under 9.50

Increasing buy limit for PIOE to Buy under 12.00

Updates

Aptevo (APVO) continues to perform poorly. The investment case remains the same. The market is currently valuing the stock as if its pipeline is worth negative value (currently -$30MM). This doesn’t make sense as Aptevo’s main drug, APVO436, has shown promising data and the company has a pipeline of other assets. This is a high-risk/reward trade because the upside could be substantial, but downside could also be substantial if it continues to burn cash with little to show for it. We will see preliminary phase II data later this year which could be a nice catalyst. Original Write-up. Buy under 25.00

Atento S.A. (ATTO) received a nice boost because of this write up in September. However, the stock has come back down to earth a bit. It’s nice to see that more investors are finding Atento because it continues to look incredibly cheap. I expect a strong quarter to be announced shortly. Atento last reported earnings in August. In the quarter, revenue increased 22% to $382MM, beating consensus by 4%. EBITDA increased 123% y/y to $50.7MM. EBITDA margin increased to 13.3%, up from 7.1% a year ago. Despite the strong performance, ATTO is still only trading at 3.9x my estimate for 2022 EBITDA. Peers such as Concentrix (CNXC) trade at 10x or higher. Original Write-up. Buy under 30.00

BBX Capital (BBXIA) disclosed in September in an 8-k that it is increasing its share buyback authorization from $10MM to $20MM. The first $10MM authorization was used to buy back $8.3MM worth of shares, the additional $10MM authorization will enable the company to continue these buybacks. Further, the company announced that it recognized a $7.7MM cash distribution from a property that they had held at a $2.1MM valuation. This is good news and implies that book value per share ($17.53) may be understated. I recently moved up my price target to $12. Here’s how I’m thinking about my new valuation: The company has $7.44 per share of net cash/notes receivable on its balance sheet and I’m giving it 100% credit for that (given recent shareholder-friendly actions). I’m assuming the remaining business is worth 5x this year’s free cash flow. Note, a $12 target is still at a significant discount to book value per share ($17.53). Given strong performance, I’m increasing my price buy under limit to 9.50. I would recommend trying to buy the stock around its 50-day moving average as that has historically been a timely entry point. Original Write-up. Buy under 9.50

Cipher Pharma (CPHRF) is a cheap, Canadian specialty pharma company that has a promising pipeline. Despite strong potential, the stock trades at a draconian valuation. Insider ownership is high, and insiders have been buying the stock in the open market. Further, the company is buying back its own shares in the open market. Downside protection is high given net cash on its balance sheet and strong free cash flow generation. My price target of 2.50 implies good upside over the next 12 months. Original Write-up. Buy under 2.00

Dorchester Minerals LP (DMLP) has moved higher on the week. SEC filings revealed that the CFO of the company bought stock in the open market in August after the company reported earnings. Q2 2021 earnings were $0.46 or $1.84 on an annualized basis. As such, the stock is trading at 11.0x annualized earnings, too cheap a multiple for such a high-quality, high-margin, and no-debt business. At its current quarterly dividend, the stock is trading at a dividend yield of 9.5%. I expect the next distribution to be announced soon. Given high oil prices, I’m increasing my price target on DMLP to 25.00. The stock has run sharply, but I would recommend buying it around its 50-day moving average (currently ~17.50). Over time, I will increase my buy limit. Original Write-up. Buy under 17.50

Drive Shack (DS) recently pre-announced revenue of $75MM which was slightly below consensus. We will get more details when the company reports earnings in November. Drive Shack also mentioned in its press release that it has successfully opened Puttery in The Colony, Texas, and initial reviews look pretty good. I continue to like the stock. At its current valuation, Drive Shack’s share price gives minimal value to the strong upside potential from new Puttery venues. Finally, alignment is high as management and directors own 16.3% of shares outstanding and have recently bought in the open market. My price target is 6.00. Original Write-up. Buy under 4.00

Epsilon Energy (EPSN) has performed well as natural gas prices have rallied. I recently spoke to the CEO of the company and learned more about Epsilon’s natural gas hedges. The company has 2/3 of its product hedged in the $3/Mcf range, but 1/3 has exposure to the spot market. From November ’21 to March ’22, 30% of production is hedged at ~$3.34/Mcf, but 70% of production is exposed to the soaring spot market. I see significant upside over the next 12 months as the company benefits from high natural gas prices. Original Write-up. Buy under 5.50

FlexShopper (FPAY) had no news this week. The stock saw strong insider buying in August in the $2.50 to $2.90 range following a strong earnings release. In the quarter, revenue grew 25% y/y to $30.7MM. Looking out to the rest of the year, strong growth should continue as the company is expanding its pilot program with an undisclosed national retailer and has added a second national retailer to its pilot program. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 2.50

IDT Corporation (IDT) recently reported a great quarter with strong growth across the board. Mobile Top-up revenue increased 41% y/y, this is the 6th consecutive quarter of 20%+ revenue growth. National Retail Solutions (NRS) revenue increased 76% y/y, with performance being driven by an increase in average revenue per user (ARPU) and terminal growth. Management expects continued upside in ARPU, driven by merchant services, advertising and data. Net2phone subscription revenue increased 46% y/y, with 80%+ gross margin. Lastly, Traditional communications reported its third consecutive quarter of revenue growth and generated $29mm of EBITDA. Original Write-up. Buy under 45.00

Leatt (LEAT) Corporation is my latest recommendation. It is a South African company that designs and manufactures protective equipment for motor bike riders. Despite a revenue compound annual growth rate (CAGR) of 24% from 2017 to 2020, and an EPS CAGR of 165%, the stock trades at a forward P/E multiple of just 13.2x. Insiders own 45% of shares outstanding, and I expect strong growth ahead. My price target of 36 implies significant upside ahead. Original Write-up. Buy under 27.

Liberated Syndication (LSYN) recently announced that it hired a new full-time CFO. This is a positive as the company had been operating without a CFO or CEO. However, I do have strong confidence in President, Laurie Sims, who has been leading the business. The stock has been languishing of late, and I recently wrote an article that addresses why that might be the case. In short, it has become very difficult to buy companies that are not current on their financials or don’t report their financials to the SEC or OTCmarkets.com due to an SEC rule change (15c2-11). I believe this is pressuring Libsyn’s stock lower. But I also believe it represents an opportunity as when the company reports its restated financials it will show a company growing revenue at ~17%. At its current valuation of 2.5x 2021 revenue, it looks very attractive. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) had no news on the week, but I did have a chance to listen to the CEO’s presentation/interview with the company. Here are my takeaways: 1) Medexus is paying out its dividend to convertible debenture holders in shares instead of cash to preserve liquidity ($1.3MM payment). 2) Medexus has enough liquidity to get itself to the FDA decision date (estimated next year) for Treosulfan. 3) CEO is still very bullish on outlook for ultimate approval for Treosulfan. CRL was unusual. Typically, 15% of drugs get a CRL. Since the questionable Biogen Alzheimer’s drug approval, 50% of drugs have gotten CRL. Historically, 55% of drugs that get a CRL are ultimately approved. I’m slowly warming back up to Medexus. It sounds like the company will be most of the way through its inventory issue with IXINITY this quarter, it has adequate liquidity (no need to raise equity), and we are 12 months away from the FDA’s decision on Treosulfan. If Treosulfan is approved (I’m assuming 50% probability even though I think that should be higher given life-saving efficacy), the stock will likely trade into the teens. Original Write-up. Hold

Performant Financial (PFMT) had no news on the week. Following a strong quarter in August, the company raised $40MM of equity. While I’m disappointed in the dilution, it will improve the company’s balance sheet substantially and allow it to accelerate growth. All in all, the investment case is still on track. My price target decreases a little bit in the medium term to 6.60 (due to the dilution) but, longer term, I think this stock could trade over 10. Original Write-up. Buy under 5.00

P10 Holdings (PIOE) recently announced it will price its (previously telegraphed) IPO in the range of $14 to $16, but there will be a .7 to 1 reverse split. PIOE opened at $11.24 on Tuesday October 12, 2021, equivalent to a $16 post IPO price. Essentially, P10 is uplisting from the OTC market to the NYSE. As part of the IPO (which really should be viewed as a secondary), the company is raising ~$172MM to de-lever and strengthen its balance sheet for additional acquisition opportunities. In addition, certain shareholders are selling ~3MM shares. Despite the stock’s recent move up, its long-term prospects still look attractive as it’s currently trading at 13x free cash flow and 15.5x EBITDA. Given the imminent uplisting/IPO, I’m increasing my price target for the stock to 16 (23 post-reverse split). I’m also increasing my buy limit to 12. Original Write-up. Buy under 12.00

Stabilis Solutions (SLNG) reported record earnings in August with revenue of $16.1MM, up 221% y/y. It was 45% above Q2 2019 revenue (pre-pandemic) of $11.0MM. The investment case remains on track, and I had an encouraging conversation with the CFO of the company recently. The high price of natural gas will not impact Stabilis’ business either way as it does not take commodity risk. As a reminder, Stabilis Solutions specializes in delivering liquid natural gas (LNG) and hydrogen to its customers who are away from pipelines and off the energy grid. Customers use Stabilis Solutions as it provides them with cheap, reliable energy that is cleaner than other fossil fuels. The company has grown revenue at a 27% CAGR and has a bright outlook. Insiders own more than 50% of the company but have been relentlessly buying more stock in the open market. The stock has performed well since the pandemic but looks like a double over the next 12 months. Original Write-up. Buy under 9.00

| Stock | Price Bought | Date Bought | Price 10/19/21 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 14.44 | -55% | Buy under 25.00 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 28.00 | 30% | Buy under 30.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 9.76 | 208% | Buy under 9.50 |

| Cipher Pharma (CPHRF) | 1.80 | 9/8/21 | 2.13 | 18% | Buy under 2.50 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 19.96 | 104% | Buy under 17.50 |

| Drive Shack (DS) | 2.61 | 5/12/21 | 2.77 | 6% | Buy under 4.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 5.64 | 13% | Buy under 5.50 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 2.72 | 28% | Buy under 2.50 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 48.53 | 151% | Buy under 45.00 |

| Leatt Corporation (LEAT) | 24.00 | 10/13/21 | 23.13 | -4% | Buy under 27.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.60 | 18% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.72 | 53% | Buy under 5.00 |

| Performant Financial (PFMT) | 4.66 | 7/14/21 | 3.41 | -27% | Buy under 5.00 |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 10.98 | 455% | Buy under 12.00 |

| Stabilis Solutions (SLNG) | 7.60 | 6/9/21 | 6.92 | -9% | Buy under 9.00 |

| * Return calculation includes dividends |

Disclosure: Rich Howe owns shares in BBXIA, LSYN, MEDXF, PIOE, FPAY, IDT, APVO, DS, SLNG, DMLP, and PFMT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.