Last week, I made the case that we may be amid a commodity bull market and that it makes sense to have a percentage of your portfolio allocated to commodity companies.

Many commodities are breaking out to the upside, yet many commodity companies continue to trade incredibly cheaply.

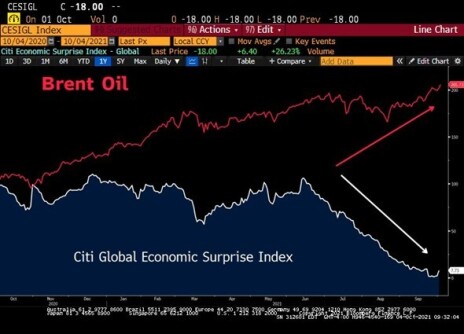

What is also interesting is global business activity is still relatively muted as the world is still dealing with the pandemic as shown below.

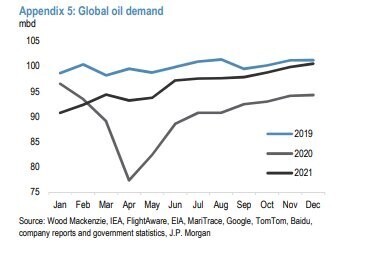

In fact, global oil demand is almost already back to all-time highs despite sluggish economic activity.

What is going to happen when the global economy really gets going?

Probably even higher commodity prices!

Usually, the best time to buy commodity companies is when there is “blood in the streets” as the expression goes. You want to buy them when they aren’t making any money.

It is often a trap when commodity companies look cheap. When prices are high, they are generating significant free cash flow. However, those high prices attract capital investment which ultimately results in a bigger supply of commodities and an ultimate crash in prices.

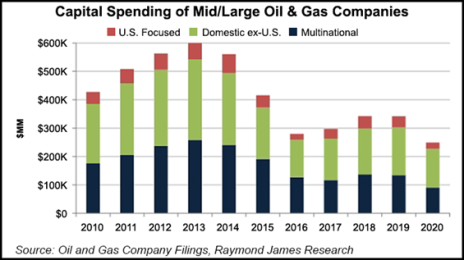

This time around, higher commodity prices will attractive more investment, but it will take some time.

Several recent boom and bust cycles in the energy industry have burned investors and starved companies of capital. This has been heightened by ESG concerns. As a result, capital investment has been down for several year as shown below.

I think commodity prices could be elevated for a prolonged period. As a result, I do think it makes sense to have exposure to energy companies.

Of our open recommendations, Dorchester Minerals (DMLP), Epsilon Energy (EPSN), and Stabilis Solutions (SLNG) will all benefit from the current commodity boom. My highest-conviction idea in the space is Dorchester, but I continue to like them all.

Before we move on to our recommendation updates, I want to share a chart from my favorite strategist, Ryan Detrick.

In 2021, the S&P 500 has made 54 new highs. Previous years with many new highs usually saw a strong finish to the year.

This week we had little news with our recommendations (more updates below), but we had two highlights.

- Liberated Syndication (LSYN) announced that it hired a full time CFO. This is positive news.

- P10 Holdings (PIOE) announced that it has made two relatively small acquisitions.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, October 13, 2021. As always, if you have any questions, please email me at rich@cabotwealth.com.

Changes This Week

No Changes

Updates

Aptevo (APVO) continues to perform poorly. The investment case remains the same. The market is currently valuing the stock as if its pipeline is worth negative value (currently -$30MM). This doesn’t make sense as Aptevo’s main drug, APVO436, has shown promising data and the company has a pipeline of other assets. This is a high-risk/reward trade because the upside could be substantial, but downside could also be substantial if it continues to burn cash with little to show for it. We will see preliminary phase II data later this year which could be a nice catalyst. Original Write-up. Buy under 25.00

Atento S.A. (ATTO) has gotten a recent boost because of this write up. It’s nice to see that more investors are finding Atento because it continues to look incredibly cheap. Atento reported earnings in August. In the quarter, revenue increased 22% to $382MM, beating consensus by 4%. EBITDA increased 123% y/y to $50.7MM. EBITDA margin increased to 13.3%, up from 7.1% a year ago. Despite the strong performance, ATTO is still only trading at 3.9x my estimate for 2022 EBITDA. Peers such as Concentrix (CNXC) trade at 10x or higher. Original Write-up. Buy under 30.00

BBX Capital (BBXIA) recently disclosed in an 8-k that it is increasing its share buyback authorization from $10MM to $20MM. The first $10MM authorization was used to buyback $8.3MM worth of shares, the additional $10MM authorization will enable them to continue these buybacks. Further, the company announced that it recognized a $7.7MM cash distribution from a property that they had held at a $2.1MM valuation. This is good news and implies that book value per share ($17.53) may be understated. I recently moved up my price target to $12. Here’s how I’m thinking about my new valuation: The company has $7.44 per share of net cash/notes receivable on its balance sheet and I’m giving it 100% credit for that (given recent shareholder-friendly actions). I’m assuming the remaining business is worth 5x this year’s free cash flow. Note, a $12 target is still at a significant discount to book value per share ($17.53). Original Write-up. Buy under 9.00

Cipher Pharma (CPHRF) is my latest recommendation. The company is a cheap, Canadian specialty pharma company that has a promising pipeline. Despite strong potential, the stock trades at a draconian valuation. Insider ownership is high, and insiders have been buying the stock in the open market. Further, the company is buying back its own shares in the open market. Downside protection is high given net cash on its balance sheet and strong free cash flow generation. My price target of 2.50 implies good upside over the next 12 months. Original Write-up. Buy under 2.00

Dorchester Minerals LP (DMLP) has moved higher on the week. SEC filings revealed that the CFO of the company bought stock in the open market in August. The company recently reported Q2 2021 earnings of $0.46, or $1.84 on an annualized basis. As such, the stock is trading at 11.1x annualized earnings, too cheap a multiple for such a high-quality, high-margin, and no-debt business. At its current quarterly dividend, the stock is trading at a dividend yield of 9.4%. I continue to like this low-risk stock which will continue to benefit from higher oil prices. Original Write-up. Buy under 17.50

Drive Shack (DS) had no news this week. The company reported an excellent quarter in August with revenue growth of 130%, beating consensus expectations by 9%. The company reported EBITDA of $7.7MM versus consensus expectations of $1.2MM. The investment case is on track for Drive Shack. At its current valuation, Drive Shack’s share price gives minimal value to the strong upside potential from new Puttery venues. Finally, alignment is high as management and directors own 16.3% of shares outstanding and have recently bought in the open market. My price target is 6.00. Original Write-up. Buy under 4.00

Epsilon Energy (EPSN) has performed well as natural gas prices have rallied. I recently spoke to the CEO of the company and learned more about Epsilon’s natural gas hedges. The company has 2/3 of its product hedged in the $3/Mcf range, but 1/3 has exposure to the spot market. From November ’21 to March ’22, 30% of production is hedged at ~$3.34/Mcf, but 70% of production is exposed to the soaring spot market. I see significant upside over the next 12 months as the company benefits from high natural gas prices. Original Write-up. Buy under 5.50

FlexShopper (FPAY) saw strong insider buying in August in the $2.50 to $2.90 range following a strong earnings release. In the quarter, revenue grew 25% y/y to $30.7MM. Looking out to the rest of the year, strong growth should continue as the company is expanding its pilot program with an undisclosed national retailer and has added a second national retailer to its pilot program. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 2.50

IDT Corporation (IDT) had no news this week but has pulled back significantly. I view this as a buying opportunity. IDT’s core business (legacy telecom) and high-growth subsidiaries (BOSS Money Transfer, National Retail Solutions, and Net2phone) continue to perform well. I expect Net2phone to be spun off in early 2022 and National Retail Solutions to be spun off in late 2022 or early 2023. I recently increased my price target to 64 but, longer term, I could see this stock trading up to 100 or higher. Original Write-up. Buy under 45.00

Liberated Syndication (LSYN) recently announced that it hired a new full time CFO. This is a positive as the company had been operating without a CFO or CEO. However, I do have strong confidence in President, Laurie Sims, who has been leading the business. The stock has been languishing of late, and I recently wrote an article that addresses why that might be the case. In short, it has become very difficult to buy companies that are not current on their financials or don’t report their financials to the SEC or OTCmarkets.com due to an SEC rule change (15c2-11). I believe this is pressuring Libsyn’s stock lower. But I also believe it represents an opportunity as when the company reports its restated financials it will show a company growing revenue at ~17%. At its current valuation of 2.5x 2021 revenue, it looks very attractive. Original Write-up. Buy under 5.00

Medexus Pharma (MEDXF) had no news on the week. I think the risk/reward looks attractive at the current valuation. Nonetheless, I’m not going to be buying more stock until I start to see some good news/good execution from the management team. Sales should stay roughly flat sequentially over the next couple of quarters, but I think sales will perk up in the fourth quarter and into 2022. I believe IXINITY has strong potential longer term, and the company has several interesting pipeline opportunities which should drive growth into 2022. Assuming execution improves, there is a lot of upside. I still believe this could be a mid-teens stock within a couple of years. But I’m personally going to be waiting for improved results before adding to my position. If I must pay a slightly higher price, so be it. It will be a small price to pay to gain increased conviction. Original Write-up. Hold

Performant Financial (PFMT) had no news on the week. Following a strong quarter, the company raised $40MM of equity in August. While I’m disappointed in the dilution, it will improve the company’s balance sheet substantially and allow it to accelerate growth. All in all, the investment case is still on track. My price target decreases a little bit in the medium term to 6.60 (due to the dilution) but, longer term, I think this stock could trade over 10. Original Write-up. Buy under 5.00

P10 Holdings (PIOE) recently announced it bought two new asset managers with ~$900MM in assets under management. While this isn’t a huge deal, it is a positive. Separately, news leaked in early September that the company is looking to uplist to the NYSE at a $1BN valuation (a premium to its market cap at the time; current market cap is $980MM), as it would raise equity. Despite the move up, the stock still looks attractive as it’s currently trading at 13x free cash flow and 15.5x EBITDA. Very reasonable considering its closest (albeit larger) peer is Hamilton Lane (HLNE) which trades at 28.2x EBITDA and 21.5x free cash flow. Original Write-up. Buy under 10.00

Stabilis Solutions (SLNG) reported record earnings in August with revenue of $16.1MM, up 221% y/y. It was 45% above Q2 2019 revenue (pre-pandemic) of $11.0MM. The investment case remains on track, and I had an encouraging conversation with the CFO of the company recently. The high price of natural gas will not impact Stabilis’ business either way as it does not take commodity risk. As a reminder, Stabilis Solutions specializes in delivering liquid natural gas (LNG) and hydrogen to its customers who are away from pipelines and off the energy grid. Customers use Stabilis Solutions as it provides them with cheap, reliable energy that is cleaner than other fossil fuels. The company has grown revenue at a 27% CAGR and has a bright outlook. Insiders own more than 50% of the company but have been relentlessly buying more stock in the open market. The stock has performed well since the pandemic but looks like a double over the next 12 months. Original Write-up. Buy under 9.00

| Stock | Price Bought | Date Bought | Price 10/05/21 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 14.55 | -55% | Buy under 25.00 |

| Atento SA (ATTO) | 21.57 | 8/24/21 | 28.00 | 30% | Buy Under 30.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 9.40 | 197% | Buy under 9.00 |

| Cipher Pharma (CPHRF) | 1.69 | 9/8/21 | 1.90 | 12% | Buy under 2.00 |

| Dorchester Minerals LP (DMLP)* | 10.45 | 10/14/20 | 20.62 | 110% | Buy under 17.50 |

| Drive Shack (DS) | 2.58 | 5/12/21 | 2.72 | 5% | Buy under 4.00 |

| Epsilon Energy (EPSN) | 5.10 | 8/11/21 | 5.78 | 13% | Buy under 5.50 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 2.94 | 38% | Buy under 2.50 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 44.96 | 132% | Buy under 45.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.30 | 8% | Buy under 5.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 2.47 | 39% | Hold |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 11.02 | 457% | Buy under 10.00 |

| Performant Financial (PFMT) | 4.66 | 7/14/21 | 3.64 | -22% | Buy under 5.00 |

| Stabilis Solutions (SLNG) | 7.85 | 6/9/21 | 7.10 | -10% | Buy under 9.00 |

| * Return calculation includes dividends |

Disclosure: Rich Howe owns shares in BBXIA, LSYN, MEDXF, PIOE, FPAY, IDT, APVO, DS, SLNG, DMLP, and PFMT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.