It’s a funny market out there!

The market is pretty close to an all-time high, but many growth and micro-cap names have pulled back substantially.

Many value names and cyclical names have pulled back sharply despite strong fundamentals.

I continue to scour the micro-cap world and see plenty of opportunity.

At the same time, it’s important to stay up to date on current positions in order to monitor their fundamentals. This week, we had good news (BBX Capital) and bad news (Medexus).

I will cover both in detail below, but my conviction levels for BBX Capital (and my price target) has increased while my confidence in Medexus continues to fall.

Longer term, I think Medexus has a ton of potential, but it looks like it might be dead money for the next couple of quarters given the Treosulfan delay and recent inventory issue with IXINITY.

This week, all the Cabot analysts are presenting at our Cabot Wealth Summit and I hope to see many of you tomorrow for my presentation on opportunities in the energy markets.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, September 8, 2021. As always, if you have any questions, please email me at rich@cabotwealth.com.

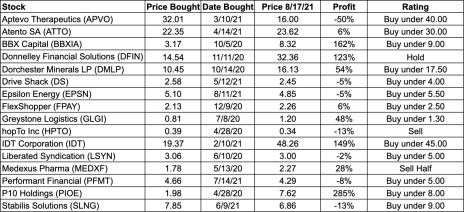

Changes This Week

Increasing buy limit for BBXIA to Buy under 9.00

Downgrading HPTO to Sell

Updates

Aptevo (APVO) announced positive news on its lead compound APVO436. In its phase I trial, the company identified a dosing regimen that proved most efficacious. Of the 9 patients treated with the most effective dose, 4 (44%) showed evidence of clinical activity and 2 patients achieved a complete response. This is positive news, but the stock has barely budged. The thesis for Aptevo remains the same. It’s pipeline is being valued by the market at negative $15MM. This doesn’t make sense given that Aptevo’s main drug, APVO436, has shown promising data and the company has a pipeline of other assets. This is a high risk/reward trade because the upside could be substantial, but downside could also be substantial if it continues to burn cash with little to show for it. Original Write-up. Buy under 40.00.

Atento S.A. (ATTO) reported a great quarter, and after shooting up, the stock has retreated. I think there’s more upside ahead. In the quarter, revenue increased 22% to $382MM, beating consensus by 4%. EBITDA increased 123% y/y to $50.7MM. EBITDA margin increased to 13.3%, up from 7.1% a year ago. Despite the strong performance, ATTO is still only trading at 3.7x my estimate for 2022 EBITDA. Peers such as Concentrix (CNXC) trade at 10x or high. With the strong performance, I recently increased my buy limit to 30. Original Write-up. Buy under 30.00

BBX Capital (BBXIA) reported an excellent quarter with revenue increasing 132% y/y. The company is on pace to generate $22MM of free cash flow this year. The company benefited from strong consumer demand, especially in single-family and multifamily housing in many of the markets in Florida where BBXIA’s real estate segment operates. I’m moving up my price target to $12. Here’s how I’m thinking about my new valuation. The company has $7.44 per share of net cash/notes receivable on its balance sheet and I’m giving it 100% credit for that (given recent shareholder-friendly actions). I’m assuming the remaining business is worth 5x this year’s free cash flow. Note a $12 target is still at a significant discount to book value per share ($17.53). I’m increasing my buy limit to 9.00. Original Write-up. Buy under 9.00.

Donnelley Financial Solutions (DFIN) reported a strong quarter last week. Revenue grew 5% beating consensus expectations by 12% as strong capital markets activity remains high. The company beat expectations on the bottom line too with EPS of $1.38. Despite the stock’s strong performance, it’s still cheap trading at 8.4x free cash flow and 5.7x forward EBITDA. Nonetheless, I have a few concerns that the company is “overearning” currently given buoyant capital market activities which tend to be cyclical. I’m going to re-underwrite my investment case to determine if there is enough upside remaining to justify recommending the stock. As such, I downgraded it to Hold last week. Original Write-up. Hold.

Dorchester Minerals LP (DMLP) reported Q2 2021 earnings of $0.46 or $1.84 on an annualized basis. As such, the stock is trading at 8.6x annualized earnings, too cheap a multiple for such a high-quality, high-margin, and no debt business. At its current quarterly dividend, the stock is trading at a dividend yield of 12%. I continue to like this low-risk stock which will continue to benefit from higher oil prices. Original Write-up. Buy under 17.50.

Drive Shack (DS) reported an excellent quarter recently with revenue growth of 130%, beating consensus expectations by 9%. The company reported EBITDA of $7.7MM versus consensus expectations of $1.2MM. The investment case is on track for Drive Shack. At its current valuation, Drive Shack’s share price gives minimal value to the strong upside potential from new Puttery venues. Finally, alignment is high as management and directors own 16.3% of shares outstanding and have recently bought in the open market. My price target is 6.00. Original Write-up. Buy under 4.00.

Epsilon Energy (EPSN) is my latest recommendation. It reported solid earnings last week with 12% revenue growth y/y. YTD the company has generated FCF of $6.3MM or $12.6MM on an annualized basis. As such, it’s trading at a 9.1x. YTD, the company has bought back about 1% of shares outstanding. Insiders already own 25% of shares outstanding but are buying stock in the open market. The company has downside protection with a net cash balance sheet and a valuable midstream business. I see significant upside over the next 12 months as the company benefits from high natural gas prices. Original Write-up. Buy under 5.50

FlexShopper (FPAY) recently reported a strong quarter but missed expectations slightly. Revenue grew 25% y/y to $30.7MM. Looking out to the rest of the year, strong growth should continue as the company is expanding its pilot program with an undisclosed national retailer and has added a second national retailer to its pilot program. Further, the company’s Chairman, Howard Dvorkin has been consistently buying in the open market, demonstrating his confidence in the long-term growth of the business. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 2.50.

Greystone Logistics (GLGI) is primed to continue to perform well. Last quarter looked weak on the surface, but it was all driven by the timing of one order. As a result, next quarter (expect it to be released within a few weeks) should be very strong. It’s trading at 8.3x current-year earnings which is too cheap given strong growth potential. When I published my original investment case, my price target was $1.58. It’s likely that I will update that price target once the company reports quarterly results. I arrived at my initial $1.58 price target by multiplying its historical P/E multiple (10.5x) by my estimate for fiscal 2021 EPS ($0.15). I want to wait to see fiscal Q4 results before I adjust my price target. My rough estimate is that GLGI could earn $0.27 in fiscal 2022. If that’s the case, and we assume it trades at its 5-year median multiple of 9.3x (the historical multiple came down slightly), my price target could increase to ~$2.50. Original Write-up. Buy under 1.30.

HopTo Inc (HPTO) reported earnings recently and results weren’t great. Revenue declined by 14% in the quarter and operating earnings declined by 51%. The stock is very cheap, trading at ~5.1x current annualized EBIT, but maybe it deserves to be. I’m moving this one to sell but will keep it on my watch list. If we see insiders buying or growth re-accelerate, it could be worth buying again. Original Write-up. Sell.

IDT Corporation (IDT) has pulled back sharply on news. IDT’s core business (legacy telecom) and high-growth subsidiaries (BOSS Money Transfer, National Retail Solutions, and Net2phone) continue to perform well. I expect Net2phone to be spun off in early 2022 and National Retail Solutions to be spun off in late 2022 or early 2023. I recently increased my price target to 64, but longer term, I could see this stock trading up to 100 or higher. Original Write-up. Buy under 45.00.

Liberated Syndication (LSYN) has been languishing recently. Its CFO resigned recently and it’s late in filing its financials. Nonetheless, I have full confidence that the financials will ultimately be filed and that a replacement CFO will be hired. Once this takes place (I hope by year end), the focus will be able to switch back to the company’s growth and excellent position in the podcast hosting market. I continue to have conviction in the stock. Original Write-up. Buy under 5.00.

Medexus Pharma (MEDXF) reported poor results yesterday. As I had feared, quarterly sales didn’t rebound as pharmacies are still working through inventory for IXINITY. The CEO commented that it will take another quarter or two to work through before the portfolio begins to grow again. Currently the stock is valued at 0.8x to 1.5x revenue depending on how you view the debentures (converted or not). This seems to me to be a fair valuation for a stock with several disappointing recent developments. I downgraded the stock to Sell Half ahead of the quarter given my cautious approach and I’m going to stick with that rating for now. Longer term, I think the stock has a lot of upside potential, but it might be dead money at best for the next couple of quarters. Original Write-up. Sell Half.

Performant Financial (PFMT) recently reported a good quarter. It took down EBITDA guidance for 2021 to be cautious but continues to expect robust growth this year and going forward. The healthcare business is poised to grow 30%+ for the foreseeable future. Despite its fast growth, the company is trading at a big discount to a competitor which was recently acquired. My price target implies ~70% upside, but longer term, this could be a multi-bagger. Original Write-up. Buy under 5.00.

P10 Holdings (PIOE) continues to look attractive. It is currently trading at 10x free cash flow and 13.0x EBITDA. Very reasonable considering its closest (albeit larger) peer is Hamilton Lane (HLNE) which trades at 28.2x EBITDA and 21.5x free cash flow. Given the stock is valued so reasonably and has great room for growth, I recently upgrading it to Buy under 8.00. Original Write-up. Buy under 8.00.

Stabilis Solutions (SLNG) reported record earnings last week with revenue of $16.1MM, up 221% y/y. It was 45% above Q2 2019 revenue (pre-pandemic) of $11.0MM. The investment case remains on track. As a reminder, Stabilis Solutions specializes in delivering liquid natural gas (LNG) and hydrogen to its customers who are away from pipelines and off the energy grid. Customers use Stabilis Solutions as it provides them with cheap, reliable energy that is cleaner than other fossil fuels. The company has grown revenue at a 27% CAGR and has a bright outlook. Insiders own over 50% of the company but have been relentlessly buying more stock in the open market. The stock has performed well since the pandemic but looks like a double over the next 12 months. Original Write-up. Buy under 9.00

P.S. Registration is now open for the next Cabot Micro-Cap Insider call on Thursday, September 9 at 2:00 PM ET. Click Here to Register

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, GLGI, HPTO, LSYN, MEDXF, PIOE, FPAY, IDT, APVO, DS, SLNG, DMLP, and PFMT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.