This week, my family and I are on Sanibel Island in Florida.

Judging from the news and my Twitter feed, it’s one of the few places in the United States that isn’t absolutely frigid.

This is the first time that we’ve gotten on a plane in over a year. The airport was pretty empty, but our flight was packed which was somewhat unnerving.

Nonetheless, the flight went well (my kids – 5 and 2 – both wore masks for the entire duration of the flight).

And it’s great to get a little respite from the Northeast winter and to see my parents (outside visits of course!).

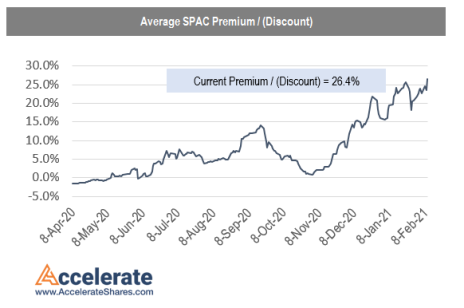

The market continues to perform incredibly well with the S&P 500 at an all-time high. And there continues to be signs of froth.

The latest data point that I’ve found is the average SPAC is trading at a 26.4% premium to its cash value.

The current SPAC craze reminds me of a passage in Margin of Safety, written by the legendary investor Seth Klarman, about closed-end fund issuance:

“The 1989-90 boom in the creation of new closed-end country funds exemplifies the tension between Wall Street and its customers…. speculative interest in closed-end country funds resulted in the shares of many funds being bid far above underlying NAVs. Buying into new offerings appeared to be a quick, easy, and almost certain way to make money. In June 1989, for example, the Spain Fund, Inc, sold at a 92% of NAV, an 8% discount. Only three months later, the shares traded at more than 260% of NAV and remained at more than twice NAV until February 1990. By late summer of that year, the share price once again approximated NAV…This price trend is not unique; the share prices of several other country funds underwent similar gyrations…The periodic boom in closed-end mutual-fund issuance is a useful barometer of market sentiment; new issues abound when investors are optimistic and markets are rising.”

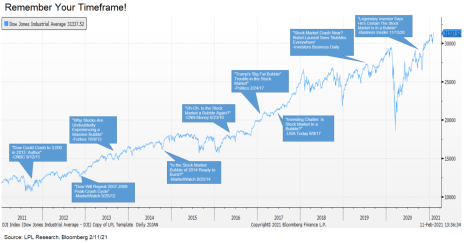

Nonetheless, it’s important to remember that markets climb a wall of worry. And there are always reasons to be bearish.

Further, we are not investing in “the market.” We are investing in individual securities that are undervalued. This bottom-up approach should help us make money no matter the market direction.

I personally am seeing many compelling investment opportunities in the microcap world such as IDT Corporation (IDT), our most recent recommendation.

While there was not much news this week, see below for the latest updates on our recommendations.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, March 10, 2021. As always, if you have any questions, don’t hesitate to email me at rich@cabotwealth.com.

Changes This Week

No changes

Updates

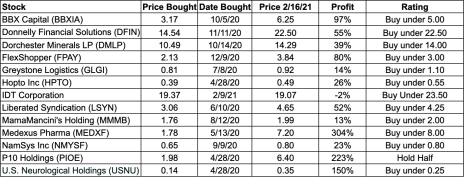

BBX Capital (BBXIA) had no news this week. The company filed an 8-k in January which disclosed that Angelo Gordon owns 4.9% of the company and that BBX Capital had granted Angelo Gordon permission to buy up to 10% of the company. Last week, Angelo Gordon filed a 13D to disclose that it owns 6.4% of shares outstanding. I view this as bullish given: 1) Angelo Gordon is a sophisticated investor and sees significant value and 2) management was open to taking on outside investment. I recently spent considerable time reviewing my investment thesis for BBX Capital. All in all, the investment case remains on track. Despite strong performance, the company trades at just 37% of book value. It should generate significant earnings and free cash flow in 2021. In October 2020, the company announced that it had authorized a $10 million share repurchase, representing 9% of its market cap. The company also recently announced that it has purchased Colonial Elegance, a supplier and distributor of building products, including barn doors, closet doors, and stair parts for 5.6x EBITDA, an attractive price. Despite poor historical corporate governance, we are aligned with management as the Levin family (controlling shareholders) own 42% of shares outstanding. I see 20%+ upside. Original Write-up. Buy under 5.00.

Donnelly Financial Solutions (DFIN) had no news this week. The company will report earnings on February 25, 2021. It will be good to get an update on the company’s progress with its turnaround. Donnelley Financial Solutions (DFin) is a 2016 spin-off that has successfully executed a turnaround, transitioning from a mainly print focused business to a software/tech-enabled services business. Despite strong cash flow generation and debt paydown, the stock still trades at a draconian valuation. Simcoe Capital, an activist investor, owns 10% of the stock, ensuring we are well aligned with insiders. With modest earnings growth and multiple expansion, coupled with significant debt paydown, the stock should hit 40 by 2024, implying over 90% upside. The stock has performed well but still only trades at 9.9x free cash flow and 7.0x forward EBITDA. Original Write-up. Buy under 22.50.

Dorchester Minerals LP (DMLP) made its most recent dividend payment of $0.24 on February 11, 2021. While the stock is up ~30% since we recommended it, it appears very undervalued given that oil prices are back above $50/bbl. Through September, the company has generated $32MM of free cash flow or $43MM on an annualized basis. As such, it is trading at 11.3x annualized free cash flow. This is an incredibly cheap valuation for a debt-free royalty business that pays out all its income in dividends and will skyrocket if (when) energy markets recover. Original Write-up. Buy under 14.00.

FlexShopper (FPAY) has performed well despite volatility even though there has been no recent news. I continue to like the stock. It is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 12.0x 2021 earnings. Importantly, the Chairman of FlexShopper owns over 20% of the company and has been buying more stock as fast as he can in the open market. Recently, H.C. Wainwright published an initiation report on the company with a $4.00 target. Also, I recently had a chance to talk to management (both the CEO and CFO), and it increased my conviction in the idea. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 3.00.

Greystone Logistics (GLGI) reported earnings recently. The stock has been a little volatile, but I still have long term conviction in it. Revenue declined by 20% in the quarter. The biggest challenge that Greystone currently has is meeting demand from its customer base. As a result, one of the company’s customers (a major beer company) gave notice that it will be diversifying purchases of case pallets between Greystone and another vender. Greystone will continue to be the sole provider for the keg pallets. Greystone believes that it will not have a material impact on its financials. On the one hand, a 20% decline in revenue is worse than I had anticipated. But on the positive side, net income increased by 187%. How is that possible? The big driver was a strong improvement in the company’s gross margin. It increased from 11.0% last year to 19.9% in the most recent. Greystone has been investing in improving its manufacturing efficiency and clearly that has paid off. The gross margin expansion is all the more impressive given that revenue declined. Usually, gross margins shrink as revenue shrinks given diseconomies of scale. The key question in my mind is “Will revenue ever start growing again?” I have high conviction that it will. From 2016 to 2020, revenue grew at a compound annual growth rate of 30.4%. Once vaccines are broadly distributed and Greystone has its workforce back up to full capacity, the company should start growing quickly again. In the most recent quarter, the company generated $0.03 of EPS or $0.12 on an annualized basis. Thus, the stock is trading at a P/E of 6.7x. This represents a good value for a company with such a strong long-term growth outlook. Original Write-up. Buy under 1.10.

HopTo Inc (HPTO) had no news this week, but the stock has generally been weak since reporting earnings in November. In the quarter, sales declined by 6%. However, just as we didn’t get too excited last quarter when sales jumped 49%, we aren’t going to get too down this quarter. On a quarterly basis, sales are lumpy. Year to date, revenue is up 3% and operating profit is up 5%. The stock has pulled back and looks attractive. I believe HTPO is worth ~0.86 per share. HopTo is currently trading at an EV/EBIT multiple of 6.2x. This is too cheap. To put it in perspective, the software and internet industry trades at an average EV/EBIT multiple of over 50x.. Original Write-up. Buy under 0.55.

IDT Corporation (IDT) is my newest recommendation. IDT Corporation is a mini-conglomerate run by Howard Jonas, one of the best value creators in the world. The stock is trading at a big discount to its sum-of-the-parts valuation, but the imminent spin-off of one or more of its high growth technology subsidiaries will unlock that value. Insiders own 25% of shares outstanding ensuring we are well aligned with management. My price target implies over 50% upside. Original Write-up. Buy under 23.50.

Liberated Syndication (LSYN) announced that it has acquired Auxbus, a podcast creation software company. Terms of the transaction weren’t disclosed, but I imagine the purchase price was quite low seeing as the company has been for sale for over a year. Libsyn has struck a deal to marry the podcast creation platform with its hosting platform, a move that allows it to keep up with a growing shift toward offering a full-service experience to producers. The addition of Auxbus will help Libsyn compete against companies such as Anchor. The Spotify-owned company allows podcast newcomers to create a show, host it on its platform, and then distribute it with a few clicks on Spotify. Libsyn continues to be a very attractive company benefitting from several secular tailwinds. Original Write-up. Buy under 4.25.

MamaMancini’s Holdings (MMMB) reported earnings in early December. Revenue grew 6.8% while EPS grew 100% to $0.02 as the company continues to leverage its fixed cost base. Sales growth decelerated slightly due to COVID headwinds, but I’m confident sales will reaccelerate in 2021 and beyond. Additionally, the company is currently running a strategic review which could result in the company being sold. Whether or not the company is sold, I believe returns should be strong going forward given the company will continue to grow and generate strong earnings growth. It has historically grown revenue at a 24% CAGR yet only trades at 9.7x forward earnings. Management owns over 50% of the stock, ensuring that incentives are aligned. Further, the company has a clean balance sheet. Original Write-up. Buy under 2.00.

Medexus Pharma (MEDXF) recently announced that it has entered into a licensing agreement with medac Gesellschaft für klinische Spezialpräparate m.b.H. (“medac”). Medac has granted Medexus the right to sell treosulfan in the United States. Treosulfan is given to acute myeloid leukemia (“AML”) and myelodysplastic syndrome (“MDS”) patients prior to stem cell transplantation. Patients who received treosulfan lived longer and had fewer side effects than patients treated with the generic alternative. Medexus believes the drug will ultimately generate more than $126MM in sales. To secure the licensing agreement, Medexus will pay medac $5MM up front followed by up to $55MM in regulatory milestone payments and $40MM in sales based milestones. Including triosulphan, Medexus has line of sight to generating $250MM to $300MM in high margin revenue. As such, the stock looks incredibly attractive. Year to date, Medexus has generated $4.0MM of free cash flow or $8.0MM annualized. As such, the stock is trading at 15.1x free cash flow, a cheap valuation for a rapidly growing company. On an EV/Revenue basis, MEDXF trades at 1.5x while slower growing peers trade at 3.6x. Medexus recently gave a great presentation which is available on YouTube. Medexus remains my highest conviction idea. Given the recently announced deal, I’m increasing my buy limit to 8.00. Original Write-up. Buy under 8.00.

NamSys Inc. (NMYSF) Recently, Namsys announced that it has terminated its long term incentive plan. The plan was originally put in place in the mid 2010’s to incentivize the team to help transition Namsys’s software from on-premise to a cloud-based offering. However, the long-term incentive plan had no limit as participants in the bonus plan are entitled to 15% of the value of the company, no matter how high it’s valued. The payout for the termination of the bonus plan will be made in cash and stock. This is a major positive as it will increase the company’s earnings growth rate going forward. Further, it’s possible that this announcement could be a prelude to a sale of the company. Despite historically growing revenue and earnings at a compound annual growth rate of 20%+, the stock only trades at 22x 2019 earnings. It has a pristine balance sheet with significant cash and no debt, and insiders own over 40% of the company, ensuring strong alignment. Original Write-up. Buy under 0.80.

P10 Holdings (PIOE)closed its acquisition of Enhanced Capital Group, a premier impact investment platform, in December. Since its inception, Enhanced has deployed over $2BN of capital into impact credit and impact equity investments. Areas of focus include small business lending in impact areas and to women and minority-owned businesses, renewable energy, and historic building rehabilitation. My estimate is that this transaction will increase run rate EBITDA to ~$75MM. As such, P10 is trading at an EV/EBITDA multiple of 13.0x. As I have said before, the stock is no longer dirt cheap. Nonetheless, it still trades at a sharp discount to its closest peer, Hamilton Lane (HLNE), which trades at an EV/forward EBITDA multiple of 28.3x. Catalysts for P10 Holdings going forward include: 1) additional deals and 2) a potential up-listing to a major exchange. Given the stock is not dirt cheap anymore, I recommend holding a half position. I want to keep exposure to the name but think it’s prudent to book some profits. Original Write-up. Hold Half.

U.S. Neurological Holdings (USNU) reported earnings in November. Revenue grew 0.6% y/y and 11% q/q as procedures and price per procedure both rebounded. Year to date, the company has generated EPS of $0.05 or $0.067 on an annualized basis. As such the company is trading at just 5.2x earnings. In addition, the company has $1.5 million ($0.19 per share) of cash and no debt on its balance sheet. It also has $1.1MM (due from related parties) and has generated over $500,000 in free cash flow year to date. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and it holds interests in radiological treatment facilities. Original Write-up. Buy under 0.25.

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, GLGI, HPTO, LSYN, MMMB, MEDXF, PIOE, FPAY, and IDT. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.