Since March lows, the market has rallied sharply driven by low interest rates, a seemingly endless supply of fiscal stimulus, and declining concerns about COVID-19.

While I personally believe we are due for a pullback, I’m finding many micro caps with robust fundamentals and attractive valuations that have been ignored by the market.

Examples include:

1) a podcast-hosting business in secular growth with activist involvement trading at 12x free cash flow;

2) a profitable diversified holding company trading at a negative enterprise value that pays a 2% dividend;

3) a video software company trading at 1.1x sales that is benefiting from an increase in remote learning due to COVID-19 with massive insider buying.

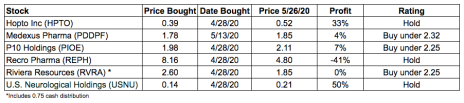

All current recommendations are performing in line with expectations except for Recro Pharma (REPH), which issued disappointing 2020 guidance and was downgraded to hold.

The next Cabot Micro-Cap Insider issue will be published on June 10, 2020. Our June webinar will take place on June 11, 2020 at 2 p.m. ET, and we will review open recommendations and answer member questions.

Changes This Week

No Changes

Updates

Hopto Inc (HPTO) reported first-quarter results last week. Sales declined 21%, which appears very bad at first glance. However, sales for hopTo are typically lumpy on a quarter-by-quarter basis. The 10-Q discloses that the decline was due to timing of revenue recognition and a larger order in Q1 2019 that did not renew. Most importantly, management noted that it expects “sales in 2020 to be similar to sales” in 2019. In other words, management doesn’t expect a decline in sales in 2020 despite the Q1 drop. This is the same language that hopTo used in 2019 (sales grew 13% in 2019). As such, I’m not concerned with the headline drop in sales in Q1. One issue that I am watching relates to the rights offering that hopTo closed in March. As part of the agreement, there was a backstop agreement whereby management and a consortium of accredited investors agreed to purchase at $0.30 per share up to $2.4 million of hopTo stock. Essentially, the backstop agreement is a massive insider buy and bodes very well for the outlook of the stock. That transaction was expected to close in April but was delayed and is now expected to close in May. If the backstop agreement doesn’t close, it will be a negative signal for the stock. Since I issued my BUY under 0.45 rating, the stock has appreciated above my 0.45 limit. As such, my current rating is HOLD. If the stock drops back to 0.44 or lower, my recommendation will change back to BUY. HOLD

Medexus Pharma (PDDPF) is a Canadian-based specialty pharma company that recently made a transformative, accretive acquisition, yet is being ignored by investors. Last week, Medexus issued a press release announcing its recently acquired drug, XINITY, had grown 19% in the first calendar quarter of 2020 and noted, “We continue to generate steady growth across our key product lines and, despite the disruption from the COVID-19 pandemic, our sales teams have continued to be remarkably productive by finding new ways to connect creatively and productively with clinicians and patients.” Medexus will release full quarterly results in June, and I expect investors to be impressed with progress to date. Pro forma for the recent acquisition of XINITY, it is trading at an EV/revenue multiple of 0.8x while peers trade at 3.0x. My rating for PDDPF is BUY under 2.32.

Earnings Date: Expected in June.

P10 Holdings (PIOE) had an uneventful week with no news. PIOE reported earnings on Thursday, April 30. Revenue grew 8% y/y due to additional fund raising by RCP Advisors. Cash earnings stayed flat y/y at $0.04 although that was due to costs related to acquiring Five Points and almost acquiring another private equity manager. RCP Advisors noted it has already raised $165 million of additional capital commitments for its private equity funds. It will launch two more funds this year and Five Points will also begin a new fundraise. Excluding one-time costs, PIOE will generate $0.27 in cash earnings in 2020. As such, PIOE is trading at 7.6x 2020 free cash flow. This is too cheap a valuation for a company that has sticky revenue, high margins, and strong growth potential. The investment case is on track. BUY Under 2.25.

Recro Pharma (REPH) bounced back a little this week after getting crushed last week following weak guidance. As a reminder, management decreased annual revenue guidance due to 1) increased competition from Mylan, a competitor to Recro customer, Teva; 2) slower-than-expected new business growth, which REPH believes is primarily attributable to COVID-19; and 3) notifications by two customers of discontinuations for two commercial product lines, which resulted in a decrease of approximately $4 million on previous 2020 revenue guidance and is estimated to have an annual impact to 2021 revenue of approximately $7 million to $8 million. Given COVID-19 headwinds, I recently took my price target down to 13.00, which corresponds to a 15.0x EV/2020 EBITDA multiple, a 25% discount to public peer Catalent. While my price target still implies significant upside longer term, I continue to believe REPH will be in “purgatory” for at least the next couple of quarters given COVID-19 headwinds. As such, my current rating is HOLD

Riviera Resources (RVRA) had no news this week. The company recently paid a $0.75 distribution, which continues the trend of management returning capital to shareholders through share repurchases and special dividends. RVRA continues to be an attractive long-term holding. It has minimal debt and is generating positive free cash flow. Further, it has a very valuable asset in its Blue Mountain midstream business. Once the energy market turns (and it always eventually does), Riviera will be well positioned to benefit. I recently adjusted my rating from Buy Under 3.00 to Buy Under 2.25 (adjusted for 0.75 distribution). BUY Under 2.25.

U.S. Neurological Holdings (USNU) operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and holds interests in radiological treatment facilities. USNU recently filed its form 10-Q to report Q1 2020 earnings. The company generated $0.02 of earnings and $399,000 of free cash flow in the first quarter, and as a result net cash on the company’s balance sheet increased to $1.7 million, or $0.22 per share. USNU did note that revenue declined 12% in the quarter, driven by fewer procedures being performed due to the outbreak of COVID-19. Eventually, I expect deferred procedures to resume. Since I issued by BUY under 0.20 rating, the stock has appreciated above my 0.20 limit. As such, my current rating is HOLD. If the stock drops back to 0.19 or lower, my recommendation will change back to BUY under 0.20. HOLD

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in HPTO, PDDPF, REPH, and RVRA. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.