We published our latest issue last week and profiled our newest idea, Medexus Pharmaceuticals (PDDPF). The stock has rallied from our recommendation price but still looks attractive. I believe next quarter will be a positive catalyst as it will be the first time that management provides an outlook that includes the recent accretive XINITY transaction. My rating is Buy under 2.32.

Also last week, we recorded our first monthly webinar. Thanks to everyone who tuned in. For those who missed it, you can view the replay here.

I’m finding many attractive opportunities in the micro-cap world and am excited to share new ideas in the coming weeks.

The next Cabot Micro-Cap Insider issue will be published on June 10, 2020. Our June webinar will take place on June 11, 2020 at 2 p.m. ET, where we will review open recommendations and answer member questions. Click here to register.

Changes This Week

No Changes

Updates

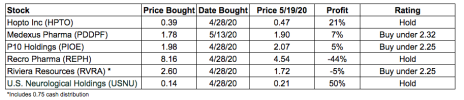

HopTo Inc (HPTO) is a fast-growing software company trading at a dirt-cheap valuation. There has been no news since my inaugural issue. I recently had a chance to speak with a patent expert who personally knows Jonathan Skeels, CEO of HPTO. While he has no knowledge of hopTo’s patent portfolio (hopTo has 39 patents that it is trying to sell) he was generally bearish on intellectual property noting it is expensive and time intensive to monetize software patents. Nonetheless, HPTO is well positioned given that its GO-Global software enables office workers to work remotely, which is especially attractive in the current environment. Since I issued my BUY under 0.45 rating, the stock has appreciated from 0.39 to 0.53. As such, my current rating is HOLD. If the stock drops back to 0.44 or lower, my recommendation will change back to BUY. HOLD

Earnings Date: Not yet announced.

Medexus Pharma (PDDPF) is a Canadian-based specialty pharma company that recently made a transformative, accretive acquisition, yet is being ignored by investors. Pro forma for the recent acquisition of XINITY (hemophilia drug), it is trading at an EV/revenue multiple of 0.9x while peers trade at 3.0x. I expect MDDPF’s next earnings report to be very positive as it will be the first time management provides guidance including the recent acquisition. My rating for PDDPF is Buy under 2.32.

Earnings Date: Not yet announced.

P10 Holdings (PIOE) reported earnings on Thursday, April 30. Revenue grew 8% year over year due to additional fund raising by RCP Advisors. Cash earnings stayed flat y/y at $0.04 although that was due to costs related to acquiring Five Points and almost acquiring another private equity manager. RCP Advisors noted it has already raised $165 million of additional capital commitments for its private equity funds. It will launch two more funds this year and Five Points will also begin a new fundraise. Excluding one-time costs, PIOE will generate $0.27 in cash earnings in 2020. As such, PIOE is trading at 7.6x 2020 free cash flow. This is too cheap a valuation for a company that has sticky revenue, high margins, and strong growth potential. The investment case is on track. BUY Under 2.25

Recro Pharma (REPH) reported earnings this week. Unfortunately, management decreased annual revenue guidance due to 1) increased competition from Mylan, a competitor to Recro customer, Teva; 2) slower-than-expected new business growth, which REPH believes is primarily attributable to COVID-19; and 3) notifications by two customers of discontinuations for two commercial product lines, which resulted in a decrease of approximately $4 million on previous 2020 revenue guidance and is estimated to have an annual impact on 2021 revenue of approximately $7 million to $8 million. Given COVID-19 headwinds, I recently took down my price target down to 13.00 which corresponds to a 15.0x EV/2020 EBITDA multiple, a 25% discount to public peer Catalent. While my price target still implies significant upside longer term, I believe REPH will be in “purgatory” for at least the next couple of quarters given COVID-19 headwinds. As such, my current rating is HOLD.

Riviera Resources (RVRA) recently paid a $0.75 distribution. The distribution continues the trend of management returning capital to shareholders through share repurchases and special dividends. RVRA continues to be an attractive long-term holding. It has minimal debt and is generating positive free cash flow. Further, it has a very valuable asset in its Blue Mountain midstream business. Once the energy market turns (and it always does, eventually), Riviera will be well positioned to benefit. I recently adjusted my rating from Buy Under 3.00 to Buy Under 2.25 (adjusted for 0.75 distribution). BUY Under 2.25

U.S. Neurological Holdings (USNU) operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and holds interests in radiological treatment facilities. USNU recently filed its form 10-Q to report Q1 2020 earnings. The company generated $0.02 of earnings and $399,000 of free cash flow in the first quarter, and as a result net cash on the company’s balance sheet increased to $1.7 million or $0.22 per share. USNU did note that revenue declined 12% in the quarter driven by fewer procedures being performed due to the outbreak of COVID-19. Eventually, I would expect deferred procedures to resume. Since I issued my BUY under 0.20 rating, the stock has appreciated from 0.14 to 0.21. As such, my current rating is HOLD. If the stock drops back to 0.19 or lower, my recommendation will change back to BUY under 0.20. HOLD

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.