Joel Greenblatt is probably my favorite investor of all time.

He wrote a book called You Can Be a Stock Market Genius that explains how to make money from investing in special situations. If you haven’t read it, I highly recommend it.

Greenblatt ran a hedge fund called Gotham Capital that generated 30% average annual returns for investors for a decade.

This week, I stumbled upon a wonderful podcast episode where Joel Greenblatt is interviewed about his thoughts on the market.

Here is the link to the interview (interview starts at 11:42 of the podcast episode).

Give it a listen when you get a moment, but one thing that Greenblatt mentioned really stood out to me.

“Businesses with over $1 billion in market cap that lost money in 2019 are up by over 40%" in 2020.

What a weird market environment!

In another recent interview, Greenblatt noted:

“It’s very interesting. I was looking back at the returns from Gotham Capital when I was running it. In 1998, we’re value investors, we were down 5%, market was up 28.6%. In ’99 we were down 5% again. That was our first two years. I started in ’85. So first two years we lost money. ’99 we were down 5%, market was up over 20%.

“But in 2000, market was down 9%, we were up 114%. It’s not that we were idiots in ’98 and ’99 and all of a sudden we became geniuses in 2000, it’s just we finally got paid for all the hard work we were doing. So, I think certain of the companies that are strong cash flow-generating companies, that earn high returns on capital, are out of favor right now because they’re not the flavor of the day, and some of those will come back.”

I personally agree with Greenblatt that “value” stocks are on the verge of an epic period of outperformance. But it’s painful to wait around while unprofitable growth stocks continue to surge higher.

The beautiful thing about micro-caps is that you can invest in stocks that are both “growth” and “value.”

Just take Medexus Pharma (MEDXF) as an example.

In its last quarter, revenue grew 71%. Adjusted EBITDA grew 900%.

A large-cap company with this growth would probably trade at 5x or 10x revenue. But MEDXF is trading at 0.8x. It’s a beautiful thing.

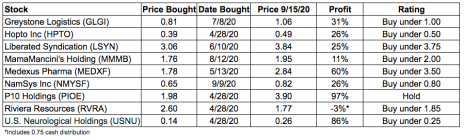

This week, we have one change that I wanted to highlight. We are increasing our buy limit for Liberated Syndication (LSYN) to 3.75 given multiple insider buys and strong operational performance.

We recently recorded our September webinar and the replay is available here. The next issue of Cabot Micro-Cap Insider will be published on Wednesday, October 14.

If you have any questions that you want me to address, feel free to send me an email at rich@cabotwealth.com.

Changes This Week

Increase buy limit for LSYN to Buy under 3.75.

Updates

Greystone Logistics (GLGI) had a quiet week, although CEO and President Warren Kruger disclosed that he purchased an additional 1,000 shares of GLGI in the open market. In total, Kruger owns over 30% of the company. As such, we are well aligned as we both will benefit from continued strong operational performance and stock price increases. Greystone reported earnings recently for its fiscal year ended May 31. Quarterly revenue was $18.3 million, down 13% from a year ago. In its press release, the company noted that demand from customers continues to grow. Its biggest challenge is maintaining an adequate workforce as many employees have opted to stay at home for protection from COVID-19. The company reported $0.06 of GAAP EPS that was helped by an unusual tax benefit. On a normalized basis, the company generated $0.03 in EPS, consistent with my expectations. Thus, in the last fiscal year, the company generated $0.12 of EPS and is trading at 7.9x earnings. This is too cheap for a company that has historically grown revenue at a 20%+ CAGR and just grew EPS 140%. Buy under 1.00.

HopTo Inc (HPTO) recently reported an excellent quarter, with revenue up 49%. Quarterly revenue growth is very lumpy so I’m not going to get too excited, but it’s good to see that year-to-date revenue is up 7%. I recently re-examined my valuation of hopTo, and as a result, I increased my price target from 0.45 to 0.50. Here’s my current thinking on valuation. In the first six months of 2019, hopTo generated $389.9k of earnings before interest and taxes (EBIT), or $779.8k annualized. I think a 12x multiple is fair, which works out to a $9.4MM enterprise value for these cash flows. This arguably is a cheap multiple for a software company, but the company is tiny and I’m not convinced it really has a sustainable competitive advantage. Next, we can add the value of hopTo’s 39 patents, which I value at $2.8MM based on where hopTo has sold other patents. Finally, we can add hopTo’s cash balance of $4.5MM (pro forma for the rights offering). Add it all up and you get a fair market cap of $16.65MM, or $0.89 per share. Buy under 0.50.

Liberated Syndication (LSYN) has performed well recently, thanks to several insider purchases. New CFO Richard Heyse has purchased 40,000 shares through several different transactions, while Eric Shahinian (the activist investor) bought an additional ~15,000 shares. In total, Shahinian owns almost 7% of the company. Libsyn recently reported an excellent quarter and hosted a helpful and transparent conference call. In the second quarter, revenue grew by 11.4%. Podcast hosting grew 11.1%, while website hosting grew 14.3%. I was a little surprised that podcast revenue didn’t grow more strongly, but management commented that podcast listening has been down due to less commuting time. Nonetheless, I expect podcast listening and Libsyn podcast revenue to reaccelerate over time. Given strong fundamentals and insider buying, I’m increasing my buy limit for LSYN from 3.35 to 3.75. Buy under 3.75.

MamaMancini’s Holdings (MMMB) reported earnings on September 14 after the market close. Revenue growth of 28% was very impressive. In the quarter, EPS grew 104% to $0.02 as the company continues to leverage its fixed costs. One area of weakness was in gross margins, which were lower than I expected. I believe this gross margin pressure was due to higher beef prices, but management commentary in the press release suggests that this pressure is starting to dissipate.

MamaMancini’s continues to execute well and the investment case remains on track. It has historically grown revenue at a 24% CAGR yet only trades at a P/E of 17.9x. Management owns over 50% of the stock, ensuring that incentives are aligned. Further, the company has a clean balance sheet. Buy under 2.00.

Medexus Pharma (MEDXF) continues to look attractive. In its most recent quarter, Medexus reported revenue growth of 71%. The company generated $4.1 million of free cash flow in the quarter, or $16.4 million annualized. As such, MEDXF is currently trading at a price to free cash flow multiple of 3.2x. On an EV/Revenue basis, MEDXF trades at 0.8x while slower growing peers trade at 3.6x. This is a good stock to average up in as the company continues to execute yet remains undervalued by the market. Buy under 3.50.

NamSys Inc. (NMYSF), my latest recommendation, is a Canadian micro-cap software-as-a-service company that caters to the cash processing and logistics niche. There was no news during the week. It has historically grown revenue and earnings at a compound annual growth rate of 20%+ yet only trades at 23x 2019 earnings. It has a pristine balance sheet with significant cash and no debt, and insiders own over 40% of the company, ensuring high alignment. The stock has run a bit since my initial recommendation but be patient. We will likely have an opportunity to buy the stock on pullbacks. Buy under 0.80.

P10 Holdings (PIOE) announced a transformative acquisition recently and the stock has rallied sharply. It will be acquiring TrueBridge Capital Partners, a venture capital firm with $3.3BN in assets under management. TrueBridge’s strategy is to invest in micro and venture funds. P10 holdings is paying $159 million for the acquisition. To pay for the deal, P10 is issuing convertible preferred debt that will yield 1% and has the right to convert into PIOE stock at a conversion price of $3.30 (PIOE’s share price was $2.58 before the deal was announced). Pro forma for this deal, P10 expects to generate $55MM in EBITDA on a run rate basis by the end of 2020. As such, the stock is trading at 12.7x EBITDA. This isn’t a dirt-cheap valuation, but it remains reasonable. P10’s most comparable company is Hamilton Lane, which trades at 30x forward EBITDA. Nonetheless, given the stock’s sharp increase, I recently moved my rating to Hold. While my official rating is Hold, it would be a fine time to sell a portion of your position as the stock approaches my 4.75 price target. Hold.

Riviera Resources (RVRA) recently announced that it has reached an agreement to sell Blue Mountain, its midstream business, to Citizen Energy for a price of $111 million. The sale price is a premium to what was implied by RVRA’s share price ahead of the sale, but is nonetheless disappointing. Over the past three years, Riviera has spent over $300 million building out the midstream asset and so the sale price is at a large discount to replacement value. The company noted in its press release that it intends to liquidate the company. After all sales close, Riviera should have ~$134 million, or ~$2.31 per share, to distribute to shareholders. I expect almost all net proceeds to be distributed by year end. Given my estimate of liquidation value, I believe it makes sense to buy the stock below 1.85 as it would imply a 25% return to liquidation. Buy below 1.85.

U.S. Neurological Holdings (USNU) was flat on the week. The company recently reported a solid quarter. While revenue declined by 28% due to hospital procedures being delayed, the company continued to generate strong cash flow, and expects operations to return to normal soon. Currently, the company has $2.0 million ($0.26 per share) of cash and no debt on its balance sheet. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and holds interests in radiological treatment facilities. Buy under 0.25.

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in GLGI, HPTO, LSYN, MEDXF, PIOE, and RVRA. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.