One benefit of investing in micro-caps is that you can talk to management.

If you’re a shareholder of Apple (AAPL) or Tesla (TSLA), good luck getting Tim Cook or Elon Musk on the phone.

But with my micro caps, it’s usually easy to get management on the phone.

Just take Medexus (MEDXF), my highest conviction idea.

When I was doing confirmatory due diligence before recommending the stock I was able to speak to CEO Ken d’Entremont. The conversation was incredibly helpful because I was able to confirm that the company’s acquisition of hemophilia drug XINITY was going to be incredibly accretive.

Some management teams aren’t as forthcoming. For instance, I haven’t been able to connect with Hopto (HPTO) CEO Jonathan Skeels. However, his actions tell me all I need to know. He and other insiders have been busy buying the stock in the open market and through the recently closed rights offering. In this case, it looks like Skeels is actively trying to avoid speaking with shareholders. Why? Perhaps he wants to keep the share price down so he can buy more stock.

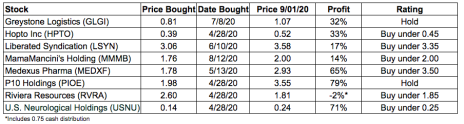

The big news this week is that P10 Holdings (PIOE) announced another major acquisition which significantly increases its earnings power. The stock has rallied sharply, and while it still looks attractive on a long-term basis, it doesn’t look dirt cheap. Therefore, I’m changing my rating to Hold.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, September 9.

If you have any questions that you want me to address, feel free to send me an email at rich@cabotwealth.com.

Changes This Week

PIOE downgraded to Hold.

Updates

Greystone Logistics (GLGI) reported earnings last week for its fiscal year ended May 31. Quarterly revenue was $18.3 million, down 13% from a year ago. In its press release, the company noted that demand from customers continues to grow. Its biggest challenge is maintaining an adequate workforce as many employees have opted to stay at home for protection from COVID-19. The company reported $0.06 of GAAP EPS that was helped by an unusual tax benefit. On a normalized basis, the company generated $0.03 in EPS, consistent with my expectations. Thus, in the last fiscal year, the company generated $0.12 of EPS and is trading at 9x earnings. This is too cheap for a company that has historically grown revenue at a 20%+ CAGR and just grew EPS 140%. While my official rating is Hold, I would recommend buying if the stock dips below 1.00. Hold.

HopTo Inc (HPTO) recently reported an excellent quarter, with revenue up 49%. Quarterly revenue growth is very lumpy so I’m not going to get too excited, but it’s good to see that year-to-date revenue is up 7%. More importantly, hopTo disclosed that its “backstop agreement” closed in early August. As a reminder, hopTo had a rights offering in March and as part of the offering, there was a backstop agreement whereby management and a consortium of accredited investors agreed to purchase at $0.30 per share up to $2.4 million of hopTo stock. The transaction was expected to close in April but was delayed indefinitely. The closing of this agreement bodes very well for the outlook of the stock as it is effectively a massive insider buy (granted, at a discounted price). Buy under 0.45.

Liberated Syndication (LSYN) recently reported an excellent quarter and hosted a helpful and transparent conference call. In the second quarter, revenue grew by 11.4%. Podcast hosting grew 11.1% while website hosting grew 14.3%. I was a little surprised that podcast revenue didn’t grow more strongly, but management commented that podcast listening has been down due to less commuting time. Nonetheless, I expect podcast listening and Libsyn podcast revenue to reaccelerate over time. One major positive in the quarter was that the profitability of the business improved dramatically. This is a direct result of a focus on profitability. In the second quarter, Libsyn generated an EBITDA margin of 38.4%, its highest level ever. I expect this trend to continue. Libsyn is going to be rolling out Libsyn 5, a new and improved user interface for podcast hosts. Management expects this new interface to improve the user experience and revenue growth. LSYN has appreciated since posting its quarterly result, but it still only trades at 9.2x Q2 2020 annualized EBIDTA and 3.7x 2019 revenue. Buy under 3.35.

MamaMancini’s Holdings (MMMB) announced this week that it will be expanding its product offering at many grocery stores nationwide including at 1,250 Publix Super Markers, at Sam’s Club locations, and at many lesser known accounts. In the press release, the CEO stated, “We continue to see momentum on all fronts of our business and expect to secure additional placements at nationwide retailers, as well as new mentions on QVC, before the end of the third quarter. I look forward to continued operational execution and providing further updates to our shareholders as appropriate.” MamaManchini’s continues to execute well and the investment case remains on track. It has historically grown revenue at a 24% CAGR yet only trades at a P/E of 16. Management owns over 50% of the stock, ensuring that incentives are aligned, and the company has a clean balance sheet. My price target of 2.50 implies significant upside. Buy under 2.00.

Medexus Pharma (MEDXF) recently reported an excellent quarter with revenue growth of 71%. The company generated $4.1 million of free cash flow in the quarter or $16.4 million annualized. As such, MEDXF is currently trading at a price to free cash flow multiple of 3.3x. On an EV/Revenue basis, MEDXF trades at 0.8x while slower growing peers trade at 3.6x. This is a good stock to average up in as the company continues to execute yet remains undervalued by the market. I recently raised my buy limit to 3.50. Buy under 3.50.

P10 Holdings (PIOE) announced a transformative acquisition last week. It will be acquiring TrueBridge Capital Partners, a venture capital firm with $3.3BN in assets under management. TrueBridge’s strategy is to invest in micro and venture funds. P10 holdings is paying $159MM for the acquisition. To pay for the deal, P10 is issuing convertible preferred debt that will yield 1% and has the right to convert into P10 stock at a conversion price of $3.30 (PIOE share price was $2.58 before the deal was announced). Pro forma for this deal, P10 expects to generate $55MM in EBITDA on a run rate basis by the end of 2020. As such, the stock is trading at 12.2x EBITDA. This isn’t a dirt-cheap valuation, but it remains reasonable. P10’s most comparable company is Hamilton Lane, which trades at 30x forward EBITDA. Nonetheless, given the stock’s sharp increase, I’m moving my rating to Hold. My price target remains 4.75. Hold.

Riviera Resources (RVRA) announced recently announced that it has reached an agreement to sell Blue Mountain, its midstream business, to Citizen Energy for a price of $111 million. The sale price is a premium to what was implied by RVRA’s share price ahead of the sale, but is nonetheless disappointing. Over the past three years, Riviera has spent over $300 million building out the midstream asset and so the sale price is at a large discount to replacement value. The company noted in its press release that it intends to liquidate the company. After all sales close, Riviera should have ~$134 million, or ~$2.31 per share, to distribute to shareholders. I expect almost all net proceeds to be distributed by year end. Given my estimate of liquidation value, I believe it makes sense to buy the stock below 1.85 as it would imply a 25% return to liquidation. Buy below 1.85.

U.S. Neurological Holdings (USNU) recently reported a solid quarter. While revenue declined by 28% due to hospital procedures being delayed, the company continued to generate strong cash flow, and expects operations to return to normal soon. Currently, the company has $2.0 million ($0.26 per share) of cash and no debt on its balance sheet. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and holds interests in radiological treatment facilities. Buy under 0.25.

P.S. Registration is now open for the next Cabot Micro-Cap Insider call on Thursday, September 10 at 2:00 PM ET. Click Here to Register

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in GLGI, HPTO, LSYN, MEDXF, PIOE, and RVRA. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.