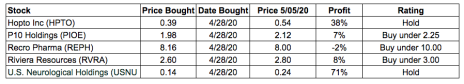

We launched Cabot Micro-Cap Insider just last week, and while there hasn’t been much news, a couple of stocks (USNU and HPTO) have already moved significantly higher. As a result, we’ve moved our ratings on them to HOLD. All other open recommendations remain BUY rated subject to the limits that I have indicated.

I wanted to share a quick clarification on using limits to buy micro caps. Let’s take REPH as an example. My “Buy under 10.00” rating for REPH means that I’m comfortable buying the stock under 10.00, however, you should try to buy the stock as close to its current price (8.00) as possible. When entering your limit order for REPH, enter the buy limit as (8.15) (slightly higher than the current market price) to get the best possible price. If you have any questions about this, please email me directly at rich@cabotwealth.com.

On Thursday, April 7, Riviera Resources will report earnings. I’m not expecting anything earth shattering, but it will be interesting to get a general update on RVRA’s operations in the current environment.

The next Cabot Micro-Cap Insider issue will be published on May 13, 2020. Going forward, we will publish a new issue on the second Wednesday of the month. We will host our inaugural monthly webinar on May 14, 2020 at 2 pm ET to review open recommendations and answer member questions. I look forward to “seeing” many of you on the webinar. Click here to register.

Changes This Week

Hopto (HPTO) moves to Hold

U.S. Neurological (USNU) moves to Hold

Updates

Hopto Inc (HPTO) is a fast-growing software company trading at a dirt-cheap valuation. There has been no news since my inaugural issue last week. I did have a chance to speak with a patent expert who personally knows Jonathan Skeels, CEO of HPTO. While he has no knowledge of Hopto’s patent portfolio (Hopto has 39 patents that it is trying to sell) he was generally bearish on intellectual property noting it is expensive and time intensive to monetize software patents. Nonetheless, HPTO is well positioned given that its GO-Global software enables office workers to work remotely, which is especially attractive in the current environment. Since I issued my BUY under 0.45 rating, the stock has appreciated from 0.39 to 0.54. As such, I am changing my rating to HOLD. If the stock drops back to 0.44 or lower, my recommendation will change back to BUY. HOLD

Earnings Date: Not yet announced.

P10 Holdings (PIOE) reported earnings on Thursday, April 30th. Revenue grew 8% y/y due to additional fund raising by RCP Advisors. Cash earnings stayed flat y/y at $0.04 although that was due to costs related to acquiring Five Points and almost acquiring another private equity manager. RCP Advisors noted it has already raised $165 million of additional capital commitments for its private equity funds. It will launch two more funds this year and Five Points will also begin a new fundraise. Excluding one-time costs, PIOE will generate $0.27 in cash earnings in 2020. As such, PIOE is trading at 7.7x 2020 free cash flow. This is too cheap a valuation for a company that has sticky revenue, high margins, and strong growth potential. The investment case is on track. BUY Under 2.25

Recro Pharma (REPH) continues to be an attractive stock with asymmetric upside. There has been no news in the past week, and REPH has not announced when it will report Q1 2020 earnings. REPH has historically grown revenue at a 13% compound annual growth rate yet it trades at a price to 2020 EPS multiple of 13.5x and at an EV/2020 EBITDA multiple of 7.1x, a sizeable discount to peers and to precedent M&A transactions. Further, the company may benefit from “buy American” sentiment that appears to be rising, as consumers and politicians move away from pharmaceuticals and other products that are sourced from China. BUY under 10.00.

Earnings Date: Not yet announced.

Riviera Resources (RVRA) announced last week that it will pay out a special dividend of $0.75. The dividend will be paid on May 12, 2020 to shareholders of record on May 7, 2020. Shareholders must hold shares through May 13, 2020 (the ex-date) to receive the dividend. The special dividend continues the trend of management returning capital to shareholders through share repurchases and special dividends. Do not buy RVRA just for the dividend. If you sell after receiving the dividend, the dividend will be treated as a short-term capital gain. If you do not sell, it will not be treated as a taxable event. I believe RVRA is an attractive long term holding. It has no debt and is generating positive free cash flow. Further, it has a very valuable asset in its Blue Mountain midstream business. Once the energy market turns (and it always eventually does), Riviera will be well positioned to benefit. BUY Under 3.00.

Earnings Date: Thursday, May 7, 2020

U.S. Neurological Holdings (USNU) operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and holds interests in radiological treatment facilities. There has been no news this week. Since I issued by BUY under 0.20 rating, the stock has appreciated from 0.14 to 0.24. As such, I am changing my rating to HOLD. If the stock drops back to 0.19 or lower, my recommendation will change back to BUY under 0.20. HOLD

Earnings Date: Not yet announced.

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.