Over the past couple of weeks, there have been a couple big news items:

- The collapse of crypto exchange, FTX.

- The market rallying on lower-than-expected inflation.

The collapse of FTX has nothing to do with micro-caps, but it’s a fascinating story. I can’t wait to read the Michael Lewis book on it (apparently, he’s been working on the book for the last 6 months).

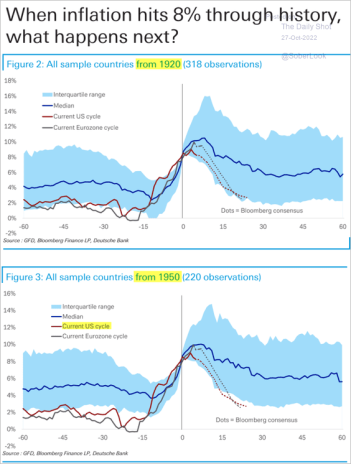

In terms of inflation, my sense is the battle with inflation is not over. Historically, it takes quite some time to reign in inflation once it gets above 8%.

Consensus expects inflation to fade within 18 months, but typically it is a little stickier.

Nonetheless, I continue to be encouraged by the valuations of the CMCI recommendations.

The stocks are cheap and most have strong fundamentals (just look at the recent results that I’ve highlighted below).

We are in the midst of earnings season so there several updates that I wanted to highlight (full updates below):

- Aptevo (APVO) filed its 10-Q. The stock remains cheap but little new information was revealed.

- Cipher (CPHRF) reported another great quarter.

- Epsilon Energy (EPSN) reported an excellent quarter.

- Medexus (MEDXF) reported a record quarter.

- Zedge (ZDGE) reported full results and showed significant growth.

The next issue of Cabot Micro-Cap Insider will be published on Wednesday, December 14. As always, if you have any questions, please email me at rich@cabotwealth.com.

CHANGES THIS WEEK

None

UPDATES

Aptevo (APVO) reported earnings this week. There was no major news. Aptevo currently has $18MM of net cash. Its market cap is $16MM. I expect Aptevo receive an additional $22.5MM of income from its Ruxience royalty over the next 18 months. Nonetheless, cash is getting tight and Aptevo will need to sell shares to increase its runway. Aptevo will present additional data for its lead compound (APVO436) at a big cancer conference in December, and I’m hopeful this will generate more investor interest in the stock. Original Write-up. Buy under 7.50

Atento S.A. (ATTO) had no news this week. On September 7th, Atento announced that it extended its lockup agreement with its largest shareholders (who represent 71% of shares outstanding) for 12 months. This is meaningful as it shows the largest shareholders of the company have conviction in the stock and believe it’s undervalued. On August 3, Atento reported another weak quarter. Management lowered revenue guidance to flat versus the consensus of +4% growth and previous guidance of “mid-single-digit” growth. EBITDA margin guidance has been reduced to 12% (at the midpoint) from 13.5%. While this quarter and guidance cut were disappointing, the stock is incredibly cheap and is not at risk of defaulting on its debt (no maturities until 2025). Thus, it makes sense to stick with the stock. Original Write-up. Buy under 10.00

Cipher Pharma (CPHRF) reported a solid quarter this week. Revenue increased 6% to $4.8MM. Adjusted EBIDTA increased 4% to $2.4MM. Cipher’s cash balance continues to grow. The company now has $27.5MM of cash on its balance sheet, over 50% of its market cap. Management continues to buy back shares. Longer term, upside will be driven by Cipher’s two pipeline products (MOB-015 for nail fungus and Piclidenoson for psoriasis). Both drugs are progressing in phase III trials. Original Write-up. Buy under 2.50

Cogstate Ltd (COGZF) had no news this week. The company got a boost when Esai and Biogen announced positive results for its Phase 3 Alzheimer’s Trial on September 27. This is massively positive news as it will drive more Alzheimer’s trials (and revenue for Cogstate). Ultimately, Cogstate’s revenue potential this year and beyond will be determined by key Alzheimer’s drug read-outs which are expected this year and next year: 1) Lecanemab from Eisai (Phase 3 data: already announced and positive), 2) Gantenerumab from Roche (Phase 3 data expected in Q4 2022), and 3) Donanemab from Eli Lilly (Phase 3 data in mid-2023). The Cogstate thesis remains on track. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) announced that it will pay out $0.39 per certificate on November 10th. On September 12th, the trust announced that it sold 7 of its properties for $65MM. The blended cap rate of the transactions was 7.3%. The trust on an aggregate basis is trading at a ~10% cap rate (the higher the cheaper). Copper Property Trust continues to look attractive. Original Write-up. Buy under 14.00

Currency Exchange International (CURN) had no news this week. It reported earnings on September 13th. They looked great! Revenue increased 139% to $21MM, beating consensus expectations by $5MM. This was truly a massive beat. Revenue in the fiscal third quarter was 67% higher than 2019 FQ3 (pre-pandemic). The company’s Payments business grew revenue 65% to $3.6MM. Year to date, Currency Exchange has generated EPS of $1.15 or $1.53 on an annualized basis. As such, the stock is trading at just 9x earnings. The investment case remains on track. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) reported an excellent quarter on November 10th. Revenue increased 6% sequentially. In the quarter, Epsilon generated $9.6MM of net income and $11.2MM in free cash flow. This is quite significant for a company with a market cap of $170MM. The company continued to buy back shares and pay a dividend. Due to the strong cash generation in the quarter, Epsilon currently has $40MM of cash on its balance sheet and no debt. The stock continues to look attractive. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) had no news this week. It reported earnings on October 25th. EPS increased 21% to $0.94. Return on assets and equity were 2.48% and 20.60%, respectively. Credit metrics remain strong with nonperforming loans of 0.67% and a reserve for loan losses of 1.24%. I continue to believe Esquire dominates an attractive niche and is set to grow nicely for the foreseeable future. Despite 21% EPS growth and strong credit metrics, Esquire trades at just 11x forward earnings. Original Write-up. Buy under 42.00

IDT Corporation (IDT) had no news this week. It reported fiscal Q4 earnings on October 6th. Similar to last quarter, revenue declined y/y (down 16%), mainly due to tough comps from last year. However, the two most important segments, NRS and net2phone, continued to generate excellent results. NRS revenue grew 157% to $17.7MM, with full-year 2022 recurring revenue increasing 129% to $45.3 million. net2phone subscription revenue increased 37% to $15.1MM. Overall, it was a solid quarter. The investment case remains on track and my price target is 55 based on an updated sum-of-the-parts analysis. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) had no news this week. The company reported first-half 2022 results on September 7th. They looked great. The company reported revenue growth of 745% and EBITDA growth of 768%. It generated free cash flow of £93MM or $186MM annualized. Kistos has pulled back due to falling natural gas prices in Europe. As such, Kistos is currently trading at 0.7x annualized EBITDA and 1.8x annualized free cash flow. This is too cheap. Another risk is that the EU is considering instituting a windfall profit tax on energy companies. While this would be a negative, I think it’s reflected in Kistos’ valuation. Further, Kistos generated $89MM of EBITDA in 2021. Thus, it’s trading at just 3.5x “normalized” EBITDA, not a demanding valuation. I continue to see at least 100% upside ahead. Original Write-up. Buy under 7.50

Liberated Syndication (LSYN) has had no news recently. Libsyn’s plan was to “go public” again in September. Obviously, that didn’t happen. It isn’t too surprising given the market volatility. I’ve reached out to Libsyn’s CEO and hope to catch up with him soon. Libsyn has posted several press releases in the past couple of months. I remain optimistic about Libsyn’s prospects. Once financials are re-filed, I’m looking forward to seeing: 1) How Libsyn’s core hosting business is doing. Podcasting conferences were a key way that Libsyn marketed. When COVID shut down in-person events, it negatively impacted Libsyn’s new customer acquisition. Now that COVID is behind us, I expect the core business to accelerate. 2) Revenue growth for AdvertiseCast. This is an exciting business opportunity Revenue grew 50% in 2021 for AdvertiseCast, and I expect continued strong growth going forward. 3) The growth of Glow. Libsyn acquired Glow in 2021. Glow enables podcast creators to offer premium shows (think substack but for podcasts). I think this is a big market opportunity. While Libsyn has been a frustrating stock, I think (and hope!) our patience will be rewarded. Original Write-up. Hold

M&F Bancorp (MFBP) is my newest recommendation. It had no news this week. M&F is taking advantage of an interesting opportunity (Emergency Capital Investment Program) available to many small banks. As a result, I expect EPS to grow from $1.36 in 2021 to $4.74 in 2025. Assuming M&F continues to trade at its average P/E multiple of 9.3x, the stock should hit 44.00 by 2025, implying almost 150% upside. Original Write-up. Buy under 21.00

Medexus Pharma (MEDXF) reported fiscal Q2 results last week. The report was excellent! Revenue grew 55% y/y and EBITDA was $4.2MM, a y/y improvement of $6.3MM. The company generated positive free cash flow and is actively exploring options to refinance its convertible debentures which come due next fall. The stock’s valuation looks cheap at 1.1x revenue and 7.6x adjusted EBITDA. The investment case remains on track! Original Write-up. Buy under 3.50

NexPoint (NXDT) filed its 10-Q to report earnings. It hasn’t hosted an earnings call yet, but I expect it to do so. The results look good. Operating cash flow is healthy. NAV as of September 30, 2022, is $24.57 so the stock is still trading at a big discount to fair value. The company generated $0.55 of funds from operations in the quarter. As such, it’s trading at ~7x, a discount to peers who trade closer to 12x. The company also was recently added to the MSCI index. As such, there will be index fund buying throughout the rest of the month. Original Write-Up. Buy under 17.00

P10 Holdings (PX) announced Q3 2022 results last week. They were great. Adjusted EBITDA grew 28% in the quarter while adjusted net income grew 56%. Assets under management increased 17% to $19BN. The investment case remains on track. Despite very strong fundamentals, the stock is trading at just 12.5x adjusted earnings. Original Write-up. Buy under 15.00

RediShred (RDCPF) had no news this week. It last reported earnings on August 26th. Results were excellent! Revenue grew 68% to $14.6MM CAD while EBITDA grew 73% to $4.5MM CAD. While acquisitions are helping, organic growth is very strong (+40% y/y). The stock continues to look incredibly cheap at a 5.1x EV/EBITDA multiple and a 7.4x price to free cash flow multiple. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Richardson Electronics (RELL) had no news this week. It reported earnings on October 6th. Revenue grew 26% to $68MM, beating consensus expectations by $5MM. EPS of $0.45 beat consensus expectations by $0.21. The stock reacted well. The company is a rapidly growing micro-cap that is benefiting from many “green” initiatives (electric trains, wind turbines, etc.). Despite strong growth expectations and a pristine balance sheet ($40MM of net cash), the stock trades at just 12x next year’s earnings. Insider ownership is high, and I see ~50% upside over the next couple of years. Original Write-up. Buy under 17.00

Transcontinental Realty Investors (TCI) recently filed an 8-K that disclosed it received $203.9MM in proceeds from the sale of its JV. Adding this to the $100MM that the company already has received and Transcontinental has 96% of its market cap in cash. Once the transaction is reflected in Q3 2022 financials, Transcontinental should see a big boost as investors recognize value that has been crystalized. Finally, insiders own 86% of the company and could make an imminent move to buy out remaining shareholders at a large premium to the current stock price. Original Write-up. Buy under 45.00

Truxton (TRUX) reported Q3 earnings on October 20th. They were very good. Net income in the quarter of $1.49 grew 11% y/y. Net revenue also grew ~11%. Credit metrics remain excellent with $0 in non-performing loans. On an annualized basis, Truxton is generating $5.96 in EPS. It is trading at 10.4x annualized earnings. Historically it has traded at 13.5x. This isn’t the most exciting stock, but it’s a slow and steady winner. Original Write-up. Buy under 75.00

Zedge, Inc. (ZDGE) announced full quarterly results. Revenue in the quarter grew 42% while operating revenue grew 117%. For the full year, Zedge reported adjusted EBITDA of $12MM. As such, it’s trading at just 2.2x EBITDA, a draconian valuation. The company continues to buy back stock. Management believes the company can grow significantly over the next couple of years but will not give guidance for 2023 given economic uncertainty. Original Write-up. Buy under 6.00

| Stock | Price Bought | Date Bought | Price on 11/16/22 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 3.09 | -90% | Buy under 7.50 |

| Atento SA (ATTO) | 21.57 | 4/14/21 | 4.38 | -80% | Buy under 10.00 |

| Cipher Pharma (CPHRF) | 1.80 | 10/11/21 | 2.54 | 41% | Buy under 2.50 |

| Cogstate Ltd (COGZF) | 1.70 | 4/13/22 | 1.30 | -24% | Buy under 1.80 |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 13.40 | 4% | Buy under 14.00 |

| Crossroad Systems (CRSS) | 14.10 | 2/9/22 | 8.70 | -38% | Sell |

| Currency Exchange (CURN) | 14.10 | 05/11/22 | 14.05 | 0% | Buy under 16.00 |

| Epsilon Energy (EPSN) | 5.00 | 8/11/21 | 7.36 | 47% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 43.46 | 27% | Buy under 42.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 25.63 | 32% | Buy under 45.00 |

| Kistos PLC (KIST) | 4.79 | 7/13/22 | 3.88 | -19% | Buy under 7.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 1.46 | -18% | Buy under 3.50 |

NexPoint Diversified Real Estate Trust (NXDT) | 14.15 | 1/12/22 | 14.14 | 0% | Buy under 17.00 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 9.88 | 232% | Buy under 15.00 |

| RediShred (RDCPF) | 3.30 | 6/8/22 | 3.00 | -9% | Buy under 3.50 |

| Richardson Electronics (RELL) | 15.72 | 9/14/22 | 22.49 | –% | Buy under 17.00 |

| Transcontinental Realty Investors (TCI) | 40.22 | 10/13/22 | 40.50 | –% | Buy under 45.00 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 64.25 | -10% | Buy under 75.00 |

| Zedge (ZDGE) | 5.73 | 3/9/22 | 2.43 | -58% | Buy under 6.00 |

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in KIST:GB, LSYN, MEDXF, PX, IDT, APVO, NXDT, COGZF, RDCPD, TCI, ZDGE, and MFBP. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members.