Today, we are profiling a Canadian SaaS company that is trading for a “value” multiple.

This company has sticky, recurring revenue. Other characteristics include:

- Strong historic revenue growth (25% CAGR)

- Over 40% insider ownership

- strong balance sheet (a significant net cash position)

- A cheap valuation

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider 920

[premium_html_toc post_id="213984"]

Take Advantage of Recent Volatility

Over the Labor Day holiday, I was up with my extended family in Arrowsic, Maine. We enjoyed going for a cruise on the Kennebec River and also got in one last beach day. It was also a peaceful setting to reflect on the outlook for the stock market in the months ahead.

In recent days, the broader market has started to head south, and volatility has picked up. As you know, I’ve been cautious for a while now given elevated valuations, signs of speculative excess, and underappreciated risks in the market. As such, the current pullback is not unexpected.

The key to dealing with market volatility is to not react to it, but rather use it to your advantage.

In other words, review your portfolio and watch list and identify the companies that you would love to add more shares to if you got the opportunity.

Of the Cabot Micro-Cap Insider recommendations, Medexus Pharma (MEDXF) and hopTo (HPTO) have very strong business momentum. These would be good candidates to buy or to add to if we are given an opportunity.

If you know your companies inside and out and have high conviction in them, you can take advantage of someone else’s panic selling.

This week, our monthly webinar will take place on Thursday, September 10 at 2 p.m. ET. We will review all open recommendations and answer subscriber questions. Feel free to email questions to me ahead of time at rich@cabotwealth.com and I can answer them during the webinar.

Now let’s get into my newest recommendation: NamSys Inc. (NMYSF).

New Recommendation

NamSys Inc: A SaaS Company Trading at a Value Multiple

Company: NamSys Inc

Ticker: NMYSF

Price: 0.65

Market Cap: $25.1 million

Enterprise Value: $19.6 million

Price Target: 1.15

Upside: 77%

Recommendation: Buy Under 0.80

Recommendation Type: Rocket

Executive Summary

NamSys Inc (NMYSF) is a Canadian micro-cap software-as-a-service company that caters to the cash processing and logistics niche. It has historically grown revenue and earnings at a compound annual growth rate of 20%+ yet only trades at 19x 2019 earnings. It has a pristine balance sheet with significant cash and no debt, and insiders own over 40% of the company, ensuring high alignment.

Background

NamSys (formerly called Cencotech) is based out of Bolton, Ontario, Canada. The company has been in business since 1989. The company used to sell hardware as well as software but sold its hardware business in 2006. NamSys has partnerships with many currency management companies.

NamSync Inc Overview

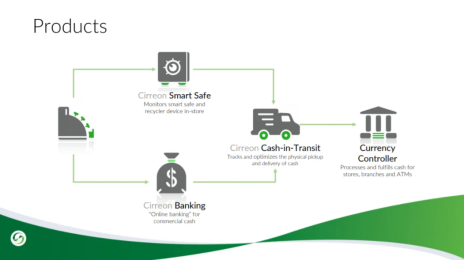

NamSys generates revenue from four business lines: Cirreon Smart Safe, Cirreon Banking, Cirreon Cash-in-Transit, and Currency Controller. The vast majority of revenue comes from the U.S. All product lines are software offerings which simplify the management of cash.

Cirreon Smart Safe

The Cirreon Smart Safe software solution is used by many Smart Safe providers including: Brinks, Tidel, and Burrough.

Each Smart Safe is connected to a network, accepts cash, and authenticates it. The cash is then stored in secure cassettes. Access to the cassettes is severely restricted (usually only cash-in-transit companies are allowed access).

The Smart Safe software solution has many benefits for retail companies (gas stations, convenient stores, etc.) including:

- Enhancing the audit trail

- Minimizing internal theft and shrinkage

- Enabling the company to immediately get credit from bank once cash is deposited to Smart Safe

This product is paid for per device per month.

Currency Controller

The Currency Controller software is used by a company’s controller to manage all its cash that is in Smart Safes company wide.

This product is billed per month per cash vault.

Cirreon Banking

The Cirreon Software solution is essentially a banking app that tracks Smart Safe deposits and can be used to manage Cash-in-Transit (CIT) pickups. It can be thought of as an online portal for commercial customers.

This product is billed as a monthly fee per store.

Cirreon Cash-in-Transit

The Cirreon Cash-in-Transit (CIT) software solution is an app that CIT drivers use to manage pick-ups. The drivers scan barcodes on bags that they pick up to efficiently track and manage cash and optimize vehicle operations.

The Cirreon Cash-in-Transit app is billed per month per truck.

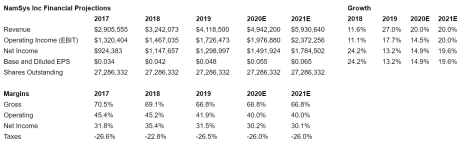

Historically, the business has grown very well, as shown in the chart below. It is also notable that 95% of revenue is recurring.

Relationship with Brinks

Brinks is NamSys’ largest customer and uses NamSys software in many of its Smart Safes. In 2019, Brinks represented 38% of revenue, which is down slightly from 2018 when it represented 40% of revenue.

Brinks is both a risk and an opportunity. It’s an opportunity because with its recent acquisition of G4S, it has 25% global market share. It’s a risk because NamSys is highly reliant on the company.

It appears that NamSys and Brinks have a mutually beneficial relationship. Further, it appears that NamSys’ software solutions are fairly sticky and it would not make sense for Brinks to move its contract to another provider.

Use of Cash Worldwide

One concern that I have is that the use of cash is in secular decline. I personally rarely use cash. Nonetheless, one in four payment in the U.S. is made in cash. Benefits of cash include: 1) it’s the least expensive payment option, 2) it’s private and instantaneous, 3) there’s no middleman or fees.

While the use of cash will continue to decline going forward, I expect most businesses to still accept cash as a payment option and for those businesses, NamSys’ product can decrease the cost of handling cash.

Further, historically NamSys has been able to grow revenue 20%+ per year despite cash usage headwinds. As such, this headwind seems manageable.

Business Outlook

In June 2020, NamSys reported that revenue through the first six months (ending April 2020) of its fiscal year had increased by 19.2%. Importantly, revenue in the quarter ending April 2020 grew 14.5% y/y despite headwinds from the pandemic.

In terms of future growth, many of NamSys’ customers only use one product so there is an opportunity to upsell them to other company offerings. The company is also exploring expanding internationally to further grow and diversify its revenue stream. To do this, the company can work with existing customers that have international operations or develop new customers.

While NamSys has grown revenue by a 25% compound annual growth rate over the past five years, I’m assuming revenue growth of 20% going forward. On a normalized basis, operating income (EBIT) and EPS should grow at ~20% per year.

Impact of Pandemic

The coronavirus pandemic should have a temporary impact on NamSys’ business as most Smart Safe customers have multi-year contracts. Eventually, stores will reopen and Smart Safes will continue to be utilized. The company also recently shared that the pandemic has not impacted its onboarding of new customers. It appears that many retail companies are taking the pandemic as an opportunity to invest in their businesses to make them more efficient.

Valuation and Price Target

Software companies on average trade at an enterprise value to earnings before interest and taxes (EBIT) of 56.9x.

Currently, NMYSF is trading at an EV/EBIT multiple of 11.3x.

Given that NamSys is a micro-cap with a high revenue concentration with Brinks, I don’t believe the stock will trade anywhere near the average software multiple. However, I do believe the company is undervalued and deserves to trade at an EV/EBIT multiple of 15.0x given its high growth potential and revenue stickiness.

Applying a 15.0x EV/EBIT multiple to my 2021 EBITDA multiple of $2.4 million implies a 1.15 price target, significantly above its current share price.

As you know, one factor that I always look for when evaluating micro-caps is insider alignment. In the case of NamSys, we are well aligned as insiders own 11.3 million shares (41% of shares outstanding).

Make sure to use limits when buying NMYSF as the stock is very illiquid.

My rating for NMYSF is Buy Under 0.80.

Risks

- Secular headwind of people using less cash.

- While this is clearly a headwind, NamSys has still been able to grow at a 25% CAGR. As such, I believe the headwind is manageable.

- Brinks reliance & revenue concentration.

- NamSys’ biggest customer, Brinks, represents 39% of revenue. This is clearly a risk as Brinks could fail to renew its contract with NamSys. Nonetheless, NamSys provides excellent customer services, and its software solutions are sticky. Therefore, I believe the risk of the company losing the Brinks contract is low.

Recommendation Updates

Changes This Week

Increase Buy limit for HopTo (HPTO) To 0.50 from 0.45.

Move Greystone Logistics (GLGI) from Hold to Buy under 1.00.

Move P10 Holdings (PIOE) to Hold.

Updates

Greystone Logistics (GLGI) reported earnings recently for its fiscal year ended May 31. Quarterly revenue was $18.3 million, down 13% from a year ago. In its press release, the company noted that demand from customers continues to grow. Its biggest challenge is maintaining an adequate workforce as many employees have opted to stay at home for protection from COVID-19. The company reported $0.06 of GAAP EPS that was helped by an unusual tax benefit. On a normalized basis, the company generated $0.03 in EPS, consistent with my expectations. Thus, in the last fiscal year, the company generated $0.12 of EPS and is trading at 9x earnings. This is too cheap for a company that has historically grown revenue at a 20%+ CAGR and just grew EPS 140%. As the stock dipped below 1.00, I’m upgrading it to Buy from Hold. Buy under 1.00.

HopTo Inc (HPTO) recently reported an excellent quarter, with revenue up 49%. Quarterly revenue growth is very lumpy so I’m not going to get too excited, but it’s good to see that year-to-date revenue is up 7%. I recently re-evaluated my valuation of hopTo, and as a result, I increased my price target from 0.45 to 0.50. Here’s my current thinking on valuation. In the first six months of 2019, hopTo generated $389.9k of earnings before interest and taxes (EBIT) or $779.8k annualized. I think a 12x multiple is fair, which works out to a $9.4MM enterprise value for these cash flows. This arguably is a cheap multiple for a software company, but the company is tiny and I’m not convinced it really has a sustainable competitive advantage. Next we can add the value of hopTo’s 39 patents, which I value at $2.8MM based on where hopTo has sold other patents. Finally we can add hopTo’s cash balance of $4.5MM (pro forma for the rights offering). Add it all up and you get a fair market cap of $16.65MM or $0.89 per share. Buy under 0.50.

Liberated Syndication (LSYN) has performed well recently. Last week, we learned that the newly appointed CFO, Richard Heyse, bought 40,000 shares of LSYN at prices ranging from $3.43 to $3.60. This is a very positive sign. Libsyn recently reported an excellent quarter and hosted a helpful and transparent conference call. In the second quarter, revenue grew by 11.4%. Podcast hosting grew 11.1% while website hosting grew 14.3%. I was a little surprised that podcast revenue didn’t grow more strongly, but management commented that podcast listening has been down due to less commuting time. Nonetheless, I expect podcast listening and Libsyn podcast revenue to reaccelerate over time. LSYN continues to look attractive trading at 9.8x Q2 annualized EBITDA and 3.6x 2020 revenue. Buy under 3.35.

MamaMancini’s Holdings (MMMB) announced last week that it will be expanding its product offering at many grocery stores nationwide including at 1,250 Publix Super Markers, at Sam’s Club locations, and at many lesser known accounts. In the press release, the CEO stated, “We continue to see momentum on all fronts of our business and expect to secure additional placements at nationwide retailers, as well as new mentions on QVC, before the end of the third quarter. I look forward to continued operational execution and providing further updates to our shareholders as appropriate.” MamaMancini’s continues to execute well and the investment case remains on track. It has historically grown revenue at a 24% CAGR yet only trades at a P/E of 16.6. Management owns over 50% of the stock, ensuring that incentives are aligned. Further, the company has a clean balance sheet. My price target of 2.50 implies significant upside. Buy under 2.00.

Medexus Pharma (PDDPF) has pulled back after a strong run. However, I think the pullback represents a buying opportunity. In its most recent quarter, Medexus reported revenue growth of 71%. The company generated $4.1 million of free cash flow in the quarter or $16.4 million annualized. As such, MEDXF is currently trading at a price to free cash flow multiple of 3.2x. On an EV/Revenue basis, MEDXF trades at 0.8x while slower growing peers trade at 3.6x. This is a good stock to average up in as the company continues to execute yet remains undervalued by the market. Buy under 3.50.

P10 Holdings (PIOE) announced a transformative acquisition recently and the stock has rallied sharply. It will be acquiring TrueBridge Capital Partners, a venture capital firm with $3.3BN in assets under management. TrueBridge’s strategy is to invest in micro and venture funds. P10 holdings is paying $159MM for the acquisition. To pay for the deal, P10 is issuing convertible preferred debt that will yield 1% and has the right to convert into P10 stock at a conversion price of $3.30 (PIOE’s share price was $2.58 before the deal was announced). Pro forma for this deal, P10 expects to generate $55MM in EBITDA on a run rate basis by the end of 2020. As such, the stock is trading at 13.0x EBITDA. This isn’t a dirt-cheap valuation, but it remains reasonable. P10’s most comparable company is Hamilton Lane, which trades at 30x forward EBITDA. Nonetheless, given the stock’s sharp increase, I’m moving my rating to Hold. While my official rating is Hold, it would be a fine time to sell a portion of your position as the stock approaches my 4.75 price target. Hold.

Riviera Resources (RVRA) announced recently announced that it has reached an agreement to sell Blue Mountain, its midstream business, to Citizen Energy for a price of $111 million. The sale price is a premium to what was implied by RVRA’s share price ahead of the sale, but is nonetheless disappointing. Over the past three years, Riviera has spent over $300 million building out the midstream asset and so the sale price is at a large discount to replacement value. The company noted in its press release that it intends to liquidate the company. After all sales close, Riviera should have ~$134 million, or ~$2.31 per share, to distribute to shareholders. I expect almost all net proceeds to be distributed by year end. Given my estimate of liquidation value, I believe it makes sense to buy the stock below 1.85 as it would imply a 25% return to liquidation. Buy below 1.85.

Watch List

This month, DMLP and SOFO remain on my watch list.

Dorchester Minerals (DMLP) is an oil and gas royalty company that pays out all its of its earnings to its shareholders. It has no debt and so has no risk of bankruptcy. The lowest quarterly distribution that DMLP has made over the past 10 years was $0.15 in 2016 (the last time energy prices were depressed). At DMLP’s current price, it’s trading at a trough yield of 5.0%. I will continue to research this name and may recommend it in a future issue.

Sonic Foundry (SOFO) is a video software company that specializes in solutions that cater to the education market. The company has struggled over the past three years but appears to be very well positioned to increase sales in the COVID-19 world as many schools will be embracing remote classes. Further, the chairman of the company recently tried to take the company private at $5.00 per share but relented when minority shareholders complained that this price was too low.

Recommendation RATINGS

| Stock Name | Date Bought | Price Bought | Price on 9/9/20 | Profit | Rating |

| Greystone Logistics (GLGI) | 7/8/2020 | 0.81 | 0.95 | 17% | Buy under 1.00 |

| Hopto Inc (HPTO) | 4/28/2020 | 0.39 | 0.45 | 15% | Buy under 0.50 |

| Liberated Syndication (LSYN) | 6/10/2020 | 3.06 | 3.72 | 22% | Buy under 3.35 |

| MamaManchini’s Holding (MMMB) | 8/12/2020 | 1.76 | 1.80 | 2% | Buy under 2.00 |

| Medexus Pharma (MEDXF) | 5/13/2020 | 1.78 | 2.87 | 61% | Buy under 3.50 |

| NamSys (NMYSF) | 9/9/2020 | 0.65 | 0.65 | 0.0% | Buy under 0.80 |

| P10 Holdings (PIOE) | 4/28/2020 | 1.98 | 4.05 | 105% | Hold |

| Riviera Resources (RVRA) | 4/28/2020 | 2.60 | 1.78 | -3%* | Buy under 1.85 |

| U.S. Neurological Holdings (USNU) | 4/28/2020 | 0.14 | 0.25 | 79% | Buy under 0.25 |

*Includes 0.75 distribution

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in HPTO, PIOE, MEDXF, LSYN, GLGI, and RVRA. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on October 14, 2020.

Cabot Wealth Network

Publishing independent investment advice since 1970.

CEO & Chief Investment Strategist: Timothy Lutts

President & Publisher: Ed Coburn

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2020. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: All recommendations are made in regular issues or email alerts or updates and posted on the private subscriber web page. Performance: The performance of this portfolio is determined using the midpoint of the high and low on the day following the recommendation. Cabot’s policy is to sell any stock that shows a loss of 20% in a bull market or 15% in a bear market from the original purchase price, calculated using the current closing price. Subscribers should apply loss limits based on their own personal purchase prices.