Today, we are recommending a micro-cap turnaround stock. If you look at the long-term stock chart, it looks like a company in secular decline. But once you look under the hood, you will realize the company has transitioned into a software/tech enabled services company with recurring revenue.

I think this stock has ~200% upside over the long term.

This company’s characteristics include:

- Near-term tailwinds from the booming IPO and SPAC market

- A draconian valuation

- An activist investor with a 10% equity stake (ensuring aligned incentives)

- Low capex requirements

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider 1120

[premium_html_toc post_id="219620"]

Full Steam Ahead

Well, it took an additional four days after election day for a winner to be declared, but on Saturday, Joe Biden was officially projected to be the 46th U.S. President.

The race was a lot closer than many anticipated, and President Trump is challenging the results in certain states, but odds are that his challenge will be unsuccessful.

The projected “Blue Wave” didn’t happen, as Republicans actually picked up some seats in the House of Representatives and it looks like the Democrats will not gain control of the Senate (although that will likely come down to two January run-off elections in Georgia).

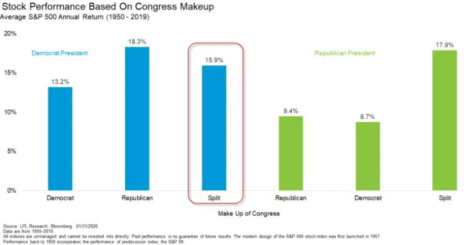

Historically speaking, the market does quite well under a Democrat president and split Congress, as shown below.

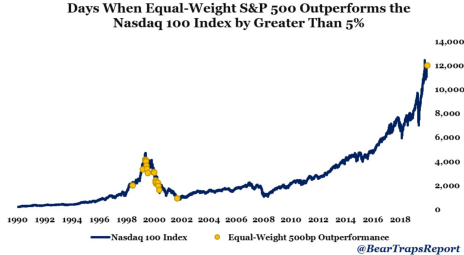

Separately, it looks like there could be a turn coming in the market that benefits more “value focused” names and micro caps. The chart below shows the Nasdaq 100. The yellow dots on the chart show the days when the equal weighted S&P 500 index outperformed the Nasdaq 100 by greater than 5% (as was the case on Monday).

In the aftermath of the tech bubble in 2000, value stocks went on an epic run of outperformance. While our micro caps aren’t necessarily all value stocks (because many of them are growing quickly!), they should perform very well in this environment.

This week, our monthly webinar will take place on Thursday, November 12 at 2 p.m. ET. We will review all open recommendations and answer subscriber questions. Feel free to email questions to me ahead of time at rich@cabotwealth.com and I can answer them during the webinar.

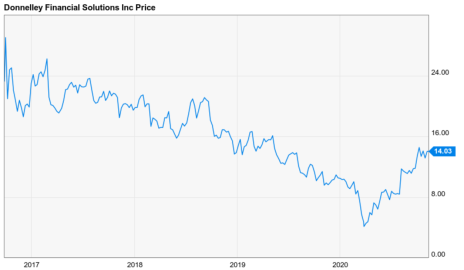

Now let’s get into my newest recommendation: Donnelley Financial Solutions (DFIN).

New Recommendation

Donnelley Financial Solutions: A Successful Turnaround That is Still Too Cheap

Company: Donnelley Financial Solutions

Ticker: DFIN

Price: 14.54

Market Cap: $475 million

Enterprise Value: $725 million

Price Target: 20

Upside: 38%

Recommendation: Buy Under 15

Recommendation Type: Rocket

Executive Summary

Donnelley Financial Solutions (DFIN) is a 2016 spin-off that has successfully executed a turnaround, transitioning from a mainly print focused business to a software/tech-enabled services business. Despite strong cash flow generation and debt paydown, the stock still trades at a draconian valuation. Simcoe Capital, an activist investor, owns 10% of the stock, ensuring we are well aligned with insiders. With modest earnings growth and multiple expansions, coupled with significant debt paydown, the stock should hit 40 by 2024, implying almost 200% upside.

Background

Donnelley Financial Solutions was spun off from R.R. Donnelley & Sons (RRD) in 2016.

Since the spin-off, DFIN stock has underperformed the market considerably.

What caused the decline?

At the time of the spin-off, Donnelley Financial generated a significant portion of revenue from financial prospectus printing, a business in secular decline.

In 2013, print represented 45% of sales. In 2019, print represented 36% of sales. By 2024, Donnelley expects print to represent 20% of sales. The balance of sales will come from software and tech-enabled solutions.

Donnelley Financial Services Overview

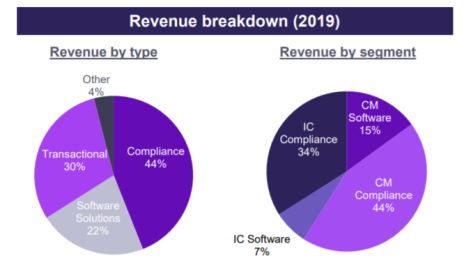

Donnelley Financial assists private/public companies and investment firms with the creation, submission and distribution of regulatory filings.

In its transactional business, Donnelley Financial is a leader in assisting companies doing IPOs, M&A transactions and debt offerings with prospectus creation, filings and printing needs.

In addition, Donnelley Financial has a strong portfolio of software solutions, including…

- Venue: Virtual Data Room for M&A, equity and debt transactions

- FundSuiteArc: Investment company with a cloud-based content management platform

- ActiveDisclosure: Document tagging, collaboration and filing

Business Outlook

The outlook for DFIN stock is very good in the near term and long term. In the intermediate term, there will be some headwinds.

Let me explain.

In the current environment, with the flurry of IPO and SPAC transactions, Donnelley Financial is doing very well.

It is a leader in providing services and solutions for companies doing IPOs and M&A transactions. Thus, business is booming.

In the recent quarter, revenue increased 7%, while EBITDA increased 53%.

As long as the IPO/SPAC market is hot, Donnelley Financial will print money.

In 2021, however, revenue will decline.

On January 1, 2021, SEC Ruled 30e-3 & 498a will become effective.

This rule enables certain registered investment companies and variable annuity providers to have an option to electronically deliver shareholder reports and other materials rather than provide such reports in paper. Investors who prefer to receive reports in paper can continue to receive them in that format.

Donnelley Financial estimates that this rule will negatively impact sales by $135MM and EBITDA by $7.5MM (both at the midpoint) in 2021.

However, starting in 2022, the company expects revenue to begin to grow at a low single-digit rate.

While a company growing revenue at a low single-digit rate doesn’t sound very exciting, Donnelley Financial’s low valuation in conjunction with several other factors should drive the share price significantly higher over time.

Activist Involvement and Capital Allocation

An incredibly important point to understand is that an activist investor, Simcoe Capital, owns ~10% of the stock. As part of a standstill agreement, Simcoe’s managing partner, Jeff Jacobowitz, he was added to the Board of Directors in 2019 and agreed to vote in favor of Donnelley Financial’s nominees in 2019 and 2020. I have no doubt that Simcoe’s influence has resulted in improved capital allocation.

In February 2020, Donnelley Financial announced a $25MM share repurchase authorization.

Through September 30, the company has spent $10MM buying back stock. Once the $25MM share repurchase authorization is complete, I expect Donnelley to create another authorization.

In addition to buying back its stock, Donnelley has been incredibly smart about retiring its debt. Since its spin-off in 2016, the company has retired $340MM of debt, paying for the debt reduction through asset sales and through internally generated cash flow.

Valuation and Price Target

I don’t know how much Donnelley Financial is worth, but I’m sure it’s a lot more than the current price.

In 2019, Donnelley Financial generated $137MM of EBITDA. Today, it has a market cap of $469MM and an enterprise value of $720MM. Thus, it is trading at an EV/EBITDA multiple of 5.3x, a cheap absolute multiple.

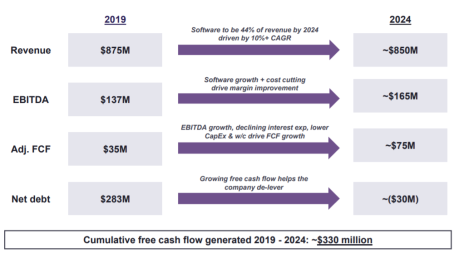

Donnelley Financial’s goal is to pay off all of its debt and generate annual EBITDA of $165MM by 2024.

We know that the company is good at generating cash and paying off debt. Since 2016, it has retired $340MM of debt. Thus, it’s a safe bet that the company will be able to retire $283MM of net debt by 2024.

Let’s just assume that EBITDA stays flat at $137MM, instead of increasing to $165MM as the company expects. Let’s further assume that the EV/EBITDA multiple stays flat at 5.3x. In this scenario, DFin’s share price would increase from ~14 to 22 by 2024, driven by the debt paydown. This works out to a total return of 61% and an internal rate of return of 12%. Not too bad.

In reality, I think it’s likely that the company hits its goal (or comes close) of $165MM in EBITDA by 2024.

In this more optimistic scenario, let’s further assume that the EV/EBITDA multiple expands to 8.0x. Most financial software firms trade closer to 20x EBITDA.

In this scenario, the share price would increase from ~14 to 40 by 2024. This works out to a total return of 185% and IRR of 29%.

I’m going to start with a 20 price target and an initial recommendation to Buy under 15.

As always, remember to use a limit and try to buy the stock as close to its current market price as possible.

Risks

- Simcoe Capital’s activist campaign fails.

- If Simcoe Capital resigns from the board and/or sells its shares, it would impair my DFIN investment case. Without an activist involved, I would have no confidence regarding capital allocation and the stock could become a value trap.

- Debt paydown doesn’t materialize.

- A large portion of this investment case is based on continued debt pay down. If insufficient cash flow is generated to pay down debt, DFIN’s valuation will likely stay depressed.

Recommendation Updates

Changes This Week

No changes.

Updates

BBX Capital (BBXIA) recently reported Q3 2020 earnings. Given the recent spin-off, there were many moving pieces. But the key takeaway is BBX Capital continues to look attractive. The company recently announced that it has authorized a $10MM share repurchase representing 14% of its market cap. This is a significant positive. The company also recently announced that it is has purchased Colonial Elegance, a supplier and distributor of building products, including barn doors, closet doors, and stair parts. This purchase compliments the company’s subsidiary, Renin Holdings, which manufactures and distributes sliding doors, door systems and hardware, and home décor products. BBX paid $39MM for the acquisition but that price includes $5.1MM of excess working capital. As a result, the purchase price goes down to $33.99MM. EBITDA in the past year was $8.1MM CAD or $6.1MM USD. As such, BBX paid 5.6x EBITDA, which seems like a rather cheap purchase price. It is hard to know for sure based on the limited information disclosed in the press release. We will have to wait until we get the financials. I want to speak to the company to get additional insight, but I continue to like the stock. Factoring in a note receivable due within five years, it is trading at ~53% of its cash and notes receivable. Further, the company has valuable operating assets that generate positive free cash flow. Despite poor historical corporate governance, BBXIA shares trade far too cheaply. I see 100%+ upside. Buy under 5.00.

Dorchester Minerals LP (DMLP) recently announced that it will pay its third-quarter distribution of $0.325 on November 12 to unitholders of record on November 2. This works out to an annualized yield of 13.0%. The third-quarter distribution represents a 43% increase over the second quarter, reflecting significantly higher average energy prices. Dorchester is the rare energy company with high margins and no capital expenditures. It generates tons of free cash flow and pays a dividend. Insiders have been gobbling up shares, and I believe the stock is a great long-term holding that will be trading significantly higher in three years. While waiting for the stock to appreciate, investors get to collect a ~13% dividend yield. Buy under 11.00.

Greystone Logistics (GLGI) recently reported first-quarter fiscal 2021 earnings by filing its 10-Q. The filing was not accompanied by a press release. In the quarter, sales declined by 6%. There was a ~16% increase in volume, but pricing structure and product mix drove the sales decline. Importantly, gross margins increased from 12.6% to 16.8%. This drastic gross margin expansion drove a 25% increase in gross profit despite the sales decline. The strong gross profit growth coupled with lower interest expenses and preferred dividends drove 94.5% EPS growth. I’m conservatively estimating forward earnings of $0.13 (fiscal 2021). As such, the stock is trading at 7.0x forward earnings. This is too cheap for a company that has historically grown revenue at a four-year CAGR of 30.4%. Further, after the 10-Q was filed we saw significant insider buying from CEO and President Warren Kruger and a director. In total, Kruger owns over 30% of the company. As such, we are well aligned as we both will benefit from continued strong operational performance and stock price increases. Buy under 1.10.

HopTo Inc (HPTO) was flat on the week with no news. Recently, an individual named Jon C. Baker disclosed that the owns 892,383 shares, or 4.8% of shares outstanding. I have no insight into Mr. Baker’s intensions. In the company’s most recent quarter, revenue grew 49%. Quarterly revenue growth is very lumpy so I’m not going to get too excited, but it’s good to see that year-to-date revenue is up 7%. I believe HPTO stock is worth ~0.89 per share. HopTo is currently trading at an EV/EBIT multiple of 7.9x. This is too cheap. To put it in perspective, the software and internet industry trades at an average EV/EBIT multiple of 62.0x. HopTo should report earnings within the week, and I look forward to reviewing the latest trends in the business. Buy under 0.55.

Liberated Syndication (LSYN) was flat on the week. Recently, we saw some insider selling, but it was by two directors who will be replaced shortly (they were appointed by the former CEO, Chris Spencer, who had issues with self-dealing). Ironically, I view their selling as a positive as it signals to me that they will be leaving the company. Libsyn recently reported an excellent quarter and hosted a helpful and transparent conference call. In the second quarter, revenue grew by 11.4%. Podcast hosting grew 11.1% while website hosting grew 14.3%. I was a little surprised that podcast revenue was higher, but management commented that podcast listening has been down due to less commuting time. Nonetheless, I expect podcast listening and Libsyn podcast revenue to reaccelerate over time. I look forward to Libsyn’s Q3 earnings, which should be reported within one week. Buy under 3.75.

MamaMancini’s Holdings (MMMB) was up on the week with no news. In the most recent quarter, revenue growth of 28% was very impressive. Even more impressive, EPS grew 104% to $0.02 as the company continues to leverage its fixed costs. One area of weakness was in gross margins, which were lower than expected due to higher beef prices, but management commentary in the press release suggests that this pressure is starting to dissipate. MamaMancini’s continues to execute well and the investment case remains on track. It has historically grown revenue at a 24% CAGR yet only trades at a P/E of 17.9x. Management owns over 50% of the stock, ensuring that incentives are aligned. Further, the company has a clean balance sheet. Buy under 2.00.

Medexus Pharma (MEDXF) was up slightly on the week and continues to look attractive. In its most recent quarter, Medexus reported revenue growth of 71%. The company generated $4.1 million of free cash flow in the quarter, or $16.4 million annualized. As such, MEDXF is currently trading at a price to free cash flow multiple of 3.6x. On an EV/Revenue basis, MEDXF trades at 0.9x while slower growing peers trade at 3.6x. This is a good stock to average up in as the company continues to execute yet remains undervalued by the market. I look forward to the company’s Q3 earnings report within a few weeks. Buy under 3.50.

NamSys Inc. (NMYSF) recently reported fiscal Q3 earnings (quarter ended July 31). Revenue grew 11.8%, which is impressive given pandemic related headwinds. Gross margins were under pressure due to an accrual of management bonuses as well as increased staffing related costs. I’m not concerned with the management bonus as it is based on continued strong execution. The increased staffing costs relate to the high demand and required salary for software engineers/programmers. I will monitor this going forward. The most important factor for NamSys is continued revenue growth. Despite historically growing revenue and earnings at a compound annual growth rate of 20%+, the stock only trades at 17.7x 2019 earnings. It has a pristine balance sheet with significant cash and no debt, and insiders own over 40% of the company, ensuring strong alignment. Buy under 0.80.

P10 Holdings (PIOE) continues to perform well. Recently, the company closed the acquisition of TrueBridge Capital Partners, a venture capital firm with $3.3BN in assets under management. TrueBridge’s strategy is to invest in micro and venture funds. Pro forma for this deal, P10 expects to generate $55MM in EBITDA on a run rate basis by the end of 2020. As such, the stock is trading at 14.5x EBITDA. This isn’t a dirt-cheap valuation, but it remains reasonable. P10’s most comparable company is Hamilton Lane, which trades at 27x forward EBITDA. Hold.

Riviera Resources (RVRA) made a distribution of $1.35 on October 28. Riviera estimates that any subsequent distributions will range from $0 to $40MM, or $0.00 to $0.69 per share. I recently spoke with Riviera management and learned that the soonest another distribution can be made is September 2021. I’m assuming Riviera’s second distribution is the midpoint of the guidance range, $0.34. As such, I believe it makes sense to buy the stock below $0.28. Buying the stock at $0.27 implies an attractive IRR of 27.0% if $0.34 is paid out by the middle of September 2021. Riviera’s estimated wind-down costs are $32MM, which seem high although there could be significant severance costs. Buy under 0.28.

U.S. Neurological Holdings (USNU) was strong on the week. The company’s last quarterly report was solid. While revenue declined by 28% due to hospital procedures being delayed, the company continued to generate strong cash flow, and expects operations to return to normal soon. Currently, the company has $2.0 million ($0.26 per share) of cash and no debt on its balance sheet. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and it holds interests in radiological treatment facilities. I expect the company to file its next quarterly report in the next week, and it will be interesting to see if revenue growth reaccelerates. Buy under 0.25.

Watch List

Sonic Foundry (SOFO), a video software company that specializes in solutions that cater to the education market, remains on my watch list. The company has struggled over the past three years but appears to be very well positioned to increase sales in the COVID-19 world as many schools will be embracing remote classes. Further, Sonic’s chairman recently tried to take the company private at $5.00 per share but relented when minority shareholders complained that this price was too low. Nonetheless, sales growth has not materialized (sales were down 21% y/y in Q2). I look forward to the company’s Q3 earnings report to see if sales accelerate.

Waitr Holdings (WTRH) has been on my watch list for a while now, but I haven’t had the conviction to pull the trigger. I’m glad I waited. Waitr just announced Q3 earnings and revenue declined by about 20% from Q2. As such, the stock doesn’t look as cheap as it did after Q2 results. I will continue to watch this one to see if the company can regain momentum.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 11/10/20 | Profit | Rating |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 4.09 | 29% | Buy under 5.00 |

| Donnelly Financial Solutions (DFIN) | 14.54 | 11/11/20 | 14.54 | 0% | Buy under 15.00 |

| Dorchester Minerals LP (DMLP) | 10.45 | 10/14/20 | 10.48 | 0% | Buy under 11.00 |

| Greystone Logistics (GLGI) | 0.81 | 7/8/20 | 0.88 | 9% | Buy under 1.10 |

| Hopto Inc (HPTO) | 0.39 | 4/28/20 | 0.57 | 46% | Buy under 0.55 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.65 | 19% | Buy under 3.75 |

| MamaMancini’s Holding (MMMB) | 1.76 | 8/12/20 | 2.17 | 23% | Buy under 2.00 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 3.65 | 105% | Buy under 3.50 |

| NamSys Inc (NMYSF) | 0.65 | 9/9/20 | 0.64 | -2% | Buy under 0.80 |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 4.81 | 143% | Hold |

| Riviera Resources (RVRA) | 2.60 | 4/28/20 | 0.31 | -7%* | Buy under 0.28 |

| U.S. Neurological Holdings (USNU) | 0.14 | 4/28/20 | 0.29 | 107% | Buy under 0.25 |

*Includes 0.75 distribution and 1.35 distribution.

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, HPTO, PIOE, MEDXF, LSYN, GLGI, and RVRA. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on December 9, 2020.

Cabot Wealth Network

Publishing independent investment advice since 1970.

CEO & Chief Investment Strategist: Timothy Lutts

President & Publisher: Ed Coburn

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2020. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: All recommendations are made in regular issues or email alerts or updates and posted on the private subscriber web page. Performance: The performance of this portfolio is determined using the midpoint of the high and low on the day following the recommendation. Cabot’s policy is to sell any stock that shows a loss of 20% in a bull market or 15% in a bear market from the original purchase price, calculated using the current closing price. Subscribers should apply loss limits based on their own personal purchase prices.