Today, we are recommending a classic re-opening play.

Our latest recommendation operates golf courses as well as “entertainment” golf venues (high tech driving ranges). Traditional golf is booming and “entertainment” golf will boom in 2021 as vaccine penetration continues to increase and life returns to normal.

Some additional details:

- The company will roll out its new concept (modern adult mini golf) and expects strong revenue growth.

- Insider ownership is high, and there has been recent insider buying.

- Downside is limited given asset value of golf operations business and existing entertainment venues.

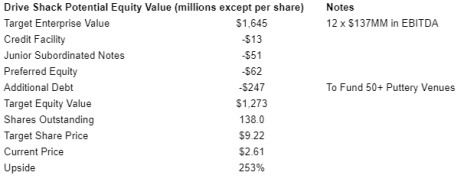

- My price target implies 100% upside, but in my bull case scenario, we could see ~250% upside.

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider 521

[premium_html_toc post_id="230315"]

Pent-Up Demand

I recently stumbled upon the below chart showing that savings rates in 2020 were 50% to 500% higher than the previous 20 years.

What is the takeaway? There is plenty of pent-up demand around the world. In other words, people have money burning a hole in their pockets! In this scenario, what stocks do you want to own?

Stocks that will benefit from a cyclical recovery.

As vaccine penetration increases (I get my second shot on Friday), people are craving to go out and enjoy themselves.

One obvious beneficiary of this? Oil stocks.

As people get out, drive more, fly more, and consume more, it will require more energy.

Oil prices are already in the mid-$60/barrel range. But many oil and gas producers aren’t increasing capital expenditures because they don’t trust the recovery. This means that prices are likely to stay high.

One of our recommendations, Dorchester Minerals (DMLP), will print money in this scenario.

At its current dividend rate ($0.303 per quarter), Dorchester is trading at an 8% yield. That looks pretty attractive to me given the company has a very attractive royalty business model and no debt.

Speaking of pent-up demand, my newest recommendation will be an obvious beneficiary of people returning to normal.

2021 and 2022 should be very strong years for Drive Shack (DS).

New Recommendation

Drive Shack: Drive for Show, Putt for Dough

Company: Drive Shack

Ticker: DS

Price: 2.61

Market Cap: $229 million

Enterprise Value: $271 million

Price Target: 6.00

Upside: 129%

Recommendation: Buy Under 3.00

Recommendation Type: Rocket

Executive Summary

Drive Shack’s traditional and entertainment golf businesses are set to boom in 2021. Given substantial recent cost cuts, operating leverage should drive earnings growth in 2021 and beyond. Longer term, growth will be driven by new Puttery Venues, which have high potential. At its current valuation, Drive Shack’s share price attributes minimal value to the strong upside potential from new Puttery Venues. Finally, alignment is high as management and directors own 16.3% of shares outstanding and have recently bought in the open market. My price target implies over 100% upside.

Drive Shack Overview

Background

Drive Shack was originally a REIT associated with private equity firm Newcastle Investment Corporation.

Over the years, it spun off several companies:

- New Media, which subsequently merged with Gannett

- New Residential

- New Senior

The remaining business eventually renamed itself Drive Shack and consisted of two segments:

- Traditional Golf

- Entertainment Golf

In recent years, Drive Shack’s business plan has been to sell off its golf course ownership to free up capital to invest into its Entertainment Golf segment (Drive Shack and Puttery Venues).

In the long term, the company expects two-thirds of revenue to come from “eater-tainment” and one-third to come from traditional golf.

Entertainment Golf

The Entertainment Golf segment consists of Drive Shacks and Puttery Venues.

Drive Shack

Drive Shacks are a modern take on driving ranges. Each Drive Shack Venue features expansive, climate-controlled, suite style bays with lounge seating; augmented-reality golf games and virtual course play; a restaurant and multiple bars; an outdoor patio with lawn games; and arcade games. See below for the view from a bay at a Drive Shack location.

Currently, the company has four Drive Shack locations that were launched in 2018 and 2019. The company expects to open another Drive Shack Venue on Randall Island in Manhattan in 2022. Its Drive Shack location in New Orleans is currently on hold.

The Puttery

The Puttery is the company’s new business focus.

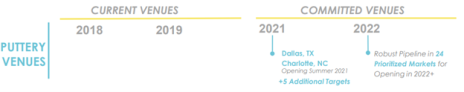

Drive Shack will initially open two Puttery Venues this summer (in Dallas, Texas and Charlotte, North Carolina). The Puttery is a modern take on mini golf.

Guests will enjoy indoor mini golf through auto-scoring technology that presents digital scores in real time. Each location will feature a series of tech-enabled miniature golf courses anchored by bars and other social spaces and exceptional food and beverage offerings that will serve to create engaging and fun experiences for guests.

Here is a rendering of the first Puttery Venue in Dallas.

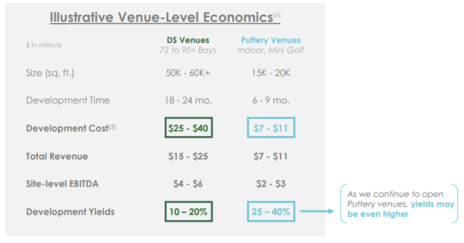

The appeal of Puttery Venues is they are less expensive to create and management believes they will generate very attractive returns on investment.

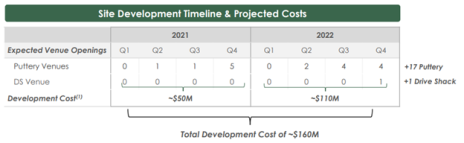

The company’s plan is to open/nearly complete seven Puttery Venues in 2021 and 10 more in 2022.

Traditional Golf

Drive Shack acquired America Golf in December 2013.

The traditional golf business generates three streams of revenue:

- Public properties (leased and owned)

- Private properties (leased and owned)

- Managed properties (public and private)

(1) Public properties (all leased)

The company has 30 leased public properties which generate revenue through:

- daily greens fees

- golf cart rentals

- food, beverage and merchandise sales.

Amenities at these properties generally include practice facilities, pro shops and food and beverage facilities.

At certain locations, public properties have larger clubhouses with extensive banquet facilities. In addition, The Players Club is a fee-based monthly membership program offered at most public properties, with membership benefits ranging from daily range access and off-peak course access to the ability to participate in golf clinics.

(2) Private properties (leased and owned)

Drive Shack leases four properties and owns another. The properties are open primarily to members and their guests.

Revenue is generated through:

- Initiation fees

- Membership dues

- Food, beverage and merchandise sales

- Guest fees

Amenities at these properties typically include practice facilities, full-service clubhouses with a pro shop, locker room facilities and multiple food and beverage outlets, including grills, restaurants and banquet facilities.

(3) Managed properties (public and private)

Twenty-five managed properties are operated by American Golf pursuant to management agreements with the owners of each property. The company recognizes revenue from each of these properties in an amount equal to a management fee and the reimbursements of certain operating costs.

Since 2019, the traditional golf business has been a secondary focus for Drive Shack.

At the time, the company announced that it would sell the 26 golf courses that it owned but keep the lucrative and higher margin management contracts associated with its golf courses.

In 2019, management guided that once all sales are completed and the business is optimized, the traditional golf business should generate $175MM of revenue with 15% to 20% EBITDA margins. Management has not updated this guidance for the recent resurgence of interest in the sport (due to the pandemic).

As of December 31, 2020, Drive Shack has successfully sold 25 of 26 owned golf properties for a total aggregate sales price of $204.2 million.

The proceeds have been used to fund construction of new Drive Shack Venues.

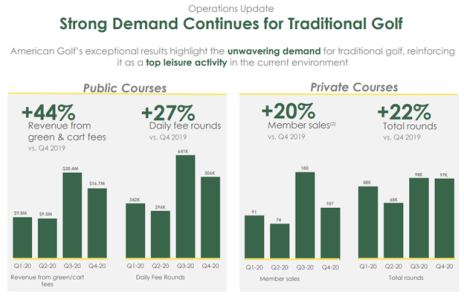

Recently, due to the pandemic and increased interest in outdoor activities, there has been a resurgence of interest in golf and this has benefited the traditional golf business in the second half of 2020 and will continue to be a tailwind in 2021.

Business Outlook

Traditional Golf is Booming

Drive Shack operates in two segments: Traditional Golf and Entertainment Golf.

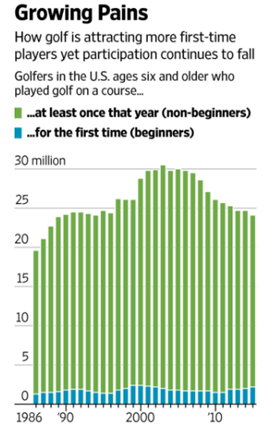

For the last 10 years, interest in traditional golf has been shrinking, as shown in the chart below.

Drive Shack’s traditional golf revenue over the past five years has declined.

This has been partially driven by Drive Shack selling its courses, but it’s also been driven by industry pressures discussed above.

The coronavirus pandemic that began in 2020 initially devastated golf participation as the whole world locked down. However, golf – being an outdoor activity – eventually emerged as a safe pandemic activity and interest surged.

Drive Shack benefited from that interest. Its traditional golf business saw excellent growth in the second half of the 2020. Despite this strong backdrop, traditional golf revenue decreased by 13% in the second half of the year as the number of large events declined by 86%.

The large decline had a disproportionate impact on high-margin (86.9% gross margin vs. 5.7% for non-food and beverage revenue) sales. For the full year, traditional golf operations declined by 14% while food and beverage sales declined by 65%.

In 2021, golf operations revenue will rebound. Importantly, high margin food and beverage sales will rebound sharply now that ~30% of the United States is vaccinated and over 50% will be by the summer.

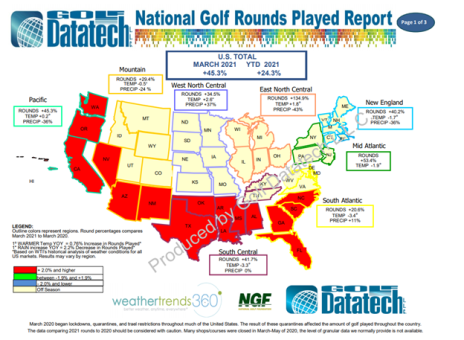

Interest in golf is not showing any signs of slowing down.

As the image below shows, the number of rounds played was up 45.3% this March.

Entertainment Golf is Due For a Massive 2021

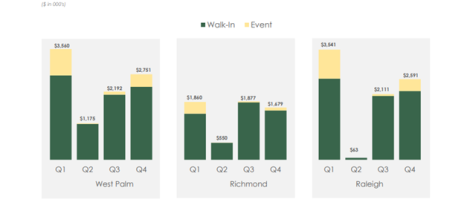

Drive Shack launches four locations 2018 and 2019. It expects to open another Drive Shack Venue on Randall Island in Manhattan in 2022. Its Drive Shack location in New Orleans is currently on hold.

The most revenue the company has ever generated in one of its four Drive Shack locations was $12.9MM in Q4 2019—right before the pandemic.

However, this doesn’t represent peak sales given that one (West Palm Beach, Florida) of the four locations opened midway through Q4 ‘19.

In 2020, of course, Drive Shack Venue revenue declined precipitously due to the pandemic.

Drive Shack Venues are the perfect post-pandemic activity. Their open air, outdoor layouts provide guests with an ideal setting for safe socializing.

The bays function as private suites, allowing each group their own defined, segmented space with physical barriers between groups.

Given the fast rollout of the vaccine and low risk of contracting COVID outside, it looks probable that Drive Shack Venues will experience strong growth in 2021.

Drive Shack Venues will also have several other tailwinds in 2021.

- Online Reservations

- 2-Bay Packages

- Game Innovation

On its most recent earnings call, Drive Shack said that it is offering online single-bay reservations for all of its locations and is seeing a positive response from customers.

The company also launched 2-Bay reservations last September to encourage small event bookings across all Venues. Since launching the 2-Bay reservation options, event revenue is up nearly 4x. Of course, event revenue will come back naturally as the pandemic fades, but the 2-Bay reservation option does appear to be helping already.

Finally, Drive Shack has rolled out team and single player tournaments and games, which increase engagement and spending per visit. Drive Shack will iterate on games as it learns from each event how to make it more engaging and profitable.

I’m not sure which of these initiatives will have the greatest impact. But the point that I’m trying to make is that this company is constantly testing new initiatives to improve the customer experience and strengthen profit margins.

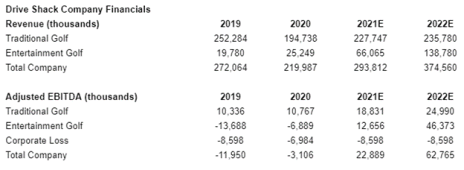

Given the many tailwinds this year, I’m modeling over 162% revenue growth for Drive Shack Venues in 2021 to get to $66MM.

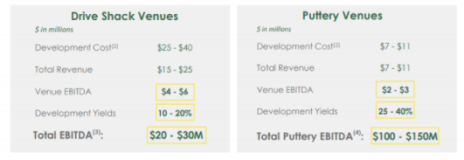

While 162% growth appears lofty, it’s important to remember that the company expects each Drive Shack Venue to be able to generate $15MM to $25MM of revenue at peak capacity. Thus, peak revenue should eventually approach $80MM from Drive Shack’s four Venues alone. Further, two Puttery Venues will be launched by this summer. Each Puttery Venue is capable of generating $9MM (midpoint of guidance) per year.

As such, we should see strong revenue upside in 2022 and beyond.

The Puttery Concept Has High Potential

On the Q2 ‘19 earnings conference call, Drive Shack first disclosed a new concept in development called Urban Box. Since then, the initiative has been rebranded to “Puttery” Venues.

The idea is to develop an indoor, small-format, technology-enabled putting venue with great food.

Initially, the reason that the company rolled out the Puttery concept was because they are much easier from a development perspective because they are smaller (15-25K square feet vs. 50-60K for a Drive Shack Venue) and there are thousands of potential sites available across the country. The permitting process is no different from permitting a drug store or clothing store.

Finally, and most important, the economics are attractive.

While Puttery Venues will generate less revenue than Drive Shack Venues, they cost less to construct and thus are expected to generate a higher return on investment.

By the end of 2021, the company expects to open 17 Puttery Venues (along with one Drive Shack Venue).

Each Puttery Venue is expected to generate $2MM to $3MM of EBITDA on an annual run rate basis. Thus, 17 Puttery Venues should generate ~$42.5MM in annual run rate EBITDA by year end 2022.

Long term, the company’s goal is to open 50+ Puttery locations by the end of 2024 (more on this later).

Historical Financials and Future Projections

If an investor pulls up the financials of Drive Shack, it’s not a pretty picture. One would see declining revenue and evaporating shareholder equity.

However, the future looks quite bright for both the Traditional and Entertainment Golf segments and for the company as a whole.

High Insider Ownership

With micro-caps, insider alignment is critical to ensure that the management team and the board of directors behave like owners.

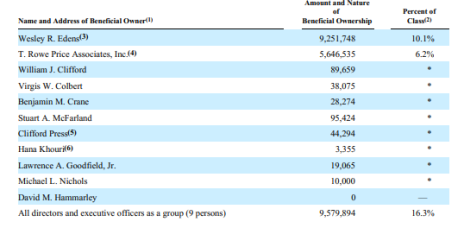

In the case of Drive Shack, we are well aligned as Wesley Edens, co-founder of Fortress Investments, owns 10.1% of the company and recently bought 672K shares in a secondary offering to fund construction of the Puttery Venues in 2021.

In total, directors and executive officers own 16.3% of shares outstanding.

See below for the full shareholder list.

Valuation and Price Target

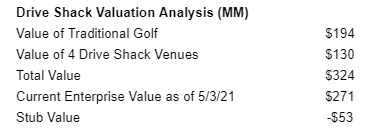

Based on the current valuation, common equity investors are paying minimal value for Puttery Venue optionality.

Let’s run through the math.

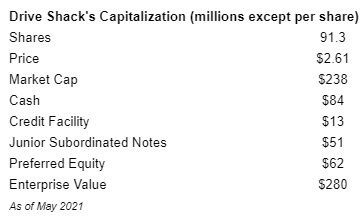

As shown below, Drive Shack has an enterprise value of $271MM.

Now let’s explore what the company’s existing business is worth today.

Traditional Golf

Traditional Golf generated $194MM and $10.8MM of adjusted EBITDA in 2020. Given strong trends in the golf market, I expect revenue growth of 17% in 2021.

What is this business worth?

We have one precedent transaction that is relevant.

In 2017, private equity firm Apollo Management bought ClubCorp for an enterprise value of $2.1BN.

At the time of the buyout, ClubCorp owned 129 golf courses. Assuming a $7.4MM value per course (based on industry date), the courses were worth $953MM at the time of the acquisition.

This implies that Apollo paid $1.19BN for $1.09BN of 2016 revenue (excluding the value of the courses), or an EV/Revenue multiple of 1.1x.

To be conservative, we can assume a 1.0x revenue multiple to value Drive Shack’s traditional golf business at $194MM.

This is likely conservative given golf is benefitting from near-term tailwinds and I expect 17% revenue growth for the company’s traditional golf business in 2021.

On a stabilized basis, Drive Shack expects its Traditional Golf segment to generate EBITDA margins of 15% to 20%.

Thus, this valuation assumes a normalized EV/EBITDA multiple of 6.7x ($195MM / $29.1MM), a reasonable, or probably conservative, multiple.

Entertainment Golf

There are a couple ways to value the company’s Drive Shack Venues.

The first is at replacement cost.

The company spent ~$130MM to construct the four Drive Shack Venues.

The businesses are expected to generate $20MM at the site level.

If we value the Venues at $130MM, it would imply a 6.5x EV/EBITDA multiple, which appears conservative as most entertainment companies trade between 12x and 15x EBITDA.

We also have another data point to inform our valuation analysis.

Callaway Golf Company recently acquired Top Golf, a direct competitor to Drive Shack, for $2.6BN. In 2019 (pre-pandemic), Top Golf generated revenue of $1.05BN.

I expect the company’s four Drive Shack Venues to generate $55MM of revenue this year. Thus, at the same 2.6x multiple, they are worth $143MM. This is likely conservative given the company expects the four Drive Shack Venues to ultimately generate $80MM annually at full capacity. Thus, Drive Shack could be worth $208MM.

Nonetheless, let’s use our lowest valuation ($130MM) to be conservative.

Based on this analysis, the market is currently valuing future Puttery and Drive Shack Venues at -$53MM.

What could it be worth?

For the purposes of this analysis, let’s take management’s long-term guidance.

By the end of 2024, management expects to build one more Drive Shack Venue and 50 Puttery Venues.

If management is able to execute this plan, the Entertainment Golf segment will generate $120MM to $180MM of EBITDA by 2024.

Assuming $29MM of EBITDA for Traditional Golf and backing out $12MM of annual corporate costs and the entire company will be generating $137MM to $197MM of EBITDA.

Applying a 12x to 15x EBITDA multiple (Dave and Busters currently trades at 14.0x forward EBITDA) implies an enterprise value of $1.6BN to $3.0BN.

Each Drive Shack Venue costs $32.5MM to construct while each Puttery Venue costs $9MM. In total, the development plan will cost ~$450MM over time, but that capital can be raised during that time.

Drive Shack has a strong balance sheet with $84MM of cash, which will be enough to cover the development of seven Puttery Venues in 2021. The development plans for 2022 (10 Puttery and one Drive Shack Venues) will require $110MM of additional capital. Management has indicated that the majority of this will come through operating cash flow and debt. As Puttery locations are successfully launched, Drive Shack’s borrowing ability should increase.

The company will likely wait until the Puttery concept has been proven out before raising additional capital from equity markets, but let’s assume that Drive Shack raises one-third of total development capital to fund the construction of the 50 Puttery Venues through an equity raise.

The total development will cost $450MM. Backing out the company’s $84MM of cash, that leaves $366MM.

Let’s assume one-third ($122MM) of that is raised through equity markets

Let’s further assume the equity capital is raised at Drive Shack’s current share price ($2.51). This would result in 48.6MM additional shares being issued and shares outstanding increasing from 91.3MM to 139.9MM.

We can assume that the additional capital ($244MM) is raised through debt markets.

Now let’s fast forward to 2024 and assume that Drive Shack is trading at an enterprise value of $1.6BN ($120MM x 12x multiple).

What would the equity value look like in this scenario?

In reality, Drive Shack would not raise that much equity at such a low share price, and so the upside above is understated. Equity will be raised over time as the market recognizes the value of the company’s development plans. Thus, dilution won’t be as drastic as my example.

Of course, management and the company need to execute on their development plan, but today, equity investors are hardly paying anything for that upside potential. In fact, based on my valuation analysis, that upside potential is being valued by the market at -$53MM.

I’m going to start with a 6.00 price target, but over time as the Puttery concept is proven out, there is more upside potential.

My official rating is Buy under 3.00.

As always is the case with micro-caps, use limits as volume is quite low.

Risks

- Poor performance in the Traditional Golf Management business is possible. Anecdotally, I have heard that the traditional golf management is not viewed strongly in the industry. This could increase the risk that management contracts are lost to competitors.

- The Puttery Venues are expected to generate EBITDA Venue level returns of 25%+. There is no guarantee that returns will be this high. Returns on Drive Shack Venues are below management’s original guidance range, and the same dynamic could play out with the Puttery.

- There is a high risk of equity dilution given the development funding needs of the business.

Recommendation Updates

Changes This Week

No changes.

Updates

Aptevo (APVO) continues to be weak on no news. It recently reported earnings and announced that it closed its Ruxience transaction and received $35MM in upfront proceeds. I continue to like the stock. In short, Aptevo’s current enterprise value of $82MM is less than the value of its royalty streams (Aptevo sold its Ruxience royalty stream for $67.5MM in total proceeds, and I estimate its IXINITY royalty stream is worth at least $18MM). This seems overly pessimistic given that Aptevo’s lead compound, APVO436, has generated one complete response and another partial response in difficult to treat AML patients. Further, Tang Capital owns over 40% of the stock and will ultimately be successful in getting a board seat. Ultimately (within a year), I believe Aptevo will be sold to the highest bidder. In the earnings release, Aptevo noted that it will publish data on its lead compound APVO436 later this year. This could serve as a key catalyst. Original Write-up. Buy under 40.

Atento S.A. (ATTO) reported a solid quarter, but the stock has been weak. EBITDA margins were slightly disappointing at 10.5% but it was due to the seasonal impact of Brazilian wage increases. Management maintained full-year guidance of 12.5% to 13.5% for EBITDA margins. A very strong point was that constant currency revenue growth came in at 8%, ahead of mid-single-digit guidance. On the call, management indicated that the quarter was ahead of their expectations. All in all, the investment case remains on track. I see over 100% upside in the stock over the next couple of years. Original Write-up. Buy under 25.00.

BBX Capital (BBXIA) reported earnings this week and results look good. The company is benefitting from a strong demand for single and multi-family housing in Florida. During the quarter, the company sold 128 developed lots to homebuilders at its Beacon Lake Community development in St. Johns County, Florida, and it has now entered into agreements with homebuilders to sell all of the remaining lots in the community. Further, leasing and rent collections at the multifamily apartment communities have returned to, and in some cases exceeded, pre-pandemic levels. The biggest positive in my mind was the company was active in repurchasing its own shares. During the quarter, the company spent $2.1MM of its $10MM authorization buying back 338,897 shares at an average cost of $6.30. Original Write-up Hold Half.

Donnelley Financial Solutions (DFIN) reported a great quarter with 11% revenue growth, significantly ahead of consensus expectations. Non-GAAP EPS of $1.15 beat consensus as well and the stock performed well. However, an analyst downgraded the stock to Hold after the earnings report, and the stock has pulled back sharply. I’m not concerned. Donnelley is executing well and is still too cheap, trading at 7.2x free cash flow and 6.0x forward EBITDA. Original Write-up. Buy under 25.00.

Dorchester Minerals LP (DMLP) announced that its next dividend of $0.30 will be paid on May 13 to shareholders of record on May 3. At an annualized rate, the annual dividend yield is 8.0%. In 2020, the company generated $39.4MM of free cash flow. Given the pandemic, we can view this free cash flow generation as a trough. As such, DMLP is trading at 13.2x trough free cash flow. This is an extraordinarily cheap multiple for such a high-quality royalty business. Original Write-up. Buy under 15.00.

FlexShopper (FPAY) reported another excellent quarter. Revenue increased by 32%, beating the consensus slightly. Adjusted EBITDA increased by 20% to $2.4MM. New originations increased 21.7%, which implies that revenue and earnings growth for 2021 should be very strong. I continue to like FlexShopper. It is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 6.2x 2021 earnings. Importantly, the chairman of FlexShopper owns over 20% of the company and has recently been buying in the open market. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 3.00.

Greystone Logistics (GLGI) is primed to continue to perform well. I recently had a chance to speak to the CEO and learned a bunch of new stuff. Why did I want to speak to the CEO? Because Greystone had recently reported a quarter that looked awful at first blush. Revenue declined in the quarter by 26% while EPS declined by 65% to $0.02. However, the 10-Q revealed that the decline in revenue was primarily due to a timing issue. In March (one month after quarter end), Greystone received an order for $7.8MM. If that quarter had been received in February, revenue would have grown by 13% and earnings would have grown significantly as well. I wanted to get clarity on what was going on. I called the company and within 30 minutes I was on the phone with CEO Warren Kruger. For the next 20 minutes, I asked Kruger a ton of questions about the industry and his business (he owns over 40% of shares outstanding). He was very candid and direct. I think it was the most informative 20-minute conversation that I’ve ever had! I had two big takeaways from the call: 1) The customer that previously decided to diversify away from Greystone for its pallet orders reversed its decision. This is a major positive. 2) The long-term outlook for the company remains bright and Kruger remains highly engaged. The stock is trading at 8.4x current fiscal-year EPS estimates of $0.15 (fiscal year ends in May), which is too cheap given the strong growth. I expect strong EPS growth in 2021 (fiscal 2022). As such, I recently increased my buy limit to 1.30. Greystone Original Write-up. Buy under 1.30.

HopTo Inc (HPTO) continues to lag. The company recently filed its 10-K to disclose Q4 earnings. Revenue increased 6% y/y to $0.8MM. For the full year, revenue grew 3%. While not a blowout quarter, it is a positive nonetheless. Insiders own a significant stake in the company and have an incentive to growth revenue and earnings to increase value. I believe HTPO is worth ~0.80 per share. The stock is currently trading at an EV/EBIT multiple of 6.5x. This is way too cheap. To put it in perspective, the software and Internet industry trades at an average EV/EBIT multiple of over 50x. Original Write-up. Buy under 0.55.

IDT Corporation (IDT) has performed well since reporting strong earnings in March. Consolidated revenue increased by 5%. National Retail Solutions (NRS), BOSS Revolution Money Transfer, and net2phone-UCaaS subscription revenues increased by 151%, 73% and 36%, respectively. In particular, NRS’ growth of 151% was incredibly impressive. NRS deployed 1,300 billable POS terminals during the quarter, increasing its network to 13,700 terminals, and had 3,800 active payment processing merchant accounts at January 31, 2021. IDT believes that the market for NRS’ point of sale terminals is 100,000. On a sum-of-the-parts basis (which I think is the right way to view this name given IDT’s propensity to sell and spin off its assets), the stock is worth 34. Original Write-up. Buy under 23.50.

Liberated Syndication announced recently that it will be making another acquisition. This time, it will buy Glow, a podcast monetization platform. Financial terms of the transaction were not disclosed. The more interesting acquisition was announced a few weeks ago when Libsyn revealed that it will acquire AdvertiseCast, an independent podcast advertising company. The combination of Libsyn’s 75,000 podcasts with AdvertiseCast’s advertising capabilities should result in accelerating revenue growth going forward. Last year, AdvertiseCast grew revenue 45% to $12MM and has scaled profitably since launching in 2016 with no outside investment. Under the terms of the transaction, Libsyn will pay $30MM ($18MM in cash, $10MM in newly issued Libsyn shares, and $2MM in earnouts). Libsyn will issue $25MM of stock to pay for the deal in a PIPE transaction which will be led by Camac Partners. The transaction is expected to close in Q2 2020. The acquisition looks like a steal. Libsyn is paying 2.5x revenue for a podcast advertising business that is growing 45% per year and profitable. With the acquisition, podcast revenue growth will increase from 11.1% to 26.2%. Total company growth increases from 5.0% to 17.5%. Original Write-up. Buy under 5.00.

MamaMancini’s Holdings (MMMB) recently reported earnings and the stock popped. While revenue in the quarter only increased by 1.4%, net income increased 500% to $0.05 as the company continues to leverage its fixed cost base. For the full year, MamaManchini’s generated EPS of $0.12 (+200% y/y) on revenue growth of 20.8%. Growth in 2021 (fiscal 2022) should continue driven by continued penetration of the company’s products in grocery stores nationwide as well as by bolt-on acquisitions. My 12-month price target is 3.80, which is driven by an estimated price-to-earnings multiple of 20x on expected fiscal 2021 earnings of $0.19. Original Write-up. Buy under 2.50.

Medexus Pharma (MEDXF) has been a little weak, but it remains our highest conviction idea. I expect Medexus to announce that it will be uplisted to the Nasdaq very soon and this could be a nice catalyst to see the stock continue its upward march. Medexus remains my highest conviction idea and largest personal holding. Management believes its current drug portfolio (including recently licensed Treosulfan) has peak sales potential of $350MM to $400MM CAD. Assuming the company can trade at 3x this revenue estimate (the company will execute additional licensing deals so I expect revenue to ultimately grow even higher) in line with slower-growing peers, MEDXF would trade at ~24 per share, implying significant upside from here. Original Write-up. Buy under 8.00.

NamSys Inc. (NMYSF) recently reported positive full-year results. In the fiscal year, revenue increased 15% to $4.7MM. Free cash flow increased 34% to $1.9MM. Namsys is attractively valued, trading at 15.3x free cash flow. The biggest news remains that the company recently announced that it has terminated its long-term incentive plan. The plan was originally put in place in the mid-2010s to incentivize the team to help transition NamSys’ software from on-premise to a cloud-based offering. However, the long-term incentive plan had no limit as participants in the bonus plan are entitled to 15% of the value of the company, no matter how high it’s valued. The payout for the termination of the bonus plan will be made in cash and stock. This is a major positive as it will increase the company’s earnings growth rate going forward. Further, it’s possible that this announcement could be a prelude to a sale of the company. Despite historically growing revenue and earnings at a compound annual growth rate of 20%+, the stock only trades at 15.9x free cash flow. It has a pristine balance sheet with significant cash and no debt, and insiders own more than 40% of the company, ensuring strong alignment. Original Write-up. Buy under 0.80.

P10 Holdings recently filed its 10-K and issued its annual letter to shareholders. It is always a great read and quick (only three pages). In the letter, Co-CEOs Robert Alpert and Clark Webb lay out high level guidance for P10 Holdings financial outlook. The business currently has $12.7 billion in assets under management and charges ~1.00% on average for its management fee. The business should generate 55% to 60% EBITDA margins. Taxes and interest payments currently amount to $18.4MM per year. After doing the basic algebra (assuming a 55% EBITDA margin), I determined that the business is currently on track to generate ~$70MM of EBITDA and $51MM of free cash flow. As such, it’s trading at 15.7x EBITDA and 12.2x free cash flow. This isn’t dirt cheap, but it is very reasonable for such a well-positioned company with organic growth and additional acquisition opportunities. Its closest (albeit larger) peer is Hamilton Lane (HLNE) which trades at 31.9x EBITDA and 21.3x free cash flow. My official rating is Hold Half, but I may eventually switch my rating back to Buy given how well the business is positioned. Original Write-up. Hold Half.

U.S. Neurological Holdings (USNU) recently filed its 10-K to report Q4 earnings. In the quarter, revenue grew 55% due to a strong snapback of demand. For the full year, revenue grew 3%, which is impressive given the pandemic. In 2020, the company generated EPS of $0.07. As such, it is trading at a P/E of 5.5x. It also has $2.0MM ($0.26 per share) of cash on its balance sheet and no debt. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and it holds interests in radiological treatment facilities. Original Write-up. Buy under 0.25.

Watch List

FitLife Brands (FTLF) sells nutritional products for health-conscious consumers. I continue to watch this name and mentioned on my recent micro-cap webinar. In the most recent quarter, revenue increased 61%! Yet it only trades at 5x earnings. The one area of concern is that 75% of sales go to GNC, which recently declared bankruptcy. Nonetheless, FitLife’s resilience in 2020 has been amazing.

Meridian Corp (MRBK) is a Pennsylvania-based commercial bank that has performed very well. It has benefitted from refinancing activity and will see earnings decline in 2021. However, the stock trades at just 6x earnings and has consistently generated a positive ROE. Financials are looking increasingly attractive in a world with rising interest rates, especially given cheap valuations.

Truxton Corp (TRUX) is a Nashville-based private bank and trust business. It recently announced it is paying a $2 special dividend and initiating a $5MM share repurchase authorization. The company has grown very nicely yet only trades at a P/E of 12.5x.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 5/11/21 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 21.85 | -32% | Buy under 40.00 |

| Atento SA (ATTO) | 22.35 | 4/14/21 | 20.15 | -10% | Buy under 25.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 6.37 | 101% | Hold Half |

| Donnelley Financial Solutions (DFIN) | 14.54 | 11/11/20 | 26.29 | 81% | Buy under 25.00 |

| Dorchester Minerals LP (DMLP) | 10.45 | 10/14/20 | 14.91 | 46% | Buy under 15.00 |

| Drive Shack (DS) | New | — | 2.61 | — | Buy under 3.00 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 2.36 | 11% | Buy under 3.00 |

| Greystone Logistics (GLGI) | 0.81 | 7/8/20 | 1.20 | 48% | Buy under 1.30 |

| hopTo Inc (HPTO) | 0.39 | 4/28/20 | 0.42 | 8% | Buy under 0.55 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 24.66 | 27% | Buy Under 23.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 4.65 | 52% | Buy under 5.00 |

| MamaMancini’s Holding (MMMB) | 1.76 | 8/12/20 | 2.56 | 45% | Buy under 2.50 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 5.92 | 233% | Buy under 8.00 |

| NamSys Inc (NMYSF) | 0.65 | 9/9/20 | 0.88 | 35% | Buy under 0.80 |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 7.00 | 254% | Hold Half |

| U.S. Neurological Holdings (USNU) | 0.14 | 4/28/20 | 0.40 | 186% | Buy under 0.25 |

*Includes dividends received.

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, HPTO, PIOE, MEDXF, LSYN, GLGI, IDT, and FPAY. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on June 9, 2021.

Cabot Wealth Network

Publishing independent investment advice since 1970.

President & CEO: Ed Coburn

Chief Investment Strategist: Timothy Lutts

Cabot Heritage Corporation, doing business as Cabot Wealth Network

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2021. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Performance: Subscribers should apply loss limits based on their own personal purchase prices.

Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.