Today, we are recommending an energy company that is both a traditional energy company but also a transition play.

The company is up over 250% in the past year, but still looks cheap on forward numbers.

Some additional details:

- Historically, the company has grown revenue at a 26% CAGR yet trades at a cheap valuation.

- Inside ownership is high and insiders have been buying as many shares as possible in the open market.

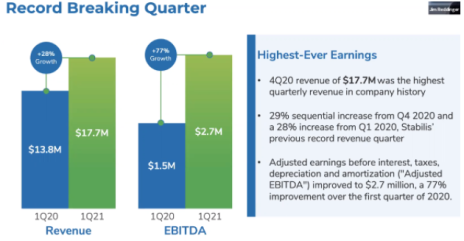

- Revenue and EBITDA are already at record levels.

- My price target implies 100% upside.

All the details are inside this month’s Issue. Enjoy

Cabot Micro-Cap Insider 621

[premium_html_toc post_id="231925"]

“Nothing is Cheap Anymore”

Every Friday, a bunch of families in my neighborhood gather at a local park to have pizza, drink some beer, and let our kids run around.

It’s a great way to unwind after the week, and the kids usually sleep well on Friday night.

My favorite person to chat with on Friday night is my friend Rick, whose daughter is good friends with my five-year-old.

Rick is a portfolio manager at Fidelity, and so it’s always fun to talk stocks.

This week Rick told me, “Nothing is cheap anymore.”

At first blush, Rick’s comment makes a lot of sense.

The market is up 32% in the past year and is within spitting distance of an all-time high.

The S&P 500 is trading at 21x forward earnings. Not bubble territory, but by no means cheap.

However, there are still plenty of opportunities.

But my response to Rick wouldn’t surprise you.

“You have to look at micro-caps!”

Even though the market has had an impressive run since the depths of the pandemic, there are still plenty of opportunities, especially in cyclical/value type names.

I know I’ve pounded the table on Dorchester Minerals (DMLP), but I will do so once more.

It’s a company with an excellent business model (energy royalties and profit shares). It currently sports a 7.9% dividend yield and is trading below its pre-pandemic level despite almost $70/bbl oil.

Another good example is the stock that I’m recommending today: Stabilis Solutions (SLNG).

The stock is up 250% in the past year, but that doesn’t mean it’s expensive. On forward numbers it actually looks quite cheap.

New Recommendation

Stabilis Solutions: Energy Transition at a Value Price

Company: Stabilis Solutions

Ticker: SLNG

Price: 7.52

Market Cap: $127 million

Enterprise Value: $131 million

Price Target: 16.00

Upside: 145%

Recommendation: Buy Under 9.00

Recommendation Type: Rocket

Executive Summary

Stabilis Solutions (SLNG) specializes in delivering liquid natural gas (LNG) and hydrogen to its customers who are away from pipelines and off the energy grid. Customers use Stabilis Solutions as it provides them with cheap, reliable energy that is cleaner than other fossil fuels. The company has grown revenue at a 27% CAGR and has a bright outlook. Insiders own over 50% of the company but have been relentlessly buying more stock in the open market. The stock has performed well since the pandemic but looks like a double over the next 12 months.

Drive Shack Overview

Background

Stabilis Solutions was founded in 2013 and was a private company until 2019 when it went public through a reverse merger with a public company called American Electric Technologies (AETI).

The company was founded by Casey Crenshaw, and he currently owns (he’s been buying aggressively in the open market) 12.9MM shares or 76% of total shares outstanding.

How does Stabilis Make Money?

Stabilis Solutions is paid to transport liquid natural gas (LNG) and hydrogen to remote areas to support industrial activity.

Natural gas is abundant in North America and is used for utility, industrial, residential, commercial and transportation applications. Natural gas is primarily transported via pipeline where there is sufficient infrastructure.

To reach remote areas, natural gas is liquefied (LNG), stored and transported to end users via truck or marine vessel.

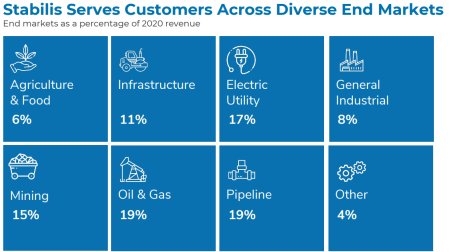

This is where Stabilis Solutions comes in. They specialize in producing, storing and delivering liquid natural gas to a variety of end markets.

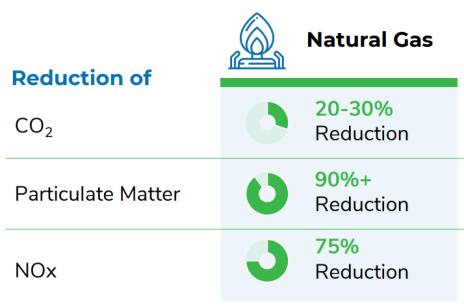

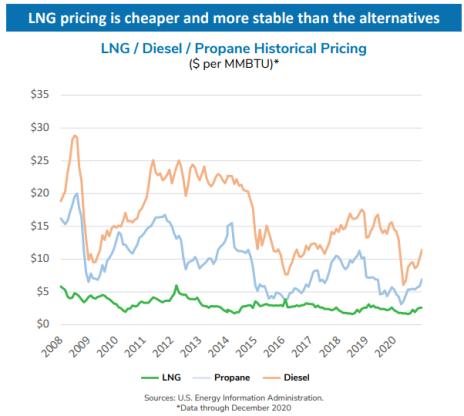

LNG is attractive for a two primary reasons: 1) it is more environmentally friendly than other fossil fuels, and 2) its price is lower and more stable than Propane and Diesel.

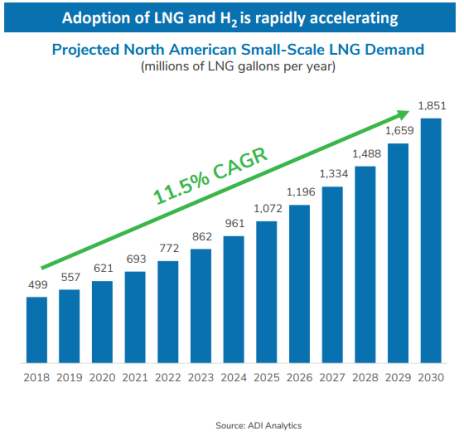

As a result, LNG consumption has grown significantly and is expected to continue to grow.

Business Outlook

In 2020, Stabilis experienced a hiccup in demand for its solutions given economic activity ground to a halt in the middle of the year.

As a result, 2020 revenue declined by 12%.

Nonetheless, revenue in the recently reported Q1 2021 is already back to an all-time high.

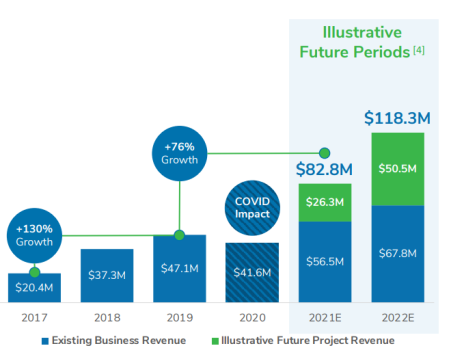

Management estimates that the business can grow organically 20% in 2021 and 2022. However, management has a full pipeline of other business opportunities that it is hoping to execute on which will drive even higher growth.

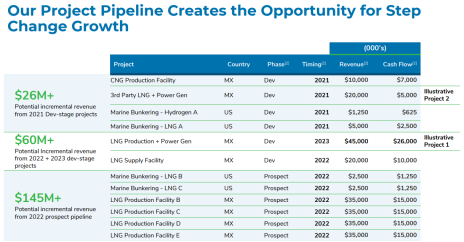

In its recent presentation, the company outlines its pipeline of new business opportunities.

Illustrative project 1 (providing LNG for a mine in Mexico for 10 years) would require a $90MM investment but would generate 2.9x cash on cash return.

Illustrative project 2 would not require any additional capital expenses but generate $5MM of additional EBITDA at a 25% margin.

Given strong historic growth, secular tailwinds for the LNG business, and a full pipeline, I expect revenue and EBITDA growth to be quite strong in 2021 and 2022.

High Insider Ownership

Significant insider ownership is the most important factor that I consider with micro-caps.

With Stabilis Solutions, we are incredibly well aligned as Casey Crenshaw, the founder and Chairman of the company owns 76% of shares outstanding.

He owns so many shares that liquidity is very low for the company.

One concern that I’ve thought about is the risk that Crenshaw tries to squeeze out minority shareholders by tendering to buy shares below fair market value but maybe at a premium to where the stock is trading at the time.

While this could be a risk, it doesn’t appear that Crenshaw has a negative reputation in the market (based on my diligence). Further, I don’t know why Crenshaw would buy shares in the open market if he planned to just squeeze out minority shareholders.

Finally, the company is likely going to raise equity to fund future projects, and Crenshaw will need to have a good reputation in the market to succeed with those capital raises.

Valuation and Price Target

In Q1 2021, Stabilis generated revenue of $17.7MM and EBITDA of $2.7MM (15.3% margin).

On an annualized basis, the company is generating $10.8MM of EBITDA.

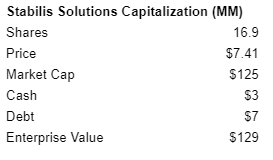

It has a current enterprise value of $129MM.

Thus, it’s currently trading at an EV/EBITDA multiple of 12x.

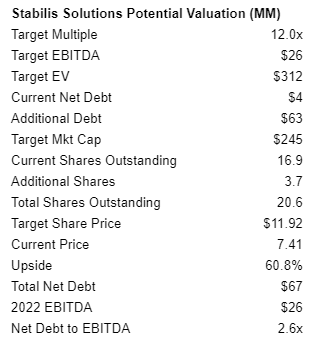

If management’s projections are right, the company will generate $118MM of revenue by 2020. Assuming a 22% EBITDA margin (given significant operating leverage in the model), the company will generate $26MM of EBITDA.

In order to hit these revenue and EBITDA targets, the company will have to raise equity and debt to fund new projects.

I estimate that the company will raise $90MM of new capital (70% debt, 30% equity). Assuming the company continues to trade at a 12x EV/EBITDA multiple, the stock price will hit 12.

I believe a 15x multiple is more appropriate given strong secular tailwinds and growth potential. In this scenario, the stock is worth $16.

My official rating is Buy under 9.00.

As always is the case with micro caps, use limits as volume is quite low.

Risks

- Economic weakness. Stabilis’ business declined during COVID and would again if we entered a recession. I’m not worried about this given it we are in the early innings of a cyclical recovery.

- The company has no debt but will likely raise some to fund new projects. Nonetheless, I believe the company will raise responsible debt levels given Casey Crenshaw owns so much of the equity and would not want to risk his stake.

- Stabilis’ business appears extremely attractive and may attract fierce competition. This is a risk that I’m going to explore more with the company.

Recommendation Updates

Changes This Week

Increase limit on IDT to Buy under 33.00

Updates

Aptevo (APVO) has stabilized over the past couple of weeks. The company will host its annual meeting June 25, 2021, and the most interesting question on the ballot is “vote upon a non-binding stockholder proposal regarding the commencement of a sale process to sell Aptevo if presented at the 2021 Annual Meeting.” I submitted my vote and voted FOR the sales process. Considering Tang Capital controls ~40% of shares outstanding, I think it’s likely that this question gets approved. Given strong asset value (through royalty value), Aptevo’s current market valuation reflects minimal value for its pipeline. This seems overly pessimistic given that Aptevo’s lead compound, APVO436, has generated 1 complete response and another partial response in difficult to treat AML patients. In the earnings release, Aptevo noted that it will publish data on its lead compound APVO436 later this year. This could serve as a key catalyst. Original Write-up. Buy under 40

Atento S.A. (ATTO), had no news this week. The company reported a solid quarter in May, but the stock has been relatively weak. EBITDA margins were slightly disappointing at 10.5% but it was due to the seasonal impact of Brazilian wage increases. Management maintained full-year guidance of 12.5% to 13.5% for EBITDA margins. A very strong point was that constant currency revenue growth came in at 8%, ahead of mid-single-digit guidance. On the call, management indicated that the quarter was ahead of their expectations. All in all, the investment case remains on track. I see over 100% upside in the stock over the next couple of years. Original Write-up. Buy under 25.00

BBX Capital (BBXIA) had no news this week regarding its BBX Capital’s tender offer to repurchase up to 21% of its shares in the open market. The share price has risen above the previously announced buyback price ($6.75). I could see a couple different scenarios playing out:

- BBX Capital raises its buyback price

- BBX Capital keeps their buyback price at 6.75 and few shares get tendered

- BBX Capital keeps their buyback price at 6.75 and the stock falls and a decent amount of shares get tendered

The transaction makes all the sense in the world as the company is buying back its stock at a massive discount to book value. Today, the book value per share is $16.00, and the stock is trading at a price to book value ratio of 0.42x. If successful with its tender offer, the company will spend $27MM to retire 4MM shares, increasing the book value per share from $16.00 to $18.41. Original Write-up. Buy with a limit of 6.75

Donnelley Financial Solutions (DFIN) recently reported a great quarter with 11% revenue growth, significantly ahead of consensus expectations. Non-GAAP EPS of $1.15 beat consensus as well and the stock performed well. The stock pulled back after an analyst downgraded it to Hold, but the stock has rebounded sharply. Donnelly is executing well and is still too cheap, trading at 8.8x free cash flow and 7.3x forward EBITDA. Original Write-up. Buy under 25.00

Dorchester Minerals LP (DMLP) recently paid a $0.30 quarterly dividend. At an annualized rate, the annual dividend yield is 7.9%. In 2020, the company generated $39.4MM of free cash flow. Given the pandemic, we can view this free cash flow generation as a trough. As such, DMLP is trading at 13.5x trough free cash flow. This is an extraordinarily cheap multiple for such a high-quality royalty business. Given oil prices are back to pre-pandemic levels but the stock remains depressed, I think the stock looks compelling. Original Write-up. Buy under 17.50

Drive Shack (DS) is my newest recommendation. Its traditional and entertainment golf businesses are set to boom in 2021. Given substantial recent cost cuts, operating leverage should drive earnings growth in 2021 and beyond. Longer term, growth will be driven by new Puttery Venues which have high potential. At its current valuation, Drive Shack’s share price gives minimal value to the strong upside potential from new Puttery Venues. Finally, alignment is high as management and directors own 16.3% of shares outstanding and have recently bought in the open market. I recently spoke to investor relations at the company and the conversation increased my conviction levels. As such, I’m increasing my buy limit to 3.50. Original Write-up. Buy under 3.50

FlexShopper (FPAY) disclosed that there was more insider buying. The Chairman and a director both bought the stock in the open market. This gives me strong confidence that strong results should continue. Recently, the company reported another excellent quarter. Revenue increased by 32.0%, beating consensus slightly. Adjusted EBITDA increased by 20% to $2.4MM. New originations increased 21.7%, which implies that revenue and earnings growth for 2021 should be very strong. I continue to like FlexShopper. It is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 8.2x 2021 earnings. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 3.00

Greystone Logistics (GLGI) is primed to continue to perform well. I recently had a chance to speak to the CEO and learned a bunch of new stuff. Why did I want to speak to the CEO? Greystone had recently reported a quarter that looked awful at first blush. Revenue declined in the quarter by 26% while EPS declined by 65% to $0.02. However, the 10-Q revealed that the decline in revenue was primarily due to a timing issue. In March (one month after quarter end), Greystone received an order for $7.8MM. If that quarter had been received in February, revenue would have grown by 13% and earnings would have grown significantly as well. I wanted to get clarity on what was going on. I called the company and within 30 minutes, I was on the phone with CEO Warren Kruger. For the next 20 minutes, I asked Kruger a ton of questions about the industry and his business (he owns over 40% of shares outstanding). He was very candid and direct. I think it was the most informative 20-minute conversation that I’ve ever had! I had two big takeaways from the call: 1) The customer that previously decided to diversify away from Greystone for its pallet orders reverse its decision. This is a major positive. 2) The long-term outlook for the company remains bright, and Kruger remains highly engaged. The stock is trading at 8.4x current fiscal-year EPS estimate of $0.15 (fiscal year ends in May) which is too cheap given strong growth. I expect strong EPS growth in 2021 (fiscal 2022). As such, I recently increased my buy limit to 1.30. Greystone Original Write-up. Buy under 1.30

HopTo Inc (HPTO) recently filed its 10-Q to disclose Q1 earnings. Disclosure was limited but revenue grew slightly in the first quarter. The company also disclosed that it sold some patents for $269.8K. The company didn’t disclose how many patents were sold, but it’s good to see that the company was able to monetize at least a portion of its patent portfolio. All in all, the investment remains on track. Insiders own a significant stake in the company and have an incentive to grow revenue and earnings to increase value. I believe HPTO is worth ~0.80 per share. The stock is currently trading at an EV/EBIT multiple of 3.6x. This is way too cheap. To put it in perspective, the software and Internet industry trades at an average EV/EBIT multiple of over 50x. Original Write-up. Buy under 0.55

IDT Corporation (IDT) reported another strong quarter, and the stock has skyrocketed. Consolidated revenue increased 16% to $374MM. National Retail Solutions (NRS) and net2phone-UCaaS subscription revenues increased by 123% and 39%, respectively. BOSS Revolution Money Transfer (IDT’s other fintech asset) experienced a revenue decline of 13% but increased by 63% when excluding the impact of FX market conditions that positively impacted revenue. The biggest surprise in the quarter was the traditional communications business which grew by 16%. This is a business that I had viewed as in secular decline. The big increase was driven by Mobile Top-Up sales growth of 56%. I’m going to talk to the company to understand if this sales growth is sustainable. Given the strong growth, I revisited my sum-of-the-parts valuation analysis and believe fair value is 43. As such, I’m increasing by my buy limit to 33. Original Write-up. Buy under 33.00

Liberated Syndication (LSYN) recently announced that it closed its AdvertiseCast acquisition. This is a major positive, and I look forward to when the company can disclose more about it. Currently, disclosure is limited given Libsyn is in the process of restating its financials as it previously mis-accounted for state sales taxes (I view this restatement to be immaterial). I continue to have conviction in the stock. Original Write-up. Buy under 5.00

MamaMancini’s Holding (MMMB) recently reported earnings and the stock popped. While revenue in the quarter only increased by 1.4%, net income increased 500% to $0.05 as the company continues to leverage its fixed cost base. For the full year, MamaMancini’s generated EPS of $0.12 (+200% y/y) on revenue growth of 20.8%. Growth in 2021 (fiscal 2022) should continue to be driven by continued penetration of the company’s products in grocery stores nationwide as well as by bolt on acquisitions. My 12-month price target is 3.80, which is driven by an estimated price to earnings multiple of 20x on expected fiscal 2021 earnings of $0.19. Original Write-up. Buy under 2.50

Medexus Pharma (MEDXF) has been a little weak, but it remains our highest-conviction idea. I expect Medexus to announce that it will be uplisted to the NASDAQ very soon and this could be a nice catalyst to see the stock continue its upward march. Management believes its current drug portfolio (including recently licensed Treosulfan) has peak sales potential of $350MM to $400MM CAD. Assuming the company can trade at 3x this revenue estimate (the company will execute additional licensing deals so I expect revenue to ultimately grow even higher) in line with slower-growing peers, MEDXF would trade at ~24 per share, implying significant upside from here. Original Write-up. Buy under 8.00

NamSys Inc. (NMYSF) recently released Q1 ’21 results. Revenue grew 9% which was solid, but a slight deceleration from last year’s growth. The Canadian dollar was strong relative to the USD and, as a result was, a headwind for the company in the first quarter. Otherwise, macro trends remain supportive of continued strong growth in 2021 and beyond. The stock continues to look attractive trading at only 15.9x free cash flow. It has a pristine balance sheet with significant cash and no debt, and insiders own more than 40% of the company, ensuring strong alignment. Original Write-up. Buy under 0.80

P10 Holdings (PIOE) recently released its Q1 ’21 letter and everything looks great. A couple highlights. Assets under management are expected to increase by 30% this year. This will drive revenue, earnings and cash flow high in 2021. The company has a full pipeline of M&A opportunities. Insiders own 73% of shares outstanding. If we assume the company can achieve $16.0BN in assets under management by the end of the year (its goal), it is trading at 10.0x free cash flow and 13x EBITDA. Very reasonable considering its closest (albeit larger) peer is Hamilton Lane (HLNE) which trades at 31.9x EBITDA and 21.3x free cash flow. My official rating is Hold Half, but I may eventually switch my rating back to Buy given how well the business is positioned. Original Write-up. Hold Half

Watch List

Epsilon Energy (EPSN) is a name that just popped up on my cheap/no debt energy screen. I need to dig deeper, but the company looks like it’s trading at roughly 5x annualized free cash flow and has no debt. More work to do, but it looks interesting. Also, insiders have been buying.

FitLife Brands (FTLF) sells nutritional products for health-conscious consumers. I continue to watch this name and mentioned it on my recent micro-cap webinar. In the most recent quarter, revenue increased 61%! Yet it only trades at 5x earnings. The one area of concern is that 75% of sales go to GNC, which recently declared bankruptcy. Nonetheless, FitLife’s resilience in 2020 has been amazing.

Gatekeeper Systems (GKPRF) is a Canadian hardware and software company that provides solutions and services for public transportation and school buses. The business is lumpy but is on an upward trajectory and will likely improve margins considerably over the next 3 years. Valuation looks reasonable.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 6/8/21 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 26.64 | -17% | Buy under 40.00 |

| Atento SA (ATTO) | 22.35 | 4/14/21 | 21.05 | -6% | Buy under 25.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 7.20 | 127% | Buy under 6.75 |

| Donnelley Financial Solutions (DFIN) | 14.54 | 11/11/20 | 31.92 | 120% | Buy under 25.00 |

| Dorchester Minerals LP (DMLP) | 10.45 | 10/14/20 | 15.37 | 50% | Buy under 17.50 |

| Drive Shack (DS) | 2.58 | 5/12/21 | 3.54 | 50% | Buy under 3.50 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 2.85 | 34% | Buy under 3.00 |

| Greystone Logistics (GLGI) | 0.81 | 7/8/20 | 1.30 | 60% | Buy under 1.30 |

| hopTo Inc (HPTO) | 0.39 | 4/28/20 | 0.44 | 13% | Buy under 0.55 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 39.91 | 106% | Buy Under 33.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 4.40 | 44% | Buy under 5.00 |

| MamaMancini’s Holding (MMMB) | 1.76 | 8/12/20 | 2.72 | 55% | Buy under 2.50 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 6.28 | 253% | Buy under 8.00 |

| NamSys Inc (NMYSF) | 0.65 | 9/9/20 | 0.88 | 35% | Buy under 0.80 |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 7.25 | 266% | Hold Half |

| Stabilis Solutions (SLNG) | New | — | 7.25 | — | Buy under 9.00 |

*Includes 0.75 distribution and 1.35 distribution.

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, HPTO, PIOE, MEDXF, LSYN, GLGI, IDT, and FPAY. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on July 14, 2021.

Cabot Wealth Network

Publishing independent investment advice since 1970.

President & CEO: Ed Coburn

Chief Investment Strategist: Timothy Lutts

Cabot Heritage Corporation, doing business as Cabot Wealth Network

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2021. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Performance: Subscribers should apply loss limits based on their own personal purchase prices.

Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.