Before we get into this recommendation, I just wanted to highlight our upcoming annual conference.

9th Annual Smarter Investing, Greater Profits Online Conference

It will take place from August 17-19 and you will hear from many experts (including me!) about opportunities in the market.

Today, we are recommending a stock with hidden value.

Some additional details:

- Its healthcare analytics division has grown at a 30%+CAGR and has a huge market opportunity in the years ahead.

- A slower growing competitor just got acquired at a premium valuation.

- My price target implies 70% upside within 12 months, but longer term this could be a multi-bagger.

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider 721

[premium_html_toc post_id="233662"]

Growth at a Value Price

If you’ve been a subscriber for a while, you’ve heard me say it before.

I love micro-caps because you can buy growth stocks at value prices.

In large-cap land, you can buy growth stocks for growth (expensive) prices and value stocks for value (cheap) prices.

That doesn’t mean you can’t make money with large cap stocks. Just look at Shopify (SHOP).

It’s 5-year median EV/sales multiple is 20x, a valuation that I consider to be very expensive.

But the stock is up 4,600% over that timeframe!

If I could find the next Shopify, I would invest it in.

But that’s not a game I can consistently win.

After all, there are thousands of smart, highly compensated analysts looking to identify the next Shopify.

I prefer to play a game where the odds are stacked in my favor: Micro-caps.

In micro-cap land, there is less competition because micro-caps are too small for institutions to own.

Therein lies the opportunity because you can invest in tiny fast-growing companies that will become the small caps, mid caps, and eventual large caps of tomorrow.

When investing in micro-caps, you don’t have to decide between growth and value.

You can have both!

I want to highlight three examples (All CMCI recommendations)

First, consider Liberated Syndication (LSYN). When I first heard about Libsyn it was trading at $0.25 and had generated EPS of $0.14 in the prior year. See a screen shot from its S-1.

This is a podcast hosting company with 37% revenue growth trading at a P/E of 1.8x.

Next consider, P10 Holdings (PIOE), a diversified private equity holding company.

When we first recommend P10, it was trading 11x trailing earnings, despite 24% revenue growth. The stock still looks cheap given strong revenue and free cash flow in 2020.

Finally, consider Medexus (MEDXF). When we first recommended Medexus, it was trading at 0.8x revenue despite 119% revenue growth.

This week, we have another “growth stock at a value price” micro-cap recommendation: Performant Financial (PFMT).

Before we get to Performant, I wanted to note one change this week. I’m switching Namsys (NMYSF) to sell in order to make room for my new recommendation. I still like the stock, but I don’t have as much conviction in it as I do in my other recommendations.

New Recommendation

Performant Financial: Hidden Value

Company: Performant Financial

Ticker: PFMT

Price: 4.66

Market Cap: $305 million

Enterprise Value: $345 million

Price Target: 7.50

Upside: 61%

Recommendation: Buy Under 5.00

Recommendation Type: Rocket

Executive Summary

Performant Financial (PFMT) has a fast-growing healthcare business which is being obscured by its declining legacy student loan recovery business. The healthcare business is poised to grow 30%+ for the foreseeable future. Despite its fast growth, the company is trading at a big discount to a competitor which was recently acquired. My price target implies ~61% upside, but longer term, this could be a multi-bagger.

Performant Financial Overview

Background

Historically, Performant’s core business was working with government agencies and a few commercial clients for recovery of federal and state taxes, private and public receivables, and delinquent and defaulted student loans. Regulation has essentially killed this business. Most notably, the passage of the Student Aid and Fiscal Responsibility Act has caused private student lending to dry up.

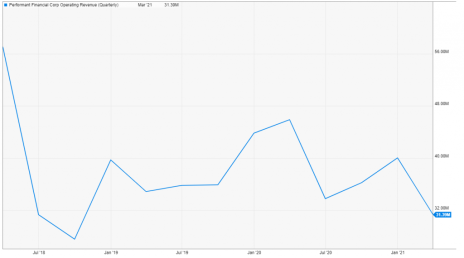

As a result, Performant’s revenue trends look shaky at first blush:

However, if you look under the hood, you will notice a rapidly growing healthcare business.

Performant recently sold the legacy business and will be 100% focused on the healthcare market going forward.

Healthcare Business

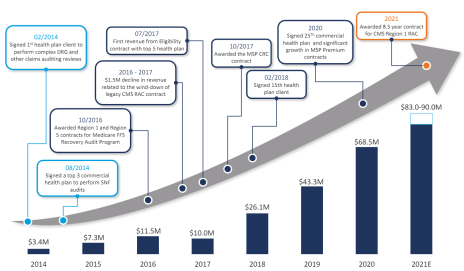

Over the past six years, Performant’s healthcare business has grown rapidly and appears poised for further growth.

How does Performant Healthcare Make Money?

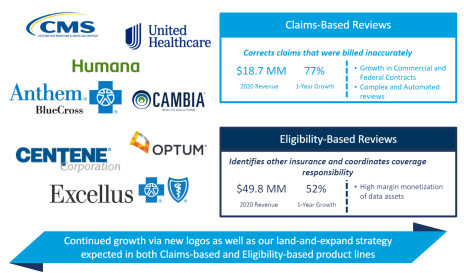

Performant generates revenue in the Payment Integrity industry. It generates revenue by correcting claims that were billed inaccurately (claims-based reviews) and revenue from determining which insurer is responsible for covering claims from an insured event (eligibility-based reviews).

Claims-based reviews are fairly straight forward. Performant reviews claims that have been paid (by the U.S. government and commercial insurers) to determine if any errors were made. If an error was made, Performant identifies it and gets to keep a portion of the savings (10% to 50% depending on the situation).

For eligibility-based reviews, Performant reviews claims to determine if the appropriate insurer paid the claim.

To give an example, let’s assume someone is in a car accident that was no fault of their own and Medicare pays a claim related to an injury which was suffered during the accident. Performant will review that claim to determine if another insurer is responsible for the claim. For instance, perhaps the other party in the accident is at fault and their insurance is responsible for the claim. In this case, Performant would identify the responsible insurer and share in the savings.

Business Outlook

As shown in the chart above, revenue has been growing at an incredible clip, and I expect it to continue going forward. Importantly, all of last year’s 58% revenue growth was organic.

In 2021, management expects 26% growth. The reason for the deceleration is many insurers last year were not focused on onboarding new venders. They were just focused on managing their business in a time of huge uncertainty. However, revenue should accelerate in 2022 and beyond.

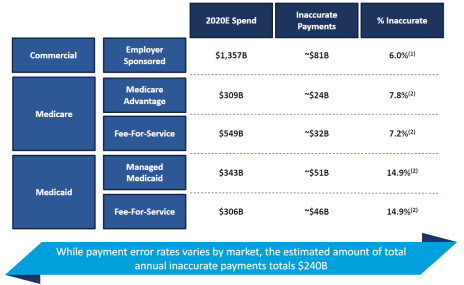

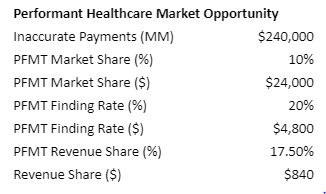

Performant has an enormous market opportunity. It estimates that there are $240BN of inaccurate payments per year in the United States.

Assuming that Performant is able to ultimately take a 10% share of this market, it should translate into a $840MM market opportunity within the next 5 to 10 years.

As such, I expect the company to continue to grow at a rapid rate for the foreseeable future.

Valuation and Price Target

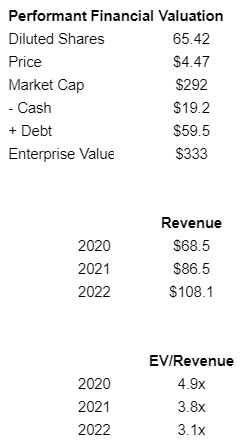

In Q1 2021, the company generated $4MM of free cash flow or $16MM on an annualized basis.

On a price to free cash flow basis, Performant is trading at 18x. This seems too cheap for a company with such strong growth potential.

On an EV/ 2021 revenue basis, it is trading at 3.8x. Recently, HMS, a competitor to Performant, was acquired at an EV/revenue multiple of 5.0x.

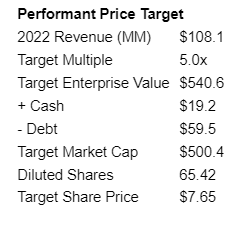

As such, I believe a 5x target multiple is reasonable/conservative given that Performant is growing much faster than HMS.

Assuming Performant will trade at 5x 2022 revenue of $108MM (estimated 25% revenue growth in ’22 could be conservative), the stock will trade at ~$7.50.

My official rating is Buy under 5.00.

As always is the case with micro caps, use limits as volume is quite low.

Risks

- I expect the stock to be volatile. There have been several write-ups on Twitter and I wouldn’t be surprised if the stock pulled back eventually, forcing out weak hands.

- Performant is subject to regulatory risk. Regulatory change killed its student loan recovery business. Given that Performant is focused on reducing waste and fraud in the medical system, I do not believe regulatory risk is high. Nonetheless, it’s one to be aware of.

- Usually, I want insider buying in stocks that I’m recommending. In this case insiders are selling. In particular, a private equity fund name Parthenon is selling its stake in the business. While I don’t know exactly why Parthenon is selling, it has owned the business for 16 years and my best guess is its fund has reached the end of its life and capital must be returned to limited partners.

- Customer concentration. 53% of revenue comes from 3 clients. However, customer concentration should dissipate as Performant continues to grow.

Recommendation Updates

Changes This Week

Change NMYSF to Sell (making room for new recommendation)

Updates

Aptevo (APVO) filed an 8-K recently disclosing that Proposal 4 (Company Sale) passed. However, the company made a special point in the footnote that the majority of non-Tang shareholders voted against the immediate sale. As such, it looks like management might believe it can proceed without an immediate sale process. I’m not a fiduciary expert, but I would think the Board of Directors would open themselves up to all sorts of lawsuits if they ignore this shareholder vote (even though it’s non-binding) unless they are extremely confident they can ultimately sell at a higher price later. Where does it leave us? Aptevo had an enterprise value of $50MM. It will receive another $32.5MM in milestone payments from its RUXIENCE sale. Further, I believe its IXINITY royalty payments could be sold for ~$20MM (assuming 10% discount rate). Thus, Aptevo’s pipeline is being valued by the market at -$2MM. This seems too low given the promising results that APVO436 has shown in difficult to treat AML patients. Besides APVO436, Aptevo has a pipeline of other interesting assets. I don’t know how it will play out, but I continue to believe APVO represents a good risk/reward opportunity with potential asymmetric upside. Original Write-up. Buy under 40.00

Atento S.A. (ATTO), had no news this week. The company reported a solid quarter in May. It sold off after earnings but has started to perk up lately. One thing should benefit Atento this year is the strength of the Brazilian Real (Brazil represents 40% of revenue) although it has started to lose a little steam vs. the USD. I expect a strong end to 2021 and believe the investment case is on track. I see over 100% upside in the stock over the next couple of years. Original Write-up. Buy under 25.00

BBX Capital (BBXIA) recently announced preliminary results from its tender offer to buy back shares at $8.00. BBX Capital had offered to buy back 3.5MM shares, but only 1,420,481 shares were tendered. Many shareholders (like me) preferred to retain their shares given that the stock still trades at a steep discount to book value. In total per the transaction, shares outstanding decreased by 7.6% and I estimate book value per share increased from 16.40 to 17.09. The stock still looks very attractive trading at 0.45x book value. I think 60% of book value is reasonable which implies a price of 10.25. Original Write-up. Buy under 8.00

Donnelley Financial Solutions (DFIN) had no news this week. It reported a great quarter in May with 11% revenue growth, significantly ahead of consensus expectations. Non-GAAP EPS of $1.15 beat consensus as well and the stock performed well. The stock pulled back after an analyst downgraded it to Hold, but the stock has rebounded sharply. Donnelley is executing well and is still too cheap trading at 9.3x free cash flow and 7.6x forward EBITDA. Original Write-up. Buy under 25.00

Dorchester Minerals LP (DMLP) will pay its next quarterly dividend in July. It’s yet to be declared, but I expect it to be at least $0.30 which was paid last quarter, given energy prices are materially higher. In 2020, the company generated $39.4MM of free cash flow. Given the pandemic, we can view this free cash flow generation as a trough. As such, DMLP is trading at 15.0x trough free cash flow. This is an extraordinarily cheap multiple for such a high-quality royalty business. Given oil prices are back to pre-pandemic levels but the stock remains depressed, I think the stock looks compelling. Original Write-up. Buy under 17.50

Drive Shack (DS) announced that Rory Mcllroy’s investment partnership has committed to invest $10MM+ in exchange for a 10% ownership stake in three yet to be opened Puttery locations. This is the first time the terms of the investment have been disclosed. McIIroy’s involvement and investment will help Puttery venues build momentum. I believe Drive Shack’s traditional and entertainment golf businesses are set to boom in 2021. Given substantial recent cost cuts, operating leverage should drive earnings growth in 2021 and beyond. Longer term, growth will be driven by new Puttery venues which have high potential. At its current valuation, Drive Shack’s share price gives minimal value to the strong upside potential from new Puttery venues. Finally, alignment is high as management and directors own 16.3% of shares outstanding and have recently bought in the open market. I recently spoke to investor relations at the company and the conversation increased my conviction levels. While the stock has rallied sharply, I still see good upside. My price target is 6, but I think the stock could hit 9 looking out a few years. Original Write-up. Buy under 3.50

FlexShopper (FPAY) disclosed recently that more insiders (Chairman and a director) bought in the open market. This gives me strong confidence that strong results should continue. Recently, the company reported another excellent quarter. Revenue increased by 32.0%, beating consensus slightly. Adjusted EBITDA increased by 20% to $2.4MM. New originations increased 21.7%, which implies that revenue and earnings growth for 2021 should be very strong. I continue to like FlexShopper. It is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 7.7x 2021 earnings. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 3.00

Greystone Logistics (GLGI) is primed to continue to perform well. In April, I had a chance to speak to the CEO and learned a bunch of new stuff. Why did I want to speak to the CEO? Greystone had recently reported a quarter that looked awful at first blush. Revenue declined in the quarter by 26% while EPS declined by 65% to $0.02. However, the 10-Q revealed that the decline in revenue was primarily due to a timing issue. In March (one month after quarter end), Greystone received an order for $7.8MM. If that order had been received in February, revenue would have grown by 13% and earnings would have grown significantly as well. I wanted to get clarity on what was going on. I called the company and within 30 minutes, I was on the phone with CEO Warren Kruger. For the next 20 minutes, I asked Kruger a ton of questions about the industry and his business (he owns over 40% of shares outstanding). He was very candid and direct. I think it was the most informative 20-minute conversation that I’ve ever had! I had two big takeaways from the call: 1) The customer that previously decided to diversify away from Greystone for its pallet orders reverse its decision. This is a major positive. 2) The long-term outlook for the company remains bright and Kruger remains highly engaged. The stock is trading at 8.7x current fiscal year EPS estimate of $0.15 (fiscal year ends in May) which is too cheap given strong growth. I expect strong EPS growth in 2021 (fiscal 2022). Original Write-up. Buy under 1.30

HopTo Inc (HPTO) has been relatively weak on no news. The company reported earnings recently. Disclosure was limited but revenue grew slightly in the first quarter. The company also disclosed that it sold some patents for $269.8K. The company didn’t disclose how many patents were sold, but it’s good to see that the company was able to monetize at least a portion of its patent portfolio. All in all, the investment case remains on track. Insiders own a significant stake in the company and have an incentive to grow revenue and earnings to increase value. I believe HPTO is worth ~0.80 per share. Original Write-up. Buy under 0.55

IDT Corporation (IDT) received a boost last week when, Connor Haley, one of my favorite Twitter follows, disclosed a new, high conviction idea: IDT Corporation (IDT). That’s the reason IDT has performed so well recently. Here’s a link to IDT presentation. His base case price target is 88, double our 44 price target. After reviewing his detailed work, especially his analysis of IDT’s point of sale segment, NRS, I believe our price target is far too conservative. NRS has the ability to increase penetration considerably while also increasing average revenue per user. This should result in continued explosive revenue growth over time. As such, we are increasing our buy limit for IDT to 45. Original Write-up. Buy under 45.00

Liberated Syndication (LSYN) recently announced that it closed its AdvertiseCast acquisition. This is a major positive, and I look forward to when the company can disclose more about it. Currently, disclosure is limited given Libsyn is in the process of restating its financials as it previously mis-accounted for state sales taxes (I view this restatement to be immaterial). I continue to have conviction in the stock. Original Write-up. Buy under 5.00

MamaMancini’s Holding (MMMB) recently reported another good quarter. Revenue declined by 5%, but this was due to a difficult comparison versus the quarter from Q2 2020 when consumers were stockpiling frozen foods in preparation for the pandemic (sales in the quarter are up 45% over a two-year period). Revenue growth will reaccelerate in the second half of 2021 driven by increased distribution into Walmart and Sam’s Club. The company is also exploring a NASDAQ uplisting and bolt-on acquisitions. My 12-month price target is 3.80, which is driven by an estimated price to earnings multiple of 20x on expected fiscal 2021 earnings of $0.19. Original Write-up. Buy under 2.50

Medexus Pharma (MEDXF) remains our highest conviction idea. Recently, we have seen two positive pieces of news. First, we saw insider buying by the management team. Second, it received approval to start selling Treosulfan in Canada (this bodes well for ultimate approval in the U.S.). Also, it recently uplisted to the Toronto Stock Exchange which is a positive. The big news for Medexus is its biggest pipeline drug, Treosulfan, will likely be approved by the FDA in August. This will drive the next leg of growth for the company. Longer term, I think revenue and the stock can triple as the company continues to execute. Original Write-up. Buy under 8.00

NamSys Inc. (NMYSF) recently filed Q2 ’21 results. Revenue grew 4.5% which is solid, but a definite deceleration from last year’s growth. While I like the company and its strategy, it’s not a high conviction idea, and I’ve decided to move the name to Sell in order to make room for new, higher conviction ideas. I will keep NamSys on my watch list and may recommend it if growth reaccelerates. Original Write-up. Sell

P10 Holdings (PIOE) recently released its Q1 ’21 letter and everything looks great. A couple highlights. Assets under management are expected to increase by 30% this year. This will drive revenue, earnings and cash flow higher in 2021. The company has a full pipeline of M&A opportunities. Insiders own 73% of shares outstanding. If we assume the company can achieve $16.0BN in assets under management by the end of the year (its goal), it is trading at 9.6x free cash flow and 12.9x EBITDA. Very reasonable considering its closest (albeit larger) peer is Hamilton Lane (HLNE) which trades at 31.9x EBITDA and 21.3x free cash flow. My official rating is Hold Half, but I may eventually switch my rating back to Buy given how well the business is positioned. Original Write-up. Hold Half

Stabilis Solutions (SLNG) has performed well on no news. It specializes in delivering liquid natural gas (LNG) and hydrogen to its customers who are away from pipelines and off the energy grid. Customers use Stabilis Solutions as it provides them with cheap, reliable energy that is cleaner than other fossil fuels. The company has grown revenue at a 27% CAGR and has a bright outlook. Insiders own over 50% of the company but have been relentlessly buying more stock in the open market. The stock has performed well since the pandemic but looks like a double over the next 12 months. Original Write-up. Buy under 9.00

Watch List

FitLife Brands (FTLF) sells nutritional products for health-conscious consumers. I continue to watch this name and mentioned it on my recent micro-cap webinar. In the most recent quarter, revenue increased slightly. It trades at an EV/EBITDA multiple of 8.4x which is pretty reasonable for a company which has a strong outlook. The one area of concern is that 75% of sales go to GNC. Nonetheless, FitLife’s resilience in 2020 was amazing.

Gatekeeper Systems (GKPRF) is a Canadian hardware and software company that provides solutions and services for public transportation and school buses. The business is lumpy but is on an upward trajectory and will likely improve margins considerably over the next 3 years. Valuation looks reasonable.

Epsilon Energy (EPSN) is a name that just popped up on my cheap/no debt energy screen. I continue to dig deeper and am intrigued. The company looks like it’s trading at roughly 6x annualized free cash flow and has no debt. More work to do, but it looks interesting. Also, insiders have been buying.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 7/13/21 | Profit | Rating |

| Aptevo Therapeutics (APVO) | 32.01 | 3/10/21 | 19.63 | -39% | Buy under 40.00 |

| Atento SA (ATTO) | 22.35 | 4/14/21 | 25.12 | 12% | Buy under 25.00 |

| BBX Capital (BBXIA) | 3.17 | 10/5/20 | 7.75 | 144% | Buy under 8.00 |

| Donnelley Financial Solutions (DFIN) | 14.54 | 11/11/20 | 32.36 | 123% | Buy under 25.00 |

| Dorchester Minerals LP (DMLP) | 10.45 | 10/14/20 | 16.80 | 64% | Buy under 17.50 |

| Drive Shack (DS) | 2.58 | 5/12/21 | 2.76 | 20% | Buy under 3.50 |

| FlexShopper (FPAY) | 2.13 | 12/9/20 | 2.66 | 25% | Buy under 3.00 |

| Greystone Logistics (GLGI) | 0.81 | 7/8/20 | 1.25 | 54% | Buy under 1.30 |

| hopTo Inc (HPTO) | 0.39 | 4/28/20 | 0.38 | -3% | Buy under 0.55 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 49.04 | 153% | Buy Under 45.00 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.82 | 25% | Buy under 5.00 |

| MamaMancini’s Holding (MMMB) | 1.76 | 8/12/20 | 2.65 | 51% | Buy under 2.50 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 5.97 | 235% | Buy under 8.00 |

| NamSys Inc (NMYSF) | 0.65 | 9/9/20 | 0.89 | 37% | Sell |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 7.75 | 291% | Hold Half |

| Stabilis Solutions (SLNG) | 7.85 | 6/9/21 | 8.64 | 10% | Buy under 9.00 |

*Includes 0.75 distribution and 1.35 distribution.

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in BBXIA, HPTO, PIOE, MEDXF, LSYN, GLGI, IDT, FPAY and SLNG Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on August 12, 2021.

Cabot Wealth Network

Publishing independent investment advice since 1970.

President & CEO: Ed Coburn

Chief Investment Strategist: Timothy Lutts

Cabot Heritage Corporation, doing business as Cabot Wealth Network

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2021. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Performance: Subscribers should apply loss limits based on their own personal purchase prices.

Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.