How to Find Good Investing Ideas

There are many ways to find good investing ideas.

You could follow the pros.

Once a quarter, all the top hedge funds in the world disclose their holdings on a 90-day delayed basis.

Sure, some of the investors could have sold their investments during the 90-day lag, but many hedge funds (like Bill Ackman’s Pershing Square) hold their investments for years. So you could just focus on hedge funds with long holding periods.

Heck, you could follow the best investor of all time, Warren Buffett.

If you had bought Apple (AAPL) when Berkshire Hathaway first disclosed its stake in 2016, you would be sitting on a 770% gain!

Other ways to find good investments…

Set up a free account on Value Investors Club and see ideas from some of the best investors on a 45-day delay.

You can find good ideas on Twitter.

I’ve used all these methods, but one of my favorite methods for finding new ideas is through “keyword” searches.

You can set up a “keyword” search for free through Google and get daily updates on certain keywords.

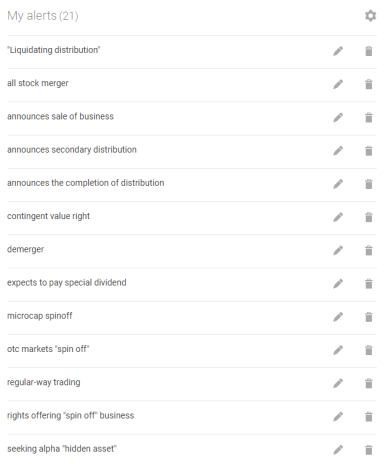

Here are the keywords that I like to monitor:

While I monitor 21 different keywords or phrases, my favorite phrases to monitor are “spin-offs” and “special dividend.”

I’ve found that spin-offs and special dividends are hard catalysts that often fly under the radar and signal a good opportunity.

My latest investment idea was flagged due to a “special dividend” keyword search.

The company that I will discuss below has paid out $28 per share in dividends and special dividends since 2005. Yet its stock trades at just $13.75.

I like to see special dividends because it signals that the CEO is not an “empire builder” who is focused exclusively on growing at all costs.

If there is a good opportunity to invest cash into the business and increase organic growth or make a strategic acquisition, great, but if no investment opportunities look compelling, I would prefer to see cash returned to shareholders through a special dividend or share buyback program.

Without further delay, let’s move on to this month’s new idea: Park Aerospace (PKE).

New Recommendation - Park Aerospace: Poised to Triple Earnings

Company: Park Aerospace

NYSE: PKE

Price: 13.75

Market Cap: $278 million

Price Target: 27.50

Total Return Potential: ~100%

Recommendation: Buy under 15.00

Recommendation Type: Rocket

Executive Summary

Park Aerospace has been around for 63 years. It has no debt and 38% of its market cap in cash. It is poised to double revenue and triple earnings over the next three years yet trades at a reasonable valuation. The company pays a competitive dividend (3.7% yield) and is buying back stock in the open market. Insiders own over 11% of the company. I see 100% upside over the next three years.

Overview

Background

Park Aerospace was founded on March 31, 1954, by Jerry Shore and Tony Chiesa with a ~ $50,000 investment.

Sales were $124,206.59 in 1960 and have grown at a compound annual growth rate of 10% to $54MM in Fiscal 2023.

Park went public in 1960 and listed on the NYSE in 1984.

It initiated a quarterly dividend in 1985 and hasn’t missed a dividend since then.

Park Aerospace develops and manufactures Solution and Hot-Melt Advanced Composite Materials used to produce composite structures for global aerospace markets.

Advanced Composite Materials are used to produce primary and secondary structures for:

1) Jet Engines

2) Large Transport Aircraft

3) Military Aircraft

4) Business Jets & General Aviation Aircraft

5) Unmanned Aerial Vehicles (UAVs or “Drones”)

6) Others

Park Aerospace also offers:

1) Specialty Ablative materials for Rocket Motors and Nozzles

2) Specially designed materials for Radome Applications (used to enclose radar systems)

Park goes after “niche” markets:

Its top 5 customers are:

1) AAE Aerospace

2) Kratos Defense and Security Solutions

3) Lockheed Martin

4) Middle River Aerostructure Systems (MRAS)* and its subcontractors

5) Nordam Group

Its revenue split by end market is as follows:

Outlook

Currently, Park’s business is being negatively impacted by staff shortages, supply chain disruptions, and freight unreliability. However, there are signs that these issues are easing.

Over the long term, the outlook for Park Aerospace is quite strong.

The main driver is that Park provides critical materials and components to new GE Aviation jet engines.

There is a huge backlog of orders for these engines and when they are fulfilled, it is going to result in very meaningful revenue and earnings for Park.

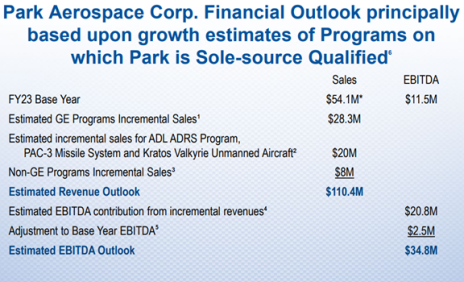

On the last call, management estimated that revenue will eventually double and earnings (EBITDA) will eventually triple.

How long will this take?

My best guess is within 3 to 5 years.

Insider Ownership

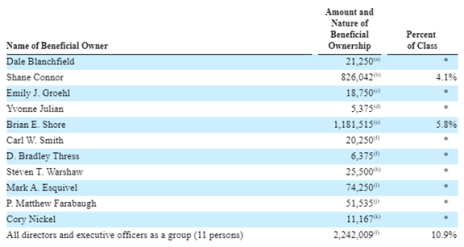

As Cabot Micro-Cap Insider subscribers know, insider ownership is high on my checklist and is critical when investing in micro-caps.

As shown below, insiders own over 10% of shares at Park Aerospace which ensures that they are aligned with minority shareholders.

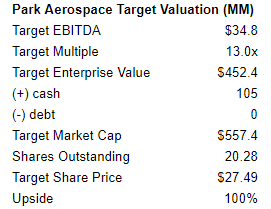

Valuation and Price Target

Park Aerospace currently trades at 17.8x trailing EBITDA.

As such, it doesn’t look that cheap.

So why am I recommending it?

Because Park Aerospace is on the verge of doubling its business.

On a recent earnings call, Park’s CEO shared that he expects revenue to double and EBITDA to triple over the medium term:

What is the right valuation given this strong outlook?

Historically, Park has traded at 13x EV/EBITDA multiple.

At 13x EBITDA of $34.8MM, Park would be worth $27.49 per share or ~100% above Park’s current share price.

The one caveat is timing is a bit uncertain. However, we do know that the outlook is quite strong and that, eventually, earnings will grow significantly.

I also believe my assumed target multiple of 13x is conservative. As you can see from my comp table below, aerospace companies with high teens/low 20% margins trade between 18x and 32x EBITDA. As such, a 13x target multiple seems reasonable if not conservative.

As is always the case, micro-caps are illiquid. Be sure to use limits.

My official rating for PKE is Buy under 15.00.

Risks

Continued Staff Shortages, Inflation, and Supply Chain Shortages

- The world is beginning to recover from the supply chain shock resulting from the COVID pandemic, and I believe headwinds will ultimately be resolved.

GE Aviation Orders Don’t Materialize

- The upside case for Park is largely driven by orders for new GE jet engines, but if they don’t materialize, revenue growth will only be moderate.

Updates

Changes This Week

Sell Transcontinental Realty Investors (TCI) to make room for new recommendation

2seventy bio (TSVT) had no news this week. It has been relatively weak since I published my recommendation on June 14. The reason? The company announced that it paused a trial of one of its pipeline drugs due to a patient death. While this is sad news on a personal level, it doesn’t impact my valuation for the stock. Why? Because my valuation doesn’t include any “credit” for the pipeline, yet I see almost 200% upside. Therefore, I would use weakness as a buying opportunity (I bought more shares and will continue to buy on weakness). The investment case is as follows: 2seventy bio is a rare biotech. It is well funded with over $300MM of cash on its balance sheet and no debt, has a rapidly growing drug that could hit peak sales of $3BN, and features a dirt-cheap valuation. But I’m betting its cheap valuation won’t last for long. An obscure tax rule in the U.S. prevents tax-free spin-offs (2seventy bio was spun out of bluebird bio) from being acquired for two years. 2seventy bio’s two-year anniversary will pass in November 2023, and at that time, I expect M&A rumors to heat up. Original Write-up. Buy under 14.00

Cogstate Ltd (COGZF) had some positive news this week. Eisai’s LEQEMBI (Alzheimer’s) was approved by the FDA. This is very positive news because it means significantly more revenue for Cogstate as the additional studies are greenlit. On May 3, Eli Lilly (LLY) announced positive results for its Alzheimer’s drug, donanemab. Patients treated with the drug saw their Alzheimer’s progression slow by 27% versus placebo. Eli Lilly plans to proceed with regulatory submissions to get approval as quickly as possible. I expect FDA approval in late 2023 or early 2024. Cogstate worked with Eli Lilly for its phase III trial of donanemab. If the drug is approved, it will mean significantly more revenue for Cogstate as the additional studies are greenlit. Cogstate reported fiscal Q3 results on April 26. Revenue declined 15% y/y to $11MM. The revenue shortfall is due to slow patient enrollment in Alzheimer’s clinical trials. This isn’t lost revenue but revenue that has just been pushed out a year or so. Management also mentioned that smaller biotechs are a little more cautious spending money given the macro environment. FDA approval of Eli Lilly’s donanemab (Alzheimer’s) in late 2023/early 2024 would be another significant catalyst for Cogstate. Positive news would mean significantly more revenue for Cogstate due to the need for additional clinical trials to expand the drugs’ labels and to monitor the effectiveness of the drugs in real patients. Finally, Cogstate announced that it is actively buying back its own stock. It currently has a $13MM authorization (5% of market cap). While Cogstate’s performance has been disappointing, I remain confident in the long-term outlook. Original Write-up. Buy under 1.80

Copper Property Trust (CPPTL) had no news this week. It announced on June 5 that it would pay out $0.107713 per trust certificate on June 12, 2023. The distribution is from cash flow that was generated from operations (minimal asset sales proceeds were included). As such, the run rate yield on the Trust is 11% – very attractive, in my opinion! The Trust has pulled back, but this is largely due to rising interest rates which have impacted all real estate companies. Copper Property Trust continues to look attractive. I’m very happy to recommend a security that has no debt, is paying an 11% dividend yield, and is liquidating properties over time. Original Write-up. Buy under 14.00

Currency Exchange International (CURN) had no news this week. It reported another strong quarter on June 13. Revenue grew 30% to $18.3MM, beating consensus expectations by $1.3MM. Net operating income grew 30% to $3.7MM. The company continues to benefit from a booming travel market. Currency Exchange’s valuation looks attractive at 9x forward earnings and 7x forward free cash flow. Original Write-up. Buy under 16.00

Epsilon Energy (EPSN) saw a flurry of insider buys this week. Insider buys are encouraging but especially so when they are made in clusters. The company announced on June 20 that it is investing $14 million in the Permian Basin in Texas for a 25% working interest in 12,373 gross acres. This investment will start to generate positive revenue and earnings in 2024 when drilling commences. It reported Q1 earnings on May 10, 2023. The company generated $3.6MM of free cash flow (excluding positive movements in working capital) in the quarter, or $14.4MM annualized. EBITDA was $5.6MM in the quarter or $22.4MM annualized. Epsilon bought back 237k shares (1% of shares outstanding) at an average price of $5.72. It paid out $1.4MM in dividends. Despite both, net cash rose to $49.8MM. While depressed natural gas prices are negatively impacting Epsilon’s results, the company looks attractively valued even using draconian assumptions. In 2020, when natural gas prices were at similar levels, Epsilon generated $15.7MM of adjusted EBITDA. Thus, the stock is trading at just 3.6x 2020 (which I view as trough) EBITDA. This valuation appears compelling. Meanwhile, the company is paying a nice dividend and buying back stock. Downside is further limited given that cash represents 43% of Epsilon’s market cap. Original Write-up. Buy under 8.00

Esquire Financial Holdings (ESQ) had no news this week. The company reported a good quarter on April 25. Capital remains strong. The common equity tier 1 ratio stands at 14.89% and would be 12.97% including all after-tax unrealized losses. Tangible common equity to tangible assets stands at 11.77% and would be 11.38% including all after-tax unrealized losses. Credit losses remain low with no non-performing loans and a 1.34% allowance for credit losses. Total deposits increased $100MM to $1.3BN from December 31, 2022, to March 31. Uninsured deposits are just 33% of total deposits, and importantly, more than 90% of uninsured deposits represent clients with full relationship banking (loans, payment processing, and other service-oriented relationships). EPS came in at $1.47 or $5.88 on an annualized basis. As such, the stock is trading at just 6x earnings. Esquire looks compelling. Original Write-up. Buy under 45.00

IDT Corporation (IDT) has been weak since reporting earnings on June 5. It looked like a solid quarter albeit not quite as strong as previous quarters. Highlights were as follows: 1) Strong NRS (National Retail Solutions) growth continues. While growth slowed down from 100%+ in prior quarters to 65% growth in the current quarter, the performance was still impressive. NRS is profitable and has a huge runway for future growth. The division was negatively impacted by a pullback in advertising. This will eventually come back. 2) net2phone continued to grow nicely as well. Revenue decelerated from 30%+ to 20% but was still impressive. The division is approaching cash flow break-even. 3) The company generated $20.5MM of EBITDA. Thus, it’s generating $82MM of EBITDA on an annualized basis. As such, it’s trading at 7.8x annualized EBITDA. 4) The company bought back ~77,000 shares of its own stock. Given challenging market conditions for high-growth companies, IDT’s subsidiaries won’t be spun off soon, but we know that, ultimately, they will be monetized either through a sale or a spin-off. The investment case remains on track. Original Write-up. Buy under 45.00

Kistos PLC (KIST: GB) had no news this week. It filed its annual report on May 30. Some takeaways: 1) The company generated €190MM of free cash flow in 2022. The market cap of the entire company today is €200MM. This company is insanely cheap. 2) Kistos is focused on diversifying away from the U.K. and Netherlands given the regressive policy of “windfall” taxes. 3) The company is positioned exceptionally well given its recently announced acquisition of Mime Petroleum, a Norwegian company. Given high insider ownership and operating excellence from the management team, I remain an enthusiastic shareholder of Kistos. Original Write-up. Buy under 7.50

Liberated Syndication (LSYN): I spoke to Libsyn’s CFO on June 14. Here are the main takeaways: 1) Their main priority continues to be to get shareholders liquidity (the two largest shareholders want liquidity). Options include selling the company, a private equity minority investment, “turn-on” trading, and a merger with a SPAC. Really anything is on the table, but it has to make sense. Nothing appears imminent. 2) Business is growing but growth has slowed given weakness in the advertising market. 3) The podcast and website hosting business is a steady cash cow. 4) The annual meeting isn’t scheduled, but management does want to hold one. From a financial perspective, revenue grew from $42MM in 2021 to $57MM in 2022. On a pro forma basis (full-year contribution from the acquisition of Julep), revenues are over $60MM. Profitability is down as the company is focused on expanding into the podcasting advertising market which has lower profitability than the hosting business. Still, I’m optimistic that Libsyn has a bright future. Original Write-up. Hold

Magenta Therapeutics (MGTA) will hold its shareholder vote to approve the merger with Dianthus Therapeutics in Q3. I plan to vote “no” and urge you to do the same. The merger is disappointing because Magenta will distribute no cash to shareholders and legacy shareholders will only own 21% of the new company. I do think downside is limited if the deal goes through because the company will be well-capitalized and be backed by many prominent healthcare investors including Fidelity and Venrock Healthcare. My hope is the deal gets sweetened or scrapped completely and the company gets liquidated. A friend of mine recently published a good quick overview of the Magenta investment case. It is worth checking out. Original Write-up. Buy under 0.75

M&F Bancorp (MFBP) had no news this week. There was a good article written on Seeking Alpha in June that you can read here. The company reported excellent earnings on May 5. EPS increased 82% to $0.89. ROE reached 32% vs. 12% a year ago. This windfall is due to M&F’s deployment of new capital from the Emergency Capital Investment Program. The bank’s CEO stated, “We are pleased with our results for the first quarter of 2023, which exceeded our expectations. We achieved significantly increased earnings available to stockholders of $1.8 million and achieved a 1.55% return on assets, which is outstanding.” The bank remains overcapitalized with stockholders’ equity representing 26.95% of total assets. Non-performing loans represent 0.19% of total assets. M&F is trading at just 6.5x annualized earnings. I expect EPS to grow to $4.74 in 2025 (this might happen by 2024). Assuming M&F continues to trade at its average P/E multiple of 9.3x, the stock should hit 44.00 by 2025, implying significant upside. Original Write-up. Buy under 21.00

Medexus Pharma (MEDXF) continues to perform very well (+53% in the past week) following a strong quarter in June and increasing clarity on refinancing its convertible debentures. In its last quarter (June 21), revenue increased 41% to $28.6MM. Adjusted EBITDA increased 336% to $4.8MM. Most importantly, the company generated $3.2MM of free cash flow in the quarter and expects to generate an additional $7MM between March 31 and September 30, or $14MM on an annualized basis. Management noted that it expects to have $20MM of cash on hand as of September and up to $20MM from its accordion debt facility. Therefore, Medexus could have $40MM in liquidity which it could use to repay its convertible debenture which is due in October. The convertible debenture is $40MM. On the call, management noted that it does not want to repay the debentures in stock given the current low stock price. I’m hoping that’s the case, but I’m assuming Medexus is able to repay $35MM in cash and $5MM in stock (assuming $1.04 share price). In this scenario, Medexus would have to issue 5MM shares and the share count would increase by 25%. But the stock still looks cheap in that situation. By my math, the valuation metrics (assuming a 25% increase in share count) would be as follows: 1.8x annualized FCF, 5.3x annualized EBITDA, and 0.9x annualized EBITDA. Of course, there is reflexivity at play. The lower the share price goes, the more the dilution. But I tend to think Medexus will be able to raise additional non-dilutive financing to address any cash shortfall. What is the right valuation for Medexus assuming the share count increases by 25%? I think a $5 share price is reasonable. That would imply valuation multiples of 8.9x FCF, 10.5x EBITDA, and 1.8x revenue. Original Write-up. Buy under 3.50

Merrimack Pharma (MACK) had some news this week. Ipsen submitted and the FDA accepted a new drug application for Onivyde to be approved for first-line treatment of pancreatic cancer. The FDA will decide by February 13, 2024. Assuming approval (odds at 90%+), Merrimack should receive $225MM (or ~$15 per share), and shortly thereafter, pay the proceeds out to shareholders. Merrimack is a biotech company that has no employees. It relies on contractors to minimize costs. Its sole purpose is to receive milestone payments from Ipsen related to the drug Onivyde. Merrimack has committed to distributing any royalty proceeds to investors. I expect Merrimack to distribute $15 per share to investors within ~9 months, representing more than 125% of its current share price. Additional upside can be achieved through future milestone payments. Finally, insiders are buying stock in the open market. Original Write-up. Buy under 12.50

P10 Holdings (PX) had no news this week. The company filed a Form 4 statement on March 16 that seemed to indicate that an insider is selling. But it appears that the company repurchased those shares at an 8% discount to the market (privately negotiated transaction). What appears like a negative is actually a positive. P10 announced an excellent quarter on March 6. Fee-paying assets under management increased 23% y/y. Revenue increased 32% and adjusted EBITDA grew 29%. P10 continues to benefit from secular tailwinds in the private equity industry. Despite strong growth, P10 trades at just 12.9x EBITDA and just 13x cash earnings. This is too cheap a valuation. The investment case is on track. Original Write-up. Buy under 15.00

RediShred (RDCPF) had no news this week. It reported another excellent quarter on April 21. Revenue grew 57% to $57MM CAD while EBITDA grew 67% to $15.3MM. The strength was driven both by acquisitions and organic growth. Organic growth is being driven by increased demand for shredding by businesses. Higher fuel costs and driver costs hurt margins, but these are starting to moderate. The stock continues to look cheap at 5.8x forward EBITDA. I continue to see 100% upside over the next 12 months and significantly more upside looking out a few years. Original Write-up. Buy under 3.50

Transcontinental Realty Investors (TCI) had no news this week. I’m closing out this recommendation to make room for my new idea. But I still believe the stock looks compelling on a valuation basis. I just don’t know what the catalyst is that will force the stock to re-rate. Original Write-up. Sell

Trinity Place Holdings (TPHS) had no news this week. It is a high-risk, high-reward stock. I see a legitimate case for the stock to go up 7x. At the same time, the stock could decline by 100%. The company’s real estate is well-located and based in New York City. The stock represents an asymmetric opportunity with a 7:1 upside-to-downside ratio. Insiders own a significant portion of shares. Original Write-up. Buy under 0.45

Truxton (TRUX) had no news this week. It reported earnings on April 20. The quarter was solid. EPS came in at $1.47. Asset quality remains high with $0 in non-performing loans as of March 31. The bank’s capital position remains strong with tier 1 leverage at 10.3%. The one negative in the quarter was that deposits decreased, albeit slightly (by 4%) from December 31, 2022, to March 31, 2023. I’m going to watch this trend closely to see if it continues. In the meantime, Truxton looks attractive at ~10x earnings. This isn’t the most exciting stock, but it’s a slow-and-steady winner. Original Write-up. Buy under 75.00

Unit Corp (UNTC) had no news this week. It paid its $2.50 per share quarterly dividend on June 26. The company did not indicate whether a Q3 dividend will be paid. My sense is it will, but the company/board of directors is still finalizing the plan. Based on conversations with Unit’s CFO, I believe Unit’s dividend policy will include a standard “normal quarterly dividend” that is sustainable (perhaps $1 per quarter) and then periodic special dividends to return excess cash. This clarity will be a major positive. On May 11, Unit Corp filed its 10-Q, and the fundamentals look terrific. The company generated over $50MM of free cash flow in Q1. My estimate for the entire year was $94MM so I’m obviously too low. Areas of upside: 1) Upstream operation expenses are tracking $25MM lower than I had modeled (this is obviously a source of material upside). 2) BOSS day rates were $30.8MM in the quarter, but 8/14 of the BOSS rigs will reprice higher in Q2. 3) Drilling operating expenses are tracking slightly lower than I expected. As a result of the strong free cash flow generation, Unit currently has $171MM of cash on its balance sheet, or 35% of its market cap. All in all, it was a very strong quarter, and the investment case remains on track. Original Write-up. Buy under 65.00

William Penn (WMPN) had no news this week. It announced on May 6 that it has authorized another share repurchase representing 10% of shares outstanding. It will commence this share repurchase after the existing authorization is complete. William Penn announced earnings on May 6. Despite the turmoil in the banking market, William Penn grew deposits in the quarter. The bank remains well capitalized with a tangible common equity ratio of 19.7%. The company continues to aggressively repurchase shares. During the quarter, the Board of Directors authorized a fourth repurchase program to buy back up to 698,312 shares. The company is being quite aggressive. In the first half of April, it repurchased nearly 400,000 shares in the open market. Tangible book value is $12.54 so the stock is currently trading at 75% of book value. This looks like a compelling valuation. Downside is low given the stock is trading below liquidation value. Original Write-up. Buy under 10.80

Watch List

Enhabit (EHAB) stays on my watch list. It is a home health and hospice company that was spun off in 2022. It has performed poorly and cannot be sold until 2024. But there is tremendous consolidation in the home health market. Last year, UNH paid 21x EBITDA for LHC Group, and currently Option Care Health and UNH are in a bidding war for Amedisys for 15x EBITDA. EHAB currently trades at 9.5x EBITDA. I need to do more work to understand the current issues facing Enhabit and whether they are cyclical or secular. But this idea looks very interesting.

FFBW, Inc (FFBW) stays on my watch list. It is a similar setup to William Penn Bancorp. It is a thrift that probably will get acquired for a nice premium. The CEO will even get a nice bonus if a sale materializes. The only reason that I went with William Penn Bancorp instead of FFBW is because of the aggressive insider buying currently at William Penn. But FFBW looks like another low-risk idea.

Sandridge Energy (SD) stays on my watch list. It is yet another dirt-cheap energy name. It just announced a $2/share special dividend and $75MM share repurchase authorization. The special dividend has been paid out and the stock continues to lag. It looks compelling.

Recommendation Ratings

| Stock | Price Bought | Date Bought | Price on 7/11/23 | Profit | Rating |

| 2seventy bio (TSVT) | 10.87 | 6/14/23 | 10.75 | -1% | Buy under 14.00 |

| Cogstate Ltd (COGZF) | 1.7 | 4/13/22 | 0.99 | -42% | Buy under 1.80 |

| Copper Property Trust (CPPTL) | 12.93 | 8/11/22 | 10.55 | -2% | Buy under 14.00 |

| Currency Exchange (CURN) | 14.1 | 5/11/22 | 18.35 | 30% | Buy under 16.00 |

| Epsilon Energy (EPSN) | 5 | 8/11/21 | 5.61 | 12% | Buy under 8.00 |

| Esquire Financial Holdings (ESQ) | 34.11 | 10/10/21 | 44.7 | 31% | Buy under 45.00 |

| IDT Corporation (IDT) | 19.37 | 2/10/21 | 24.25 | 25% | Buy under 45.00 |

| Kistos PLC (KIST) | 4.79 | 7/13/22 | 2.35 | -51% | Buy under 7.50 |

| Liberated Syndication (LSYN) | 3.06 | 6/10/20 | 3.75 | 23% | Hold |

| M&F Bancorp (MFBP) | 19.26 | 11/9/22 | 20.5 | 6% | Buy under 21.00 |

| Magenta (MGTA) | 0.79 | 4/12/23 | 0.77 | -3% | Buy under 0.75 |

| Medexus Pharma (MEDXF) | 1.78 | 5/13/20 | 1.38 | -22% | Buy under 3.50 |

| Merrimack Pharma (MACK) | 11.99 | 2/7/23 | 11.72 | -2% | Buy under 12.50 |

| P10 Holdings (PX)** | 2.98 | 4/28/20 | 11.22 | 277% | Buy under 15.00 |

| Park Aerospace (PKE) | NEW | -- | -- | --% | Buy under 15.00 |

| RediShred (RDCPF) | 3.3 | 6/8/22 | 2.85 | -14% | Buy under 3.50 |

| Transcontinental Realty Investors (TCI) | 40.22 | 10/13/22 | 35.72 | -11% | Sell |

| Trinity Place Holdings Inc. (TPHS) | 0.4 | 6/13/23 | 0.56 | 40% | Buy under 0.45 |

| Truxton Corp (TRUX)* | 72.25 | 12/8/21 | 59 | -15% | Buy under 75.00 |

| Unit Corp (UNTC) | 58.08 | 12/14/22 | 47.3 | 0% | Buy under 65.00 |

| William Penn Bancorp (WMPN) | 11.91 | 4/11/23 | 9.89 | -9% | Buy under 10.80 |

**Original Price Bought adjusted for reverse split.

* Return calculation includes dividends

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

Disclosure: Rich Howe owns shares in PX, MEDXF, LSYN, IDT, DMLP, NXDT, KIST, and RDCPF. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.

The next Cabot Micro-Cap Insider issue will be published on August 9, 2023.