Cabot Micro-Cap Insider Watch List Update: Two Stocks to Keep an Eye on

Given the market pullback, a couple names on my watch list are looking particularly interesting. I haven’t completed my analysis yet, but stay tuned—all of these names could ultimately make their way into the Cabot Micro-Cap Insider portfolio.

First, let’s start with Waitr Holdings (WTRH), a food delivery company. You’ve probably heard of some of their competitors, including Grubhub, DoorDash, Uber Eats, and Postmates.

The food delivery market is a hot market, especially in a COVID-19 world where consumers are reticent to dine in at restaurants.

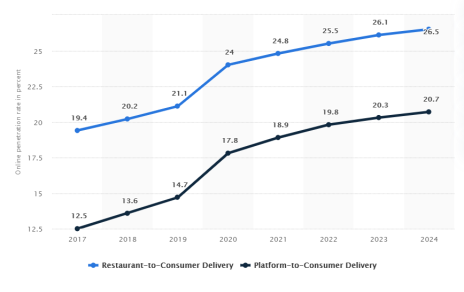

One other major bullish data point is that online restaurant delivery penetration in the U.S. remains low but is expected to continue to increase going forward, as shown below.

Waitr’s strategy is to focus on delivering food in cities with populations of 50,000 to 750,000. The largest competitors, such Uber Eats and DoorDash, are focused on larger markets. As such, Waitr has carved out a nice niche in the market.

In 2019, the company was struggling and losing money. However, that all changed when a new CEO, Carl Grimstad, was hired. He cut costs and aggressively partnered with new restaurants. In early 2020, the company started to turn a profit.

Then the pandemic hit, and restaurant food delivery began to boom.

Record sales combined with a lean cost structure have created booming profits for Waitr.

In the second quarter, Waitr generated $10.65 million of net income, or $42.2 million on an annualized basis. Waitr’s market cap is currently $363 million, so the stock is currently trading at 8.6x net income. Not bad for a company growing revenue 20%+.

The key question is sustainability. Will Waitr be able to maintain that growth?

I don’t have a definite answer, but given the low penetration rate of restaurant delivery and the impact of the pandemic (going forward restaurants will want to ensure they have a delivery option incase another pandemic strikes), I think growth should be quite strong going forward.

Further, Waitr could be acquired. Recently, Uber Eats announced it is acquiring Postmates for 3.9x revenue while Just Eat Takeaway recently announced that it is acquiring Grubhub for 6.0x revenue.

Waitr is currently trading at 1.9x revenue. In an acquisition scenario, Waitr would trade significantly higher.

Dorchester Minerals (DMLP) is another company that has pulled back and is very interesting. You may recognize that this company has been on my watch list for several months.

Dorchester Minerals is an energy company, but it doesn’t light cash on fire like most energy companies.

It owns mineral rights and royalties associated with oil and gas production. As such, it doesn’t have to spend significant capital drilling new wells. It just sits back and collects royalty checks from existing oil and gas production.

Better yet, it distributes most income to shareholders.

DMLP has pulled back more than 24% from its high in June and looks compelling.

Insiders have taken advantage of share price weakness and bought stock in the open market, as shown below.

With depressed oil prices, the stock’s quarterly distribution has declined to $0.23. On an annualized basis, this works out to an 8.7% yield. Not too shabby. The quarterly distribution could decline further (it troughed in 2016 at $0.15), but eventually, it will rebound higher.

This is a great way to play the eventual energy market recovery because you get paid a nice dividend while you wait.

Keep an eye on Waitr Holdings and Dorchester Minerals as one or both might end up as a recommendation in the Cabot Micro-Cap Insider portfolio. As a reminder, we will publish our next issue on October 14, 2020.