Riviera Sells Blue Mountain. Company to be Liquidated.

This morning, Riviera Resources (RVRA), announced that it has reached an agreement to sell Blue Mountain, its midstream business, to Citizen Energy for a price of $111 million.

The sale price is a premium to what was implied by RVRA’s share price ahead of the sale, but is nonetheless disappointing.

Over the past three years, Riviera has spent over $300 million building out the midstream asset and so the sale price is at a large discount to replacement value.

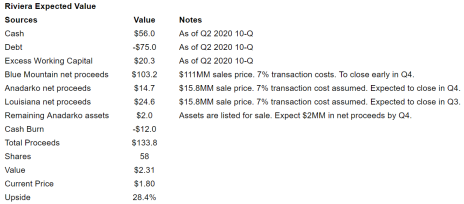

With this sale announcement, substantially all of Riviera’s assets are in the process of being sold. The company does have a small additional upstream property in the Anadarko Basin that will be sold by the 4th quarter, but I’m expecting minimal value from it ($2 million in net proceeds).

Excluding its $56 million of net cash, Riviera has Net Working Capital (current assets minus current liabilities) of $20.3 million. This can be distributed to shareholders.

On the liability side, Riviera has $19.3 million of asset retirement obligations (ARO), however, the responsibility for these AROs will transfer to whoever buys the upstream assets.

I expect that all excess net cash will be distributed to shareholders promptly based on the following from the Company’s press release.

“The Company intends to evaluate the process of winding-up and of returning the majority of its remaining capital to its shareholders as efficiently as reasonably possible, at which point the Company would completely exit the upstream and midstream business, in the event this sale and other contemplated asset divestitures are completed.”

So effectively, the company has become a liquidation play.

An important question to answer is how long the liquidation will take.

Given that the company has promptly returned cash to shareholders following past asset sales, I believe almost all net cash will be distributed to shareholders in Q4 shortly after the asset sales close. A small amount of cash will stay with the company as it winds up its affairs in 2021.

How much cash will Riviera burn as it winds up its affairs?

During the first half of 2020, Riviera burned $12.3 million of cash (cash flow from operations). Even though the company is doing everything in its power to cut costs, I expect it to spend an additional $12 million in the second half of 2020 as it will have to pay severance and other expenses.

Factoring in the above, I expect Riviera to have ~$134 million in net cash or $2.31 per share that is available to be distributed to shareholders in Q4 2020.

Given my estimate of liquidation value, I believe it makes sense to buy the stock below 1.85 as it would imply a 25% return to liquidation.

Buy under 1.85.

Disclosure: Rich Howe owns shares in RVRA. Rich will only buy shares after he has shared his recommendation with Cabot Micro-Cap Insider members and will follow his rating guidelines.