Thoughts on Libsyn + Notes from My Call with President, Laurie Sims

I was recently able to speak to Laurie Sims, President at Libsyn. We had a nice conversation, and I got some good insights into the business. See my notes at the end of this update.

I’ve spent a lot of time thinking about Libsyn, and I think the risk/reward setup looks attractive.

In case you’ve missed previous updates, Libsyn recently filed a an 8k disclosing that it doesn’t expect to file its financials before December 2021 and that as a result, it is obligated to pay a monthly fee to investors that participated in the secondary earlier this year (up to 2% of purchase price of $24.875MM = $497,500).

Camac Partners and Brad Tirpak waived their right to the fee so the recent payment was $147,000 to the other investors. Libsyn noted there is no guarantee that Camac and Tirpak waive their fee going forward. Libsyn is working towards filing its financials but doesn’t expect to do so before December 1, 2021. Thus, it will likely be on the hook to pay those investors $1.99MM (4 x $497,500) through the end of the year.

Further, Libsyn will be impacted by a change to SEC Rule 15c2-11 which will come into effect on September 28, 2021. This rule change will basically make it almost impossible to buy or sell stocks that aren’t up to date with the SEC on their financials (like LSYN).

To continue to own Libsyn, you need to be comfortable with illiquidity (you might not be able to sell) in the name until at least January 2022.

I’m personally planning to maintain my position in Libsyn and perhaps opportunistically buy more.

Why?

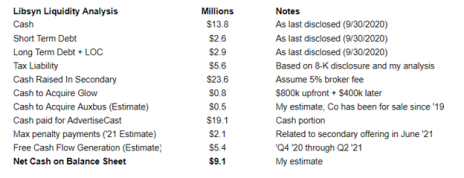

Libsyn is very cash generative and has plenty of liquidity (I estimate $9.1MM of net cash). Further, pro forma for the AdvertiseCast, I estimate Libsyn is trading at an EV / ‘21 Revenue multiple of 2.7x (I think a fair multiple is at least 5x) given that revenue will be growing at a mid-to-high-teens rate.

Once financials are filed (I think a matter of when not if), I think the stock will quickly re-rate. Theoretically, I could buy it back after the financials are re-filed, but I’m not sure I will be able to, given limited liquidity due to the change to SEC Rule 15c2-11.

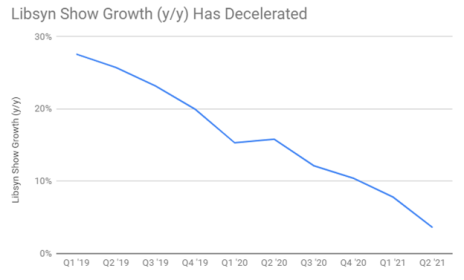

The one issue that I’m a little concerned about is declining core revenue for Libsyn’s podcast hosting (more on this below). Essentially, core podcast hosting (# of shows) growth has decelerated from 20%+ in 2019 to 4% in Q2 2021. I don’t think the number of shows on Libsyn’s network will shrink given 1) stickiness of podcast hosting service and 2) all the improvements that Libsyn is rolling out for its service, but the trend is not encouraging. It’s something I will continue to watch/monitor.

Notes from Conversation with Libsyn President, Laurie Sims

Why did the CFO leave? Did he know that the restatement was going to be a mess and didn’t want to deal with it?

In part, yes. He had come out of retirement to take the job. Chris Spencer had hired him, and restating financials is not the most fun job. Nobody at the [company] is enjoying the process, but we are working through it. He has stayed on as a consultant, and is going to stay on as long as we need him.

LSYN wants to hire a CEO and a CFO who has prior experience with high growth companies.

Has the board considered you for CEO?

[She kind of dodged the question, and stated that right now, they don’t really have a C-Suite (it’s only her) and they are trying to build it out].

Per this 8-k, Libsyn will have to pay the investors that participated in the June ‘21 secondary 1% of gross purchase price if its financials haven’t been filed and 1% if its financial haven’t been declared effective [works out to $497.5K per month (2% * $24.875MM)] by August. The first payment was recently made and will continue indefinitely. However, Bradley Tirpak (Chairman of the Board) and Eric Shahinian (Camac Partners) agreed to waive their August fee. So the net payment by Libsyn to secondary investors was $147K not $497.5K. Will Bradley and Eric waive their fee going forward?

While I can’t speak for Bradley and Eric, it’s a good sign that they waived their fee for August.

[Seems to bode well that they will waive their fees going forward, although, this is not guaranteed.]

Does Libsyn have adequate liquidity to cover tax payments and penalties related to the secondary?

Laurie didn’t provide an update regarding liquidity, but said:

If you run the math based on our last disclosed net cash balance, what was paid for acquisitions, and what was raised from investors, you will see that there is plenty of liquidity.

Based on my analysis/guidance, Laurie’s suggestion checks out. I estimate Libsyn has roughly $9.1MM of net cash on its balance sheet. It generates ~$7.2MM of free cash flow per year.

I’m really excited about your AdvertiseCast Acquisition. Its business grew 44% in 2020. Can that growth continue?

AdvertiseCast provides advertising for 1,500 podcasts, Libsyn has 75,000 podcasts. I don’t think it’s a stretch for AdvertiseCast to be able to get to 3,000 or 4,500 clients.

This makes a lot of sense to me. Seems like low-hanging fruit. Not all podcasts on Libsyn’s network will want to advertise, but a good percentage of them will want to. Each 1,500 clients added would generate additional revenue of ~$12MM.

How has integration of the acquisitions gone?

The integration has gone pretty well. There are always challenges and opportunities.

I was surprised that core podcast revenue decelerated last year. Through Q3 2020 (last disclosure), podcasting revenue was +12%. In prior years it had been high teens to low twenty percent growth. What drove the deceleration?

When the pandemic hit, there was a boom in new shows created because many creators were stuck at home and had time to start a podcast. So podcast hosting revenue continued to grow strongly. However, that strong growth was offset by a decline in LibsynPro revenue.

LibsynPro is Libsyn’s enterprise podcast solution. Clients include Trader Joe’s, eBay, and others. Customers pay a hosting fee, but they also pay a bandwidth fee and that fee declined last year because people were spending less time listening to podcasts (less commute time).

One thing that I do want to monitor is that Libsyn’s core podcast business appears to be slowing down (+11% in 2020 vs. >+20% in prior years).

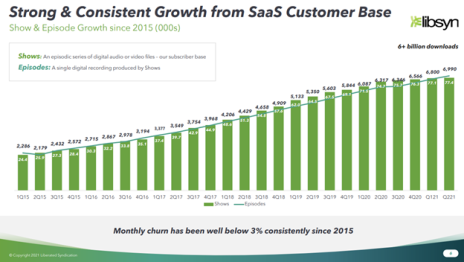

Libsyn recently released an updated slide deck which is excellent.

In it, they show this chart:

It looks like a great chart, but it’s clear that core podcast (# of shows) has slowed.

One thing that Laurie mentioned was that “free podcast hosts are having an impact.” Since the beginning of podcasting, there have been free podcast hosts. But Libsyn always argued (rather effectively) that “free” wasn’t really free because you couldn’t control your content and the podcast host could advertise on your shows. I think that is still the case, but nonetheless, this is the first time the company has acknowledged it.

Anchor (recently acquired by Spotify) is the most famous of the free competitors. Podbean has been around for years. While there have always been free podcast hosts, the new podcast hosts these days have better technology and cool podcast creation tools.

Libsyn has been trying to address this by improving its user interface (Libsyn 5) and making several acquisitions, Auxbus for podcast creation, AdvertiseCast for podcast advertising, and Glow for podcast community and monetization.

But core growth is something that I’m going to be closely following.

I’m looking for it to stabilize and reaccelerate.