Medexus’ Treosulfan Will Be Delayed

This morning, we received bad news from Medexus.

Medexus announced that it has received a complete response letter from the FDA related to Treosulfan, its newly in-licensed drug that was expected to drive substantial revenue growth.

What is a complete response letter?

This is a good explainer article, but in summary it means the FDA told Medexus that it isn’t comfortable approving Treosulfan before certain issues are addressed.

This news is surprising given Treosulfan has been approved in Canada and in Europe.

Further, it appears to be significantly more effective than the current standard of care busulfan.

Where does that leave us?

In short, it’s unclear.

Medexus needs to meet with the FDA to decide what next steps need to be taken to get the FDA comfortable with Treosulfan. It could take 6 months or if it could take several years. To be conservative, I’m going to assume it will take years before Treosulfan is approved.

But there is a silver lining.

Medexus didn’t spent years and millions in R&D to develop Treosulfan. It gained access to the drug through a licensing agreement with medac.

The terms of the agreement were as follows:

- $5MM upfront payment from Medexus to medac.

- $55MM in payments depending on approval and the label of Treosulfan.

- $40MM in payments based on Treosulfan milestone payments.

The $5MM upfront payment will not be recovered. But my understanding is the vast majority of the $55MM in potential payments for approval/the label of Treosulfan has not been paid and will not be paid until the drug is approved.

Thus, financial losses are very limited.

Now, Medexus has been investing in its sales force and hired a chief medical officer in anticipation of the Treosulfan launch. So these are additional costs that the organization had/has to bear. But Medexus can rationalize the sales force as needed if Treosulfan isn’t going to be launched any time soon.

I still think Medexus looks very cheap, despite this news.

First, consider that Medexus was trading significantly higher than today on February 2, 2021 prior to announcement of the Treosulfan deal.

The stock is getting hit hard today. In my opinion, this is due to the sentiment and management credibility hit (more on this later). I think the stock still looks attractive on a fundamental basis.

Second, let’s assume that Treosulfan doesn’t ever get approved. Where does that leave us?

Previous guidance had been that the ex-Treosulfan portfolio could generate $150-200MM of CAD sales with 30% EBITDA margins.

If we assume the low end of the range ($150MM CAD of sales), it implies $45MM CAD of EBITDA.

Now let’s consider the company’s current capitalization.

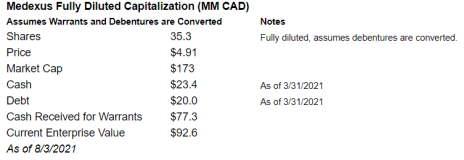

On a fully diluted basis (assumes all warrants are exercised and debentures are converted to common stock), Medexus has a market cap of $173MM CAD and an enterprise value of $93MM.

On this basis, it’s trading at 0.6x target revenue and 2.1x target EBITDA.

This year, Medexus generated revenue of $99.6MM CAD and adjusted EBITDA of $10MM CAD. On that basis, it’s trading at 0.9x revenue and 9.0x EBITDA. These multiples are incredibly cheap for a high margin, high growth, and low capital intensity business.

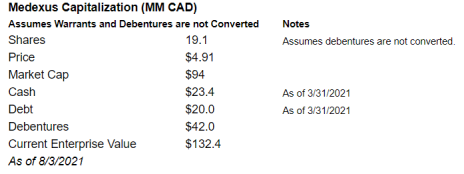

On a Non-Fully Diluted Basis, Medexus has a market cap of $94MM and enterprise value of $132.4MM.

On this basis, it’s trading at 0.9x target revenue and 2.9x target EBITDA and 1.3x current revenue / 12.9x current EBITDA. This also looks incredibly cheap.

Why is the stock down so much?

I touched on it above, but I think investors are losing confidence in management’s credibility.

I personally like CEO, Ken d’Entremont (have spoken to him several times) and loved the deal that he structured for IXINITY.

But the lack of NASDAQ uplisting and the lack of FDA approval for Treosulfan after he publicly expressed high confidence in both undermine investor confidence in his judgement.

I personally am not going to sell a share of Medexus given:

- The stock looks really cheap on current and future revenue/EBITDA (excluding any contribution from Treosulfan).

- The financial hit from the Treosulfan delay is immaterial ($5MM upfront payment).

- The stock was trading 63% higher on the day prior to announcement of the Treosulfan deal.

- Medexus will be able to consummate more licensing deals (similar to the IXINITY deal).

- The FDA’s issues with Treosulfan could be resolved.

Given the hit to management’s credibility, I am reducing my medium-term price target for Medexus to $6.80 which corresponds to a 1.5x target EV/revenue multiple and 4.9x target EV/EBITDA multiple. Longer term, I still believe the stock can and ultimately will trade up into the mid-teens.

I’m reducing my buy limit to Buy under 5.00.