By Andy Crowder, Chief Analyst, Cabot Options Institute

I hate to say this about some of my fellow options traders, but I can’t tell you how much I abhor those in the industry that absolutely ruin the true benefits of options for the self-directed investor.

Claims of outlandish 300%, 400%, 1,200% in just a few days, without even a small discussion on the risks of the trade. Encouraging the use of low-probability out-of-the-money puts as a predominant strategy without the mention of selling premium. And I’m not saying selling premium is the only way to make consistent returns using options. In fact, I know numerous professional traders who have made a good living predominantly buying options … but they are few and far between. But what I am saying is that consistent returns at those levels just isn’t realistic. Yes, they will happen from time to time, but they are indeed the anomaly and shouldn’t be the basis for a sustainable trading approach.

It’s frustrating. It’s frustrating to see so many so-called gurus with no real-world experience act as options traders when their services fail time and time again.

For some reason investors don’t crave what’s truly important, realistic strategies with realistic gains. Transparency. Knowing that trading isn’t easy and is a life-long endeavor. And that while the journey may be bumpy at times over the long haul, it is worth all of the effort. A long-term approach focusing on short- to intermediate-term trading with high-probability trades as its foundation. Selling premium or buying premium based on levels of volatility. Always talking about the importance of position-sizing. Always considering risk management.

[text_ad]

Why would people rather join services that tout such outlandish claims? It is beyond me. Are self-directed investors really that gullible? Why do they continue to fight statistics?

It is my hope that I have carved and will continue to carve a slice of decency and transparency into the options world. I am certainly not perfect, but I know that selling options is a valuable strategy with an overwhelming statistical advantage. And it is my goal to teach as many self-directed investors as I can about the benefits they offer.

Use Probabilities Now!

Some people will try to take a simple concept and sprinkle it with some mumbo jumbo to make it seem complicated and then claim only they can explain it to you! Don’t listen or don’t buy into any such load of bunk!

Take options. Yes, a lot of people, maybe even your stockbroker, will tell you options are too complicated and confusing. What they may really be telling you is options are something they don’t want to spend the time to understand, so they don’t want you to trade them either!

It was only 20 years ago that there were only a privileged few investors who could take advantage of things like streaming quotes and real-time options chains. Options were shrouded in mystery and deemed too complex for the average Joe—to be traded only by the so-called “sophisticated” professional investors.

Since then, however, seismic changes in the options world have leveled the playing field for individual traders and investors. Thanks to advances in technology, innovative trading tools, and better access to what was once privileged information, the self-directed investor is now equipped with the ability to trade like a professional options trader.

So, now that we as self-directed investors have the same technology as professional traders why aren’t we applying the technology in the same way?

We all know that a stock or ETF only has a 50/50 statistical chance of success. That’s right, no better than a coin flip. But what most self-directed investors don’t know is that there is a way to increase the statistical chance of success to well above 50/50. Professional options traders do, and they have been using powerful, statistically based strategies for years. But, as I stated before, now we have the same technology. Now it is up to us to use it to our advantage.

The Essential Guide to High-Probability Trading

The foundation of all quantitative or statistically based options traders rests on one statistical law – The Law of Large Numbers.

The Law of Large Numbers states that as you increase your sample size, in our case number of trades, our expected value or probability of success will come to fruition.

This is because the Central Limit Theorem shows us that actual values will converge on expected values.

But, in order for the Central Limit Theorem to work, we need a large enough sample size or number of observations–in our case, trades. This is where the Law of Large Numbers comes in.

I’m certain many of you during elementary, middle or high school went through the following math exercise.

Coin Toss Example

A coin has a 50% chance, or probability, of landing on heads or tails.

Therefore, according to the Law of Large Numbers, the number of heads in a large number of coin flips should be 50%, which is known as our expected value. Basically, as our number of trades increase over time our win ratio (the number of heads or tails) should fall increasingly closer to our expected value—again, 50%.

But in order for the law of large numbers to work, we must have a large enough sample size or, in our case, number of trades.

For instance, if we take a position that has an 80% probability of success we should expect to see a win ratio of roughly 80%. But the journey to get to that percentage should never be considered straight forward, especially in the beginning. Basically, just because you place 10 trades, eight of those trades are not guaranteed to be winning trades. In the world of statistics, we call this sequence risk, or sequencing risk.

We must understand that when we follow a quantitative approach there are several obstacles that we must acknowledge.

Variance is a Factor

When flipping a coin 10 times the variance of the coin landing on heads has an average range of three heads to seven heads. As we increase the number of observations the range tightens until eventually the overall probability of success stands at approximately 50%.

But, early on, due to variance we will experience bouts of sequencing risk.

So, just because our expected value is 50% it doesn’t mean that for every 10 flips we are going to fall right at 50%, or five heads and five tails. In the world of quantitative trading, we call this sequencing risk. Sequencing risk simply means that we could have numbers that vary from zero heads to 10 heads for every 10 flips. We call these statistical outliers, and they should be expected from time to time.

But again, the Law of Large Numbers always falls around the expected outcome as the number of observations (trades) increase.

It’s an incredibly easy concept to understand, yet, most traders simply don’t allow the Law of Large Numbers to work in their favor. Lack of patience is typically the reason.

My Approach to Trading

The Law of Large Numbers is important to understand because unlike a coin flip that has a 50% probability of success, my approach has a probability of success that is significantly higher, roughly 70% to 85%.

As a result, my expected outcome, or win ratio, is going to be 70% to 85%.

This is why professional options traders trade for a long, long time, well after retirement. Stock traders, not so much. Why? Well, again, it comes down to probabilities and when your probabilities are at best roughly 50%…the Law of Large Numbers will eventually catch up to you.

We want the Law of Large Numbers to catch up to our strategies. We want to see our expected probability of success of 70% to 85% come to fruition. Because if we know what are expected outcome is going to be over the long term we know ahead of time how to manage our risk, and managing risk is THE MOST IMPORTANT ASPECT of investing or trading.

Power of Probabilities

As an options trader, I’ve never understood why professional “talking heads” rarely, if ever, mention the topic of probabilities.

Wouldn’t you prefer to know the probability of a stock hitting a certain price? It certainly seems logical. Yet, I rarely hear investors, professional or otherwise, talk about statistics of any kind. It’s unfortunate.

We always hear the brief analysis about a stock, the analyst’s target price, but never the probability or a timeframe of the stock they are advising people to buy actually hitting the proposed price.

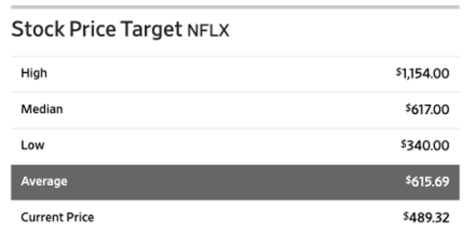

Just look at an older example in Netflix (NFLX). At the time, according to The Wall Street Journal there were 40 institutional analysts following the stock. With the tech stock trading for 489.32 the average price target at the time was 615.69 with a high of 1,154.00. The high price target, was roughly 135% above where NFLX was trading at the time, or again, 489.32. Of course, no timeframe was given as to when the analyst predicts NFLX would hit the predicted price.

While it’s great to have an understanding of the company you are potentially investing your hard-earned money in coupled with an arbitrary price target, does it really equate to making money? And isn’t that why we invest, to make money?

This is why, an as options trader, I take a quantitative approach to the market.

I want to know what the probabilities are of a stock going to a specific price before I put my money to work. More importantly, I want to know exactly how much I stand to make and stand to lose so I can manage my risk accordingly. I’ll discuss managing risk through the use of various options strategies at another time.

Let’s focus on the probabilities of NFLX hitting the average price target of roughly 616 and the high price target of 1,154.

Probability of Touch

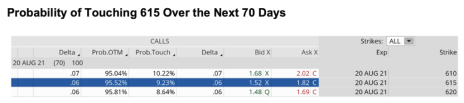

The probability of touch may be a new concept to some investors/traders, but it certainly isn’t to those that trade options. The probability of touch tells us the probability of an underlying stock touching a specific price over a specific timeframe. For example, going back to our older NFLX example look at the probability of NFLX touching 615 in 70 days, 224 days and 644 days.

As you can see above the probability of NFLX to hit the 615 strike prior to the expiration in 70 days was only 9.23%.

The Probability of Touch increases as a stock’s option expiration increases. It makes perfect sense, right? An options expiration date that is further out in time gives the stock more of an opportunity to hit the stated strike price.

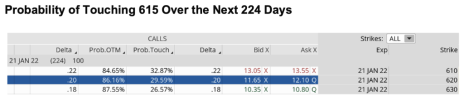

And as you can see, the Probability of Touch increased from 9.23% in the expiration date with 70 days to just over 29.59% in 224 days.

There isn’t a 615 strike available, but you can clearly see the 610 strike offers a 32.87% Probability of Touch and the 620 strike a 29.59% Probability of Touch. So, my guess is the Probability of Touch in the next 224 days is roughly halfway between the 610 strike and 620 strike, or 31.23%.

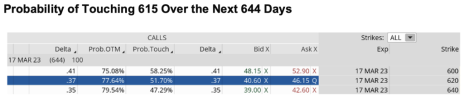

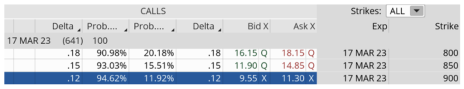

It is only when we go out to the March 17, 2023 expiration that the Probability of Touch pushes above a coin flip.

But what about the analyst who gave a price target of 1,154? What was the Probability of Touch that NFLX would hit that price target?

Well, at the time we looked at all the option expirations for NFLX and the highest strike offered was 900. And yet a professional analyst, someone who gets paid lots of money to do sound research, went as far to say that NFLX would hit 1,154. It never did.

Again, going out to the March 17, 2023 expiration date for NFLX the Probability that NFLX would hit the 900 strike prior to the expiration date was a paltry 11.92%. So, the probability of NFLX hitting a price level of 1,154 was incredibly low. Most likely in the 1% to 2% range, if that high.

Overall, with price targets of 615 and 1,154 we, as investors, are left with essentially coin flips and lottery tickets. Maybe that’s why we never hear about the probabilities of price targets? Because analysts don’t want investors to know the real probabilities behind their trades.

This is exactly why, again, as a professional options trader, I take a quantitative approach to the market.

I want to know the probability of a stock or ETF hitting a specific price target over a specified period of time. By knowing this information, I have the ability to not only choose a variety of options strategies, but I also have the ability to choose the probability of success for each and every trade I place.

That’s right, we all have the ability to use options strategies that allow us to choose our own probability of success … in real time. That’s powerful! And as an investor, or options trader, we need to harness this ability by expanding our arsenal of investment/trading strategies we use on a regular basis.

What is High-Probability Options Trading?

I am often amazed by the lack of common sense when it comes to investing. Investors seek the best possible information, but unfortunately most turn to the wrong sources.

For starters, turning on the television for investment advice, in most cases, is a big no-no. Yet, how many people listen intently to the daily drivel coming out of screaming mouths on CNBC?

Investors, particularly traders, should know that every trade spouted from these sources have, at best, a 50% chance of success. Add in transaction costs and the probability declines even further. Yet, the majority of investors and newbie traders take this approach, mostly because they are not privy to any other form of investing. Individual investors are not aware that there are investment strategies based purely on probabilities, not gut-driven analysis.

Which leads me to high-probability trading.

So, what exactly is high-probability options trading? And why is it so appealing to statistically inclined traders?

Well, the foundation of high-probability trading is based on two simple laws of statistics: the law of large numbers and the law of probability. It’s that simple.

Of course, trading around these statistical truths takes a bit more knowledge and skill, but the foundation is clear. And as always, you must have a disciplined risk-management plan in place.

Let’s take a look at an example of a high-probability trade using the high-probability mean reversion indicator as our tool for order entry.

An Example of a High-Probability Trade

Volatility, as seen through the VIX, was recently back above 30. And when the VIX kicks above 30, option premium is always inflated by historical standards, so it’s typically a great time to sell a little premium.

And one of my favorite ways to take advantage of inflated volatility is to sell premium using a variety of credit spreads. Bear call spreads, bull put spreads and iron condors allow me the freedom to make money in any type of market environment while keeping my risk defined. More importantly, I can be completely wrong in my directional assumption (if I even have one) and still make a return.

The reason is simple: If you take a high-probability approach you are inherently giving yourself a large margin of error. But when volatility is high, you can increase your margin of error while maintaining your typical return. Of course, you can also maintain your typical margin of error and have the opportunity to make a greater than typical return. That’s the beauty of options—you always have the ability to choose your own level of risk and reward with every trade you place.

One security that continues to offer plenty of opportunities to sell premium is the SPDR S&P 500 ETF, one of the most highly-liquid ETFs in existence.

Sample Trade: Bear Call Spread – S&P 500 ETF (SPY)

It amazes me how many people, some professional options traders included, run from challenging markets.

The beauty of options is that we have the ability to make money in any type of market, bull, bear or sideways.

I mean, come on, it’s been an incredible environment for bear call spreads and numerous other options strategies over the past few years. And while many investors have struggled to make a return, we’ve managed to make outsized gains using bear call spreads and several other credit spread strategies.

Just over a month ago SPY was trading for roughly 430.

My intent was to take off the trade well before the November 17, 2023, expiration date. For this bearish spread example, my preference was to go with a trade that had around an 80% to 85% probability of success.

Once we chose our expiration cycle (it will differ in duration depending on outlook, strategy and risk), we began the process of looking for a call strike within the November 17, 2023, expiration cycle that had around an 85% probability of success.

If you don’t have access to probabilities of success on your trading platform, look for the delta of the call strike. Without going into too much detail, look for a call strike that has a delta around 0.15 to 0.20, as seen below.

Since we were focused on using a bear call spread, we only cared about the upside risk.

The 452 call strike, with an 84.92% probability of success, worked for us. It was just inside the expected range, but we could adjust accordingly if the trade went awry. I wanted to have an opportunity to bring in 17.4% over the next 49 days, while keeping my probability of success at the onset of the trade around 80% or higher.

The short 452 call strike defined my probability of success on the trade. It also helped to define my overall premium, or return, on the trade. Basically, as long as SPY stayed below the 452 call strike at the November expiration in 49 days we had the ability to make a max profit on the trade. But, as I stated before, my preference was to take off profits early and, in most cases, reestablish a position if warranted, much like I have with past trades.

Also remember, because we are using an options selling strategy, time decay works in our favor. As we get closer and closer to expiration our premium will erode at an accelerated rate. As a result, we always have the opportunity to take a bear call spread or any credit spread off for a nice profit prior to expiration–unless, of course, SPY spiked to the upside over the next 49 days. But still, that doesn’t hide the fact that with this trade we could have been completely wrong in our directional assumption and still made a max profit.

Once I chose my short call strike, in this case the 452 call, I then proceeded to look at the other half of a 3-strike-wide, 4-strike-wide and 5-strike-wide spread to buy.

The spread width of our bear call defined our risk/capital on the trade.

The smaller the width of our bear call spread the less capital required, and vice versa for a wider bear call spread.

When defining your position size, knowing the overall defined risk per trade is essential. Basically, your premium will increase as your chosen spread width increases.

Bear Call Spread: November 17, 2022, 452/457 Bear Call Spread or Short Vertical Call Spread

Now that we chose our spread, we then executed the trade.

Simultaneously:

Sold to open SPY November 17, 2023, 452 strike call,

Bought to open SPY November 17, 2023, 457 strike call for a total net credit of roughly $0.74, or $67 per bear call spread.

- Probability of Success: 84.92%

- Total net credit: $0.74, or $74 per bear call spread

- Total risk per spread: $4.26, or $426 per bear call spread

- Max Potential Return: 17.4%

Again, as long as SPY stayed below our 452 strike at expiration in 49 days, I had the potential to make a max profit of 17.4% on the trade. In most cases, I would make less, as the prudent move is to buy back the bear call spread prior to expiration.

I always look to buy back a spread when I can lock in roughly 50% to 75% of the original credit. Since we sold the spread for $0.74, I would look to buy the spread back when the price of my spread hit roughly $0.35 to $0.15, if not less.

Of course, there are a variety of factors to consider with each trade. And we allow the probabilities and time to expiration to lead the way for our decisions. But, taking off risk, or at least half the risk, by locking in profits is never a bad decision, and by doing so we can take advantage of other opportunities the market has to offer.

Risk Management

Since we know how much we stand to make and lose prior to order entry we can precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so keeping each trade at a reasonable level (I use 1% to 5% per trade) allows not only the Law of Large Numbers to work in your favor … it also allows you to sleep well at night.

I also tend to set a stop-loss that is 1 to 2 times my original credit. Since I sold the 452/457 bear call spread for $0.74, if my bear call spread reached approximately $1.48 to $2.22, I would exit the trade.

Summary

Thankfully, we didn’t have to worry about buying back our spread for a loss. In fact, we bought back our trade shortly after we placed the trade for $0.03, or a 16.6% profit in 29 days.

Not a bad return, especially given our probability of success at the onset of the trade was a staggering 84.92%. The goal is to place three to five of these trades per month, using a variety of different underlying stocks and ETFs while maintaining a high-probability strategic approach.

Hopefully you now have a basic understanding of my statistical approach to trading! As always, if you have any questions regarding my high-probability approach, please feel free to email me at andy@cabotwealth.com. I am more than happy to answer any and all of your options-related questions.