The S&P 500 (SPY) has pushed 18.1% higher since the low set on June 17 and is now firmly entrenched in an overbought state, with the 200-day moving average looming overhead.

In fact, last Tuesday (August 16), the world’s largest stock index attempted to push through the 200-day moving average and failed.

The significance of the failure should not be overlooked.

Esteemed analyst Jason Goepfert of Sundial Capital Research pointed out shortly after the failure, “the S&P 500 has more assets benchmarked against than any other global index. And the 200-day moving average is the most consistently used indicator among those who look at price charts,” especially for longer-term trends. And for the first time in several months, “the S&P approached its 200-day average on Monday (and again Tuesday), and so far, it has failed to pop above it. This also happened in 2001 and 2008. Gulp.” One year later the S&P 500 was trading 23.0% and 33.5% lower.

[text_ad use_post='262604']

He also goes on to state, “While the S&P index neared its 200-day moving average, fewer than half of its member stocks have climbed above theirs. A hallmark of a healthy index is when 60% or more of the constituent stocks trade above their 200-day moving averages; we still haven’t seen that.”

Now, this isn’t to say that the S&P is going lower. There were also numerous instances where the index reversed and rallied higher. The fact is no one knows where this market is headed next.

But we know that we’ve seen an incredible sell-off that lasted more than six months, followed by a rally that over the past month has been relentless. And now the S&P stands only 11% lower on the year. So given how far we’ve come over the past few months, why would we not want to protect the good fortune of this latest rally while still allowing ourselves the ability to make a return on the upside, just in case the bulls continue to push the market higher? It’s kind of a no-brainer, especially if you know that it will only cost you a few dollars to potentially save you thousands just in case the market turns sour once again. So let’s give ourselves some options insurance. Here’s what I mean.

The Protective Collar Option Strategy

Given the scenario above, professional options traders prefer, in most cases, an options strategy known as a collar. The strategy’s goal is to preserve capital, while simultaneously allowing a position to continue making profits.

Unfortunately, greed deters investors from using protective collars. Hedge funds and even large institutional managers frequently use collars, so why don’t most individual investors?

It’s because most investors don’t realize that collars not only protect their unrealized profits, they also allow you to hold a position that you don’t want to sell but want some downside protection on just in case the stock takes a fall, while again, still allowing for some upside gains. Investors don’t realize collars offer one of the cheapest and most effective ways to reduce risk.

A collar is an options strategy that requires an investor, who already owns at least 100 shares of a stock, to purchase an out-of-the-money put option and sell an out-of-the-money call option.

Think of it as a covered call coupled with a long put. Here’s how it works:

- Long Stock (at least 100 shares)

- Sell call option to finance the purchase of the protective put

- Buy put option to hedge downside risk.

*Collar Option Strategy: long stock + out-of-the-money long put + out-of-the-money short call

That’s right, you read bullet point “3” correctly. You can actually finance most of your protection, so the cost of a collar is limited, if not free. Again, this is why intelligent investors and professional traders use collars habitually.

I’m going to use the heavily traded SPDR S&P 500 ETF (SPY) for my example. You could use collars on any stock or ETF that resides in your portfolio and, of course, offers liquid options.

“Options Insurance”

Let’s say we own 100 shares of SPY and would like to protect our return going forward. We still want to hold the ETF and participate in further upside. But we also realize that SPY has had an incredible run and want some downside protection, specifically over the short to intermediate-term.

1. With SPY currently trading for 427.89, we want to sell an out-of-the-money call as our first step in using a collar option strategy. I typically look for a call that has roughly 30-65 days left until expiration. So, to keep things simple, I am going with the October 21, 2022 options that are due to expire in 64 days.

I don’t want to sell calls that are too far out-of-the-money because I want to bring in a decent amount of premium to cover most, if not all, of the protective put I’m going to buy.

As a result, I try to sell a call with a delta somewhere around 0.20 to 0.45.. The SPY 440 October call option with a delta of 0.36 fits the bill. We can sell the 440 call option in October for $7.40, or $740 per call. We can now use the $740 from the call sold to help finance the put contract needed to achieve our goal of protecting returns.

2. The next and final step is to find an appropriate protective put to purchase. There are many different ways to approach this step, mostly centered around which expiration cycle to use. Should we go out 30 days in expiration? 60 days? 120 days? It really is up to you to decide.

I prefer to go out as far as I can without paying too much for my protective put.

I’m going to go out to the December 16 expiration cycle with 119 days left until expiration. This allows me to sell even more premium after my October 440 calls expire, thereby lowering the cost of our puts even further. I would say that we could most likely bring in conservatively speaking $12.00 worth of call premium, if not more.

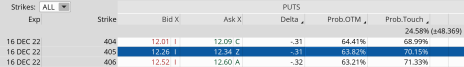

Knowing that I can bring in roughly that amount in call premium by December expiration, I plan on buying the 405 puts for roughly $12.30, or $1,230 per put contract.

This means that almost the entire cost of the December 405 puts will be covered by selling the our October 440 calls and, once they expire, selling more calls for the December expiration cycle. Essentially, it’s free insurance if SPY falls below the 405 strike prior to December expiration in 119 days.

As it stands our upside return is limited to 440 over the next 64 days. So if SPY pushes above 440 per share at October expiration, our stock would be called away. Basically, you would lock in any capital gains up to the price of 440. With SPY currently trading for roughly 428 (as of this writing), you would tack on an additional $12, or 2.8%, to your overall return.

But the key reason to use the strategy is not about making additional returns, it’s about protecting profits. And through using a collar option strategy, in this instance you are protected if SPY falls 5.3%, or below 405 (where we purchased our put option). Given that the low set two months ago in SPY was 362, this could be a viable play if protecting your capital is a priority. And remember, there are many ways to use the strategy.

Collars limit your risk at an incredibly low cost and allow you to participate in further, albeit limited, upside profit potential. I’m certain you won’t regret adding this easy yet effective options strategy to your investment tool belt, especially if you think there is potential for some downside as we move towards the end of the calendar year.

[author_ad]