Is now the time to start dipping your toes into the market, if you haven’t already?

Surely there are some good “buys” at these levels?

These are just two of the many questions I’m hearing right now, from the TV talking heads to readers of this daily. So, for those of you asking this question and just receiving a simple “yes” in return, well, I think I might have a better alternative to consider—it’s more of a treading-lightly approach. It’s called a wheel options strategy.

What is a Wheel Options Strategy?

The wheel strategy is an inherently bullish, mechanical options income strategy known by various names. The covered call wheel strategy, the income cycle, and the options wheel strategy are just a few of the many names that investors use. But one thing is certain: The systematic approach remains the same.

[text_ad use_post='262603']

More and more investors are choosing to use the wheel options strategy over a buy-and-hold approach because of the ability to create a steady stream of income on stocks you want to or already own.

The mechanics are simple.

- Sell Cash-Secured Puts on a stock until you are assigned shares (100 shares for every put sold)

- Sell Covered Calls on the assigned stock until the shares are called away

- Repeat the Process!

Basically, find a highly liquid stock that you are bullish on and have no problem holding over the long term. Once you find a stock that you’re comfortable holding, sell out-of-the-money puts at the price where you don’t mind owning the stock.

Keep selling puts, collecting even more premium, until eventually you are assigned shares of the stock at the strike price of your choice. Once you have shares of the stock in your possession begin the process of selling calls against your newly issued shares. Basically, you are just following a covered call strategy, collecting more and more premium until the stock pushes above your call strike at expiration. Once that occurs, your stock will be called away, thereby locking in any capital gains plus the credit you’ve collected.

No one can call a bottom, or top for that matter. But we can use probabilities to our advantage and collect premium while doing so to lower the cost basis of a stock that we eventually want to own, again, at the price of our choosing.

By selling puts, you are able to produce a steady stream of premium that can be used as a potential source of income or to simply lower your cost basis on the position.

I take this approach every time I wish to purchase a stock or ETF, regardless of if I am “bottom-feeding” or not. And oftentimes, once I am put shares of the stock, I simply sell covered calls against my newly acquired shares and use the wheel approach going forward.

Using the Wheel Strategy on Walmart

So, let’s say we are interested in buying Walmart (WMT), but not at the current price of 129.82.

You prefer to buy WMT for 120.

Now, most investors would simply set a buy limit at 120 and move on, right? But that approach is archaic. Because you can sell one put for every 100 shares of WMT and essentially create your own return on capital.

Some say it’s like creating your own dividend, and I agree.

A short put, or selling puts, is a bullish options strategy with undefined risk and limited profit potential. Short puts have the same risk and reward as a covered call. Shorting or selling a put means you are promising to buy a stock at the put strike of your choice. In our example, that’s the 120 strike.

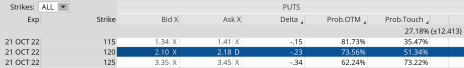

If you look at the options chains for WMT below you will quickly notice that for every 100 WMT shares we want to purchase at 120, we are able to bring in roughly $2.12, or $2.12 per put contract sold, every 70 days.

The trade itself is simple: Sell to open WMT October 21, 2022, 120 puts for a limit price of $2.12.

By selling the put options in October, you can bring in $212 per put contract for a return of 1.8% on a cash-secured basis over 70 days. That’s potentially $1,272, or 10.8% annually, per contract. You can use the premium collected from selling the 120 puts either as a source of income or to lower your cost basis.

Just think about that for a second.

You want to buy WMT at 120. It’s currently trading for roughly 129.82. By selling cash-secured puts at the 120 strike for $2.12 you can lower your cost basis to 117.88. That’s 9.2% below where the stock is currently trading. And you can continue to sell cash-secured puts on WMT over and over, lowering your cost basis even further until your price target is hit.

Or, like most investors, you could just sit idly by and wait for WMT to hit your target price of 120–losing out on all that opportunity cost and the inflated premium that can help to provide a decent source of consistent income.

In review, by selling cash-secured puts at the 120 strike we receive $212 in cash. The maximum profit is the $212 per put contract sold. The maximum risk is that the short 120 put is assigned and you have to buy the stock for 120 per share. But you still get to keep $212 collected at the start of the trade, so the actual cost basis of the WMT position is $120 – $2.12 = $117.88 per share. The 117.88 per share marks our breakeven point. A move below that level and the position would begin to take a loss.

But remember: most investors would have purchased the stock at its current price, unaware there was a better way to buy a security. We rarely take that approach. We know better. We understand we can purchase stocks at our own desired price and collect cash until our price target is hit. It’s a no-brainer.

[author_ad]