Overall, the markets and investor sentiment are back to a bullish stance, although with caution. The Dow Jones Industrial index has been mostly positive for the past month.

Unemployment continues to improve; housing prices—according to the latest Case-Shiller index—are stabilizing. We are seeing proof of that here in Tennessee. Several appraisers have told me that they are not going to let prices get out of hand—rising faster than true value—so that we don’t revisit the housing crisis of the last recession from 2007-2009. That’s a relief!

And, importantly, consumer confidence remains positive, rising from 109.8 to 113.8 in the last week.

State of the Markets

The Dow Jones Industrial Average has risen about 1,700 points since our issue last month. The VIX, or CBOE Volatility Index dropped considerably over the past 30 days, but recently, has begun to rise again, so we may be in for a bit more volatility in the next few weeks.

Dow Jones Industrial Average

S&P 500

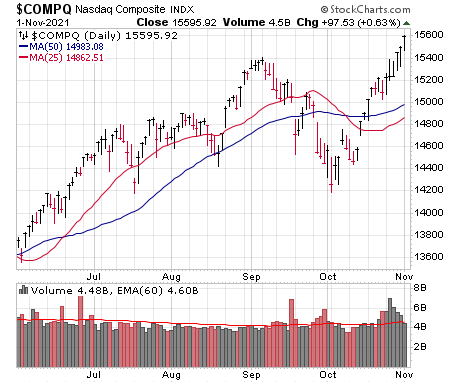

Nasdaq Composite Index

Feature Recommendation

I’ve always been intrigued by the franchising industry. In fact, in late 2000, my newsletter bought shares of Franchise Finance Corporation of America, a company whose clients included Applebee’s, Arby’s, Burger King, Checker Auto Parts, Chevron, Circle K, Citgo, Cracker Barrel, Hardee’s, Jack in the Box, Long John Silver’s, Midas Muffler Shops, Pizza Hut, 7-Eleven, Taco Bell, Texaco, Valvoline Instant Oil Change, and Wendy’s. We sold the stock four months later, when GE Capital bought it, for about a 14% gain. Not bad.

By the end of 2021, the franchising industry expects to have made a full recovery—back to 2019, pre-pandemic levels. Growth is forecast at 3.5%, with a net gain of 26,000 businesses, for a total of 780,188 franchise establishments in 2021—actually 6,585 units higher than 2019’s pre-COVID level.

Employment in the industry is generally in the retail, food, and service segments and for lower-skilled workers, but is expected to reach 800,000 jobs in the U.S. by the end of the year.

Growth sectors include: Commercial & residential services, real estate, retail food, products & services, and business services. And lodging, as well personal services (beauty salons, massage & spa studios, gyms, recreational facilities, child-related services, etc.), are expected to rapidly recover once COVID is behind us.

The U.S. Census Bureau reports that some 3% of the national GDP is accounted for by franchise accounts, providing a cumulative economic output of $757.2 billion.

In my real estate business, I’ve been part of a couple of franchises. They turned out to be too costly, so I took my firm independent a year or so ago.

When I was in banking, I had several customers that consulted with me about buying franchises--some made sense; others didn’t.

The bottom line is, if you are interested in purchasing a franchise, you’ll need to be ready to do some diligent research—on the industry, demographics, growth forecasts, franchise fees (a big one!), and what exactly you get for your money (such as training, equipment, supplies, accounting assistance, etc.).

But if you want to make money from a franchise, sometimes it’s just easier to buy shares in a franchise, or in the case of this month’s feature recommendation—a company that owns several different franchises.

Franchise Group, Inc. is a retailer, a franchisor operator, and acquirers franchised and franchisable businesses. It was formerly known as Liberty Tax, Inc., and changed its name to Franchise Group, Inc. in September 2019.

The company operates through four segments: Liberty Tax, Buddy’s, Sears Outlet, and Vitamin Shoppe. Franchise Group provides tax preparation services in the U.S. and Canada; and franchises and operates rent-to-own stores that lease durable goods, such as electronics, residential furniture, appliances, and household accessories to customers.

The company also operates as a retailer—primarily focused on providing customers with in-store and online access to purchase new, one-of-a kind, out-of-box, discontinued, obsolete, used, reconditioned, overstocked, and scratched and dented products in various merchandise categories, including home appliances, mattresses, furniture and lawn and garden equipment, at prices that are lower than list prices; and a specialty retailer of vitamins, minerals, herbs, specialty supplements, sports nutrition, and other health and wellness products.

Franchise Group also operates specialty pet stores (Pet Supplies Plus)

Franchise Group continues to grow internally, and by acquisition. The company recently announced that it closed its $81 million cash purchase of Sylvan Learning, which is forecast to add about $12 million in EBITDA this year. Tutoring service Sylvan has more than 700 locations, in 49 states, including more than 560 physical centers, of which all but six are franchised. This acquisition adds diversification into consumer services to Franchise Group’s growing list of sectors.

The company targets franchised or franchisable businesses that produce strong cash flow and support attractive and growing dividends to shareholders. They must:

- Provide industry diversification and demographic resiliency

- Demonstrate superior unit level economics

- Offer existing and prospective franchisees multiple brands to cluster and leverage infrastructure

Additionally, acquired businesses must have strong unit-economics and typically fit into one of three categories:

- Multi-unit franchise businesses that can be scaled

- Multi-unit businesses that are predominantly corporate-owned but can be refranchised and grown through franchising

- Multi-unit businesses that can be accretive to FRG

The company has beaten analysts’ earnings estimates for four consecutive quarters, including surpassing EPS forecasts by $0.30 in the last quarter. Franchise Group will report earnings on November 2. EPS is estimated at $0.80 on $809.41 million in revenues. Over the next five years, the company is expected to grow earnings by more than 15% annually.

| Franchise Group, Inc. (FRG) 52-Week Low/High: $22.76 - 41.50 Shares Outstanding: 40.23M Institutionally Owned: 69.75% Market Capitalization: $1.479B Dividend yield: 4.01%, paid quarterly Website: franchisegrp.com | Why Franchise Group:

|

Top Institutional Holders

| Holders | Shares | Date Reported | % Out | Value |

| Blackrock Inc. | 2,216,791 | 29-Jun-21 | 13.67% | 78,186,218 |

| Hood River Capital Management LLC | 1,675,764 | 29-Jun-21 | 10.34% | 59,104,196 |

| B. Riley Financial, Inc. | 1,613,595 | 29-Jun-21 | 9.95% | 56,911,495 |

| Vanguard Group, Inc. (The) | 1,386,641 | 29-Jun-21 | 8.55% | 48,906,828 |

| Wells Fargo & Company | 1,001,752 | 29-Jun-21 | 6.18% | 35,331,793 |

| Cannell Capital LLC | 813,551 | 29-Jun-21 | 5.02% | 28,693,943 |

| Ophir Asset Management Pty Ltd | 726,836 | 29-Jun-21 | 4.48% | 25,635,505 |

| American Financial Group Inc. | 686,115 | 29-Jun-21 | 4.23% | 24,199,276 |

| State Street Corporation | 645,603 | 29-Jun-21 | 3.98% | 22,770,417 |

| Punch & Associates Investment Management, Inc. | 625,125 | 29-Jun-21 | 3.86% | 22,048,158 |

Source: Yahoo! Finance

Technical Analysis

The shares of Franchise Group show some resistance at about 38 per share, but the Relative Strength Index (RSI), moving averages, and other technical indicators look positive for purchasing the shares right now.

Price Target: $49.50

Stop Loss: $30.00

Sector Round-Up

The best sectors for the month were Energy (up 8.97%), Technology (up 6.81%), and Consumer Discretionary (up 6.51%). The worst performers were Communication Services (down .47%), Healthcare (up 1.02%), and Consumer Staples (up 2.66%).

Our Feature Stock this month is part of the Consumer Cyclical or Discretionary sector.

Our pick this month fits into the moderate category, although as the economy strengthens, we may move it into the aggressive growth strategy segment.

Flows for 10/22/2021 - 10/28/2021

| Top 10 Creations (All ETFs) | ||

| Ticker | Fund Name | Net Flows |

| IVV | iShares Core S&P 500 ETF | 8,488.61 |

| QQQ | Invesco QQQ Trust | 2,005.72 |

| SPY | SPDR S&P 500 ETF Trust | 1,970.94 |

| VOO | Vanguard S&P 500 ETF | 1,704.64 |

| FALN | iShares Fallen Angels USD Bond ETF | 1,174.44 |

| SDY | SPDR S&P Dividend ETF | 1,020.46 |

| NUGO | Nuveen Growth Opportunities ETF | 1,003.00 |

| USMV | iShares MSCI USA Min Vol Factor ETF | 996.70 |

| TIP | iShares TIPS Bond ETF | 772.47 |

| VCSH | Vanguard Short-Term Corporate Bond ETF | 622.44 |

| Top 10 Redemptions (All ETFs) | ||

| Ticker | Fund Name | Net Flows |

| LQD | iShares iBoxx USD Investment Grade Corporate Bond ETF | -1,410.49 |

| IGSB | iShares 1-5 Year Investment Grade Corporate Bond ETF | -1,291.08 |

| BBJP | JPMorgan BetaBuilders Japan ETF | -1,071.86 |

| TQQQ | ProShares UltraPro QQQ | -949.60 |

| XLF | Financial Select Sector SPDR Fund | -760.15 |

| IXN | iShares Global Tech ETF | -568.76 |

| VLUE | iShares MSCI USA Value Factor ETF | -547.83 |

| XLE | Energy Select Sector SPDR Fund | -490.94 |

| FAS | Direxion Daily Financial Bull 3x Shares | -463.72 |

| IXG | iShares Global Financials ETF | -447.15 |

Source: ETF.com

Portfolio Updates

Conservative Stocks

As a conservative investor, you are less willing to accept market swings and significant changes in the value of your portfolio in the short or long term. Capital preservation is your primary goal, and you may plan on using the principal from your investments in the near term, preferably as a steady income stream. The average level of return you expect to see is 5%-10%, annually.

The Coca-Cola Company (KO)

Coca-Cola shares continue to move nicely, recovering from the pandemic, and buoyed by a very good earnings report.

The company’s EPS for the third quarter was $0.65, beating estimates of $0.58. And revenues also beat, with Coca-Cola posting top-line sales of $10.04 billion vs. $9.75 billion expected.

Coca-Cola raised its full-year profit forecast on Wednesday, banking on higher prices and demand for its sodas globally to counter rising costs due to supply chain disruptions.

The company also raised its full-year profit forecast to show adjusted earnings per share rising 15% to 17%, compared with a prior forecast of a 13% to 15% increase. Hold

Sun Life Financial Inc. (SLF)

Sun Life Financial Inc. will release its third-quarter 2021 earnings on November 3, after markets close. The company is expected to post EPS of $1.23.

Sun Life also announced it is acquiring DentaQuest, the nation’s second-largest provider of dental benefits, with 33 million members. The price is $2.48 billion, and Sun Life expects the purchase to add $100 million to its income in the first year following closing. Buy

Mueller Water Products, Inc. (MWA)

Mueller increased its quarterly dividend by approximately 5.5% to 5.80 cents ($0.058) per share from 5.50 cents per share, payable on or about November 22, 2021, to stockholders of record as of the close of business on November 10, 2021.

The number of hedge funds invested in Mueller’s shares rose by two, bringing the total to 22 hedge funds who have MWA shares in their portfolios. Buy

TC Energy Corporation (TRP)

TC Energy Corporation will announce third-quarter earnings on November 5, 2021. Estimated EPS is $0.80 on $2.7 billion in sales.

The company and Nikola Corp have signed a strategic collaboration to co-develop large-scale hydrogen (150 tons per day) production hubs in the U.S. and Canada. Nikola will use the hydrogen to fuel its Class B fuel cell electric vehicles (FCEVs), and plan to eventually sell it to third parties. Hold

Moderate Stocks

As a moderate investor, you seek longer-term investment gains. You are comfortable with some swings in your portfolio’s performance, but generally seek to invest in more conservative stocks that build wealth over a substantial period of time. The average level of return you expect to see is 10%-25% annually.

National Storage Affiliates Trust (NSA)

Hedge funds also continue to buy into NSA shares, rising from 14 funds in March to 21.

The company will release financial results for the three months ended September 30, 2021 on November 2, 2021. Analysts expect EPS of $0.37 on $148.53 million in revenues.

NSA is benefiting from strong demand for space in its self-storage facilities. And the REIT continues to grow by acquisition. It purchased 20 properties in the second quarter for around $270 million and expects to spend a total of $1.1-1.3 billion on purchases this year. NSA is forecasting FFO to rise by 24.3% this year. Hold

Aggressive Stocks

As an aggressive investor, you primarily seek capital appreciation and are open to more risk. Swings in the market, whether short term or long term do not impact your investment decisions and you have confidence that volatility is necessary to achieve the high return-on-investment you are looking for. You typically expect a 25%+ return, annually, though you do not need your principal investment immediately.

Evolent Health, Inc. (EVH)

Another hedge-fund darling, Evolent Health was in 24 hedge funds’ portfolios at the end of the second quarter of 2021—an all-time high. Park West Asset Management announced that it has a $21,625,000 stake in the company.

The company will release its third-quarter 2021 operating results on Wednesday, November 3, 2021, and is expecting a loss of -$0.03 per share on revenues of $225.62 million. Buy

Entravision Communications Corporation (EVC)

Entravision Communications will release its third-quarter 2021 financial results on November 4, 2021. Analysts are forecasting EPS of $0.09 on revenues of $210.77 million. Buy

OneMain Holdings, Inc. (OMF)

The shares of OneMain Holdings pulled back after the company announced that it would offer an additional 10,010,208 shares of its common stock by an entity managed by affiliates of Apollo Global Management, Inc. (the “selling stockholder”). The company will purchase 1,870,000 shares of common stock that as part of the offering.

The shares had climbed after the company’s stronger-than-expected third-quarter earnings. Adjusted earnings were $2.37 per share, beating analysts’ expectations of $2.29 per share, and higher than last year’s $2.19 per share.

It’s a good time to buy a few shares, if you do not own the stock. Buy

Primoris Services Corporation (PRIM)

Now that the infrastructure bill is getting close to passage (I know, close doesn’t count!), Primoris is starting to show some decent signs.

The company just announced several civil contracts of more than $115 million.

Primoris will announce earnings for the third quarter 2021 on November 8, with analysts expecting EPS of $0.78 on $991.51 million in sales. Buy

Textainer Group Holdings Limited (TGH)

Textainer shares continue to pay off for us. The company will announce third-quarter results on November 4. Analysts are forecasting EPS of $1.22 on revenues of $191.61 million. I expect that we’ll see some impact from the standstill at ports around the world, but that should be temporary. Hold

ETFs & Mutual Funds

Cohen & Steers REIT and Preferred Income Fund, Inc. (RNP) continues to rise, up 22% now. We’re also seeing good movement in Artisan Mid Cap Fund Investor Class (ARTMX), up 50%; and Fidelity Balanced Fund (FBALX), up 26%.

Two ETFs that are still good buys are Invesco Aerospace & Defense (PPA) and Invesco S&P Global Water Index (CGW). Buy

We’ll let all our other funds and ETFs ride for now. Hold

Current Portfolio

| Wall Street’s Best Stocks Portfolio | ||||||||

| Conservative Stocks | Symbol | Date Bought | Price Bought | Price on 11/1/21 | Dividends YTD | Div Freq. | Gain/ Loss % | Rating |

| The Coca-Cola Company | KO | 2/2/21 | 41.90 | 56.17 | 1.26 | Quarterly | 37% | Hold |

| Mueller Water Products, Inc. | MWA | 8/3/21 | 14.93 | 16.56 | 0.06 | Quarterly | 11% | Buy |

| Sun Life Financial Inc. | SLF | 6/2/21 | 54.08 | 57.21 | 0.44 | Quarterly | 7% | Buy |

| TC Energy Corporation | TRP | 2/2/21 | 42.73 | 54.50 | 2.09 | Quarterly | 32% | Hold |

| Moderate Stocks | Symbol | Date Bought | Price Bought | Price on 11/1/21 | Dividends YTD | Div Freq. | Gain/ Loss % | Rating |

| National Storage Affiliates Trust | NSA | 2/2/21 | 27.39 | 62.68 | 1.14 | Quarterly | 133% | Hold |

| Spirit Realty Capital | SRC | 2/2/21 | 42.27 | 49.60 | 1.89 | Quarterly | 22% | Hold |

| The Toronto-Dominion Bank | TD | 2/2/21 | 40.82 | 73.14 | 1.89 | Quarterly | 84% | Hold |

| Aggressive Stocks | Symbol | Date Bought | Price Bought | Price on 11/1/21 | Dividends YTD | Div Freq. | Gain/ Loss % | Rating |

| Entravision Communications Corporation | EVC | 9/7/21 | 7.45 | 8.47 | 0.03 | Quarterly | 14% | Buy |

| Evolent Health, Inc. | EVH | 10/5/21 | 32.20 | 29.37 | 0.00 | — | -9% | Buy |

| OneMain Holdings, Inc. | OMF | 2/2/21 | 29.49 | 53.25 | 8.85 | Quarterly | 111% | Buy |

| Primoris Services | PRIM | 3/2/21 | 34.98 | 27.58 | 0.18 | Quarterly | -21% | Buy |

| Textainer Group Holdings | TGH | 4/1/21 | 28.77 | 39.29 | 0.00 | — | 37% | Hold |

| ETFs | Symbol | Date Bought | Price Bought | Price on 11/1/21 | Dividends YTD | Div Freq. | Gain/ Loss % | Rating |

| Cohen & Steers REIT and Preferred Income | RNP | 2/2/21 | 23.34 | 27.54 | 1.12 | Monthly | 23% | Hold |

| Consumer Discretionary Select Sector SPDR | XLY | 2/2/21 | 116.94 | 204.84 | 0.79 | Quarterly | 76% | Hold |

| First Trust Dow Jones Global Select Dividend Index Fund | FGD | 5/5/21 | 26.11 | 25.87 | 0.75 | Quarterly | 2% | Hold |

| Invesco Aerospace & Defense ETF | PPA | 4/1/21 | 72.87 | 73.86 | 0.20 | Quarterly | 2% | Buy |

| Invesco S&P Global Water Index ETF | CGW | 6/2/21 | 54.03 | 59.33 | 0.00 | Yearly | 10% | Buy |

| SPDR S&P 500 ETF Trust | SPY | 2/2/21 | 218.25 | 460.04 | 4.08 | Quarterly | 113% | Hold |

| Vanguard Dividend Appreciation Index | VIG | 2/2/21 | 105.13 | 164.25 | 1.89 | Quarterly | 58% | Hold |

| Mutual Funds | Symbol | Date Bought | Price Bought | Price on 11/1/21 | Dividends YTD | Div Freq. | Gain/ Loss % | Rating |

| Artisan Mid Cap Fund Investor Class | ARTMX | 2/2/21 | 37.29 | 56.63 | 0.00 | Yearly | 52% | Hold |

| Fidelity Balanced | FBALX | 2/2/21 | 23.88 | 30.25 | 0.19 | Quarterly | 27% | Hold |

| Sold Positions | ||||||||

| Stocks | Symbol | Date Bought | Date Sold | Price Bought | Price Sold | Div Freq. | Dividends YTD | Gain/ Loss % |

| cbdMD, Inc. | YCBD | 2/2/21 | 3/31/21 | 2.25 | 4.06 | — | 0.00 | 80% |

| Clean Ener-gy Fuels Corp. | CLNE | 2/2/21 | 3/2/21 | 2.63 | 13.66 | — | 0.00 | 419% |

| Conagra Brands, Inc. | CAG | 2/2/21 | 8/3/21 | 29.87 | 33.33 | Quarterly | 0.59 | 14% |

| Investors Bancorp, Inc. | ISBC | 7/6/21 | 8/3/21 | 13.90 | 13.72 | Quarterly | 0.14 | 0% |

| Orange S.A. | ORAN | 5/4/21 | 7/7/21 | 12.61 | 11.16 | Semi Annually | 0.00 | -12% |

| Unilever PLC | UL | 2/2/21 | 5/3/21 | 42.84 | 59.12 | Quarterly | 0.00 | 38% |

| ETFs | Symbol | Date Bought | Date Sold | Price Bought | Price Sold | Div Freq. | Dividends YTD | Gain/ Loss % |

| Technology Select Sector SPDR | XLK | 2/2/21 | 3/2/21 | 42.01 | 133.88 | Quarterly | 0.00 | 219% |

| Mutual Funds | Symbol | Date Bought | Date Sold | Price Bought | Price Sold | Div Freq. | Dividends YTD | Gain/ Loss % |

| T. Rowe Price Blue Chip Growth | TRBCX | 2/2/21 | 4/1/2021 | 90.40 | 169.55 | Yearly | 0.00 | 88% |

| Needham Small Cap Growth Retail Class | NESGX | 2/2/21 | 5/5/2021 | 14.61 | 27.28 | Yearly | 0.00 | 87% |

| Fidelity Select Industrials Portfolio | FCYIX | 3/2/21 | 6/2/21 | 37.95 | 37.66 | Quarterly | 0.73 | 1% |

| Cohen & Steers Infrastructure Fund, Inc | UTF | 2/2/21 | 6/24/21 | 37.95 | 27.85 | Monthly | 0.62 | -25% |

The More You Know

I’m frequently asked by subscribers, as well as Money Show attendees, “How can I learn more about investing?”

I asked myself this question more than thirty years ago when I first embarked upon my investing career, and the answer was easy—I just read everything I could find that addressed the subject of investing.

Of course, that was before the advent of Internet access for the masses, as well as the proliferation of TV channels devoted to investing. Today, there is a plethora of information bombarding investors, many good—even great—sources of education, but, unfortunately, a lot of bad advice, too.

And although I’ve been in this business for many years, one of my favorite pastimes continues to be reading and learning about what’s new in investing. Truthfully, I am often amazed at the drivel that gets published, purporting to be “proven, successful” investing strategies. Most of this stuff has just one purpose—enriching the author. And while you may first think, so what—this is American capitalism at its best—the problem is, some of this advice is very detrimental to the investors who act upon it.

I’ve pretty much seen it all, including:

- Systemic strategies that work well just a couple of times but are extrapolated for investment essays or books as “make you rich,” “never fail,” “can’t miss” guides to investing success

- Intentional, fraudulent advice aimed at hyping worthless stocks

- Just plain, old bad advice that promises great wealth, but often forgets to mention the tremendous risks involved in chasing those riches

I hate seeing the individual investor taken for a ride, so I thought it might be a good idea to give you some recommendations for investment books that I genuinely feel do offer some good tips for investors.

Now, I have to say, as a diversified, value-growth investor, I also don’t always agree with them about all of their advice. After all, not many financial professionals agree about much of anything!

But my purpose here is to give you a selection of publications that contain a wide range of pretty solid advice, which will, hopefully, inspire you to seek even more information to help you advance your investing success.

Hands-down, the most important book I have ever encountered and which I credit with helping me begin my career on the right track is:

Graham and Dodd’s Security Analysis, by Cottle, Murray & Block. First printed in 1934, this book is the bible of security analysts everywhere, delving into exactly how to analyze a company for investment purposes. It is not a chatty, conversational tome like most investment books on your retailer’s shelf, but it is the essential book to begin with if you are a serious long-term investor.

A very good accompaniment to the above book, The Intelligent Investor, by Benjamin Graham (yes, the Graham from the above book), first published in 1949, gives the investor much greater insight into this value investor’s thinking—strategies that remain viable and successful, almost 60 years after its first publication.

For a couple more oldies but goodies, try ex-Fidelity Magellan manager, Peter Lynch’s One up on Wall Street, and Beating the Street. While some of the data may be out-of-date, the commonsense advice is still good.

Widening our search, it’s imperative that even if you are not a fixed income investor, that you are aware of and knowledgeable about income investing. Income investing is not your grandfather’s version—corporate and government bonds and certificates of deposit—any longer. A much wider range of income investments is available now, so many that the word “fixed” is being erased from the category name. But a book was written a few years ago by Richard Lehmann, now retired, but who used to write Forbes’ ISI newsletter (now written by Martin Fridson), and a newsletter I have quoted extensively in my Wall Street’s Best Digest newsletter. I think Richards’ book, Investing Today: Safety and High Income through Diversification, is still very worthwhile.

For a spirited view of the mutual fund industry, try Vanguard founder John Bogle’s Common Sense Investing.

And if you are looking for an investment primer—the A, B, C’s of investing—you can always read my own book, Make Money Buying and Selling Stocks, available on Amazon.com.

These are just a few of my favorites and will hopefully broaden your investment education. I encourage you to keep reading, seeking more knowledge. But please maintain a skeptical eye. If it sounds too good to be true, it probably is!

The next Wall Street’s Best Stocks issue will be published on December 7, 2021.