It’s been an interesting month in the markets. Since last month’s issue, the Dow Jones Industrial Average lost about 1,200 points, mostly due to the new COVID variant, Omicron, which has now hit the United States. The jury is still out as to whether or not the variant is more contagious, more dangerous, etc. Also, there remains some market uncertainty due to the polarization in Washington, D.C. And, lastly, Fed Chairman Powell’s remarks about speeding up tapering also affected investors.

But overall, we’ve had some pretty good days, in addition to the declines. After all, the economy is still chugging right along. Housing remains very strong, with price rises seeming to moderate for the moment. There is still a huge dearth of inventory, and now the slow real estate season is upon us. Perhaps that will give homebuilders an opportunity to play catch-up, as builders in my area tell me that they are now more than two years out. And some are not taking any more folks on their waiting lists! I have myself on such a list, and I’m looking at about 2 ½ years until I can be in my new home.

State of the Markets

All the broad market averages—The Dow Jones Industrial Average, the S&P 500, and the Nasdaq, have taken somewhat of a beating this past month. Also, the VIX, or CBOE Volatility Index has been on an upward tear, showcasing the market volatility and investor uncertainty.

Dow Jones Industrial Average

S&P 500

Nasdaq Composite Index

Feature Recommendation

It should come as no surprise to my faithful subscribers that I love education! When I was in banking, I taught banking and economics courses at a local college for about six years. Then, after I focused my career on investing, I spent many years traveling the country to speak at various conferences such as the Money Shows, NAIC, and Investment Expos.

So, when I see an educational stock that looks interesting, I’m all in!

And those of you who have been part of our Cabot family for a while will, no doubt, recognize this stock. I recommended it a few years ago as my favorite stock at one of our Cabot Investing Summits.

Lincoln Educational Services (LINC) is involved in career-oriented post-secondary education services, delivered to high school graduates and working adults in the United States.

These services are designed for folks who decide that a four-year college or university is not for them—for any number of reasons. And that adds up to a lot of people! As of 2020, according to Statista.com, just 37.5% of Americans have a college degree. And that percentage is declining. In fact, college enrollment peaked in 2010, at 21 million, as reported by educationdata.org, and is now 17.5 million, according to the most recent statistics. That’s a little more than half the 18-24 population in the U.S. (about 30 million, according to datacenterkidscount.org.

Here in the U.S. about 65% of all open jobs require a bachelor’s or associate degree. That’s unfortunate, because in many cases, a degree isn’t even needed for the job; and, secondly, requiring a degree leaves a whole lot of very qualified people looking for jobs with adequate living wages. It’s a shame, but I’ve read that some 61% of human resource managers won’t even look at a resume unless the applicant has a four-year degree.

Consequently, businesses are missing out on tons of qualified workers.

Thousands of good students can’t get into college, due to finances. This year, the median annual household income in the U.S. is $79,900. According to collegedata.com, annual tuition in the U.S. is now:

- $37,650 at private four-year colleges

- $10,560 at public four-year colleges (in-state residents)

- $27,020 at public four-year colleges (out-of-state residents)

And when you add in room and board, lab fees, books, etc., a year at a four-year college can add up to a whopping $70,000 per year!

That’s outrageous. I know I’m dating myself, but when I went to Ohio State for my bachelor’s degree, as an in-state student, I spent about $3,000 per year.

Not many families can afford such high educational costs. That’s why it’s imperative that we have other avenues for our high school graduates to build thriving, successful, and economically viable careers.

And that’s what these technical or trade schools or vocational academies offer. According to bestcolleges.com, a student can get a full certificate at such a school for a total cost of around $33,000. That’s still a lot of money, but over two-three years, it’s much more palatable.

The other good news is that students at most of these schools are also eligible for federal financial aid, as long as the program they choose runs longer than 15 weeks. If it’s shorter, students may still apply for federal loans.

It’s true that folks who have a bachelor’s degree usually make more money over their lifetimes than those that don’t. But of those students that enroll in a college, more than 40% don’t graduate. So, add those students to the ones that never enter college, and you have a lot of folks who need usable skills.

So, it’s good to know that trade schools offer an alternative, and one that averages $42,000 per year in salaries.

Here are some average trade school graduate salaries:

| Carpenter | $48,330 per year |

| Ironworker | $53,650 per year |

| Plumber | $55,160 per year |

| Electrician | $56,180 per year |

| Home Inspector | $60,710 per year |

| Dental Hygienist | $76,220 per year |

| Elevator Mechanic | $84,990 per year |

| Construction Manager | $95,260 per year |

| Air Traffic Controller | $122,990 per year |

Source: Bestcolleges.com

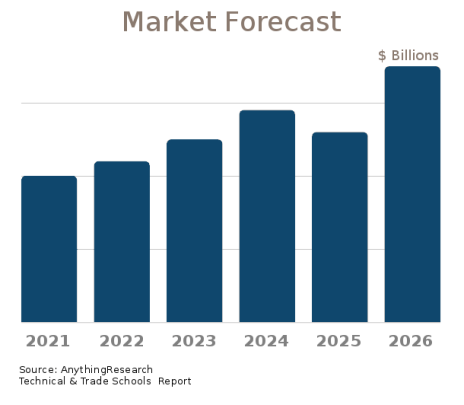

The Trade & Technical Schools market in the U.S. is worth about $13.1 billion, and as you can see by the following graph, it’s steadily rising, with a big jump forecast by 2026.

And that’s great news for our Featured Stock, Lincoln Educational Services. There have been a lot of new companies in this space in the last decade or so, but Lincoln is an old-timer; it’s been around since 1946.

Lincoln operates through three segments: Transportation and Skilled Trades, Healthcare and Other Professions, and Transitional. It offers associate degrees, and diploma and certificate programs in automotive technology; skilled trades, including welding, computerized numerical control, and electrical and electronic systems technology, as well as heating, ventilating, and air conditioning programs; healthcare services comprising nursing, dental and medical assistant, claim examiner, medical administrative assistant, etc.; hospitality services, such as culinary, therapeutic massage, cosmetology, and aesthetics; and information technology.

The company operates 22 schools in 14 states under the Lincoln Technical Institute, Lincoln College of Technology, Lincoln Culinary Institute, and Euphoria Institute of Beauty Arts and Sciences, as well as associated brand names. As of June 30, 2021, it had more than 14,000 students.

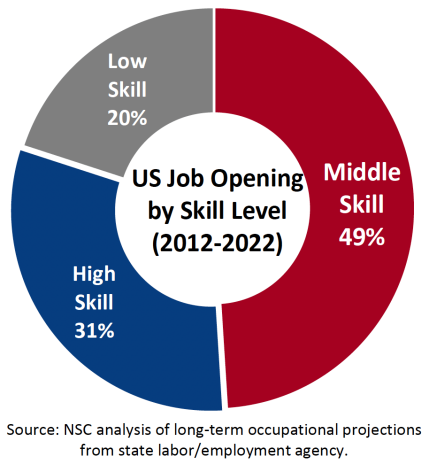

Lincoln offers two segments that focus on “middle skills training,” which accounts for about 49% of current job openings.

Transportation and Skilled Trades

- 13 Campuses

- Approximately 9,500 students

- High employer demand for training in Automotive, Diesel, HVAC, CNC, Welding, Electrical

- Growing list of industry partners

Healthcare and Other Professions

- 9 Campuses

- Approximately 4,500 students

- Growing demand for healthcare professionals

- Strong demand by students especially for licensed practical nursing

And according to HVAC Excellence, the nation’s largest and oldest accrediting body, the company is also a national leader in specialized technical training, leading all educational institutions in the country with 36 Certified Master HVAC/R Educators (CMHEs). In fact, more than 25% of all certified master educators in the HVAC industry are now employed within the Lincoln Tech Group of Schools.

Lincoln just reported earnings of $0.11 per share, beating analysts’ estimates of $0.09 per share, and higher than last year’s $0.08 per share. Revenues were $89.06 million, beating forecasts by 7.60%, and rising from $78.79 million a year ago. That makes the fourth consecutive quarter that the company has surpassed consensus EPS estimates.

In other news, Lincoln continues to expand. The company announced that, along with Republic Services, Inc. it has opened the diesel industry’s first dedicated training facility in Dallas, TX.

The company is expected to grow at an annual rate of 15% over the next five years.

Lincoln’s shares are now trading at a forward P/E of just 11.83, signaling undervaluation. The mean analyst short-term price target is $9.50. My long-term target is $11.50, which would give us appreciation of around 60%.

I recommend that you Buy the shares of Lincoln Educational Services.

| Lincoln Educational Services Corporation (LINC) 52-Week Low/High: $5.25 - 8.20 Shares Outstanding: 27M Institutionally Owned: 68.45% Market Capitalization: $195.215MWebsite: lincolntech.edu | Why Lincoln Educational:

|

Top Institutional Holders

| Holders | Shares | Date Reported | % Out | Value |

| Heartland Advisors Inc. | 2,253,850 | 29-Sep-21 | 8.35% | 15,078,256 |

| Paradice Investment Management, LLC | 1,907,344 | 29-Sep-21 | 7.06% | 12,760,131 |

| Alyeska Investment Group, L.P. | 1,857,549 | 29-Sep-21 | 6.88% | 12,427,002 |

| Nantahala Capital Management, LLC | 1,434,674 | 29-Sep-21 | 5.31% | 9,597,969 |

| Vanguard Group, Inc. (The) | 1,228,803 | 29-Sep-21 | 4.55% | 8,220,692 |

| Punch & Associates Investment Management, Inc. | 1,152,054 | 29-Sep-21 | 4.27% | 7,707,241 |

| Royce & Associates LP | 836,725 | 29-Sep-21 | 3.10% | 5,597,690 |

| Renaissance Technologies, LLC | 728,878 | 29-Sep-21 | 2.70% | 4,876,193 |

| RBF Capital, LLC | 563,798 | 29-Sep-21 | 2.09% | 3,771,808 |

| Juniper Investment Company, LLC | 563,274 | 29-Sep-21 | 2.09% | 3,768,303 |

Source: Yahoo! Finance

Technical Analysis

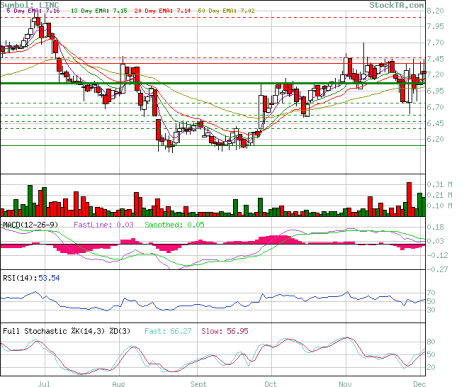

The shares of Lincoln Educational Services are trading above both their 50-day and 200-day moving averages. The stock is trading right now at a resistance level, with the 14-day RSI at $9.38. All are positive signals.

Price Target: $11.50

Stop Loss: $6.00

Portfolio Updates

Conservative Stocks

As a conservative investor, you are less willing to accept market swings and significant changes in the value of your portfolio in the short or long term. Capital preservation is your primary goal, and you may plan on using the principal from your investments in the near term, preferably as a steady income stream. The average level of return you expect to see is 5%-10%, annually.

The Coca-Cola Company (KO)

Billionaire Jim Simons of Renaissance Technologies has been on a Coca-Cola stock buying spree, adding more than 6 million shares in the third quarter, which has tripled his holdings in the stock.

This increased interest in Coca-Cola may be both a defensive and inflation play. The stock yields 3.17%, which comes in handy in case of a market slowdown in appreciation.

Coca-Cola just bought the remainder of sports drinks purveyor BodyArmor, which has #2 market share in that category, with the intent of further eroding Gatorade’s long-held leading (75%) position.

The company also signed a worldwide marketing network partner agreement with WPP, the global sales leader, to help Coca-Cola capture more of the global sports drink market. That market is expected to grow by 5.3% annually over the next 10 years.

Our shares are up 30%. Continue to Hold.

Sun Life Financial Inc. (SLF)

Sun Life Financial reported earnings for its third quarter. Net income of $765 million (C$902 million) rose 21% year over year, as a result of “business growth, favorable credit experience, and higher tax-exempt investment income.” Insurance sales were up by 4.2% year over year to $532.6 million (C$628 million), and Wealth sales increased by 8.9%, to $43 billion (C$50.7 billion).

Sun Life recently made another acquisition—the $48,289,152 purchase of Dialogue Health Technologies Inc., a Canadian digital healthcare and wellness platform.

The company said it is now turning its acquisitive power to Asia, which currently comprises 15% of the company earnings. Sun Life will focus on increasing earnings by 15% annually in that area of the globe.

The company declared an $0.11 per share dividend, payable on December 31, 2021 to shareholders of record at the close of business on November 24, 2021. When added to the quarterly dividend of $0.55 per share declared on November 3, 2021, that’s a nice extra $0.66 in the pockets of Sun Life shareholders. Buy

Mueller Water Products, Inc. (MWA)

Mueller Water Products also reported but missed earnings estimates by $0.07. EPS was $0.19. It was the first time in four quarters for an earnings miss by the company.

On the earnings call, President & CEO J. Scott Hall said results were heavily impacted by supply shortages, labor availability, and the rising cost of raw materials, due to the pandemic. For instance, scrap steel and brass ingot prices are up more than 50% from last year. However, demand remains very strong, and the company’s forecasts for full-year 2022 consolidated net sales to increase between 4% and 8%, with adjusted EBITDA also increasing between 4% and 8% as compared with the prior year. Buy

TC Energy Corporation (TRP)

Also reporting earnings, TC Energy’s third-quarter 2021 adjusted EPS was $0.80 (up from $0.71 last year), with the U.S. Natural Gas Pipelines segment performing nicely, which was partially offset by a weak performance of the Canadian Natural Gas Pipelines, and the Power and Storage segments.

The company declared a quarterly dividend of $0.87 per share.

We are up 13% on our shares. Hold

Moderate Stocks

As a moderate investor, you seek longer-term investment gains. You are comfortable with some swings in your portfolio’s performance, but generally seek to invest in more conservative stocks that build wealth over a substantial period of time. The average level of return you expect to see is 10%-25% annually.

National Storage Affiliates Trust (NSA)

National Storage reported funds from operations (FFO) of $0.57 per share, beating the analysts’ estimates of $0.56 per share, and considerably higher than last year’s $0.44.

Yearly earnings estimates have been rising, with most analysts now expecting $1.00 per share from the company. NSA also declared a dividend of $0.45 per share payable on December 30, 2021 to shareholders of record on December 15, 2021.This is a 28.6% increase over last year’s dividend.

We are sitting on gains of 134% in our shares. Continue to Hold.

Spirit Realty Capital, Inc. (SRC) reported quarterly FFO of $0.84 per share, beating the forecast by a penny and also beating last year’s FFO of $0.72. During the quarter, the REIT Invested $294.2 million, including the acquisition of 31 properties.

Also battered a bit by the market this month, this 5.61% dividend payer is being upgraded to Buy.

The Toronto-Dominion Bank (TD) declared a dividend of $0.89 per share (an increase of 13%) after releasing quarterly earnings. The bank earned C$2.09 a share, beating estimates of C$1.96. Net interest margins were up 5%, but CEO Bharat Masran said on the earnings call, “While we have good momentum entering the year, the road ahead is likely to be bumpy,” due to rising inflation and the withdrawal of stimulus funds.

Analysts (and I) remain bullish on the stock. We are ahead 89%. If you don’t own it, it’s ok to Buy a little here. Otherwise, Hold.

Aggressive Stocks

As an aggressive investor, you primarily seek capital appreciation and are open to more risk. Swings in the market, whether short term or long term do not impact your investment decisions and you have confidence that volatility is necessary to achieve the high return on investment you are looking for. You typically expect a 25%+ return, annually, though you do not need your principal investment immediately.

Evolent Health, Inc. (EVH)

Evolent Health posted a quarterly loss of $0.03 per share, meeting analysts’ estimates. Revenues were $222.47 million.

Evolent shares were hit during the market gyrations of the past month, so remain at a very good entry point. Buy

Entravision Communications Corporation (EVC)

Entravision Communications saw its revenues of $199.01 million beat analysts’ estimates by 0.21%. EPS also beat forecasts, coming in at $0.14, above the estimate of $0.09 per share.

Going forward, two analysts have increased their forward EPS numbers, and the company is expected to grow by 15.9% next year.

Also still in a good buying range, we recommend these shares as a Buy.

OneMain Holdings, Inc. (OMF)

OneMain Holdings has seen its Chairman Douglas Shulman scooping up shares, increasing his stake by 9.3% over the previous year. That is usually a great sign! Our shares of OneMain are up 104%. I continue to think there is plenty more room for growth. Buy

Primoris Services Corporation (PRIM)

I’m throwing in the towel on Primoris. I thought the signing of the infrastructure bill would boost the shares, but the market turned, taking the shares down further. We may reenter at some future point as infrastructure building takes off. Sell

Textainer Group Holdings Limited (TGH)

Textainer Group posted quarterly earnings of $1.52 per share, handily beating the estimate of $1.19 per share, and absolutely pummeling last year’s $0.41 per share. That’s the fourth quarter in a row that TGH has surpassed earnings forecasts.

Revenues also beat, coming in at $195.83 million, and also beating last year’s revenues of $149.13 million. We are up 15% on our shares. Continue to Hold.

ETFs & Mutual Funds

This month, our leading ETFs and Funds are SPDR S&P 500 ETF Trust (SPY), up 111%, and Consumer Discretionary Select Sector SPDR Fund (XLY), up 74%. Vanguard Dividend Appreciation Index Fund ETF Shares (VIG) is also performing well, up 58%.

There’s still time to buy: Invesco Aerospace & Defense (PPA) and Invesco S&P Global Water Index (CGW). Buy

We’ll let all our other funds and ETFs ride for now. Hold

Current Portfolio

| Wall Street’s Best Stocks Portfolio | ||||||||

| Conservative Stocks | Symbol | Date Bought | Price Bought | Price on 12/6/21 | Dividends YTD | Div Freq. | Gain/ Loss % | Rating |

| The Coca-Cola Company | KO | 2/2/21 | 41.90 | 54.91 | 1.68 | Quarterly | 35% | Hold |

| Mueller Water Products, Inc. | MWA | 8/3/21 | 14.93 | 14.04 | 0.11 | Quarterly | -5% | Buy |

| Sun Life Financial Inc. | SLF | 6/2/21 | 54.08 | 54.06 | 0.96 | Quarterly | 2% | Buy |

| TC Energy Corporation | TRP | 2/2/21 | 42.73 | 46.17 | 2.09 | Quarterly | 13% | Hold |

| Moderate Stocks | Symbol | Date Bought | Price Bought | Price on 12/6/21 | Dividends YTD | Div Freq. | Gain/ Loss % | Rating |

| National Storage Affiliates Trust | NSA | 2/2/21 | 27.39 | 63.34 | 1.14 | Quarterly | 135% | Hold |

| Spirit Realty Capital | SRC | 2/2/21 | 42.27 | 45.97 | 1.25 | Quarterly | 12% | Buy |

| The Toronto-Dominion Bank | TD | 2/2/21 | 40.82 | 74.02 | 1.89 | Quarterly | 86% | Hold |

| Aggressive Stocks | Symbol | Date Bought | Price Bought | Price on 12/6/21 | Dividends YTD | Div Freq. | Gain/ Loss % | Rating |

| Entravision Communications Corporation | EVC | 9/7/21 | 7.45 | 7.01 | 0.03 | Quarterly | -6% | Buy |

| Evolent Health, Inc. | EVH | 10/5/21 | 32.20 | 27.49 | 0.00 | — | -15% | Buy |

| OneMain Holdings, Inc. | OMF | 2/2/21 | 29.49 | 51.31 | 9.55 | Quarterly | 106% | Buy |

| Primoris Services | PRIM | 3/2/21 | 34.98 | 23.47 | 0.18 | Quarterly | -32% | Sell |

| Textainer Group Holdings | TGH | 4/1/21 | 28.77 | 33.92 | 0.25 | Yearly | 19% | Hold |

| ETFs | Symbol | Date Bought | Price Bought | Price on 12/6/21 | Dividends YTD | Div Freq. | Gain/ Loss % | Rating |

| Cohen & Steers REIT and Preferred Income | RNP | 2/2/21 | 23.34 | 26.97 | 1.24 | Monthly | 21% | Hold |

| Consumer Discretionary Select Sector SPDR | XLY | 2/2/21 | 116.94 | 201.93 | 0.79 | Quarterly | 73% | Hold |

| First Trust Dow Jones Global Select Dividend Index Fund | FGD | 5/5/21 | 26.11 | 25.02 | 0.75 | Quarterly | -1% | Hold |

| Invesco Aerospace & Defense ETF | PPA | 4/1/21 | 72.87 | 70.40 | 0.11 | Quarterly | -3% | Buy |

| Invesco S&P Global Water Index ETF | CGW | 6/2/21 | 54.03 | 59.19 | 0.00 | Yearly | 10% | Buy |

| SPDR S&P 500 ETF Trust | SPY | 2/2/21 | 218.25 | 458.79 | 4.08 | Quarterly | 112% | Hold |

| Vanguard Dividend Appreciation Index | VIG | 2/2/21 | 105.13 | 166.00 | 1.89 | Quarterly | 60% | Hold |

| Mutual Funds | Symbol | Date Bought | Price Bought | Price on 12/6/21 | Dividends YTD | Div Freq. | Gain/ Loss % | Rating |

| Artisan Mid Cap Fund Investor Class | ARTMX | 2/2/21 | 37.29 | 43.22 | 0.00 | Yearly | 16% | Hold |

| Fidelity Balanced | FBALX | 2/2/21 | 23.88 | 29.71 | 0.19 | Quarterly | 25% | Hold |

| Sold Positions | ||||||||

| Stocks | Symbol | Date Bought | Date Sold | Price Bought | Price Sold | Div Freq. | Dividends YTD | Gain/ Loss % |

| cbdMD, Inc. | YCBD | 2/2/21 | 3/31/21 | 2.25 | 4.06 | — | 0.00 | 80% |

| Clean Ener-gy Fuels Corp. | CLNE | 2/2/21 | 3/2/21 | 2.63 | 13.66 | — | 0.00 | 419% |

| Conagra Brands, Inc. | CAG | 2/2/21 | 8/3/21 | 29.87 | 33.33 | Quarterly | 0.00 | 12% |

| Investors Bancorp, Inc. | ISBC | 7/6/21 | 8/3/21 | 13.90 | 13.72 | Quarterly | 0.00 | -1% |

| Orange S.A. | ORAN | 5/4/21 | 7/7/21 | 12.61 | 11.16 | Semi Annually | 0.00 | -12% |

| Unilever PLC | UL | 2/2/21 | 5/3/21 | 42.84 | 59.12 | Quarterly | 0.00 | 38% |

| ETFs | Symbol | Date Bought | Date Sold | Price Bought | Price Sold | Div Freq. | Dividends YTD | Gain/ Loss % |

| Technology Select Sector SPDR | XLK | 2/2/21 | 3/2/21 | 42.01 | 133.88 | Quarterly | 0.00 | 219% |

| Mutual Funds | Symbol | Date Bought | Date Sold | Price Bought | Price Sold | Div Freq. | Dividends YTD | Gain/ Loss % |

| T. Rowe Price Blue Chip Growth | TRBCX | 2/2/21 | 4/1/2021 | 90.40 | 169.55 | Yearly | 0.00 | 88% |

| Needham Small Cap Growth Retail Class | NESGX | 2/2/21 | 5/5/2021 | 14.61 | 27.28 | Yearly | 0.00 | 87% |

| Fidelity Select Industrials Portfolio | FCYIX | 3/2/21 | 6/2/21 | 37.95 | 37.66 | Quarterly | 0.73 | 1% |

| Cohen & Steers Infrastructure Fund, Inc | UTF | 2/2/21 | 6/24/21 | 37.95 | 27.85 | Monthly | 0.62 | -25% |

The More You Know

As we grow older and enter different stages of our lives, our financial requirements radically change. Therefore, investments that were perfect for us in our 20’s, when we were just starting our careers are almost never the same vehicles that are best for us during our retirement years. To ensure that you have the resources you need for every stage of your life, it is imperative that you have an investment plan for each of those periods.

That is why no portfolio should be without an allocation strategy. Allocation simply means the mix of stocks, bonds and cash in your investment portfolio. A couple of rules of thumb:

- Stocks tend to be more volatile than bonds, but have historically experienced higher returns.

- The greater your expected return, the more volatility and risk you can expect.

Portfolio allocation will and should change as dictated by your personal lifestyle requirements. Here are some examples of typical allocations during different life stages:

Single, 25 years old, in first job after college

Typically a renter, this investor would have no major financial responsibilities, except possibly the repayment of student loans. With 40 years of work and savings in front of her, she can afford an aggressive investing strategy. A portfolio of 90% stocks and 10% cash might suit her needs perfectly.

Upwardly mobile, single, no children, 35 years old

Generally, this investor is a first-time homeowner, seeing healthy annual income increases, and beginning his prime earning years. He should concentrate on growth investments with the ideal portfolio consisting of 80% stocks and 20% cash.

Married couple, dual careers, 35 years old, 2 small children

Will most likely have a mortgage and are trying to save for their children’s college education. In their prime earning years, they should maximize their growth investments, yet begin to consider some fixed vehicles. The ideal portfolio for them may be 70% equities, 10% fixed income, and 20% cash.

Married couple, 55 years old, with grown children

Staring retirement in the face, this couple should begin thinking about preservation of capital and income needs. A portfolio of 60% equities, 20% fixed and 20% cash may be just what they need.

Retired couple, 70 years old

A few years into retirement, with a life expectancy of maybe another 12 to 20 years, this couple wants to make sure their money lasts as long as they do. Thus, they need income as well as continued growth in the portfolio. They would do well to structure their portfolio to include 40% equities, 40% fixed income and 20% cash.

Widow, 80 years old

A decade or so since retirement, this investor will generally have a life expectancy of another 5-10 years. In her years of retirement, she has probably figured out exactly how to live on the monies she and her spouse accumulated. Yet she is also concerned with rising medical expenses. After those two needs are met, she is most interested in preserving her capital for her heirs. Thus, she would continue to invest for income and want to remain very conservatively invested, with a sufficient cash position. Her optimal portfolio might consist of 30% equities, 50% fixed income and 20% cash.

No matter in which category you fall, you will need to go through the following process to determine the best allocation for your portfolio.

A. Determine your investment goals - What do you hope to achieve by investing?

Growth, or appreciation of value, is best achieved by investing aggressively in equities. The Dow Jones Industrial Average (DJIA) has averaged 10% per year since its inception. But remember: The higher your expected return, the greater the volatility in your investments.

Income-oriented investors should consider less aggressive equities such as mature companies with stable earnings that pay dividends. Additionally, they should consider adding fixed income investments such as bills, notes and bonds that provide a steady stream of income to their portfolios.

Fixed income is an excellent way to balance out the volatility of stocks and also helps hedge against stock deflation during times of higher interest rates.

Capital preservation is for investors who just want to make sure they don’t lose their principal. The most conservative of strategies, it results in a portfolio that is defined as “close to cash.” Your returns won’t be spectacular, but your principal will stay intact regardless of market fluctuations. An investor may choose certificates of deposits, government guaranteed investments, or money market funds.

Note: There are certainly more asset classes in which you can invest, including real estate, art, limited partnerships, commodities and many others, each with their own particular characteristics. You will need to decide if any of those investments meet your personal guidelines.

B. Your time horizon - How long before you need to access your money? Will you need it in five years for a down payment on a home, in ten years to pay for a child’s education, or in thirty years when you retire? And if the money is needed for retirement, how long do you expect your retirement to be?

Short-term. If your time horizon is less than 5 years, you should keep your investments as close to cash as possible.

Medium-term. If you don’t need your money for at least 5 to 10 years, you can afford to consider a mix of equities, fixed income and cash - perhaps a 50%, 40% and 10% combination. This will be more volatile, but gives you the potential for much higher returns.

Long-term. The longer you hold an investment, the better off you’ll probably be. Although you will see bear and bull markets in the long run, historical statistics tell us that staying put through the lean times will result in a positive overall return for the market and your investments. A long time-horizon lets you take more risk by investing in a more heavily equity-weighted portfolio—perhaps as much as 80%—and thus increases your return potential.

C. Your risk tolerance - Risk doesn’t mean that you are going to lose your investment. It simply means the amount that your investment’s value will fluctuate over time. Risky investments rise and fall more at a more rapid rate than safer investments. The relationship between risk and return is direct—as your potential return increases, so does your level of risk. Remember that diversification among assets and categories within those asset classes reduces your risk.

Low - If you would not be able to tolerate a short-term decline in your assets of 10% or less, equities should make up no more than 25% to 30% of your portfolio.

Medium - If your risk tolerance is a little higher, and you could stand to watch your portfolio decline by 20%, keep no more than 50% of your portfolio in equities.

High - If you are more of a risk-taker and can bear a 30% to 40% short-term decline in stock prices, your portfolio can afford a 70% equity allocation.

Now that you have considered all of the above possibilities, it is time to develop your personal portfolio allocation.

I’ll leave you with just a few reminders:

- An investment plan is crucial to your long-term financial well-being

- Diversification among asset classes and investments within those classes is extremely important

- Err on the side of conservatism

Start early and be disciplined in contributing regularly to your investment program

The next Wall Street’s Best Stocks issue will be published on January 13, 2021.