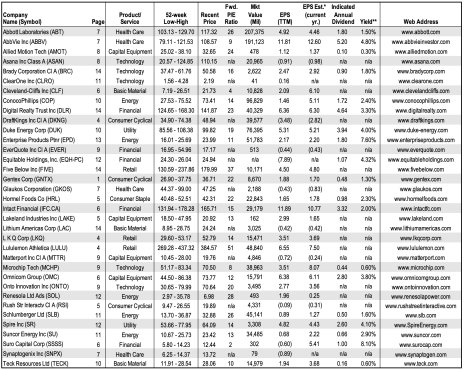

Here is your October Wall Street’s Best Digest.

In the past month, the markets have been seesawing—mostly due to Washington shenanigans—but the overall long-term picture continues to be bright. The rise in housing prices seems to be mitigating, the unemployment rate dropped to 4.8%, and FactSet expects the S&P 500 companies to produce earnings growth of more than 27% for this quarter. So, the fundamentals appear to be in place for a longer bull run, although as I often say—it’s a stock-picker’s, not a dartboard, market.

And with that in mind, our contributors have found some very interesting companies for you this month.

Market Views

The indexes are not showing a lot of strength one way or the other. When the major indexes are in neutral, and the economic forecasts are weakening and inflation seems to be getting worse and the supply chains across the entire spectrum seem to be broken, it is hard to see how this market rallies into the rest of the fourth quarter. But, the market is not tanking either.

The market opened on a bit of a positive move higher, following on the heels of last Friday’s rally.

The raising of the debt ceiling last week triggered a muted relief rally. And, as a result, the technical data improved a bit, but not enough to jump back into the market with both feet.

The only Sector showing any significant strength to the upside is Energy, followed by the Financial sector. We are nicely positioned in several strong, up-trending, high-dividend oil and gas stocks in the DIS model and I may add some oil/gas companies to our TG and TQA models if the Sector continues to outperform.

Mike Turner, Turner Capital Investments, turnercapital.com, 855-678-8200, October 11, 2021

‘Tis the Season for Strength in the Markets

The fourth quarter is a seasonally strong quarter that is characterized by positive gains for October, November and December. I should add that January is also a seasonally strong month, so we have four straight months of seasonal strength to look forward to. November is the strongest month in the fourth quarter, since we typically get an “early January effect” just before Thanksgiving, when small capitalization stocks seasonally surge.

Louis Navellier, Navellier Market Notes, 1 East Liberty, Ste. 504 Reno, Nevada 89501, info@navellier.com, October 7, 2021

Near-Term Volatility

Just when the market looked ready to go over the falls last week the buyers stepped in, pushing the major indexes sharply higher. It’s certainly encouraging, but by our measures, we haven’t seen confirmation of a new intermediate-term uptrend, and while a few stocks have popped to new highs, most individual names are in the same no-man’s-land environment. Longer term, the strong, broad bounce is a good sign the overall bull market is alive and well, but near term, it’s still uncertain whether we’ll see another leg lower or more vicious rotation.

Michael Cintolo, Cabot Top Ten Trader, cabotwealth.com, 978-745-5532, October 11, 2021

Spotlight Stock

Gentex designs, develops, manufactures, and supplies digital vision, connected car, dimmable glass, and fire protection products, including: automatic-dimming and non-automatic-dimming rearview mirrors and electronics for the automotive industry; dimmable aircraft windows for the aviation industry; and commercial smoke alarms and signaling devices for the fire protection industry. Automotive revenues represented about 98% of the company’s total 2020 revenue.

More than 45 years ago, Gentex opened its doors as a manufacturer of high-quality fire protection products. Company founder, Fred Bauer, revolutionized the industry with the first dual-sensor photoelectric smoke detector.

While millions of Gentex smoke detectors and signaling devices are found in hospitals, hotels and office buildings, Gentex is best known as the pioneer of the electrochromic automatic dimming mirror industry. Over the years, Gentex has made driving safer for millions of drivers around the world by providing mirrors that detect and eliminate dangerous rearview mirror glare. With an estimated 94% market share in 2020, Gentex is the dominant auto-dimming mirror supplier to the auto industry with over 30 auto manufacturers now offering Gentex mirrors as standard or optional equipment on 570 vehicle models.

Employing decades of experience in electrochromics, Gentex delivered the first electrochromic dimmable aircraft windows in 2010. At the touch of a button, window shades for aircraft cabins easily switch from a bright, clear state to an extreme dark state or to a comfortable intermediate level.

In 2013, Gentex acquired HomeLink, the automotive industry’s leading car-to-home automation system, now integrated into Gentex mirrors enabling remote connection with garage doors, entry door locks and gates, home lighting and security systems. In 2015, Gentex began shipping the Full Display Mirror, an on-demand, mirror-borne LCD display that streams live video of the vehicle’s rearward view to improve safety. Gentex boasts more than 1,700 patents on its technology and products, providing Gentex with competitive advantages in its markets.

As vehicle electrification and autonomous driving trends progress, Gentex’s core technologies stand to become integral components in connected cars.

Gentex has always maintained a strong balance sheet, thanks to the company’s excellent free cash flow generation that has compounded at double-digit rates over the last decade.

Gentex operated debt-free until 2013 when it took on $265 million of long-term debt to help finance the HomeLink acquisition. Gentex steadily paid down the debt and has operated debt-free since 2018.

During the first half of 2021, Gentex generated $220.9 million in free cash flow, a stellar 110% of net earnings, a sign of HIquality reported earnings. After paying $58 million in dividends and $214 million in share repurchases during the first half of 2021, Gentex sported $560 million of cash and investments on its sturdy, debt-free balance sheet as of June 30, 2021.

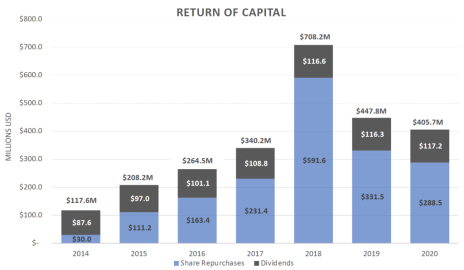

Beyond funding capital expenditures and acquiring emerging technologies that fit well with its portfolio, Gentex’s robust cash flow allows for a growing dividend that has compounded at an 8% annual clip since 2016, along with substantial share repurchases. In addition to paying $720 million in dividends since 2015, Gentex has repurchased 86 million shares, reducing the share count by nearly 18%. Management remains “hyperfocused” on returning 100% of free cash flow to shareholders through dividends and share repurchases.

The board recently approved an additional 25 million share repurchase program. Given expected continued semiconductor supply shortages and other macro headwinds, management lowered 2021 revenue guidance to between $1.88 billion to $1.98 billion with 2022 revenue expected to be 10% to 15% higher than 2021. Long-term investors should reflect on Gentex, a HIquality, innovative market leader with a strong balance sheet and a sound capital allocation strategy. Buy.

Ingrid R. Hendershot, Hendershot Investments, hendershotinvestments.com, 703-361-6130, September 2021

Gentex Corporation (GNTX) 52-Week Low/High: $26.90 - 37.75 | Why Gentex:

|

Feature Article

Our Spotlight Stock, Gentex Corporation (GNTX) is probably not a name that you find instantly recognizable. Unless you are an automobile manufacturer, where Gentex owns the market in dimmable mirrors.

Founded in 1974, the company is the recognized world leader in the manufacturing of electrochromic, automatic-dimming mirrors for the auto industry. Gentex sells to nearly every automotive manufacturer, in the United States, Germany, Japan, Mexico, and internationally.

The company’s Vision Systems include:

- Auto Dimming Mirrors – IEC and OEC

- Camera Systems – SmartBeam

- Combination of Cameras and Displays: Rear Camera Display (RCD), Full Display Mirror (FDM), and Camera Monitoring Systems (CMS)

Its Connectivity products include:

- HomeLink

- HomeLink Connect

- Integrated Toll Module

- Biometrics

And its Dimmable Devices are:

- 787 and 777x Aerospace Windows

- Auto-dimming Mirrors

- Large Area Dimmable Devices for Automotive

In her recommendation, contributor Ingrid Hendershot of Hendershot Investments, mentioned Gentex’s acquisition of HomeLink, an important purchase, but one of several acquisitions and partnerships that has made Gentex number one in the automotive market, and also has contributed to growing its market share in aviation.

Its recent purchases and partnerships are many:

- Mayo Clinic – Partnership – 2019

- PayByCar – Partnership – 2020

- RetiSpec – Partnership – 2020

- Simplenight – Partnership – 2020

- Vaporsens – Acquired – 2020

- Argil – Acquired – 2020

- Air-Craftglass – Acquired – 2020

- Guardian – Acquired – 2021

According to Gentex, the company targets businesses that align with its core competencies, have unique/proprietary technology or capabilities, and extends its product portfolio or market opportunities.

As Ingrid also noted, and you can see from the following graph, Gentex has a long track record of shareholder rewards, via dividend payments and share repurchases.

And with zero debt on its books, and growing revenues and earnings, that record should continue, especially as supply constraints in the auto industry work themselves out.

For this year, Gentex’s earnings are expected to rise by 19.6%; next year, by 25.7%. Meanwhile, the shares are trading at a forward P/E of 15.31, looking pretty attractive as the economy strengthens.

Growth

DraftKings Inc. (DKNG) | Daily Alert September 15

DraftKings is a Power Buy. The company (TSINetwork Rating: Extra Risk) is acquiring Golden Nugget Online Gaming (GNOG) for $1.56 billion in stock.

The deal gives the company a combined database of more than five million customers. And by using the Golden Nugget brand, DraftKings hopes to reach a broader consumer base for online casino games, also known as iGaming.

Tilman Fertitta, who owns 46% of Golden Nugget, has agreed to continue to hold the DraftKings shares to be issued to him in the merger for a minimum of one year from the closing of the transaction. Tilman will join DraftKings’ board of directors, as well as being one of its largest shareholders.

Golden Nugget Online Gaming operates in New Jersey and Michigan. Its catalog of online casino games in the New Jersey market number more than 800 titles. The company is now targeting Pennsylvania, Illinois, West Virginia, and Virginia as potential states in which to expand.

DraftKings should remain the dominant player in the expanding U.S. sports-betting market—and Golden Nugget just adds to that. Meanwhile, the company’s online business model is a big plus, compared to the capital-intensive casino model.

DraftKings is a Power Buy.

Patrick McKeough, Power Growth Investor, tsinetwork.ca, 888-292-0296, September 2021

Lululemon Athletica Inc. (LULU) | Daily Alert September 24

Lululemon Athletica designs and sells athletic apparel and markets its yoga-inspired clothing under the lululemon athletica and ivivva athletica brand names.

Lululemon has a strong brand and growing direct-to-consumer sales, which we expect will lead to higher margins over the next several years. In addition, we expect revenue growth from the expansion of the company’s men’s clothing line. With relatively few stores outside North America, the company also has substantial opportunities for international expansion, particularly in China. In all, we believe that the company’s prospects are among the best in the apparel sector.

The company reported fiscal 2Q22 adjusted EPS of $1.65, up from $0.74 a year earlier and above the consensus forecast of $1.18. Net revenue of $1.45 billion rose 61% on a reported basis and 56% in constant currency. We are raising our FY22 EPS estimate to $7.50 from $6.80 and our FY23 estimate to $9.40 from $8.50. Our five-year compound annual EPS growth rate forecast is 15%.

On the fundamentals, LULU shares are trading at 45-times our revised FY23 EPS estimate, above the five-year average of 40. We believe that they deserve to trade at higher multiples given the company’s increasing comp sales, strong brands, and prospects for continued growth. Our revised price target of $500 implies a multiple of 53-times our FY23 estimate.

Jim Kelleher, CFA, Argus Weekly Staff Report, argusresearch.com, 212-425-7500, September 16, 2021

LKQ Corporation (LKQ) | Daily Alert October 1

Near-term and long-term consumer trends favor LKQ, a maker of aftermarket and recycled auto parts used in dealerships and repair shops. First, tight supplies for new vehicles in 2021 have boosted demand for older vehicles, which are more likely to require repair. Second, vehicle miles driven are rebounding but still haven’t reached pre-pandemic levels, suggesting room for more growth as conditions normalize. Additionally, the average age of a vehicle on U.S. roads has steadily climbed over the past 15 years, reaching a record 12 years in 2020.

Moreover, LKQ says two transformational changes within the automotive industry—electric vehicles and autonomous vehicles—should have little, if any, effect on its business model during this decade.

LKQ raised its 2021 profit guidance in July, prompting analysts to hike their estimates for sales for the September quarter (now expected to rise 7%), December quarter (6% growth), and 2022 (3%). LKQ has topped the consensus sales estimate in seven of the past eight quarters. LKQ expects full-year earnings per share to climb 39% to 47%. The consensus currently targets 44% growth, leaving some room for upside. Earning a Quadrix Overall score of 95, LKQ is a Focus List Buy and a Long-Term Buy.

Richard Moroney, CFA, Dow Theory Forecasts, dowtheory.com, 800-233-5922, September 20, 2021

Lakeland Industries, Inc. (LAKE) | Daily Alert October 4

Strategy: P/E Growth: Peter Lynch. This methodology would consider LAKE a “fast-grower.”

Lakeland Industries manufactures and sells a line of safety garments and accessories for the industrial and public protective clothing market. The company’s product categories include limited-use/disposable protective clothing, high-end chemical protective suits, firefighting and heat protective apparel, durable woven garments, high-visibility clothing, and gloves and sleeves.

P/E GROWTH RATIO: PASS

SALES AND P/E RATIO: NEUTRAL

INVENTORY TO SALES: PASS

EPS GROWTH RATE: PASS

TOTAL DEBT/EQUITY RATIO: PASS

NET CASH POSITION: BONUS PASS

John Reese, Validea Hot List Newsletter, validea.com, 877-439-0506, September 17, 2021

*Rush Street Interactive, Inc. (RSI)

On Tuesday, executives at DraftKings (DKNG) announced a $20 billion offer for Entain, the British sports betting behemoth. The interesting part is that Entain currently has a joint venture with MGM Resorts International (MGM).

Demand for iGaming—classified as any activity involving online sports betting—is surging as technological advancements and political expediency collide.

Sports betting is currently legal in 24 states, although New York could come online sometime this year. Betting legislation is pending in five more states, with even more likely to be included during 2022 and 2023.

Rush Street Interactive is a software maker creating tools for the next generation of sports betting. And it could possibly be MGM’s next darling depending on how the DraftKings situation works out.

Rush Street Interactive operates an online casino and sports betting business. Its strength is the software that underpins iGaming. The nine-year-old company went public in January through a special purpose acquisition company (SPAC).

Shares have been on the move in September following DraftKings $1.6 billion acquisition of Golden Nugget Online, a similar business. Investors are speculating Rush Street will get gobbled up in the rush by bigger players to gather digital tools.

Rush Street Interactive reported sequential quarterly growth for the past seven quarters. First-quarter revenue grew to $112 million, up 218% year over year.

The company currently operates in 11 states. In 2021, it launched a sportsbook in MI, VA and IA. Monthly active users grew to 115,000, up 166% from a year ago, and average revenues per user grew 21% to $302.

Rush Street Interactive is a logical target for a bigger player … yet the core business is strong enough to stand on its own. Investors should consider buying this stock into weakness.

Jon Markman, Pivotal Point, issues@e.moneyandmarkets.com, 1-800-291-8545, September 22, 2021

Growth & Income

Hormel Foods Corporation (HRL) | Daily Alert September 27

Hormel Foods produces and markets a variety of meat and food products in the U.S. and internationally.

The company’s business is reported under four segments: 1) Grocery Products; 2) Refrigerated Foods; 3) Jennie-O Turkey Store (JOTS); and 4) International & Other. HRL sells food products under four classes: 1) Perishable; 2) Poultry; 3) Shelf-stable; and 4) Miscellaneous.

In February 2021, HRL announced that it has signed an agreement with Kraft Heinz to purchase the Planters business for $3.35B in cash. HRL will acquire four brands under the acquisition: 1) Planters; 2) Nut-rition; 3) Cheez Balls; and 4) Corn Nuts.

HRL has a strong track record of returning cash to shareholders through share repurchases and dividends. As a member of the S&P 500 Dividend Aristocrats Index, HRL has increased dividend payments for 55 consecutive years.

Kelley Wright, IQ Trends, iqtrends.com, info@iqtrends.com, 866.927.5250, Mid-September 2021

Financials

Intact Financial Corporation (IFC.TO, IFCZF) | Daily Alert October 6

Shorter-term Treasuries that are especially sensitive to Fed policy also shot higher. The five-year yield got to within a whisker of 1% … the highest since February 2020. By historical standards, those are obviously still low … but the action is still noteworthy

We’re likely to see so-called value stocks and more economically sensitive names outperform. At the same time, high-growth stocks and sectors like technology may underperform. Core financials—including banks—could benefit. But higher-yield, slower-growth stocks like utilities could lose some steam.

You can find some strong industrial and financial names in your Highest-Rated Stocks Heat Map. Intact Financial (Rated “B”) is sitting at the top of that map right now. The Toronto-based company sells property and casualty insurance across Canada, as well as specialty and other commercial and personal insurance products in the U.S., U.K., and Europe.

IFC shares have risen more than 11% in the past year. Many brokers allow you to buy Canadian shares on Canadian markets. But in this case, Intact Financial also has U.S. tracking shares trading under the ticker IFCZF on the over-the-counter markets.

Mike Larson, Weiss Stock Ratings Heat Maps, issues@e.weissratings.com, 1-877-934-7778, September 28, 2021

*SuRo Capital Corp. (SSSS)

We’re adding SuRo Capital to the portfolio. SuRo Capital is a Business Development Company (BDC) that invests in startups that haven’t yet gone public. SuRo pays dividends from returns received from selling assets. It has no recurring income.

In the last 12 months, SuRo paid dividends totaling $5.97 per share. Based on that figure, SuRo’s dividend yield calculates to 46.2%. But, in the entire year 2020, dividends totaled only $0.65 per share. In 2019 SuRo’s payouts totaled $0.32. Nothing was paid in 2017 and 2018, and SuRo paid out $2.80 per share in 2016. Thus, SuRo is truly a speculative play.

Harry Domash, Dividend Detective, dividenddetective.com, 866-632-1593, October 5, 2021

Value

Omnicom Group Inc. (OMC) | Daily Alert September 14

Omnicom Group provides advertising, marketing, and corporate communications services. The company’s agencies offer a comprehensive range of services including traditional media advertising, customer relationship management (CRM), public relations and specialty communications.

OMC scores very well in our proprietary valuation framework, while management has been active in repurchasing its shares. OMC’s EPS took a hit in 2020 to $4.85, but analysts expect a recovery to 2019’s $6 level this year as corporate advertising picks up. OMC trades for 1.1 times sales, while the free cash flow yield is a generous, 14% and the forward P/E ratio is under 12.

Omnicom’s balance sheet includes $3.3 billion of cash, $0.5 billion of preferred obligations and $6.9 billion of long-term debt, with $1.625 billion of liquidity available, and the current debt load carries a weighted coupon of 3.0% and maturity of October 2026 (5.8 years), giving management flexibility to operate in a somewhat uncertain advertising environment.

John Buckingham, The Prudent Speculator, theprudentspeculator.com, 877-817-4394, September 3, 2021

Cleveland-Cliffs Inc. (CLF) | Daily Alert October 5

Rather than pushing into new multi-year-high territory as was hoped might occur as last month’s issue was going to press, Cleveland-Cliffs’ stock has “only” managed to trade sideways instead since then. However, given the run that the stock has made over the past 12 months, I very much welcome this consolidation, as it is exactly what we both “need” and would expect to see after such a powerful move to the upside.

If you are still underweighted in this stock, you are encouraged to make it a “first buy” this month as part of a longer-term game to build a decent-sized position in commodities as time goes by.

The stock has solid relative strength and an economic backdrop that should help it continue to move higher make this a “Top Pick” again. CLF is a strong buy under $22 and a buy under $27.

Nate Pile, Nate’s Notes, NotWallStreet.com, 707-433-7903, September 2021

Healthcare

Abbott Laboratories (ABT) | Daily Alert September 17

Abbott Laboratories (Rated “B”) offers medical testing, medical devices, pharmaceuticals, nutritional products, and related services.

Abbott has also been at the forefront of COVID-19, in the background making rapid COVID-19 tests. Its ID NOW molecular test and the BinaxNOW antigen test allow for faster diagnoses than other tests that require lab work.

It looks like longer-term COVID-19 testing demand is here to stay. That’s because employers, schools, sports leagues, governments, and others are looking to get more workers back in the office and back on the field. Rapid testing will help that.

And again, Abbott isn’t a one-trick pony. That’s why second-quarter sales jumped more than 39% year over year to $10.2 billion. The results easily beat the average forecast of $9.69 billion. Sales in non-COVID-19 operations also rose 11% from 2019’s pre-pandemic levels. Moreover, driven by growth in all four business segments, adjusted earnings more than doubled to $1.17 per share. This beat analysts’ $1.02-per-share estimate.

Mike Larson, Safe Money Report, 1-877-934-7778, weissratings.com, September 2021

Glaukos Corporation (GKOS) | Daily Alert September 23

Glaukos is a medical technology company focused on innovative therapies for the treatment of glaucoma, corneal disorders, and retinal diseases.

There is no cure for glaucoma, and patients usually begin treatment with eye drops. But many eventually opt for cataract surgery. Glaucoma currently impacts three million Americans, and the usual surgery is invasive and can have serious side effects, including bleeding and retinal detachment.

In contrast, Glaukos’ revolutionary product is the iStent, a tiny L-shaped titanium implant that has helped thousands of people with glaucoma successfully manage intraocular pressure. The device received regulatory approval from the FDA in 2012. Glaukos launched its next-generation iStent inject device in 2018 and during its second-quarter earnings call, Glaukos announced that it expects the new iteration—the iStent infinite—to receive regulatory approval before the end of this year, though it has already been approved in Australia and India.

Glaukos has the most comprehensive pipeline in ophthalmology. New product launches will broaden its market opportunities, including acquisitions and expansion into international markets.

The timing to invest in the stock is logical since its share price is down more than 49% from its 52-week high. Its balance sheet is solid with more than $400 million in cash.

Ian Cooper, The Cheap Investor, support@thecheapinvestor.com, September 2021

AbbVie Inc. (ABBV) | Daily Alert October 7

AbbVie hasn’t recovered from the selloff after the FDA announced it will require a warning label on its new immunology drug Rinvoq one month ago. It’s not good news because this is a star drug that AbbVie needs to overcome lost revenues when Humira loses its U.S. patent in 2023. But it isn’t a game changer. The story is still intact. Meanwhile, ABBV has strong technical support around the current level. BUY

Carl Delfeld, Cabot Explorer, cabotwealth.com, 978-745-5532, September 16, 2021

Synaptogenix, Inc. (SNPX) | Daily Alert October 11

Synaptogenix’s drug, Bryostatin, activates something called protein kinase C (PKC) epsilon that is already in the brain from birth and helps build the synaptic wiring in the brain in one’s early years. But its ability to do so can weaken over time, especially in Alzheimer’s patients. Bryostatin reactivates PKC epsilon and that neural/synaptic network which helps rebuild connections in the brain.

The company has done two pilot Phase 2 studies that were placebo controlled, and kicks it up a notch testing on moderate to moderately severe Alzheimer’s patients … and they are seeing improvement (that increases with time) especially in moderates, not just a slowing of decline.

A 100-patient 6+ month third trial, a full-fledged Phase 2, is now 80% enrolled and hopefully will be fully enrolled by year end, with readout in ~Q3 2022. The trial is supported by a $2.7 million grant from the prestigious NIH (National Institutes of Health), which will cover about 25% of the cost. The drug has been safely administered in over 1,600 patients (1,500 of these were in failed testing on cancer patients) and the current trial has also reported no safety issues to date.

Despite trading 300,000 shares on an average day, SNPX has only 6 million shares outstanding. This means its market cap is barely $60 million dollars, as compared to Anavex’s $1.3 billion and Cassava’s $2.5 billion. Yet, Synaptogenix is the only one that has bonafide placebo-controlled studies showing improvement in Alzheimer’s disease, especially in more advanced cases.

The potential market cap for a company that has a treatment that really helps Alzheimer’s patients is about $20 billion (at least 2 times revenue for a $10 billion/yr. drug). Even if the company has to issue another 30 million shares (which would raise almost $300 million … way more than needed) to get there, that would imply a market price of over $500 a share, in theory … ($20 billion/36 million shares).

Don’t bet the farm, these biotechs can be risky and volatile as we well know, but- Buy.

Tom Bishop, BI Research, biresearch.com, October 4, 2021

Technology

Allied Motion Technologies Inc. (AMOT) | Daily Alert September 9

Allied Motion makes precision and specialty-controlled motion products and solutions, including DC motors, servo drives, motors, gearing, and controllers. These are used in a broad range of industries within the company’s four segments: Vehicle, Medical, Aerospace & Defense, and Industrial.

Revenues since 2011 have grown at a 15.9% average annual rate, while EPS growth is a bit choppier and just 11.0%, held back some by 2020’s slowdown.

That 2020 slowdown appears to be history. In the second quarter ended June 30, 2021, revenues were up 17.2% over the Q2 2020, and EPS jumped 60.0% to $0.32 from the weakened year-ago quarter. Backlog increased 12% over the first quarter of 2021 and 33% quarter-over-quarter to a record $170.4 million. The time to convert the majority of backlog to sales is approximately three to six months.

Analysts who cover Allied Motion on Wall Street are optimistic about its prospects, projecting 30% average EPS growth over the next five years. We have ratcheted that down to a much more conservative 11.0% for revenues and 13.0% for EPS growth.

From a recent price of $33.75, we calculate that the stock could reach $79 and is a buy up to $39. Our downside price is $25, and the current price represents a reward/risk ratio of 5.4:1. The potential total annual return with a small dividend is 18.8%.

Doug Gerlach, Smallcapinformer.com, 1-877-33-ICLUB, September 2021

Asana, Inc. (ASAN) | Daily Alert September 17

ASAN was acting sloppy for a few weeks, but a very bullish Q2 report has caused a fresh rush of buying. The big story of the report wasn’t so much the numbers (though they were excellent—revenue growth accelerated again to 72%) but the fact that, after a long time of being deployed in a department here or here, Asana’s work management platform is now seeing widespread adoption among big enterprises.

On the conference call, the top brass talked about a few specific deployments and said that revenue received from its largest customers (those spending at least $50,000 annually with Asana) rose a whopping 45% from a year ago—meaning these whales are ordering more after (usually smaller) initial test runs, including some that have 25,000 employees using the platform.

The stock has zoomed higher on the news and has actually extended those gains this week despite the wobbles in growth stocks. We’re aiming to average up (fill out our stake by purchasing another half-sized position) but given that ASAN is extended, and the sell-strength environment, we’ll hold off a bit and see if shares can set up a better risk-reward entry point. We will stay on Buy a Half, though again, aiming for dips is advised. BUY A HALF

Michael Cintolo, Cabot Growth Investor, cabotwealth.com, 978-745-5532, September 9, 2021

Matterport, Inc. (MTTR) | Daily Alert September 21

Matterport scored a really nice upside chart breakout on volume that was about five-plus times normal, and if you look at the chart you can see it. This stock is fairly unknown except for in the real estate community.

I think as this story gets out more to the public/people you will see more institutional money come toward this (exciting) idea that really makes sense.

I would buy MTTR up to $20 and won’t chase it past that.

Reminder, this is NOT a blue-chip, this is NOT a bargain, this is brand-spanking NEW technology that is a game changer, and this stock IS RISKY—just know that. If the market took a header, this could drop 40 or 50%—full disclosure.

Bob Howard, Positive Patterns, P.O. Box 310, Turners, MO 65765, 417-887-4486, September 14, 2021

EverQuote, Inc. (EVER) | Daily Alert September 29

EverQuote is new to the platform space, and insurance is the platform’s principal offering. EverQuote is already the leading online marketplace for insurance shopping.

The service is free to consumers. Revenue is generated from consumer referrals to insurance providers and advertising by the providers. In some instances, EverQuote receives commissions on insurance-policy sales.

In 2018, the year EverQuote become a publicly traded company, it posted $163.3 million in revenue. Here we are, not quite three years later, and it posted $396.2 million in revenue for the trailing 12 months.

Management is projecting revenue to grow another 30% year over year this year. Growth is expected to throttle back in 2022. Still, Wall Street projects 20% annual revenue growth next year. The company should end 2022 with roughly $534 million in annual revenue.

EverQuote is positioning itself to exploit the opportunity increased online spending brings. It acquired health insurance agency Crosspointe last year to raise its profile in healthcare. PolicyFuel LLC was acquired this past month to expand into property and casualty insurance. Look for EverQuote to further expand into life and home insurance.

I see extreme value in EverQuote’s low share price. Today, they are priced at 1.3 times. Even a return to a two price-to-revenue multiple could produce a 50% return over the next few months. That’s not unreasonable. What’s more, Wall Street’s call for a share price above $50 also resides within the realm of reason.

Buy EverQuote shares up to $25.

Ian Wyatt and Stephen Mauzy, Personal Wealth Advisor, wyattresearch.com, September 7, 2021

Onto Innovation Inc. (ONTO) | Daily Alert October 13

Onto Innovation is being upgraded to Best Buy. The company’s systems and software are used for defect inspection and to control the manufacturing of advanced semiconductors. Major customers include Samsung Semiconductor and Taiwan Semiconductor—tech giants seeking ways to shrink chip designs, accelerate product development, and improve performance.

Onto earns solid Quadrix® scores, including an 86 Overall and 93 in Performance. For 2021, the consensus calls for per-share earnings of $3.56 and implies 85% growth—an achievable target based on recent operating momentum and strong industry trends. For 2022, the consensus implies 13% growth to $4.04, putting the forward P/E at a reasonable 19. Onto is a top pick for 12-month gains.

Richard J. Moroney, CFA, Upside, upsidestocks.com, 800-233-5922, October 2021

*Microchip Technology Incorporated (MCHP)

Microchip Technology’s chips power the everyday gadgets and devices you’ll find in every home in the country.

It comes down to a core piece of technology known as the MCU. Short for microcontroller unit, the MCU is a type of semiconductor that is made up of a processor unit, memory modules, communication interfaces, and peripherals.

The lower-end 8-bit MCUs, like the ones offered by Microchip Technology, are a vital component to the household electronic devices we often take for granted. They’re utilized in products like washing machines, robot and drone technology, and even the video game controllers kids use for hours on end.

Over half the company’s revenue derives from a vast array of electronic devices you use every day, from the chips in your garage door opener all the way down to the ones that are found in the power windows of your car.

For the full fiscal year of 2021, the company posted record sales of $5.4 billion and experienced record gross margins of 62.1%, record operating income of $998.1 million, and a net income of $349.4 million.

For its first fiscal quarter for 2022, it showed rock-solid 19.8% year-over-year growth at $1.57 billion.

We rate Microchip Technology a “Buy” under $160. The risk level is “Low.”

Keith Kohl, Technology & Opportunity, angelpub.com, 877-303-4529, October 2021

*Maxar Technologies Inc. (MAXR)

Maxar Technologies Inc. provides space technology solutions for commercial and government customers worldwide, including communication and imaging satellites, space-based and airborne surveillance solutions, and robotic systems.

Wealth Advisory Earnings Grade: B-

I’m shaking up the portfolios and moving Maxar to the “Dividend Growers” section because I think that its divvy is going to start growing again soon.

Maxar continued to drift lower last month despite announcing a $26 million contract from the U.S. National Geospatial-Intelligence Agency, another five-year contract worth $60 million from the NGA, and a contract to build the SXM-10 satellite for SiriusXM. The successful launch of the next satellite is likely to send shares back into orbit.

Maxar Technologies is a “Buy” anywhere under $45. The 12-month target is $105.

Jason Williams, The Wealth Advisory, angelpub.com, 877-303-4529, October 2021

Resources, Energy, & Utilities

Duke Energy Corporation (DUK) | Daily Alert September 13

Duke Energy is one of the top energy companies in the U.S., serving electric power to more than 7.9 million people. Duke has raised its dividend every year since 2008!

That’s a stunning track record, but like most utilities, Duke is strapped with high fixed costs and low cash flow. Over the past five years, the company has generated negative free cash flow. This means Duke’s cash from operations—the money that it brings in the door selling electric power –hasn’t been enough to cover its capital expenditures.

But things are looking up for the company. Free cash flow is projected to improve from negative $1.051 billion to negative $18.1 million. That’s a 98.28% increase!

All in all, Duke has showcased its commitment to its dividend by annually increasing it the last 13 years. And more importantly, analysts expect further increases over the next couple of years. Management’s demonstrated commitment to the dividend, coupled with strong free cash flow growth, makes Duke’s dividend safe for now.

Brett Owens, Contrarian Outlook, BNK Invest Inc., 500 North Broadway, Suite 265, Jericho, NY 11753 USA, 516-620-4294, September 9, 2021

Teck Resources Limited (TECK) | Daily Alert September 28

Teck Resources Ltd. is a Vancouver, Canada based company that acquired a diversified group of commodity assets, including steel-making coal, copper, and zinc. Management has done an excellent job in acquiring valuable mines at discount prices that have not been reflected in Teck’s shareholder valuation. The company plans to reduce risk by not developing some of these huge mines in Peru, Mexico, and Chile, and may even sell a portion of these assets as commodity prices continue to rise.

It may take a while for most investors to realize this, but copper is critical in every aspect of achieving low carbon goals on a global basis. LanczGlobal’s analysis continues to like copper, zinc, and strategic metals, much of which asset-rich Trek Resources own. The EV (Electric Vehicle) and battery growth over the next few years will only push prices higher and make companies like Teck show impressive growth. The fact that management plans to also use this growth to improve its balance sheet and return monies to shareholders is another big plus.

We strongly recommend purchase at current levels for a potential double in valuation over the next 1-2 years.

Alan B. Lancz, The Lancz Letter, lanczglobal.com, 419-536-5200, September 21, 2021

ConocoPhillips (COP) | Daily Alert September 30

Four issues seem to be weighing on Exploration & Production stocks like ConocoPhillips. First, investors are increasingly looking to avoid climate-unfriendly companies. Also, investors have low interest in exposure to volatile and unpredictable oil and gas prices, especially since the entire energy sector has a tiny 2.6% weighting in the S&P 500 index. Another concern is that company managements will lose their new-found capital spending discipline. And there is always the risk that OPEC+ opens their oil production spigots, sending oil prices down.

Yet, supporting energy prices is resilient demand, which has nearly returned to pre-pandemic levels despite still-subdued jet fuel and gasoline demand.

Subdued supply growth should also support oil prices. Major global energy companies are under increasing pressure to reduce their production to help fight climate change.

Given this, we see a contrarian opportunity in ConocoPhillips. The company is the world’s largest independent E&P company, with most of its production in the United States, Canada, and Australia. With the news that it is acquiring Royal Dutch Shell’s Texas assets for $9.5 billion in cash, we believe the time to buy has arrived.

We like Conoco’s low valuation at about 5x EV/EBITDAX1. Most analysts have oil prices of perhaps $55-$60/barrel in their earnings estimates, implying that profits and cash flow will be stronger than estimated, as oil has traded close to $70/barrel for most of

We are placing an 80 price target on ConocoPhillips shares. The shares have jumped some on the Texas acquisition news, so investors may want to buy a partial position now, then wait for any pullbacks. BUY.

Bruce Kaser, Cabot Undervalued Stocks Advisor, cabotwealth.com, 978-745-5532, September 24, 2021

Suncor Energy Inc. (SU.TO, SU) | Daily Alert October 8

Suncor is one of the largest integrated oil companies in Canada and one of the top 10 in North America. It has operations in the oil sands in Western Canada, offshore Eastern Canada, the US, and the North Sea, some of which were acquired when it took over Petro Canada in 2014. It produced 695,000 barrels of oil per day (bpd) in 2020, and its refinery operations have a capacity of 466,000 bpd. It estimates it has 7.4 billion barrels of oil equivalent (boe) in proven and probable oil reserves.

Suncor’s funds from operations (FFO) increased to $2.36 billion ($1.57 per share) in the second quarter ended June 30, compared with $488 million ($0.32 per share) in the prior year quarter. Net earnings were $868 million ($0.58 per share) compared with a loss of $614 million (-$0.40 per share) last year.

With demand recovering, production increasing, and the additional resources from the Terra Nova acquisition, Suncor is well positioned to benefit from a combination of rising demand and rising oil prices. It remains a Buy.

Gavin Graham in Gordon Pape’s Income Investor, buildingwealth.ca, 1-888-287-8229, September 21, 2021

*Schlumberger Limited (SLB)

Drilled, uncompleted wells are wells that have been drilled but not yet fractured and put into production; producers have quickly burned through much of their DUC inventory and we’re approaching levels unseen since late 2016. As shale producers run out of DUCs to complete, they’ll need to start drilling new wells more aggressively just to maintain current output or grow oil output slowly over time, in line with current plans.

We’re looking for signs that this phenomenon might boost demand for services and equipment used to drill US shale wells.

We already believe the recovery in the services market outside the US is well underway.

And, as more producers recognize the looming supply challenges caused by underinvestment in new supply since the 2013/14 oil price crash, we believe the need for significant catch-up spending will play right into the hands of Schlumberger (NYSE: SLB) with its focus on international services work.

Elliott H. Gue and Roger S. Conrad, Energy Income Advisor, energyandincomeadvisor.com, 888-960-2759, October 1, 2021

Low-Priced Stocks

*ClearOne, Inc. (CLRO)

ClearOne, Inc. designs, develops and sells conferencing, collaboration and network streaming solutions for voice and visual communications. Its products are used in numerous industries such as enterprise, healthcare, education, government, legal and finance.

The second quarter marked the fourth consecutive quarter of year-over-year (yoy) revenue growth. Quarterly revenues grew 22% yoy and annual revenue is in an upward trend. Bottom line results have also improved, with net income totaling $1 million over the trailing twelve-month period.

Insiders currently hold 70% of CLRO’s total outstanding shares, many of whom have been accumulating sharesconsistently for years.

A significant risk is volatility due to a low float of just 8 million shares. The best way to mitigate this risk is to use limit orders to prevent buying or selling at unreasonable prices.

Sales outlook is great due to the popularity of ClearOne’s newest products. The recent move towards online learning is a good example of how the company plans to capture market share.

ClearOne is a value stock with the appeal of a growth stock. Recent revenue growth stems from the increasing demand for high-quality microphones and audio solutions. Outside of its product sales, the company offers a great long-term investment opportunity due to its strong fundamentals.

Faris Sleem, The Bowser Report, thebowserreport.com, 757-877-5979, September 2021

*ReneSola Ltd (SOL)

Solar stocks, like SOL could see higher highs. The White House said it wants solar to account for nearly half of electricity supply by 2050. At the moment, solar powers about 3% of the grid, says CNBC. By 2050, it could be up to 45%. All in an effort to decarbonize the energy industry.

According to Energy.gov:

“The U.S. Department of Energy (DOE) today released the Solar Futures Study detailing the significant role solar will play in decarbonizing the nation’s power grid. The study shows that by 2035, solar energy has the potential to power 40% of the nation’s electricity, drive deep decarbonization of the grid, and employ as much as 1.5 million people—without raising electricity prices.”

The U.S. just pledged to reduce emissions by up to 52% over the next several years. Europe wants to cut CO2 emissions by up to 55% by 2030. China says it’ll stop releasing CO2 in the next 40 years.

In short, it may not be a good idea to bet against green energy stocks, like SOL.

Ian Cooper, The Cheap Investor, support@thecheapinvestor.com, October 2021

Preferred Stocks & High Yield

Equitable Holdings, Inc. (EQH-PC) | Daily Alert September 10

Equitable Holdings, Inc.; 4.30% Fixed Rate, Non-Cumulative Perpetual; Par $25.00; Annual Cash Dividend $1.075; Current Indicated Yield 4.27%; Call Date 03/15/26 at $25.00; Yield to Call 4.13%; Pay Cycle 3m

Equitable Holdings, Inc. (EQH) is a global financial services company.

EQH’s 4.30% fixed rate preferred is callable on 03/15/26, or on any dividend payment date thereafter, at par plus any declared and unpaid dividends. Although this issue is rated non-investment grade by Moody’s, EQH’s senior debt rating is Baa2 with a positive outlook, while S&P rates EQH’s senior debt BBB+. EQH reported 2Q 2021 adjusted operating earnings of $758.0 million or $1.71 per share.

EPS results easily surpassed analysts’ $1.37 estimates. Adjusted bottom line operating results soared 68% from a year ago, benefiting from the strong economic reopening, net asset inflows of $6.1 billion, and favorable equity markets.

Assets under management (AUM) grew 22% year-over-year, reaching $869.0 billion. This investment is suitable for low- to medium-risk taxable portfolios. Buy at or below $25.85 for a 3.49% yield to call.

Martin Fridson, CFA, Income Securities Investor, isinewsletter.com, 800-472-2680, September 2021

Spire Inc. (SR) | Daily Alert September 20

Spire was previously known as the Laclede Group (LG), one of the first twelve industrial companies that made up the Dow Jones Industrial average and was first listed on the NYSE on November 14th, 1889.

Spire has five gas utilities, serving 1.7 million homes and businesses across Alabama, Mississippi, and Missouri, making it the 5th largest publicly traded natural gas company in the country.

For the third quarter, the company generated $327.8 million in sales, up 2.1% compared to Q3 2020. Net income equaled $5.3 million or $0.03 in the quarter, up from a loss of $92.3 million or -$1.87 per share in the year ago period.

The management team has affirmed its fiscal 2021 guidance of $4.30 to $4.50 in earnings-per-share (EPS) for the year.

Shares of Spire are trading at a price-to-earnings ratio of 14.7. Our fair value estimate is 16 times earnings. When combined with the 4.0%+ starting yield and 5.5% expected earnings-per-share growth rate, this suggests the potential for 10.6% annual total returns over the next five years.

Ben Reynolds, Bob Ciura, Josh Arnold, & Eli Inkrot, Sure Retirement Newsletter, suredividend.com, ben@suredividend.com, September 2021

*Enterprise Products Partners L.P. (EPD)

Enterprise Products Partners raised its quarterly dividend to $0.45 per share this year, and it is expected to pay another dividend in October. It also has a $2 billion share repurchase program in place.

Motley Fool identified the Houston-based pipeline and energy storage company as one of five stocks that are expected to double in value by 2029—largely due to its generous dividend yield. EPD has raised its annual payout for 22 consecutive years, and it has plenty of cash flow to continue this policy, while also expanding its infrastructure investments. Enterprise Partners is ahead 19% this year, one of the few bright spots in the commodity sector.

Mark Skousen & Jim Woods, Forecasts & Strategies, markskousen.com, Eagle Financial, 300 New Jersey Ave. NW, Suite 500, Washington, D.C. 20001, October 2021

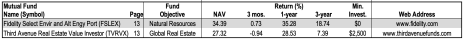

Funds & ETFs

Fidelity Envir and Alt Energy Fund (FSLEX) | Daily Alert October 12

Until recently a Select fund, Environment & Alternative Energy is now a part of Fidelity’s expanding suite of “socially conscious” funds. But a mere name change is not the full extent of its metamorphosis.

While Alt Energy’s primary investment objective remains capital appreciation, 80% of its assets must be assigned to companies that are “principally engaged” in alternative and renewable energy production, energy efficiency, pollution control, water infrastructure and even waste management.

Benchmarked against the FTSE Environment Opportunities & Alternative Index, the fund’s new co-managers rely on Fidelity’s proprietary ESG screens as a first cut in defining its investable universe.

While the fund’s rising large-cap growth-stock exposure has pushed it away from value, Alt Energy remains an economically sensitive industrial fund, albeit one not tied to Rust Belt manufacturers.

Jack Bowers, John M. Boyd and John Bonnanzio, Fidelity Monitor & Insight, fidelitymonitor.com, 800-397-3094, October 2021

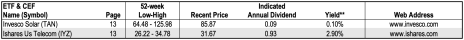

Invesco Solar ETF (TAN) | Daily Alert September 22

The Invesco Solar ETF is used as a proxy for the solar industry and has 100% of its holdings in solar manufacturing and related equipment including the technology to operate power plants, store energy, and build related equipment. It is passively managed, follows the MAC Global Solar Energy Index, and is rebalanced quarterly. It has $3.2 billion in assets and 56 holdings.

About half of the companies are in the US, with roughly a quarter each in Asia and Europe.

The ETF offers broad diversification within the solar sector with a reasonable management expense ratio of 0.50%. Its higher weighting towards North American companies means a greater participation in higher-margin solar products, including inverters, which are the brains of these systems.

Adam Mayers in Gordon Pape’s Internet Wealth Builder, buildingwealth.ca, 1-888-287-8229, September 13, 2021

*Third Avenue Real Estate Value Fund Investor Class (TVRVX)

Third Avenue Real Estate Value Investor Fund is up 17.9% so far in 2021. It has an advantage over other mutual funds during recessions. Unlike the typical REIT, management will go to cash when asset prices are generally high. Cash is preserved for scooping up opportunities.

It is a global real estate fund which means it is not confined to US real estate with low cap rates which translate to high valuations. Management looks for growth more than current income by focusing on real estate operating companies which, unlike REITs, can reinvest profits back into the business. Management also searches for opportunities in different aspects of a real estate company’s capital structure by investing in senior debt in addition to equity.

Gray Cardiff, Sound Advice, soundadvice-newsletter.com, 800-825-7007, September 30, 2021

*iShares U.S. Telecommunications ETF (IYZ)

Over the last 15 years, Telecom has generated an average return of 2.7% during its bullish seasonality from the middle of October through around year end. This is the top ETF within this sector. Use a buy limit of $32.85 and stop loss of $29.57. If above-average gains materialize, take profits at the auto sell of $37.11. Top 5 holdings are: Comcast, Cisco Systems, Verizon, AT&T and Charter Communications. Aggressive competition has hindered the sector, but IYZ does boast a 12-month trailing yield of 2.46% as of August 31.

Jeffrey A. Hirsch, Stock Trader’s Almanac, stocktradersalmanac.com, 800-762-2974, October 7, 2021

Updates

SELL The remainder of Five Below, Inc. (FIVE) | Daily Alert September 17

Updated from WSBD 839, March 18, 2021

FIVE’s beautiful breakout and strong upside follow-through from a multi-month base early last month completely fell apart after fears of higher costs (first on Dollar General’s quarterly report, then after Five Below’s own report last week) ripped through the sector.

To be fair, those fears do seem overblown, but we’re wondering if the market is sniffing out something else—FIVE’s massive-volume break (biggest weekly volume since June 2020) not only crushed the recent breakout but has landed the stock below its 200-day line. Long-term, we could revisit the stock again when things shape up, but given the damage, that probably won’t be for a while. We sold our position on a special bulletin Tuesday morning. SOLD

Michael Cintolo, Cabot Growth Investor, cabotwealth.com, 978-745-5532, September 9, 2021

SELL Digital Realty Trust, Inc. (DLR) | Daily Alert October 7

Updated from WSBD 838, February 18, 2021

Digital Realty Trust has broken through technical support on the downside. We recently kept half of the position because the stock moves independently of the overall market at a time when the market is looking increasingly treacherous. But it appears to be independently heading lower. It should be okay over the long term, but I don’t want to hang on through many months of languishing. It’s also not a bad time to take some money off the table. SELL

Tom Hutchinson, Cabot Dividend Investor, cabotwealth.com, 978-745-5532, September 29, 2021

SELL Brady Corporation (BRC) | Daily Alert October 13

Updated from WSBD 843, July 8, 2021

Brady was downgraded to Sell. The stock’s Overall score has slumped to 50, hurt by weakness in Momentum (32) and Earnings Estimates (21). Brady has been under pressure in recent months, and analysts have trimmed estimates for three of the next four quarters. Brady should be sold.

Richard J. Moroney, CFA, Upside, upside stocks.com, 800-233-5922, October 2021

*SELL Half: Lithium Americas Corp. (LAC)

Updated from WSBD 844, August 12, 2021

Let’s start out with a win. Not long ago, we recommended Lithium Americas at $14.08. Today, it’s up to $21.92 and is becoming a bit overbought. Let’s sell the second half of this stock today to secure the win.

Ian Cooper, The Cheap Investor, support@thecheapinvestor.com, October 2021

Investment Index

The next Wall Street’s Best Digest issue will be published on November 11, 2021.