Happy Holidays!

The markets seem to be recovering from the initial scares of the Omicron COVID variant. We’ve seen some nice rises in the last couple of days.

Despite Washington’s hostile environment, the latest worries about the possible invasion of Ukraine by Russia, and the Fed’s new dedication to tapering, the economy still looks pretty solid.

While both Black Friday and Cyber Monday retail sales underperformed, by 1.1% and 1.4%, respectively, industry pundits reminded us that many sales were just pushed forward this year, as pre-Black Friday sales began by late October. Online sales look strong for the holidays, up 11.9^ from November 1 through Cyber Monday.

Market Views

The stock market decline has seen $VIX explode to the upside, and that has set off some reactions. First and foremost, the trend of $VIX is now higher. That is, the 20-day Moving Average of $VIX and also $VIX itself are both above the 200-day MA. That defines an uptrend for $VIX, in our terminology, and issues an intermediate-term sell signal. This crossover is marked on the chart in Figure 4 with a green circle.

We are no longer recommending a “core” long position. We will trade individual signals as they are confirmed, and right now most of those are sell signals. But things can change, and these oversold conditions will certainly lead to confirmed buy signals eventually.

Lawrence G. McMillan, The Option Strategist, optionstrategist.com, 973-328-1303, December 3, 2021

Stay Long

The most confusing move is the longer maturity Treasury yields falling on the heels of the new expectations of an accelerated tapering by the Fed, the biggest U.S. Treasury bond buyer in the market by far. This is on top of a consensus that inflation is not “transitory” and that bonds are already offering negative real yields (stated yield minus inflation) before yields started falling. This is far too big a market to brush aside as inconsequential, especially since all year long lower rates resulted in stronger high valuation tech names moving higher and now tech is falling with interest rates. It feels like a risk-off flight to quality but with the rest of the stock market acting well and earnings and GDP forecasts still strong, we are certainly being presented with mixed signals.

Longer-term, earnings are what matter, which are driven primarily by the consumer in the U.S., and both remain in very good shape. The Fed repositioning is a good thing by giving them optionality they need to have a more credible “put” if needed, and as the Fed takes away the punch bowl, Congress should be stepping up with additional liquidity in the Build Back Better legislation. The year-end isn’t as hot as hoped but should still end on a high. Temper expectations but stay long.

Louis Navellier, Navellier Market Notes, 1 East Liberty, Ste. 504 Reno, Nevada 89501, info@navellier.com, December 6, 2021

Neutral, but not Counting out the Bulls

The market is (literally) teetering on the edge of moving out of a bull-market bias and into a neutral-market bias; and, of course, it “could” be on its way to entering a bear-market condition. If the market continues to fall, our investment bias will turn much more conservative and be looking for opportunities to book profits or, at the very least, keep losses as small as possible.

At this writing, I am far more neutral than bullish. But, as we have seen many, many times this year, the market could boom higher this week in one more massive whipsaw.

Mike Turner, Turner Capital Investments, turnercapital.com, 855-678-8200, December 6, 2021

Spotlight Stock

Western Union is a leading global money transfer company, with a highly recognized brand and an immensely broad reach provided by over 550,000 branches in nearly every country around the world. About 62% of its revenues are produced outside of North America. Founded in 1851, Western Union, based in Denver, Colorado, has a remarkably complicated history that includes a bankruptcy, numerous owners, acquisitions across many industries and several business splits that eventually landed it at First Data Corporation. Western Union was spun off from First Data in 2006 and has since remained an independent public company.

Western Union’s challenges appear sizeable. Competition from digital money services like Venmo and Bitcoin continues to increase. Global remittance pricing pressure and slow economic growth outside of the United States weighs further on revenue growth. Western Union’s ineffective acquisition program has drained cash and diverted management’s attention, adding to investor frustration. And investors harbor a general wariness about money laundering, terrorist financing and other risks associated with the money transfer business.

Since the spin-off, Western Union’s share price performance has been lackluster at best. Improved financial results in 2019 and in early 2021 offered some encouragement but weren’t sustainable. The most recent disappointments have driven WU shares down sharply to 10% below their 2006 spin-off price. Investors seem to be abandoning the stock, likely exacerbated by some of the year-end selling motivations.

Our interest in Western Union shares stems from three traits. First, the shares are strongly out of favor. In addition to the sell-off, the share price values Western Union at only 6.0x EV/EBITDA – a level that implies a dour future. While peers like Global Payments (GPN) and Fiserv (FISV) have superior business models and rightfully trade at much higher multiples, the WU discount appears overly wide.

Second, Western Union’s fundamentals are surprisingly healthy. Its revenues are stable if not fast-growth, as are its operating profits. These have helped Western Union generate decent free cash flow such that it has paid a steadily increasing dividend and repurchased 27% of its share base over the past eight years, in addition to funding several acquisitions. The company’s balance sheet holds $1 billion in cash and will add another $800 million from the pending sale of its non-core Business Solutions operations, offsetting much of its $2.9 billion in debt.

The brand name alone carries considerable value, which the company is leveraging into digital services which now comprise 21% of total revenues. Impressively, the Western Union mobile app was the most downloaded app among similar money transfer companies in the third quarter. New initiatives like the WU+ digital banking app launch in Germany and Romania look to extend this growth.

Third, the board recently announced that the CEO of 11 years is retiring. His replacement is an impressive senior executive, Devin McGranahan, who is leaving his post as head of fintech giant Fiserv’s Global Business Solutions segment to lead Western Union. Prior to his five years at Fiserv, McGrahanan was a senior partner in McKinsey’s financial industry practice, so, all in, he brings considerable leadership and fintech industry expertise. His fresh perspective will be valuable in navigating the competitive environment and refocusing and accelerating the company’s promising digital and other paytech initiatives while defending its legacy products.

An investment in Western Union carries risks, and a turnaround will likely take some time. Yet, the washed-out shares and low investor expectations appear to limit the downside, while the steady fundamentals and new leadership look well-placed to produce considerable upside. WU shares offer an attractive and sustainable 5.5% dividend yield to compensate for the wait.

We recommend the purchase of Western Union shares with a 25 price target.

Bruce Kaser, Cabot Turnaround Letter, cabotwealth.com, 978-745-5532, December 1, 2021

The Western Union Company (WU) 52-Week Low/High: $ 15.69 - 26.61 | Why Western Union:

|

Feature Article

Do you recognize these lyrics, “Telegram just had to say, you’ve learned your lesson all the way. Western Union…”

The lyrics come from the Western Union song, by the Five Americans, written in 1967. Not many businesses get a song written about them, so the younger folks reading this may not realize just how popular the Western Union company was in those days.

The firm was founded in 1851, and telegrams were its product. According to The New York Times, “at the height of their use 1929, Western Union sent over 200 million telegrams around the world. In 2005, the company sent just 21,000. Western Union sent the last United States telegram on January 27, 2005.”

Today, Western Union is known for money transfers. It serves more than 150 million customers in 200 countries and territories with a 130-currency portfolio.

And as contributor Bruce Kaser of Cabot Turnaround Letter noted, Western Union has been through some tough times. But there are bright spots, signaling a much-needed turnaround may be coming.

In its third quarter, Western Union posted adjusted EPS of $0.63, up from $0.57 in the prior-year period and beat analysts’ consensus estimates by 8.6%. Those gains were primarily driven by its digital money transfer and Business Solutions businesses, where revenues rose by 15%, and now account for 24% and 37% of total customer-to-customer (C2C) revenues and transactions, respectively.

As part of its continuing focus on digitization, Western Union recently expanded its longstanding partnership with Mastercard Incorporated (MA), on two fronts: 1) integrating Mastercard Send within Western Union’s global money movement network; and 2) using the global network of Western Union Business Solutions to increase Mastercard Cross-Border Services fund dispensing.

Western Union is also seeing monthly active users of its mobile app rising nicely, 8% during the quarter. App markeing firm Sensor Tower reported that Westernunion.com was “the most downloaded mobile app among its peer money transfer companies during the third quarter.”

The stock of Western Union should also get a boost from its inclusion in the S&P MidCap 400, due to begin on December 20.

In its quarterly report, the company updated its 2021 financial outlook, saying that it now expects earnings per share to be $2.05-2.10, higher than the prior guidance $2-2.10. It also estimates that constant currency revenue growth will rise 3-4% for 2021.

And as Bruce mentioned, the shares of Western Union are trading at bargain-basement levels. Sure, there’s work to be done. But where else can you find such a discounted stock that also pays some nice cash flow—a dividend that has been increased by nearly 47% over the past five years?

Growth

Canopy Growth Corporation (CGC) | Daily Alert November 16

First, the good news: widening cannabis legalization will eventually lead to some great business successes. The bad news is that only a few of the multitude of cannabis stocks today will pay off for investors. Consumer cannabis demand is high, but growing and distributing it across multiple markets is more difficult. With “Cannabis Corner,” we focus on quality stocks that are most likely to emerge as winners in the “Wild West” of marijuana investing.

Canopy Growth (Toronto symbol WEED/TO; TSINetwork Rating: Speculative), TSI Cannabis Quality Rating [CQR]:) is acquiring privately held Wana Brands, a Colorado-based cannabis edibles brand that believes it leads the North American gummies category by market share.

Rather than buying Wana outright, Canopy will buy an option to buy 100% of the company if cannabis becomes federally legal in the U.S. It will pay $297.5 million U.S. for the option. The future cost of buying Wana has not yet been disclosed.

Canopy Growth is a speculative buy.

Patrick McKeough, Power Growth Investor, tsinetwork.ca, 888-292-0296, November 2021

Growth & Income

ABM Industries Incorporated (ABM) | Daily Alert November 15

ABM Industries has a deep book of customers with janitorial services, facilities engineering, parking management, landscaping and grounds management, mechanical and electrical services, and vehicle maintenance.

Third-quarter revenue was $1.5 billion, up 11% year over year. ABM’s earnings per share came to $0.90 during the quarter, $0.09 ahead of consensus estimates.

ABM announced it would acquire Able Services, a janitorial services and engineering company, for a total consideration of $830 million. ABM management believes the acquisition, once it closes, will be immediately accretive.

Following third-quarter results, we expect $3.50 in earnings per share for 2021.

ABM has also enhanced its organic growth over the years with acquisitions, eliminating competitors and further boosting its own size.

ABM looks well-priced today at 13.2 times this year’s projected earnings, as that compares very favorably to our fair-value estimate of 17.5 times earnings. Due to this, we see a sizable 5.7% annual tailwind to total returns in the coming years. In total, we see robust 12.1% total annual returns in the coming years.

Ben Reynolds, Eli Inkrot, Josh Arnold & Nate Parsh, Sure Dividend Newsletter, suredividend.com, support@suredividend.com, 800-531-0465

McDonald’s Corporation (MCD) | Daily Alert November 30

McDonald’s posted global comparable store sales [growth] of nearly 13% in the third quarter and a 10.2% increase on a 2-year basis.

McDonald’s is the largest restaurant business in the world, with some 40,000 restaurants in over 100 countries.

Systemwide digital sales were about $13 billion, or over 20% of total systemwide sales in the firm’s top six markets. Per-share profits of $2.76 were up 24% year over year and handily beat the analysts’ consensus estimate of $2.46. McDonald’s recently boosted its dividend 7% to a quarterly rate of $1.38. The dividend increase marks the 45th consecutive year that McDonald’s has boosted the dividend.

The recent stock action of McDonald’s is bullish, and I expect the latest price breakout to have some legs. McDonald’s is also the type of low-beta stock that should show good relative performance should a more risk-off market environment develop.

While the stock moved to an all-time high on the solid earnings report, these shares have underperformed the S&P 500 over the last 12 months. Thus, I think the stock has room for more catchup, and I look for the stock to put up nice results in 2022.

Charles B. Carlson, CFA, DRIP Investor, dripinvestor.com, 800-233-5922, December 2021

*Ford Motor Company (F)

Though Rivian’s (RIVN) recent IPO and its trading since then has been quite extraordinary, and electric vehicle (EV) momentum is accelerating, I believe that Ford represents a better risk/reward idea that comes with several benefits.

First, Ford earlier made a capital investment in Rivian, which makes the current situation more interesting. Rivian has a market value of $105 billion, whereas Ford is at $81 billion. However, Ford made a $500 million investment in Rivian for a 12% stake, so its position is now worth $12.6 billion. Nice return.

Ford’s strategic plan, outlined in May, has positioned the company as an aggressive player in electric vehicles, committing $7 billion to three new battery factories in Tennessee and Kentucky, along with a plant to build electric pickup trucks as part of $30 billion in electric-vehicle investments planned through 2025.

Big picture, Ford plans to sell 600,000 EVs annually by 2023. By 2030, Ford expects to generate 40% of its revenue from electric vehicles (EVs).

Another plus is that Ford announced on November 18 that it has entered into a chipmaking partnership with U.S.-based GlobalFoundries, which has operations all over the world to produce semiconductors.

Rivian will have basically zero revenue and profits in 2021 while Ford expects to earn between $4 billion to $5 billion in adjusted free cash flow (FCF) and $10.5 billion to $11.5 billion in earnings before interest and taxes (EBIT). The bet for Rivian assumes much higher growth and profitability than Ford going forward. We shall see.

Finally, Ford offers a balanced approach to investing in EVs – if electric vehicles in America do not take off in the coming decade as assumed (shortage of rare earths and metals, perhaps?), it will simply sell more regular cars.

BUY A HALF POSITION

Carl Delfeld, Cabot Explorer, cabotwealth.com, 978-745-5532, November 23, 2021

*Maximus, Inc. (MMS)

Maximus reported fiscal-year 2021 revenues increased 23% to $4.25 billion with EPS up 38% to $4.67. Maximus generated a solid 20% return on shareholders’ equity for the year. Revenue growth was driven by approximately $1.1 billion of COVID19 response work. For fiscal 2022, Maximus expects revenues in the range of $4.4 billion to $4.6 billion and EPS in the range of $4.00-$4.30. Over the last five years, Maximus’ stock has gained a tidy 41%. Buy.

Ingrid R. Hendershot, Hendershot Investments, hendershotinvestments.com, 703-361-6130, December 2021

Value

*First Solar, Inc. (FSLR)

First Solar has been climbing in exactly the sort of “up a lot and then down a little” manner that we like to see, and given how things are playing out in the world of clean energy these days, I am making it a “Top Pick” this month. First Solar’s stock has been behaving exactly how we like our stocks to be behave when they are making moves to the upside, though both Portfolios already own “enough” for the time being.

For its third quarter, First Solar reported revenues of $583.5 million and net income of $45.2 million, or $0.42 per share, as compared to revenues of $629.2 million and net income of $82.4 million, or $0.77 per share, in the same period a year ago. I am raising the buy limits this month and want to make sure all newer subscribers see that it is flagged as a “first buy.” With a reminder to scale-in over time rather than all at once, FSLR is now a strong buy under $95 and a buy under $115.

Nate Pile, Nate’s Notes, NotWallStreet.com, 707-433-7903, November 13, 2021

Financials

Regions Financial Corporation (RF) | Daily Alert November 17

We’re going after regional banks because their nimble shares are hyper-tuned to Treasury yields.

That’s part 1 of our taper-driven small-bank play. As for parts 2 and 3, we want small banks that are hiking dividends or buying back shares—and ideally both. That’s because both dividend growth and buybacks ignite share prices.

You can see buybacks’ effect on share prices with Regions Financial... RF has branches across the South and Midwest and yields 2.8% today. The bank’s buybacks over the last five years have provided a floor for the stock, sending it higher as management slashed shares outstanding by 21%.

Buybacks Boost Regions’ Share Price

Supported by its buybacks and surging dividend, Regions’ stock snapped back from the 2020 crash. Further tapering by Powell will power both dividends and buybacks, pushing Regions’ shares higher still!

Brett Owens, Contrarian Outlook, BNK Invest Inc., 500 North Broadway, Suite 265, Jericho, NY 11753 USA, 516-620-4294, November 9, 2021

Equitable Group Inc. (EQB.TO, EQGPF) | Daily Alert November 23

Equitable Group provides mortgage lending services to individuals and businesses in Canadian urban markets, with a focus on entrepreneurs and new Canadians.

The shares have been in an upward trend all year. On Oct. 25, the stock split 2 for 1, which means you now own 200 shares for every 100 you had before.

Revenue for the three months to Sept. 30 was $165.6 million, after added back $3.5 million for reversed credit loss allocations. That compared with $151.6 million in the same period of 2020.

The company expects next year’s performance will be positively influenced by the carry-forward effect of growth in loans this year, an asset mix favoring its high-value conventional loan book, ongoing success in growing EQ Bank customer relationships, and the reduction in funding costs to be achieved through expansion of its covered bond program.

Buy.

Gordon Pape, Internet Wealth Builder, buildingwealth.ca, 1-888-287-8229, November 15, 2021

CBIZ, Inc. (CBZ) | Daily Alert December 6

CBIZ Inc. is a neat little insurance/brokerage outfit in Cleveland. CBZ offers financial, insurance, tax and advisory services. The biggest revenues are from its very profitable Insurance Brokerage/offices. The company has three distinct sectors—Insurance & Benefits, Financial Services, and National Practices. CBZ is mostly Midwest-based and serves the smaller- to mid-level-business market, owning a nice niche.

CBZ sells for about 22 times 2022 earnings, and about 14 times cash flow (it throws off handsome free cash flow). With a market cap of about $2 Billion, CBZ has net debt of about $150 million, and maybe less than that, as CBZ carries a very conservative accounting ledger. The company does a good job of growing profits.

Totally ignored on Wall Street, Zack’s shows one lonely analyst following it, and that’s ok with us. In fact, I really like it when I can find good stocks that nobody in my business pays any attention to. That’s the way TPL was 5 years ago.

I think we see nice/quiet steady progress here, and I will move my buy up to $40 but won’t chase it past that.

Bob Howard, Positive Patterns, P.O. Box 310, Turners, MO 65765, 417-887-4486, November 26, 2021

*Sun Life Financial Inc. (SLF)

GURU CRITERIA: JOHN NEFF

Sun Life Financial Inc. is a Canada-based financial services company that provides a diverse range of insurance, wealth and asset management solutions. The company’s segments include Canada, U.S., Asset Management, Asia and Corporate. The Canada segment provides protection, health, and wealth solutions. The U.S. segment provides group benefits such as group insurance products and services in the United States market. The Asset Management segment comprises of MFS and SLC Management

P/E RATIO: PASS

EPS GROWTH: PASS

FUTURE EPS GROWTH: FAIL

SALES GROWTH: PASS

TOTAL RETURN/PE: PASS

John Reese, Validea Hot List Newsletter, validea.com, 877-439-0506, December 3, 2021

Healthcare

Silk Road Medical Inc (SILK) | Daily Alert December 3

We see solid long-term growth opportunities for Silk Road given the safety and efficacy advantages of the company’s TransCarotid Artery Revascularization (TCAR) treatment over traditional procedures. The company is also expanding its salesforce and continues to train surgeons in the TCAR procedure. Based on SILK’s risk profile and relatively high valuation, we see the stock as appropriate for risk-tolerant investors.

Silk Road Medical faces near-term headwinds as more elective surgical procedures – including the company’s TCAR procedure – are deferred due to the Delta variant surge and rising COVID-19 hospitalizations. The company cut its 2021 sales guidance after the number of TCAR procedures performed in 3Q21 fell short of management’s target. However, we believe that Silk Road has strong long-term growth prospects given the advantages of its TCAR procedure over traditional carotid endarterectomy (CEA), which has been the standard of care for more than 60 years.

Key drivers for revenue growth are market expansion through physician training, international expansion, and new indications for the TCAR procedure. Based on the updated guidance, we are widening our loss estimates to $1.20 per share from $1.10 for 2021 and to $0.70 per share from $0.50 for 2022.

Despite near-term pressure from COVID-19 on hospital procedural volumes, we see a strong long-term growth profile for SILK.

Our rating is BUY with a revised price target of $60.

Jim Kelleher, CFA, Argus Weekly Staff Report, argusresearch.com, 212-425-7500, November 26, 2021

*Seres Therapeutics, Inc. (MCRB)

When the microbiome gets out of balance things can go haywire in the intestinal tract leading to such things as clostridium difficile infection (CDI), Crohn’s, colitis or irritable bowel syndrome. Seres Therapeutics is devoted to adding important missing bacteria back into the disbiotic microbiome via orally taken capsules to restore homeostasis to the microbiome.

The shares leaped as much as 35% to a high of $9.22 upon releasing its Q3 report, though I didn’t see much new in the report to justify it. I speculated that if that was the reason, it might be just the school of investors (or possibly just algorithms/computers?) that mindlessly buy any stock with a big earnings beat.

And if that’s what was going on it’s a little scary because we already knew that Nestle had paid the upfront fee of $175 million in Q3 for the U.S. rights to market the drug and 50% of the profits. So, the EPS “beat” was simply because some analysts had not gotten around to factoring this into their estimates yet, or did not know how to, so this was not an actual surprise in my mind and it’s a one-timer.

With the shares back to $9.16 investors appear to have turned more optimistic. For me the most interesting was that the in-depth analysis of all the detailed microbiome data resulting from the SER-287 Phase 2 study, that “failed,” was expected to be completed and announced by year end. And among other things, they hoped to figure out why the trial failed when results from the 1b trial were encouraging.

Also, this does include subgroup analysis to see if SER-287 worked better in certain subsets of the trial population, a common task after any Phase 2 trial. Though hope is not a strategy, the above has strengthened my hope for a rise from the dead for SER-287, as happened with SER-109 which, after being tweaked, completed a successful Phase 3 study and now seems headed for FDA approval. As to SER-109, the safety study has been completely enrolled and should have final results by mid-2022.

Also, Seres signed a contract with a Swiss company (Bacthera) to help produce larger quantities of SER-109 as demand grows beyond the launch quantities Seres can produce. Especially interesting is the location in Europe where Nestle has the rights and will be paying royalties.

What it comes down to is simply—do you believe in the thesis that restoring health to the microbiome could cure more intestinal disorders than just c. diff., like U.C. and perhaps help with graft vs. host disease, or possibly even make drugs for Alzheimer’s and cancer more efficacious?

If so, then you may want to take a chance on Seres again down here as I’ve been doing. Of course, there are no guarantees, but Seres is the leader in this field and SER-109, if approved, will be the first in this microbiome class. I have seen estimates of SER-109 being a billion-dollar drug. Buy.

Tom Bishop, BI Research, biresearch.com, November 24, 2021

Technology

Charter Communications, Inc. (CHTR) | Daily Alert November 12

Charter Communications has risen to the top of our filter again. You’ll recall Charter is a broadband communications company and the second largest cable operator in the U.S.

The company’s Spectrum brand provides cable TV, internet, and home phone services to more than 31 million customers in 41 states. Charter is near the top of the list of 10 biggest entertainment companies, with a market cap of about $123 billion.

Charter has benefited from a spike in Internet usage due to pandemic work-from-home and online schooling but is fighting off weakened residential subscriber trends due to cord-cutting and competition. When internet, wireless and video customers are lumped together, though, Charter continued to gain ground in Q3.

For Q3 2021, Charter reported income of $6.50 a share (above estimates and improved from $3.90 a year ago). Revenue was up 9% to $13.15 billion.

In the last 12 months, management has reduced shares outstanding by 10.287%.

David R. Fried, The Buyback Letter, buybackletter.com, 888-289-2225, November 5, 2021

Ambarella, Inc. (AMBA) | Daily Alert November 22

Ambarella was hit hard today on the market’s weakness and news that its CFO is taking a health-related leave of absence. Again, we’re not complacent, but even after today’s sharp plunge, the stock is still a few points above its 25-day line (now at 177.5) because of the recent huge run. We’ll be watching closely, but (a) the uptrend is still intact, and (b) with “only” a half-sized position and a solid profit we advise giving the stock room to maneuver. If you don’t own any, we’re OK starting a small position here or on further dips. BUY A HALF

Michael Cintolo, Cabot Growth Investor, cabotwealth.com, 978-745-5532, November 10, 2021

Akamai Technologies, Inc. (AKAM) | Daily Alert December 1

Akamai Technologies, Inc. invented the world’s largest Content Network Delivery (CND) architecture. The Akamai network service runs customers’ applications near the point of contact for the user, often called the “edge” of the Internet. Akamai’s network comprises 325,000 servers in 4,100 locations within 130 countries, and interfaces with over 1,400 networks that support user connections.

Akamai’s customers include a large percentage of the world’s most important brands, including hundreds of media companies, online retailers, governments, financial institutions, and other enterprises. No customer accounted for greater than 10% of revenue during the past three years.

Over the past five years, international revenue has more than doubled, growing 19% per year and now accounting for 44% of total revenue.

Another growth driver for Akamai is the need for customers to fight security threats such as malware, distributed denial of service (DDoS) attacks, non-human (bot) users, and ransomware. The Security Technology Group, about 38% of 2021 YTD revenue, has grown 27% this year and in the long term is expected to make up more than 50% of total revenue. Only 67% of current customers have purchased a security offering, leaving plenty of room for additional business. Further, the nature of ever-changing cyberattacks creates the opportunity for new, stand-alone cybersecurity offerings that can generate incremental revenue.

Media streaming should drive significant bandwidth growth. Today, even though 50% of all Internet bandwidth usage is media streaming, only 20% of viewership is streamed over the Internet versus 80% for television. Akamai should continue to get a boost from newer streaming services like Disney+, HBO Max, and Comcast’s Peacock, all of which are customers.

Acquisitions should also contribute to Akamai’s growth, particularly in the Security Technology Group

Analysts are projecting 12% average annual long-term earnings growth. Five years at this pace and a future high P/E of 35.8 could generate a stock price as high as 230.

Doug Gerlach, InvestorAdvisoryService.com, 1-877-33-ICLUB, December 2021

ON Semiconductor Corporation (ON) | Daily Alert December 2

We see ON Semiconductor as capable of outgrowing its peers, in part by expanding its presence in newer end markets, such as cloud power, electric-vehicle charging, and machine-vision applications like automotive cameras. ON also stands to benefit from the accelerating pace of data-center creation. The company generates more than $300 per 5G platform.

The company projects the market for sensor semiconductors (14% of ON’s revenue in the year ended September) will grow at an annualized rate of 10% through 2025, reflecting continued demand for industrial automation and autonomous cars. Revenue for power semiconductors (51% of revenue) should expand at a 6% annual clip, driven by the push for energy efficiency and the electrification of consumer and industrial products. ON’s two biggest end markets are automotive (34% of company sales) and industrial (26%).

Analysts target growth of 24% in sales and 167% in per-share profits for the December quarter, followed by 6% higher sales and 16% higher profits next year.

Richard Moroney, CFA, Dow Theory Forecasts, dowtheory.com, 800-233-5922, November 22, 2021

*KLA Corporation (KLAC)

KLA Corporation designs, manufactures, and markets process control and yield management solutions for the semiconductor and related nanoelectronics industries worldwide. The company offers chip and wafer manufacturing products, including defect inspection and review systems, metrology solutions, in situ process monitoring products, computational lithography software, and data analytics systems for chip manufacturers to manage yield throughout the semiconductor fabrication process.

Risk: C Fair

Reward: A- Excellent

Mike Larson, Weiss Stock Ratings Heat Maps, issues@e.weissratings.com; phone: 1-877-934-7778, November 2021

*Western Digital Corporation (WDC)

According to Analyst Rocky White’s data, Western Digital stock has averaged a December gain of 8.7% over the past 10 years and has finished with a positive monthly eight of those times.

From its current perch, a move higher of similar proportions would put WDC above $65 for the first time since late August. And although the shares have shed around 21% over the last six months, the 40-day moving average is back in place as a trendline of support after months of pressure.

An unwinding of pessimism in the options pits could boost the stock even higher. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), WDC’s 10-day put/call volume ratio ranks in the 97th annual percentile. In other words, puts are being picked up at a quicker-than-usual clip.

Short sellers are jumping ship, with short interest falling 13% in a month. The 7.04 million shares sold short account for 2.3% of the stock’s available float, or just under two days’ worth of pent-up buying power.

Bernie Schaeffer, Schaeffer’s Investment Research, SchaeffersResearch.com, 800-327-8833, December 2, 2021

Sensata Technologies Holding plc (ST) | Daily Alert December 7

Sensata Technologies, originally recommended by Bruce Kaser for the Buy Low Opportunities Portfolio of Cabot Undervalued Stocks Advisor, first topped 60 in early January, and since then has been trading in a range between 55 and 60, preparing for its next advance.

In his update last week, Bruce wrote, “Sensata is a $3.8 billion (revenues) producer of nearly 47,000 highly engineered sensors used by automotive (60% of revenues), heavy vehicle, industrial and aerospace customers. About two-thirds of its revenues are generated outside of the United States, with China producing about 21%. On October 26, Sensata reported a strong third quarter. Revenues rose 17% net of acquisitions/divestitures, and adjusted earnings increasing 32%. Both were higher than the consensus estimates. Free cash flow was fine, and the balance sheet remains sturdy and under-leveraged, so Sensata is resuming its share buyback program and will probably resume its dividend, as well as also look for more acquisitions.

However, the company’s fourth-quarter guidance was light—revenues and earnings were guided to about 3-9% below consensus estimates—due to difficult auto industry conditions and higher inflation. This left the market with an unclear near-term direction. The company’s 2022 outlook remains unchanged.

We retain our Buy rating as the longer-term outlook remains encouraging. ST shares have about 24% upside to our 75 price target.” BUY

Timothy Lutts, Cabot Stock of the Week, cabotwealth.com, 978-745-5532, November 29, 2021

Preferred Stocks & High Yield

*PermRock Royalty Trust (PRT)

PermRock Royalty Trust (PRT) owns a perpetual interest in dedicated oil and natural gas production areas in the Permian Basin. PRT receives 80% of the net profits from the wells in the dedicated areas. The trust does not engage in any business operations.

Monthly distributions are paid two months after the actual production. Distribution rates are based on oil and natural gas prices, and the production amounts from the dedicated acreage.

Production stays relatively level. The breakeven for distribution payments is at about $40 per barrel of oil. As oil moves higher, the monthly payouts get larger. Based on the last three distributions, PRT yields 10%.

Tim Plaehn, The Dividend Hunter, yn345.isrefer.com/go/cabmdpc/cab/, December 2021

*BASF SE (BASFY)

Founded in 1865, BASF is the world’s largest chemical maker, operating across five segments (in order of revenue contribution): Functional Solutions, Chemicals, Performance Products, Agricultural Solutions and Oil & Gas. Strong pricing and volumes have contributed to a nice year, with EPS expected to breach 1.60 euros (double that of a year ago). Nevertheless, concerns about elevated raw materials pricing and significant automotive exposure that is heavily supply-chain impacted remain headwinds as shares reside nearly 25% below the latest high set in March. While these issues are likely to linger in the near term, we note that the stock trades for just 10 times estimated earnings, a sizable discount to its long-run average P/E multiple of 14. In addition, we like that BASF produces tremendous free-cash-flow and offers a robust dividend.

John Buckingham, The Prudent Speculator, theprudentspeculator.com, 877-817-4394, December 2, 2021

*Ready Capital Corporation (RC-PE)

Ready Capital 6.50% Series E Cumulative (RC-E): Ready Capital originates, manages and finances commercial real estate loans and related securities. Ready is not credit-rated, but its dividends are cumulative, meaning that Ready remains on the hook for any missed payouts. Ready recently traded at $24.78 per share, and its market yield was 6.6%. Its yield to call to its 6/10/26 call date is 6.7%.

Harry Domash, Dividend Detective, dividenddetective.com, 866-632-1593, December 5, 2021

Resources, Energy, & Utilities

The AES Corporation (AES) | Daily Alert November 18

Utilities are (1) not expensive relative to their valuation levels in the past, (2) much cheaper relative to the broad stock market than they’ve been at any point since the bull market began in March 2009 and (3) have done better than arguably any other major sector at growing into their stocks’ bull market gains.

Utility growth rates actually held up last year during the pandemic. And with regulators still supportive of the CAPEX plans behind them—and federal dollars about to flow to their purpose as well—there’s every reason to believe companies’ earnings and dividends will continue to rise at that robust pace going forward.

Despite recent gains, AES Corp. still trades at less than 15 times expected next earnings. Last month’s successful partial IPO of Fluence Energy (FLNC) should accelerate growth of that energy storage venture with Siemens AG, opening up a new profit stream even as the company executes its earnings and dividend guidance for 7 to 9 percent growth through 2025. There’s another dividend increase set for next month, and a boost by Moody’s to investment grade by mid-2022 is likely.

Buy up to 28.

Roger Conrad, Conrad’s Utility Investor, ConradsUtilityInvestor.com, 888-960-2759, November 2021

Cameco Corporation (CCJ) | Daily Alert Novembr 24

Nuclear power is one of the best climate change solutions and yet it has been demonized as unsafe because of earlier accidents. Significant advances in nuclear power plant design have improved efficiency and safety, and [have been] largely ignored. Regardless, plants are being built. China, for instance, is a large source of growth, and as of June of this year, generates power from 50 reactors. It has announced plans to build 150 new civilian reactors until 2035. Many micro-reactors are being tested in the U.S. alone.

CCJ is one of the largest global providers of uranium, needed to fuel the reactors. It has the theoretical mine capacity to produce more than 53 million pounds of uranium concentrates annually and has about 455 million pounds of proven and probable uranium reserves.

Looking at the stock, it is trading up from its 52-week low of $9.32 to almost $28 today—a 200% increase. Investors are beginning to take note, as seven analysts covering the stock give it a good rating. Three rate it as a “Strong Buy,” two as a “Buy,” and two as a “Hold.”

Sean Christian, The Personal Capitalist, 9524 East 81st Street, Suite B #1715, Tulsa, OK 74133, November 15, 2021

Chevron Corporation (CVX) | Daily Alert November 29

Chevron is the best-run oil major with high margins and can more quickly turn a profit as things improve. Chevron’s cost per dollar of BOE produced has fallen from $18 in 2014 to under $10 today. Chevron has lower costs and higher margins than its peers.

The oil giant also hit this recession right. It completed several large projects in the past several years and had already wound down capital expenditures.

There’s an important thing to realize about Chevron. It is skewed more heavily toward oil exploration and production and is more leveraged to oil prices than the other energy majors. Third-quarter earnings skyrocketed to $6.1 billion, the highest since 2013. Cash flow of $6.7 billion for the quarter was the highest ever.

Yet, despite the stellar performance, CVX is still below the pre-pandemic price. The good times should continue to roll for CVX, which received a slew of analyst upgrades after the third-quarter report.

The stock is still close to the high and I expect another surge at some point in the near future.

Tom Hutchinson, Cabot Dividend Investor, cabotwealth.com, 978-745-5532, November 10 & 17, 2021

*Royal Gold, Inc. (RGLD)

Royal Gold had a very strong quarter with volume, revenue, and cash flow records. First, silver was received from Khoemacau, where Royal also just increased its stream to 90% of the silver produced at this copper mine in Botswana.

There have been positive developments at several of the non-producing assets in their portfolio, including a new feasibility study at Red Chris which Newcrest recently acquired.

Another paydown on the revolving credit facility left Royal with $60 million of cash and $50 million outstanding debt, as well as available credit of $950 million. The new global minimum tax will have less impact on Royal than its Canadian peers since Royal, a U.S. company, was already paying U.S. tax on its offshore streaming income, currently at a little over 13%.

Royal is trading at multiples lower than the other large royalty companies and with a better near-term growth profile as Khoemacau ramps up, and further out from IAMGOLD’s new Côté project in Ontario (though Osisko, also with a good near-term growth profile, trades lower on a price-to-book metric, higher on cash flow metrics). If you do not own it, you can buy at this level.

Adrian Day, Adrian Day’s Global Analyst, adriandayglobalanalyst.com, 410-224-8885, November 28, 2021

Low-Priced Stocks

Dynatronics Corporation (DYNT)

Dynatronics Corp. designs, manufactures and sells physical therapy, rehabilitation, orthopedics, pain management and athletic training products. The company markets its products through the Solaris®, Hausmann™ and PROTEAM™ brands. Dynatronic’s most robust product line is that of Bird & Cronin® Manufactured Products, which include various supports and immobilizers.

It currently exports its products to approximately 30 countries and has customers that include professional sports teams ranging from the Minnesota Vikings to the Boston Red Sox.

The company recently executed a financial turnaround that focused on long-term growth prospects. Both EBIT and net income have trended higher over the past year, and book value is increasing. Net sales are on pace for approximately $11.5-$12 million for the first quarter of 2022, exceeding the $9.8 million in continued product net sales in the fourth quarter. DYNT expects net sales of $40-45 million in 2022, roughly a 15% improvement over the $37 million in 2021.

The Selected Rehabilitation and Bracing markets are projected to grow at 5.3% CAGR and 6.5% CAGR, respectively. The largest growth is anticipated from the Bracing market, which should total $1.8 billion by 2025.

Management has repeatedly expressed interest in growth via acquiring companies with at least a 40% gross margin and immediate cash flow contributions.

Faris Sleem, The Bowser Report, thebowserreport.com, 757-877-5979, November 2021

Funds & ETFs

PGIM Global High Yield Fund, Inc (GHY) | Daily Alert November 11

PGIM Global High Yield Fund, Inc. typically invests at least 80% of its managed assets in a portfolio of high-yield debt with varying maturities.

Under its 80% guideline, GHY can invest in derivatives, including interest rate and credit default swaps, up to 20% of investable assets. As of 09/30/21, approximately 70% of the fund’s investments were rated “B” or “BB.” Sector exposure was well diversified, with Other Energy (7.4%), Foods (5.2%), Telecom (4.5%), Retailers (4.4%), and Gaming (4.2%) constituting the top five sectors. GHY’s largest issuers included Ford Motor (1.9%), Petroleos Mexicanos (1.8%), Republic of Turkey (1.5%), Republic of Ukraine (1.5%), and Chesapeake Energy (1.5%).

This investment is suitable for medium- to high-risk portfolios. Buy at $17.50 or below for a 7.20% annualized yield.

Martin Fridson, CFA, Income Securities Investor, isinewsletter.com, 800-472-2680, November 2021

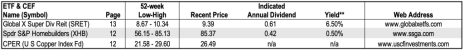

United States Copper Index Fund, LP (CPER) | Daily Alert November 19

Copper has a tendency to make a major seasonal bottom in November/December and then a tendency to post major seasonal peaks in April or May.

Traders can look to go long a May futures contract on or about December 14 and hold until about February 24. In this trade’s 49-year history, it has worked 32 times for a success rate of 65.3%.

One option that provides exposure to the copper futures market without having to have a futures trading account, is United States Copper. This ETF tracks the daily performance of the SummerHaven Dynamic Copper Index Total Return less fund expenses. CPER’s daily volume can be on the light side, but it does appear to be sufficiently liquid with average daily volume approaching 300,000 shares. Stochastic, relative strength and MACD technical indicators applied to CPER are all beginning to improve.

A position in CPER can be considered at current levels up to a buy limit of $27.20. If purchased, an initial stop loss of $24.90 is suggested. This trade will be tracked in the Almanac Investor Sector Rotation ETF Portfolio.

Jeffrey A. Hirsch, Stock Trader’s Almanac, stocktradersalmanac.com, 800-762-2974, November 11, 2021

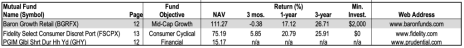

Baron Growth Fund Retail Shares (BGRFX) | Daily Alert December 8

Baron Growth Fund has been a consistent winner this year, rising 20% year to date. It invests in low-profile but well-managed companies such as Penn National Gaming, Vail Resorts, Arch Capital and FactSet. Baron Growth is also famous for what it does not invest in: Tesla! Conservative investors should consider investing in the Baron Growth Fund.

Mark Skousen & Jim Woods, Forecasts & Strategies, markskousen.com, Eagle Financial, 300 New Jersey Ave. NW, Suite 500, Washington, D.C. 20001, July 2021

*SPDR S&P Homebuilders ETF (XHB)

One way to take advantage of the boom in new home construction is through housing exchange-traded funds (ETFs), which tend to minimize investors’ risk while broadening exposure to the entire industry.

One of those ETFs is the SPDR S&P Homebuilders ETF (Rated “B”). XHB is the benchmark for the homebuilders’ segment of the S&P Total Market Index. It has $2.24 billion in assets under management (AUM) and an expense ratio of 0.35%.

XHB has an annualized return of over 34% in the last year and 24.32% over the past three years.

While there are rumblings about the Federal Reserve raising interest rates at some point in 2022, any policy changes will likely be gradual and carefully measured. Consequently, the impact on the housing market could be negligible, as price forecasts remain strong.

Investors should consider using any near-term weakness in XHB’s price as a buying opportunity. Always remember to conduct your own due diligence before making any investment decisions.

Jon Markman, Pivotal Point, issues@e.moneyandmarkets.com, 1-800-291-8545, November 23, 2021

*Global X SuperDividend REIT ETF (SRET)

Global X SuperDividend REIT ETF is a global REIT, with a mandate to invest in the 30 highest-yielding REITs from around the world. Two of the top five holdings are Canadian:

The emphasis is on the US, with 70.6% of the fund’s assets. Canada is next with 11.5%, followed by Australia (9.5%), Singapore (5.9%), and Mexico (2.6%).

The fund is quite evenly balanced, with Chimera Investment Corp. the top holding at 4.51%. It’s a US company that, unlike most other REITs, does not own brick-and-mortar assets. Rather, it invests in a portfolio of mortgage-backed securities. It has a forward yield of 8% at the current price.

This ETF takes a somewhat different approach from REET and would be the better choice right now if cash flow is the primary objective. But, based on recent history, don’t expect much in the way of capital appreciation.

Buy.

Gordon Pape, Income Investor, buildingwealth.ca, 1-888-287-8229, November 23, 2021

*Fidelity Select Consumer Discretionary Portfolio (FSCPX)

Manager Katherine Shaw has been emphasizing global brands and retail outlets, an area that may benefit from strength in consumer spending as pandemic restrictions wind down amid rising vaccination rates.

The fund performed poorly against its benchmark this year because it underweighted technology disruptor stocks. But we’re sticking with it because we don’t think it will be as much of a problem going forward.

Amazon is a top holding and accounts for 20-25% of assets.

Jack Bowers, John M. Boyd and John Bonnanzio, Fidelity Monitor & Insight, fidelitymonitor.com, 800-397-3094, December 2021

Updates

SELL CrowdStrike Holdings, Inc. (CRWD) | Daily Alert November 22

Updated from WSBD 839, March 18, 2021

In the Model Portfolio, in fact, we’re going to take our medicine on CrowdStrike, which is flashing abnormal action after yet another analyst downgrade today that cited increasing competitive pressures and slowing growth in the endpoint market. As always, we care less about what analysts say than what big money managers do, but after attempting to break out twice (both times rejected) and today’s huge-volume selling, we’re going to (relatively) quickly cut our loss and look for greener pastures. SELL

Michael Cintolo, Cabot Growth Investor, cabotwealth.com, 978-745-5532, November 15, 2021

*SELL Omega Healthcare Investors, Inc. (OHI)

Updated from WSBD 843, July 8, 2021

Omega Healthcare Investors, Inc. continues to struggle. It beat Street expectations last month, but the stock is drifting down again.

CEO Taylor Pickett sent out a warning: “Facility occupancy continued to improve in the quarter but still sits meaningfully below pre-pandemic levels and, as a result, many operators continue to rely on federal and state government support.”

I’ve decided it’s time to sell Omega Healthcare (OHI). It still pays a high dividend, but it’s no longer secure.

Mark Skousen & Jim Woods, Forecasts & Strategies, markskousen.com, Eagle Financial, 300 New Jersey Ave. NW, Suite 500, Washington, D.C. 20001, December 2021

*SELL Signet Jewelers Limited (SIG)

Updated from WSBD 837, January 21, 2021

This afternoon we are moving shares of Signet Jewelers (SIG) from BUY to SELL.

Although our initial price target was 29, the company’s fundamentals have improved immensely, and our current price target is 94. With the shares now trading just over 104, our willingness to raise our target again is limited, given the risk/return trade-off, so we are moving the shares to a SELL.

Bruce Kaser, Cabot Turnaround Letter, cabotwealth.com, 978-745-5532, November 8, 2021

*SELL Generac Holdings Inc. (GNRC)

Updated from WSBD 819, July 10, 2019

Generac has been a terrific investment since we first initiated coverage. But now it is hard to look past its deteriorating Quadrix scores and weak recent stock-price action. The Overall score is down to 28, hurt by dismal ranks for Momentum (11), Value (9), and Earnings Estimates (7). Up 689% since we started coverage three years ago, Generac should be sold.

Richard J. Moroney, CFA, Upside, upsidestocks.com, 800-233-5922, November 19, 2021

*SELL DexCom, Inc. (DXCM)

Updated from WSBD 827, March 19, 2020

Nothing has changed with Dexcom the company, but the stock has gotten caught up in the market’s selling wave, at least partially on fears that the reaction to another Covid spike could crimp business. We’ve given the stock plenty of rope here, even holding through the dip below the 50-day line earlier this week, but the lack of any support (no ability to bounce yet), our growing loss and the weak market had us cutting bait on the special bulletin this morning. SOLD

Michael Cintolo, Cabot Growth Investor, cabotwealth.com, 978-745-5532, December 2, 2021

*SELL International Money Express, Inc. (IMXI)

Updated from WSBD 845, September 9, 2021

International Money Express is being dropped from coverage. September-quarter earnings per share jumped 25% and sales increased 26%. But the global provider of money transfers has slumped since reporting results and underperformed the S&P SmallCap 600 Index, hurt by worries about demand in certain regions and margin pressures. International Money Express was initiated as a Buy at $17.78 in August.

Richard J. Moroney, CFA, Upside, upsidestocks.com, 800-233-5922, November 19, 2021

Investment Index

The next Wall Street’s Best Digest issue will be published on January 13, 2021.