The top five holdings of this 3-star-rated Morningstar fund are Baker Hughes Inc (BHI, 9.47% of assets); Anadarko Petroleum Corp (APC, 8.51%); ConocoPhillips (COP, 6.73%); Schlumberger Ltd (SLB, 6.06%) and Encana Corp ECA.TO (4.79%).

Fidelity Select Natural Gas Fund (FSNGX)

From Sound Advice

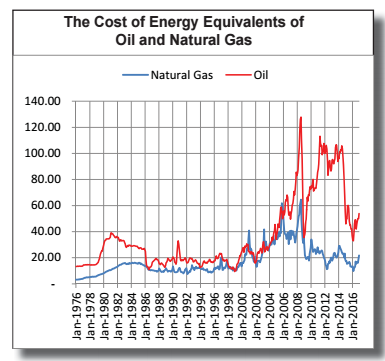

Fidelity Select Natural Gas Fund (FSNGX) is a diversified way to participate in the recovery of the natural gas industry through strong companies. Natural gas provides the same energy as oil for pennies on the dollar, and natural gas is more environmentally friendly. One barrel of oil provides approximately 5.8 million British Thermal Units (BTUs) of energy. At, say $53 a barrel, that is the cost of 5.8 million BTUs.

However, with the current market price for natural gas at $3.12 for one million BTUs, 5.8 million BTUs will cost $21.70. So, the same amount of energy is available for approximately 34 cents on the dollar, if it is in the form of natural gas rather than oil.

The updated chart shows the historic relationship between the costs of these two forms of energy. The red line shows the price of a barrel of oil since the mid-1970s. The blue line shows the price of natural gas multiplied by 5.8 to approximate the same amount of energy contained in a barrel of oil. The fact that natural gas provides energy for pennies on the dollar will translate into an expanding natural gas industry.

Gray Cardiff, Sound Advice, www.soundadvice-newsletter.com, 800-825-7007, February 2017