This money center bank beat estimates by two cents, but recently cut its CEO’s pay for not living up to its financial targets. Shares appear to be currently undervalued.

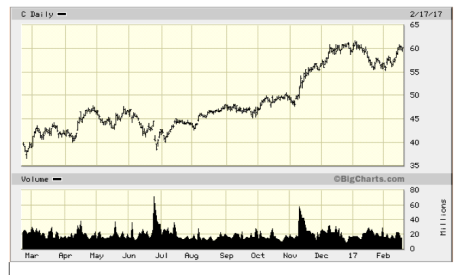

Citigroup (C)

From AlphaProfit Sector Investors’ Newsletter

Citigroup (C) shares have lagged the post-election rally in bank stocks despite its fourth quarter EPS growing 8% from the year-ago period and beating analysts’ forecast by 2%. Analysts are dissatisfied with the growth in Citi’s net interest margin and progress towards operating targets.

Citi is, however, continuing to reduce expenses. Its capital strength supports its dividend and share buyback program. Citi shares interest value investors. They trade at 11% discount to tangible book value and 11.1Xtimes forward EPS versus prospects for 10% EPS growth in 2017. (Next earnings: Mid- April)

Sam Subramanian, PhD, AlphaProfit Sector Investors’ Newsletter, www.alphaprofit.com, 281-565-6963, February 2017